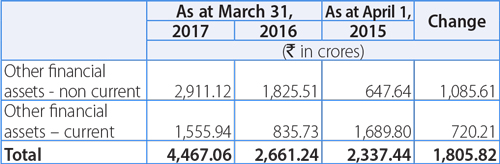

Other Financial Assets

These included Rs. 4,285.52 crores of derivative financial instruments, mainly attributable to Jaguar Land Rover as at March 31, 2017 compared to Rs. 2,348.54 crores as at March 31, 2016, reflecting notional liability due to the valuation of derivative contracts.

Inventories as at March 31, 2017, were R35,085.31 crores as compared to R32,655.73 crores as at March 31, 2016, an increase of 7.4%. Inventory at Tata and other brand vehicles (including vehicle financing) was R6,923.42 crores as at March 31, 2017 as compared to R6,819.13 crores as at March 31, 2016. Inventory at Jaguar Land Rover was R28,079.40 crores as at March 31, 2017, an increase of 8.5%, as compared to R25,762.35 crores as at March 31, 2016, mainly due to inventory volumes, higher actual costs of all models, due to working of GB£/EUR exchange rate and other overheads. In terms of number of days of sales, finished goods represented 34 inventory days in Fiscal 2017 as compared to 32 days in Fiscal 2016.

Trade Receivables (net of allowance for doubtful debts) were Rs. 14,075.55 crores as at March 31, 2017, representing an increase of 3.7% compared to Rs. 13,570.91 crores as at March 31, 2016. Trade Receivables have increased at Tata and other brand vehicles (including vehicle financing) to Rs. 3,471.93 crores as at March 31, 2017 as compared to Rs. 3,255.88 crores as at March 31, 2016. Trade receivables at Jaguar Land Rover was Rs. 10,006.21 crores as at March 31, 2017, as compared to Rs. 10,024.79 crores as at March 31, 2016. The allowances for doubtful debts were Rs. 1,377.44 crores as at March 31, 2017 compared to Rs. 1,274.29 crores as at March 31, 2016.

Cash and cash equivalents were Rs. 13,986.76 crores, as at March 31, 2017, compared to Rs. 17,153.61 crores as at March 31, 2016. The Company holds cash and bank balances in Indian rupees, GB£, Chinese Renminbi, etc. The decrease is also attributable to unfavourable currency translation impact from GB£ to INR of Rs. 2,028 crores.

Other bank balances were Rs. 22,091.12 crores, as at March 31, 2017, compared to Rs. 13,306.79 crores as at March 31, 2016. These include bank deposits maturing within one year of Rs. 21,852.76 crores as at March 31, 2017, compared to Rs. 12,775.97 crores as at March 31, 2016.

Current tax assets (net) (current + non-current) were Rs. 1,195.67 crores, as at March 31, 2017, compared to Rs. 1,412.56 crores as at March 31, 2016.

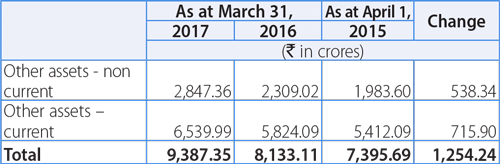

Other assets

These mainly includes prepaid expenses, including rentals on operating lease of Rs. 2,063.55 crores as at March 31, 2017, as compared to Rs. 1,774.54 crores as at March 31, 2016. Taxes recoverable, statutory deposits and dues from government were Rs. 6,030.06 crores as at March 31, 2017, as compared to Rs. 5,472.15 crores as at March 31, 2016.

Equity attributable to owners of Tata Motors Ltd was Rs. 58,061.89 crores and Rs. 78,952.41 crores as at March 31, 2017 and 2016, respectively, a decrease of 26.5%.

