Suppliers

The Company has an extensive supply chain for procuring various components. The Company also outsources many manufacturing processes and activities to various suppliers. In such cases, it provides training to external suppliers who design and manufacture the required tools and fixtures.

The Company's associate company, Tata AutoComp Systems Ltd., or TACO, manufactures automotive components and encourages the entry of internationally acclaimed automotive component manufacturers into India by setting up joint ventures with them.

The Company's other suppliers include some of the large Indian automotive supplier groups with multiple product offerings, such as the Anand Group, the Sona Group, and the TVS Group, as well as large multinational suppliers, such as Bosch, Continental, Delphi and Denso, Johnson Controls Limited for seats and Yazaki AutoComp Limited for wiring harnesses. The Company continue to work with company's suppliers for its Jaguar Land Rover business to optimize procurements and enhance its supplier base, including for the sourcing of certain of company's raw material and component requirements. In addition, the co-development of various components, such as engines, axles and transmissions also continue to be evaluated, which the Company believes may lead to the development of a low-cost supplier base for Jaguar Land Rover.

In India, the Company has established vendor parks in the vicinity of its manufacturing operations and vendor clusters have been formed at Company's facilities at Pantnagar and Sanand. This initiative is aimed at ensuring availability of component supplies on a real-time basis, thereby reducing logistics and inventory costs as well as reducing uncertainties in the long distance supply chain. Efforts are being taken to replicate the model at new upcoming locations as well as a few existing plant locations. The Company also encourage suppliers to follow sustainability principles and ensuring long-term sustainability.

As part of Company's pursuit of continued improvement in procurement, it has integrated its system for electronic interchange of data with its suppliers. This has facilitated real time information exchange and processing, which enables the Company to manage supply chain more effectively.

The Company has also started working on a new initiative "Auto Data Exchange (autoDX)". It is a collaborative initiative by Society of Indian Automobile Manufacturers (SIAM) and Automotive Components Manufacturers Association (ACMA) developed by IBM. autoDX is delivered on a Business-to-Business Cloud based Platform that has the power to transform the Automotive Industry by accelerating the movement of data & reducing transaction cost.

In 2016, the Company had introduced a comprehensive supplier assessment processes MSA (Manufacturing site assessment). The framework is broadly based on lead measures and lag measures to assess the suppliers capability and for the first time the company have put in place a financial risk assessment that would help in bringing a consistent level of oversight to it.

The Company has established processes to encourage improvements through knowledge sharing among it's vendors through an initiative called the Vendor Council, which consists of the Company's senior executives and representatives of major suppliers. The Vendor Council also helps in addressing common concerns through joint deliberations. The Vendor Council works on four critical aspects of engagement between the Company and the suppliers: quality, efficiency, relationships and new technology development.

The Company import some components that are either not available in the domestic market or when equivalent domestically available components do not meet company's quality standards. The Company also imports some products based on competitive pricing and capacity/lead time where domestic suppliers are not able to meet Company's requirements.

Long-term agreements have been entered into with Ford for technology sharing and joint development providing technical support across a range of technologies focused mainly around powertrain engineering such that the Company may continue to operate according to its existing business plan. This includes the EuCD platform, a shared platform consisting of shared technologies, common parts and systems and owned by Ford, which is shared among Land Rover, Ford and Volvo Cars.

Supply agreements, aligned to the business cycle plan and having end-stop dates to December 2020 at the latest, were entered into with Ford Motor Company for (i) the long-term supply of engines developed by Ford, (ii) engines developed by the Company but manufactured by Ford and (iii) engines developed by the Ford-PSA joint venture. Purchases under these agreements are generally denominated in euro and pounds sterling.

Following the global financial crisis and its cascading effect on the financial health of Company's suppliers, it has commenced efforts to assess supplier financial risk. Suppliers are appraised based on Company's long-term requirements through a number of platforms, such as Vendor Council meetings, council regional chapter meetings, national vendor meets and location-specific vendor meets.

