Commercial Vehicles in India

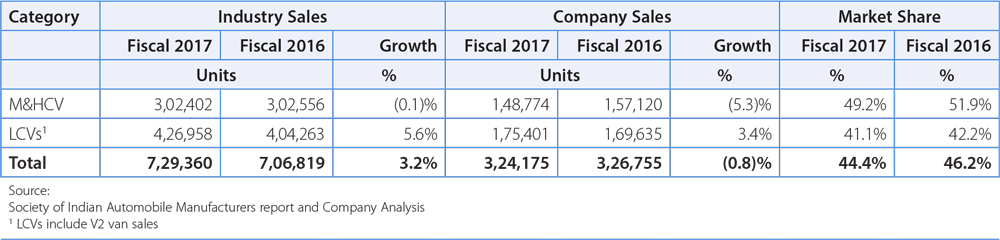

The following table sets forth the Company's commercial vehicle sales, industry sales and relative market share in commercial vehicle sales in India.

Industry sales of commercial vehicles increased by 3.2% to 729,360 units in Fiscal 2017 from 706,819 units in Fiscal 2016. Industry sales in the medium and heavy commercial vehicle segment remained flat at 302,402 units in Fiscal 2017, as compared to 302,556 in Fiscal 2016. The sector was hit by BSIII ban and demonetization, but improvement in economic conditions brought the sale level back to previous year. Industry sales of light commercial vehicles reported an increase of 5.6% to 4,26,958 units in Fiscal 2017, from 404,263 units in Fiscal 2016. The ban on BSIII vehicles saw unprecedented discounts in prices of vehicles, which resulted in the increase in sales at the end of the fiscal.

However, overall, sales of the Company's commercial vehicles in India declined by 0.8% to 324,175 units in Fiscal 2017 from 326,755 units in Fiscal 2016. The Company's sales in the medium and heavy commercial vehicle category decreased by 5.3% to 148,774 units in Fiscal 2017, as compared to sales of 157,120 units in Fiscal 2016. However, sales in the light commercial vehicles segment increased by 3.4% to 175,401 units in Fiscal 2017, from 169,635 units in Fiscal 2016. The customers in this segment are waiting for clarity about GST, which may bring prices down. The other factors like emission norms, Bus code for safer and comfortable journey, etc. affected this segment.

Tata and other brand vehicles — International Markets

The Company's exports (on standalone basis) grew by 10.6% to 64,221 units in Fiscal 2017 as compared to 58,058 units in Fiscal 2016. The increase of imports in Nepal provided an opportunity for the Company. The launch of new models in the Middle East and Africa region, along with the opening of new markets in these regions, contributed to an increase in international sales volumes. The Company's top five (quantity terms) export destinations for vehicles manufactured in India - Bangladesh, Sri lanka, Nepal, South Africa and Tunisia accounted for approximately 85% of the exports of commercial vehicles and passenger vehicles.

In Fiscal 2017, TDCV's overall vehicles sales increased by 13.2% to 10,317 units, from 9,116 units in Fiscal 2016, mainly due to increase in domestic sales. TDCV continued to have strong performance in the domestic market despite increased competition and increased sales by 25% to 8,795 vehicles, second highest in TDCV history, compared to sales of 7,036 vehicles in Fiscal 2016, primarily due to strong demand from construction sector and replacement demand including factors such as low interest rates and diesel prices. However, the export market was very challenging. Factors, such as- low oil prices, local currency depreciation against the US Dollar, continuing statutory regulations to reduce imports, the slowdown in Chinese economy impacting commodity exporting countries, and increased dealer inventory adversely impacted TDCV's exports in major markets, such as GCC, Russia, Algeria, Vietnam and South Africa. The export sales were 1,522 commercial vehicles, 26.8% lower compared to 2,080 commercial vehicles in Fiscal 2016.

Tata and other brand vehicles — Sales, Distribution and Support

The Company's sales and distribution network in India as at March 2017 comprised approximately 4,538 contact points for sales and service for its passenger and commercial vehicle business. The Company's subsidiary, TML Distribution Company Limited, or TDCL, acts as a dedicated distribution and logistics management Company to support the sales and distribution operations of its vehicles in India. The Company believes this has improved the efficiency of its selling and distribution operations and processes. The Company uses a network of service centers on highways and a toll-free customer assistance center to provide 24-hour roadside assistance, including replacement of parts, to vehicle owners.

TDCL provides distribution and logistics support for vehicles manufactured at the Company's facilities and has set up stocking points at some of Company's plants and at different places throughout India. TDCL helps us improve planning, inventory management, transport management and timing of delivery. The Company has customer relations management system, or CRM, at all of its dealerships and offices across the country, which supports users both at its Company and among its distributors in India and abroad.