Other equity decreased by 26.7% from R78,273.23 crores as at March 31, 2016 to Rs. 57,382.67 crores as at March 31, 2017. Though, the profit for Fiscal 2017 was Rs. 7,454.36 crores, decrease in other equity of Rs. 20,890.56 crores was primarily attributable to following reasons:

- Debits for remeasurement of employee benefit plans was Rs. 6,569.14 in Fiscal 2017.

- Translation loss of Rs. 9,952.33 crores recognized in Translation Reserve on consolidation of subsidiaries further contributed to a decrease in Reserves and Surplus.

- Further reduction in Hedging Reserves by Rs. 11,759.48 crores, primarily due to mark-to-market losses on forwards and options in Jaguar Land Rover, primarily due to decline in the US$-GB£ forward rates.

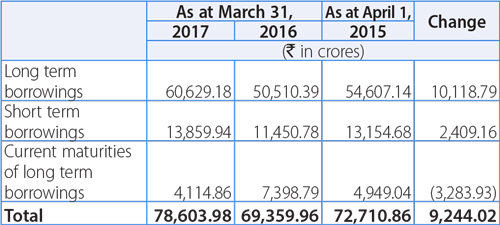

Borrowings:

- Current maturities of long-term borrowings represent the amount of loan repayable within one year.

- During Fiscal 2017, the Company raised Rs. 2,700 crores through unsecured non-convertible debentures with a tenor ranging from 2 years to 5 years.

- During Fiscal 2017, Jaguar land rover Automotive plc, issued Euro 650 million (Rs. 4,466.88 crores) Senior Notes maturing in January 2024 at a coupon of 2.20%. Further, it issued GB£ 300 million (Rs. 2,406.52 crores) Senior Notes maturing in January 2021 at a coupon of 2.75%.

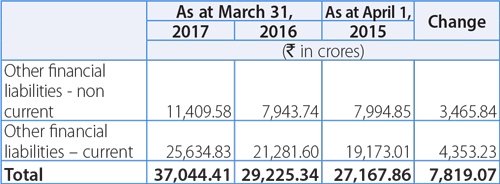

Other financial liabilities

These included Rs. 25,517.52 crores of derivative financial instruments, mainly attributable to Jaguar Land Rover as at March 31, 2017 compared to Rs. 14,226.41 crores as at March 31, 2016, reflecting notional liability due to the valuation of derivative contracts. However, current maturities of long-term borrowings were Rs. 4,114.86 crores as at March 31, 2017, as compared to Rs. 7,398.79 crores as at March 31, 2016.

Trade payables were Rs. 57,698.33 crores as at March 31, 2017, as compared to Rs. 57,580.46 crores as at March 31, 2016.

Acceptances were Rs. 4,834.24 crores as at March 31, 2017, as compared to Rs. 3,981.33 crores as at March 31, 2016.

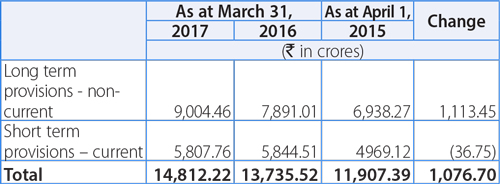

Provisions (current and non-current) were made towards warranty and employee benefit schemes. Short-term provisions are those, which are expected to be settled during next financial year. The details are as follows:

- Provision for warranty increased to Rs. 12,031.33 crores as at March 31, 2017, as compared to Rs. 11,516.43 crores as at March 31, 2016, an increase of Rs. 514.90 crores.

- The provision for employee benefits obligations decreased to Rs. 801.90 crores as at March 31, 2017, as compared to Rs. 954.69 crores as at March 31, 2016.

- Provision for legal and product liability increased to Rs. 822.17 crores as at March 31, 2017, as compared to Rs. 758.37 crores as at March 31, 2016.