OPPORTUNITIES:

The Union budget of 2017, has provided funds worth Rs. 6,400 crores for Infrastructure development including highway development has been set up, which is good for Heavy machinery and construction equipment manufacturers.

The Indian economy is slated to prosper along with China (estimated growth rate of more than 5%). This creates opportunity in rise in vehicle ownership. By 2020, transportation will have 23% of private consumer spending which is perfectly synergistic with the fact that automotive sales in Indian market is destined to resonate with global economic shift. India's car market is expected to grow to 6 million plus units annually in next two years.

The Automotive Mission Plan 2016-26 aims at 13% share of automotive industry in GDP, along with implementation of BSIV vehicles in 2019, BSVI Vehicles in 2019 and Increase in Value added services. National Electric Mobility Mission, aims at providing 7 million electric cars 2020, along with concession in manufacturing of selected parts for electric cars. Use of Block chain in Supply chain; augmented reality in designing and manufacturing; 3D printing and Four-cylinder supercar. At a global level, increasing levels of environmental regulations adds up the complexity quotient in design, marked by diverging behaviour.

Jaguar Land Rover intends to grow its business by diversifying its product range to compete in new segments, for example the Jaguar XE sports saloon, the Jaguar F-PACE (on sale since April 2016) and the new Range Rover Velar (goes on sale in the summer of 2017) ensures that Jaguar Land Rover competes in new premium segments with class-leading products that further supports their growth plans.

FINANCIAL PERFORMANCE ON A CONSOLIDATED BASIS

The Company has adopted Indian Accounting Standards on April 1, 2016, with the transition date as April 1, 2015. Accordingly, financial statements for Fiscal 2017 along with the comparatives (Fiscal 2016) have been prepared in accordance with the recognition and measurement principles stated therein, prescribed under section 133 of the Companies Act 2013 read with the relevant rules issued thereunder and the other accounting principles generally accepted in India.

The financial information discussed in this section is derived from the Company's Audited Consolidated Financial Statements.

Overview

The Company income from operations including finance revenues decreased by 1.1% to Rs. 274,492.12 crores in Fiscal 2017 from Rs. 277,660.59 crores in Fiscal 2016. The decrease is attributable to Rs. 27,686 crores impact due to unfavourable currency translation from GB£ to INR. The Company's net income (attributable to shareholders of the Company) declined by 35.6% to Rs. 7,454.36 crores in Fiscal 2017 from Rs. 11,579.31 crores in Fiscal 2016. Overall, earnings before other income, finance cost and tax, were Rs. 15,593.80 crores in Fiscal 2017 compared to Rs. 21,596.73 crores in Fiscal 2016, a decrease of 27.8%. The decrease in net income was primarily driven by performance at India operations of the Company, foreign exchange losses at Jaguar Land Rover business coupled with higher depreciation and amortization.

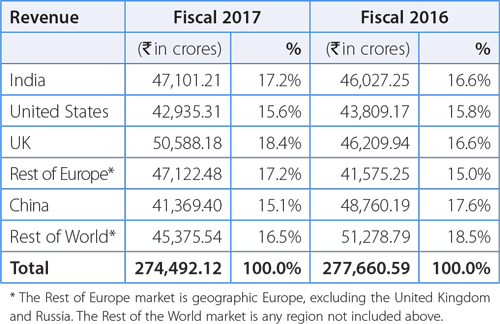

The Company has pursued a strategy of increasing exports of Tata and other brand vehicles to new and existing markets. The performance of the Company's subsidiary in South Korea, TDCV, and TTL, its specialized subsidiary engaged in engineering, design and information technology services, contributed to its revenue from international markets. Improved market sentiment in certain countries to which the Company exports and the strong sales performance of Jaguar Land Rover has enabled the Company to increase its sales in these international markets in Fiscal 2017. However, due to unfavourable currency translation from GB£ to INR and also growth in revenue in India in Fiscal 2017, the proportion of the Company's net sales earned from markets outside of India decreased to 82.5% in Fiscal 2017 from 83.4% in Fiscal 2016. The following table sets forth the Company's revenues from its key geographical markets and the percentage of total revenues that each key geographical market contributes for the periods indicated:

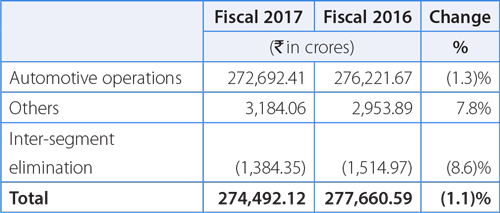

The Company's operations is divided into automotive operations and other operations as described further below. The table below sets forth the breakdown in revenues between the Company automotive operations and other operations in Fiscal 2017 and 2016 and the percentage change from period to period.

Automotive operations

Automotive operations are the Company most significant segment, accounting for 99.3% of the Company's total revenues in Fiscal 2017 and 99.5% of the Company's total revenue in Fiscal 2016. In Fiscal 2017, revenue from automotive operations before inter-segment eliminations was Rs. 272,692.41 crores as compared to Rs. 276,221.67 crores in Fiscal 2016, a decrease of 1.3%.

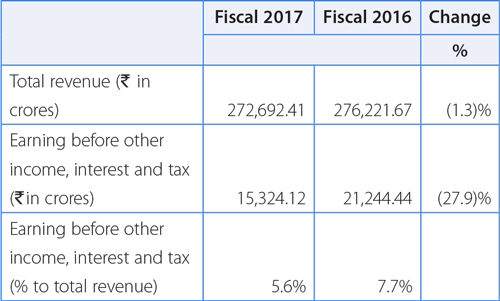

The following table sets forth selected data regarding the Company's automotive operations for the periods indicated, and the percentage change from period to period (before inter-segment eliminations).

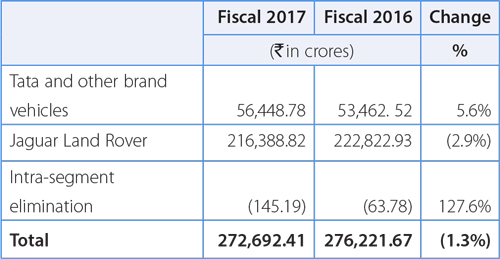

The Company's automotive operations segment is further divided into Tata and other brand vehicles (including vehicle financing) and Jaguar Land Rover. In Fiscal 2017, Jaguar Land Rover contributed 79.4% of the Company's total automotive revenue compared to 80.7% in Fiscal 2016 and the remaining 20.6% was contributed by Tata and other brand vehicles in Fiscal 2017 compared to 19.3% in Fiscal 2016.

The Company's revenue from Tata and other brand vehicles (including vehicle financing) and Jaguar Land Rover in Fiscals 2017 and 2016 and the percentage change from period to period (before intra-segment eliminations) is set forth in the table below.

Other operations

The following table sets forth selected data regarding the Company's other operations for the periods indicated and the percentage change from period to period (before inter-segment eliminations).

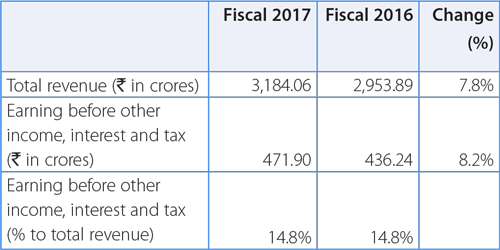

The other operations business segment includes information technology, machine tools and factory automation solutions. In Fiscal 2017, revenue from other operations before inter-segment eliminations was Rs. 3,184.06 crores compared to Rs. 2,953.89 crores in Fiscal 2016. Results for the other operations business segment before other income, finance cost, tax and exceptional items (before inter-segment eliminations) were Rs. 471.90 crores in Fiscal 2017 as compared to Rs. 436.24 crores for Fiscal 2016.