The Company markets its commercial and passenger vehicles in several countries in Africa, the Middle East, South East Asia, South Asia, Australia, Latin America, Russia and the Commonwealth of Independent States countries. The Company has a network of distributors in all such countries, where it exports its vehicles. Such distributors have created a network of dealers and branch offices and facilities for sales and after-sales servicing of the Company's products in their respective markets. The Company has also stationed overseas resident sales and service representatives in various countries to oversee its operations in the respective territories.

Through the Company's vehicle financing division and wholly owned subsidiary, TMFL along with Tata Motors Finance Solutions Ltd or TMFSL, the Company provides financing services to purchasers of its vehicles through independent dealers, who act as the Company's agents for financing transactions, and through the Company's branch network. Revenue from the Company's vehicle financing operations (on Consolidated basis as per Ind AS) decreased by 8.4% to Rs. 2,429.23 crores in Fiscal 2017 as compared to Rs. 2,240.03 crores in Fiscal 2016.

TMFL disbursed Rs. 9,298 crores and Rs. 8,985 crores in vehicle financing during Fiscal 2017 and 2016, respectively. During Fiscal 2017 and 2016, approximately 22% and 23%, respectively, of the Company's vehicle unit sales in India were made by the dealers through financing arrangements where the Company's captive vehicle financing divisions provided the support. Total vehicle finance receivables outstanding as at March 31, 2017 and 2016 amounted to Rs. 17,563.25 crores and Rs. 15,751.47 crores, respectively. As at March 31, 2017 and 2016, the Company's customer finance receivable portfolio comprised 552,991 and 584,101 contracts, respectively. The Company follow specified internal procedures, including quantitative guidelines, for selection of its finance customers and assist in managing default and repayment risk in the Company's portfolio. The Company originate all of the contracts through its authorized dealers and direct marketing agents with whom the Company have agreements. All the Company's marketing, sales and collection activities are undertaken through dealers or by TMFL.

Tata and other brand vehicles — Spare Parts and After-sales Activity

The Company's consolidated spare parts and after-sales activity revenue was Rs. 4,419.90 crores in Fiscal 2017, compared to Rs. 4,088.74 crores in Fiscal 2016. The Company's spare parts and after-sales activity experienced limited growth due to weak sales of both commercial vehicles and passenger vehicles in recent years.

Tata and other brand vehicles — Competition

The Company faces competition from various domestic and foreign automotive manufacturers in the Indian automotive market. Improving infrastructure and robust growth prospects compared to other mature markets has attracted a number of international companies to India that have either formed joint ventures with local partners or have established independently owned operations in India. Global competitors bring with them decades of international experience, global scale, advanced technology and significant financial resources, and, as a result, competition is likely to further intensify in the future. The Company has designed its products to suit the requirements of the Indian market based on specific customer needs such as safety, driving comfort, fuel-efficiency and durability. The Company believes that its vehicles are suited to the general conditions of Indian roads and the local climate. Its vehicles have also been designed to comply with applicable environmental regulations currently in effect. The Company also offers a wide range of optional configurations to meet the specific needs of its customers and intends to develop and is developing products to strengthen its product portfolio in order to meet the increasing customer expectations of owning world-class products.

Tata and other brand vehicles — Seasonality

Demand for the Company's vehicles in the Indian market is subject to seasonal variations. Demand for the Company's vehicles generally peaks between January and March, although there is a decrease in demand in February just before release of the Indian fiscal budget. Demand is usually lean from April to July and picks up again in the festival season from September onwards, with a decline in December due to year-end.

Jaguar Land Rover

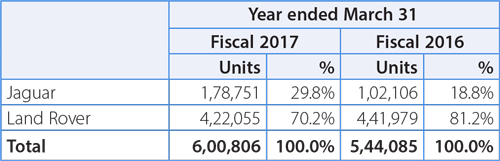

Total wholesales of Jaguar Land Rover vehicles (including Chery Jaguar Land Rover) with a breakdown between Jaguar and Land Rover brand vehicles, in Fiscal 2017 and 2016 are set forth in the table below:

In Fiscal 2017, Jaguar Land Rover wholesale volumes were 600,806 units (including unconsolidated sales from the China Joint Venture), up 10% compared to Fiscal 2016 primarily reflecting the introduction of the Jaguar F-PACE and continued strong demand for the Land Rover Discovery Sport partially offset by the production run-out of the Land Rover Defender and Discovery ahead of the start of sales of the all new Discovery in the fourth quarter of Fiscal 2017. Wholesale volumes were up in China (30%), North America (21%), Europe (9%), and the United Kingdom (4%) but down 12% in other overseas markets, which includes Russia, Brazil and South Africa.