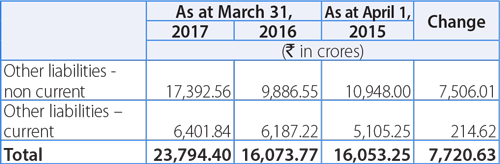

Other liabilities

These mainly includes liabilities towards employee benefits obligations of Rs. 11,984.02 crores as at March 31, 2017, as compared to Rs. 5,547.24 crores as at March 31, 2016, increase mainly at Jaguar Land Rover, primarily driven by a decline in AA rated UK corprate bond yields. Deferred revenue were Rs. 6,926.35 crores as at March 31, 2017, as compared to Rs. 5,609.88 crores as at March 31, 2016. Statutory dues (VAT, Excise, Service Tax, Octroi etc.) were Rs. 2,658.93 crores as at March 31, 2017, as compared to Rs. 2,443.43 crores as at March 31, 2016.

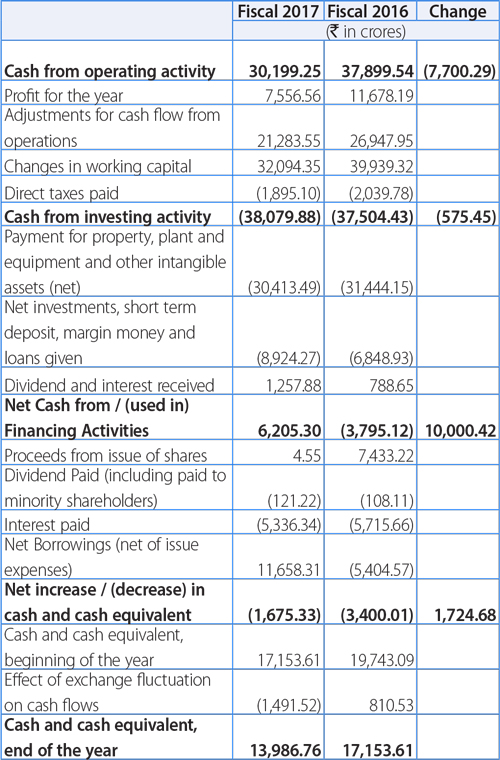

Consolidated Cash Flow

The following table sets forth selected items from consolidated cash flow statement:

- Cash generated from operations before working capital changes was Rs. 28,840.11 crores in Fiscal 2017, as compared to Rs. 38,626.14 crores in the previous year, representing a decrease in cash from generated from consolidated operations, consistent with the reduction in profit on a consolidated basis. After considering the impact of working capital changes including the net movement of vehicle financing portfolio, the net cash generated from operations was Rs. 30,199.25 crores in Fiscal 2017, as compared to Rs. 37,899.54 crores in the previous year. The increase in trade receivables, inventories and other assets amounting to Rs. 11,668.00 crores mainly due to increase in sales was offset by increase in trade and other payables and provisions amounting to Rs. 14,922.24 crores.

- The net cash outflow from investing activity increased to Rs. 38,079.88 crores in Fiscal 2017 from Rs. 37,504.43 crores in Fiscal 2016.

- Capital expenditure (net) was at Rs. 30,413.49 crores in Fiscal 2017, compared to Rs. 31,344.15 crores, related mainly to capacity/expansion of facilities, quality and reliability projects and product development projects.

- Net investments, short-term deposits, margin money and loans given was an outflow of Rs. 8,924.27 crores in Fiscal 2017 as compared to Rs. 6,848.93 crores in Fiscal 2016, mainly at Jaguar Land Rover.

- The net change in financing activity was an inflow of Rs. 6,205.30 crores in Fiscal 2017 as compared to an outflow of Rs. 3,795.12 crores in Fiscal 2016.

- During Fiscal 2016, the Company raised Rs. 7,433.22 crores through rights issue of shares.

- In Fiscal 2017, Rs. 9,172.39 crores were raised from longterm borrowings (net) as compared to repayment of Rs. 3,526.78 crores (net) in Fiscal 2016 as described in further detail below

- Net increase in short-term borrowings of Rs. 2,485.30 crores in Fiscal 2017 as compared to a decrease of Rs. 1,877.98 crores in Fiscal 2016, mainly at Tata and other brand vehicles (including vehicle financing).

