FINANCIAL PERFORMANCE ON A STANDALONE BASIS

The financial information discussed in this section is derived from the Company's Audited Standalone Financial Statements. These include the Company's proportionate share of income and expenditure in its two Joint Operations, namely Tata Cummins Pvt Ltd and Fiat India Automobiles Pvt Ltd.

Fiscal 2017 has been a challenging and highly volatile year, which followed a period of low demand and inconsistent recovery in the prior year in the automotive sector in India. In addition, the Company also underperformed on many fronts, amplifying the impact of the external environment.

Income from operations of the Company for Fiscal 2017, stood at Rs. 49,100.41 crores as compared to Rs. 47,383.61 crores, increased by 3.6%. Total number of vehicles sold were 545,416 units in Fiscal 2017, as compared to 511,931 units in Fiscal 2016, a growth of 6.5%.

Cost of materials consumed (including change in stock)

Cost of material consumed increased from 61.4% of total revenue to 63.8% in Fiscal 2017, representing an increase of 240 bps, mainly due to product mix – relatively lower proportion of M&HCV sales.

Excise duty were Rs. 4,736.41 crores in Fiscal 2017 as compared to Rs. 4,538.14 crores in Fiscal 2016, an increase of 4.4%, primarily due to increase in revenues.

Employee Costs were Rs. 3,558.52 crores in Fiscal 2017 as compared to Rs. 3,188.97 crores in Fiscal 2016, an increase by 11.6%, mainly due to annual increments and wage revisions at various plant locations.

Other Expenses includes all works operations, indirect manufacturing expenses, freight cost, fixed marketing costs and other administrative costs. These expenses have increased by 5.9% to Rs. 8,697.42 crores in Fiscal 2017 from Rs. 8,216.65 crores in Fiscal 2016. The breakdown is provided below:

The changes are mainly driven by volumes and the size of operations.

- Freight, transportation, port charges etc., as a percentage to total revenue, were 3.1% in Fiscal 2017, as compared to 2.7% in Fiscal 2016. The increase was due to rise in diesel prices.

- Publicity expenses represented 1.7% of total revenues in Fiscal 2017 and 1.4% in Fiscal 2016. In addition to routine product and brand campaigns, the Company incurred expenses relating to new product introduction campaigns for the Tiago, the Hexa, the Tigor, the Yodha, etc.

- Warranty expenses represented 1% of the Company's revenues in Fiscal 2017 and 2016.

- Information technology/computer expenses represented 1.6% and 1.3% of the Company's revenues in Fiscal 2017 and 2016, respectively. The increase was mainly due to certain purchases of software for the Company.

- Works operation and other expenses have decreased to 4.9% of net revenue in Fiscal 2017 from 5.3% in Fiscal 2016.

Amount capitalized represents expenditure transferred to capital and other accounts allocated out of employee cost and other expenses, incurred in connection with product development projects and other capital items. The expenditure transferred to capital and other accounts has decreased by 9.0% to Rs. 941.55 crores in Fiscal 2017 from Rs. 1,034.40 crores in Fiscal 2016, mainly due to various product development projects undertaken by the Company for the introduction of new products and variants.

Other Income decreased by 30.2% to Rs. 978.84 crores in Fiscal 2017 from Rs. 1,402.31 crores in Fiscal 2016. This includes interest income of Rs. 184.65 crores in Fiscal 2017, compared to Rs. 263.79 crores in Fiscal 2016. Dividend income decreased to Rs. 676.50 crores in Fiscal 2017 from Rs. 1,061.71 crores in Fiscal 2016, whereas profit on sale of investment increased to Rs. 116.76 crores in Fiscal 2017, compared to Rs. 67.48 crores in Fiscal 2016, which are primarily profit on the sale of mutual funds.

Profit before exceptional items, depreciation and amortization expense, finance costs, foreign exchange (gain)/loss and tax is Rs. 2,679.51 crores in Fiscal 2017, representing 5.5% of revenue in Fiscal 2017 compared to Rs. 4,767.14 crores in Fiscal 2016.

Depreciation and amortization expense (including product development / engineering expenses): During Fiscal 2017, expenditures increased by 24.6% to Rs. 3,423.87 crores from Rs. 2,747.49 crores in Fiscal 2016. The depreciation has increased by 34.1% to Rs. 1,873.41 crores as compared to Rs. 1,396.65 in Fiscal 2016 is due to new product launches and change in useful life of certain assets. The amortization expenses have increased by 17.5% to Rs. 1,095.98 crores in Fiscal 2017 from Rs. 932.57 crores in Fiscal 2016, and are attributable to new products introduced during the year. Expenditure on product development / engineering expenses decreased by 8.7% to Rs. 454.48 in Fiscal 2017 from Rs. 418.27 in Fiscal 2016.

During, Fiscal 2017, the Company has carried out a review of the useful life of its assets, considering the physical condition of the assets and benchmarking analysis. As a result the depreciation and amortization charge is higher by Rs. 253.29 crores.

Finance Cost was flat at Rs. 1,590.15 crores in Fiscal 2017 from Rs. 1,592.00 crores in Fiscal 2016. Though, the borrowings have increased in Fiscal 2017, the decrease was mainly achieved by refinancing certain long-term loans with loans with lower interest rates and reduction in interest rates.

Foreign exchange (gain)/loss (net) of Rs. 252.45 crores in Fiscal 2017 as compared to loss of Rs. 221.91 crores in Fiscal 2016. The gain was due to appreciation on INR as compared to USD.

Exceptional items

- Employee separation cost: The Company has given early retirement to various employees resulting in an expense both in Fiscal 2017 and 2016.