Jaguar wholesale volumes were 178,751 units, up 75% compared to Fiscal 2016, reflecting the introduction of the Jaguar F-PACE and the launch of the XE in the US in May 2016. However, Land Rover wholesale volumes were 422,055 units, down 5% compared to the prior fiscal year as continuing strong demand for the Land Rover Discovery Sport, solid sales of the Range Rover Evoque and the start of sales of the all new Discovery were offset by the production run-out of the Defender and the previous Discovery model.

Jaguar Land Rover's performance in key geographical markets on a retail basis

Retail volumes (including retail sales from the China Joint Venture) in Fiscal 2017 increased by 16% to 604,009 units from 521,571 units in Fiscal 2016 following the introduction of the Jaguar F-PACE, the launch of XE in the US and continued strong demand for the Land Rover Discovery Sport which offset the production run-out of Defender and Discovery with retail sales of the all new Discovery only starting in February 2017. Jaguar XF retail volumes were higher supported by the launch of the long wheelbase XFL from Company's joint venture in China.

United Kingdom

Industry vehicle sales rose by 2.1% in Fiscal 2017 in the United Kingdom broadly in-line with economic growth despite the outcome of the Brexit vote. Jaguar Land Rover retail volumes increased by 16% to 124,755 units in Fiscal 2017 from 107,371 units in Fiscal 2016, with a strong sales performance from Jaguar, up 42% in Fiscal 2017, reflecting the introduction of the F-PACE and solid sales of the XF. Land Rover retail volumes increased by 7%, reflecting continued strong demand for Discovery Sport and Evoque as well as solid sales of the Range Rover Sport.

North America

Economic performance in North America was generally favourable in Fiscal 2017 as the labour market approached full employment and the Federal Reserve increased interest rates by another 0.25% in March. Passenger car sales were broadly in-line with the prior year but Jaguar Land Rover retail volumes increased by 24% in Fiscal 2017 to 123,527 units from 99,606 units in Fiscal 2016. Jaguar retail sales were up over 150% in North America with the introduction of the F-PACE and XE at the beginning of the year. Land Rover retailed 81,949 in Fiscal 2017, down slightly 1%, as continued strong demand for the Land Rover Discovery Sport and solid sales of the Range Rover Sport were offset by softer sales of the Range Rover and the Evoque as well as the run-out of the Discovery.

Europe

Passenger car sales increased by 6.9% in Europe supported by positive, albeit lower, economic growth, improving labour markets as well as lower inflation. Jaguar Land Rover retail sales of 141,043 units in Europe were higher than in any of the Company's other key regions in Fiscal 2017, up 13% compared to 124,734 units sold in Fiscal 2016. Jaguar volumes increased by 92% to 40,332 units in Fiscal 2017 compared to 21,051 units in Fiscal 2016, primarily driven by the introduction of the F-PACE and solid sales of XF. Land Rover retails were 100,711 units in Fiscal 2017, down 3% compared to the 103,683 units in Fiscal 2016 as solid sales of the Discovery Sport, Range Rover Sport, Range Rover and Evoque were offset by the production runout of Defender and the prior Discovery Model.

China

Passenger car sales in China increased by 14.5% in Fiscal 2017 supported by GDP growth in-line with the government's target and a stronger economic performance more recently. Jaguar Land Rover retail volumes (including sales from the China Joint Venture) increased by 32% to 125,207 units in Fiscal 2017 from 95,167 units in Fiscal 2016. Jaguar retail sales in Fiscal 2017 were 29,351 units, up 93% compared to the 15,230 units sold in Fiscal 2016 led by the introduction of the F-PACE and the start of sales of the long wheelbase Jaguar XFL from Company's China joint venture in September 2016 as well as positive sales growth of other Jaguar models. Land Rover retail sales were 95,856 units in Fiscal 2017, up 20% compared to the 79,937 units sold in Fiscal 2016 led by strong sales of the Discovery Sport from company's joint venture in China, and solid sales growth of Range Rover and Range Rover Sport.

Other Overseas markets

Jaguar Land Rover's retail volumes in the other overseas markets declined by 6% to 89,477 units in Fiscal 2017 compared to 94,693 units in the prior year. Jaguar retail volumes were 22,455 units, up 60% compared to the 14,047 units last year with the introduction of the F-PACE and solid sales of Jaguar's XE and XF saloon models. Land Rover retail volumes were 67,022 units, down 17% on the 80,646 units retailed in Fiscal 2016 as solid sales of the Discovery Sport were more than offset by the production run-out of the Defender and Discovery as well as softer sales of Range Rover, Range Rover Sport and Evoque.