As at March 31, 2017, the Company's borrowings (including shortterm debt) were R78,603.98 crores, compared to R69,359.96 crores as at March 31, 2016.

Principal Sources of Funding Liquidity

The Company finances its capital expenditures and research and development investments through cash generated from operations, cash and cash equivalents, debt and equity funding. The Company also raises funds through sale of investments, including divestment in stakes of subsidiaries on a selective basis.

The Company's cash and bank balances on a consolidated basis were Rs. 36,077.88 crores as at March 31, 2017, as compared to Rs. 30,460.40 crores as at March 31, 2016. These enable the Company to cater to business needs in the event of changes in market conditions.

The Company's capital expenditures were Rs. 31,750.74 crores and Rs. 31,425.39 crores for Fiscal 2017 and 2016, respectively, and it currently plans to invest approximately R400 billion in Fiscal 2018 in new products and technologies. The Company intends to continue to invest in new products and technologies to meet consumer and regulatory requirements. These investments are intended to enable the Company to pursue further growth opportunities and improve the Company's competitive positioning. In December 2015, Jaguar Land Rover announced the initial investment of GB£ 1 billion to build a manufacturing facility in Slovakia with annual capacity of 150,000 units and production scheduled to begin in 2018 (construction of the plant commenced in September 2016) and in November 2016 confirmed that the all new Land Rover Discovery would be the first model manufactured at the plant. In November 2015, Jaguar Land Rover announced additional investment of GB£ 450 million to double capacity at the engine manufacturing facility in Wolverhampton and production of the 2.0l Ingenium petrol engine recently began. The manufacturing partnership with Magna Steyr, an operating unit of Magna International Inc, to build vehicles in Graz, Austria was announced in July 2015 and more recently Jaguar Land Rover announced that their first battery electric vehicle, the Jaguar I-PACE would be produced under the agreement with Magna Steyr from 2018. The Company expects to meet most of its investments out of operating cash flows and cash liquidity available. In order to meet the remaining funding requirements, the Company may be required to raise funds through additional loans and by accessing capital markets from time to time, as deemed necessary.

With the ongoing need for investments in products and technologies, the Company on a standalone basis (Including joint operations) was free cash flow (a non-GAAP measure, measured at cash flow from operating activities, less payment for property, plant and equipment and intangible assets) negative in Fiscal 2017, of Rs. 2,045.52 crores. The Company expects that with the improvement in macro-economic conditions and business performance, through other steps like raising funds at subsidiary levels, review of non-core investments, and through appropriate actions for raising additional long-term resources at Tata Motors Limited on a standalone basis, the funding gap can be appropriately addressed.

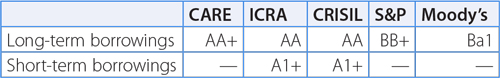

The following table provides information for the credit rating of Tata Motors Limited for short-term borrowing and long-term borrowing from the following rating agencies as at March 31, 2017: Credit Analysis and Research Ltd Ratings, or CARE, Information and Credit Rating Agency of India Ltd, or ICRA, Credit Rating Information Services of India Limited, or CRISIL Ltd, Standard & Poor's Ratings Group, or S&P, and Moody's Investor Services, or Moody's. A credit rating is not a recommendation to buy, sell or hold securities. A credit rating may be subject to withdrawal or revision at any time. Each rating should be evaluated separately of any other rating:

The Company believes that it has sufficient liquidity available to meet its planned capital requirements. However, the Company's sources of funding could be materially and adversely affected by an economic slowdown, as was witnessed in Fiscal 2009, or other macroeconomic factors in India and abroad, such as in the United Kingdom, the United States, Europe, Russia and China, all of which are beyond the Company's control. A decrease in the demand for the Company's vehicles could affect its ability to obtain funds from external sources on acceptable terms or in a timely manner.