- Rs. 147.93 crores for Fiscal 2017, relates to provision for inventory of BSIII vehicles as at March 31, 2017.

Loss before tax was Rs. 2,420.77 crores in Fiscal 2017, compared to Rs. 67.10 crores in Fiscal 2016. The losses were mainly attributable to reduction in sales volumes of medium & heavy commercial vehicles and competitive pressure on pricing. Further, there was increase in depreciation expenses as a result of additions to plant and facilities in recent years and change in useful life of certain assets; increase in employee cost due to wage revision at various plant locations; increase in publicity expenses due to new product launches. Furthermore, there was reduction in dividend from subsidiary companies and there was provision for BSIII inventory and discounts thereon as at March 31, 2017.

Tax Expense represents a net charge of Rs. 59.22 crores in Fiscal 2017, as compared to net credit of Rs. 4.80 crores in Fiscal 2016.

Loss after tax was Rs. 2,479.99 crores in Fiscal 2017 as compared to Rs. 62.30 crores in Fiscal 2016.

Standalone Balance Sheet

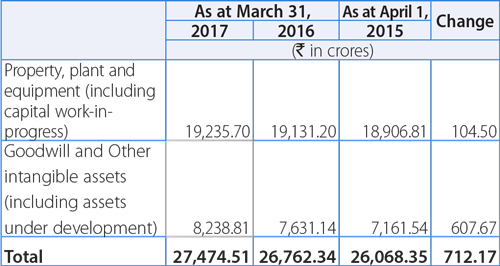

Property, plant and equipment, Goodwill and Other Intangible assets

There is increase (net of depreciation and amortization) in the intangible and tangible assets in Fiscal 2017. The increase is mainly due to dies and toolings capitalized for new products launched during the year and also product development costs capitalized (under development) during the year.

Investments in subsidiaries, joint ventures and associates were Rs. 14,778.87 crores as at March 31, 2017, as compared to Rs. 14,590.41 crores as at March 31, 2016. During Fiscal 2017, the Company converted Rs. 159 crores of optionally convertible preference shares into equity in one of the associates, namely Tata Hitachi Construction Machinery Co. Ltd.

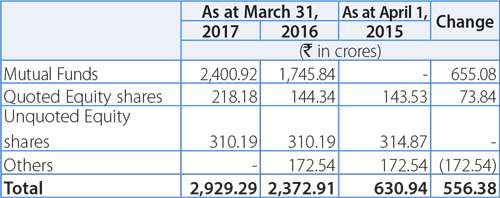

Investments (Current + Non-current) were Rs. 2,929.29 crores as at March 31, 2017, as compared to Rs. 2,372.91 crores as at March 31, 2016. The details are as follows:

There was increase in mutual fund investments in Fiscal 2017. Increase in quoted equity shares were due to increase in market value as at March 31, 2017. Others in Fiscal 2016 included optionally convertible preference shares in one the associates of the Company, which were converted to equity in Fiscal 2017.

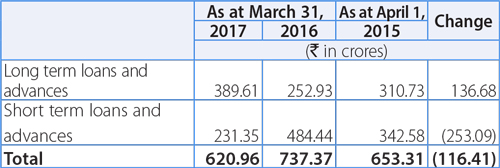

Loans and Advances

Loans and advances include advance to suppliers, contractors etc. Fiscal 2016 included loan to Joint operation, Fiat India Automobiles Pvt Ltd of Rs. 132.50 crores, which has been repaid in Fiscal 2017. Advance and other receivables decreased to Rs. 81.94 crores as at March 31, 2017, as compared to Rs. 166.45 crores as at March 31, 2016.

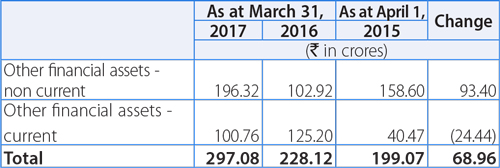

Other Financial Assets

These included Rs. 291.11 crores of derivative financial instruments, as at March 31, 2017 compared to Rs. 159.71 crores as at March 31, 2016, reflecting notional liability due to the valuation of derivative contracts.

Inventories as at March 31, 2017, were Rs. 5,504.42 crores as compared to Rs. 5,117.92 crores as at March 31, 2016, an increase of 7.6%. In terms of number of days of sales, finished goods represented 21 inventory days in Fiscal 2017 as compared to 22 days in Fiscal 2016.

Trade Receivables (net of allowance for doubtful debts) were Rs. 2,128.00 crores as at March 31, 2017, representing an increase of 4.0% compared to Rs. 2,045.58 crores as at March 31, 2016. The allowances for doubtful debts were Rs. 693.17 crores as at March 31, 2017 compared to Rs. 632.10 crores as at March 31, 2016.

Cash and cash equivalents were Rs. 188.39 crores, as at March 31, 2017, compared to R427.07 crores as at March 31, 2016. The decrease was mainly attributable to reduction in balances and deposits with banks.

Other bank balances were Rs. 97.67 crores, as at March 31, 2017, compared to Rs. 361.35 crores as at March 31, 2016. These include earmarked balances with banks of Rs. 86.60 crores as at March 31, 2017, compared to Rs. 291.28 crores as at March 31, 2016. Current tax assets (net) (current + non-current) were Rs. 854.07 crores, as at March 31, 2017, compared to Rs. 803.47 crores as at March 31, 2016.

Current tax assets (net) (current + non-current) were Rs. 854.07 crores, as at March 31, 2017, compared to Rs. 803.47 crores as at March 31, 2016.