The Company's cash is located at various subsidiaries within the Tata Motors Group. There may be legal, contractual or economic restrictions on the ability of subsidiaries to transfer funds to the Company in the form of cash dividends, loans, or advances. Brazil, Russia, South Africa and other jurisdictions have regulatory restrictions, disincentives or costs on pooling or transferring of cash. However, such restrictions have not had and are not estimated to have a significant impact on the Company's ability to meet its cash obligations.

In order to refinance the Company's borrowings and for supporting long-term fund needs, the Company continued to raise funds in Fiscal 2016 and 2017, through issue of various debt securities and Rights issue of shares described below.

During Fiscal 2016, the Company allotted 15,04,90,480 Ordinary shares (including 3,20,49,820 shares underlying the ADRs) of Rs. 2 each at a premium of Rs. 448 per share, aggregating Rs. 6,772.07 crores and 2,65,09,759 'A' Ordinary shares of Rs. 2 each at a premium of Rs. 269 per share, aggregating Rs. 718.42 crores pursuant to the Rights issue. Out of the proceeds of the Rights issue, Rs. 500 crores have been used for funding expenditure towards plant and machinery, Rs. 1,500 crores towards research and product development, Rs. 4,000 crores towards repayment in full or in part of certain long-term and shortterm borrowings, and Rs. 1,401.10 crores towards general corporate purposes.

During Fiscal 2016, TML Holdings Pte. Ltd., a subsidiary of the Company, has

- refinanced an existing unsecured multi-currency loan of US$600 million (US$250 million and SG$62.8 million maturing in November 2017 and US$210 million and SG$114 million maturing in November 2019) with a new unsecured loan of US$600 million (US$300 million maturing in October 2020 and US$300 million maturing in October 2022); and

- refinanced the existing SG$350 million 4.25% Senior notes due in May 2018 with a new syndicated loan of US$250 million maturing in March 2020.

During Fiscal 2016, Tata Motors Finance Limited issued 43,400,000 privately placed, cumulative non-participating compulsory convertible preference shares of Rs. 100 each convertible after seven years, which qualified as tier 1 capital.

In Fiscal 2016, TMFL, and its subsidiary, TMFSL, through secured and unsecured NCDs raised Rs. 2,214 crores.

In January 2017, Jaguar Land Rover Automotive plc issued EUR 650 million senior notes due 2024 at a coupon of 2.20% per annum and GB£ 300 million senior notes due 2021 at a coupon of 2.75% per annum. The proceeds were for general corporate purposes, including support for Jaguar Land Rover's ongoing growth and capital spending requirements.

In March 2017, Jaguar Land Rover Automotive plc completed consent transactions to align the terms of its US$ 500 million 5.625% senior notes due 2023, its US$ 700 million 4.125% senior notes due 2018 and its GB£ 400 million 5.000% senior notes due 2022 to bonds it issued after January 2014.

During Fiscal 2017, Tata Motors Limited issued rated, listed, unsecured NCDs of Rs. 2,700 crores with a tenor ranging from 2 to 5 years. The proceeds have been utilized for general corporate purpose. Tata Motors Limited prepaid R300 crores of its Unsecured 8.60% NCD due 2018 in February 2017.

During Fiscal 2017, Tata Motors Finance Limited through its subsidiary Sheba Properties Ltd., issued 22,500,000 privately placed, cumulative non-participating compulsory convertible preference shares of R100 each convertible after seven years, which qualifies as tier 1 capital. In Fiscal 2017, Tata Motors Finance Limited, and its subsidiaries, Sheba Properties Ltd and Tata Motors Finance Solutions Ltd, raised NCDs Rs. 3,161 crores through secured and unsecured NCDS.

The Tata Motors Group funds its short-term working capital requirements with cash generated from operations, overdraft facilities with banks, short-and medium-term borrowings from lending institutions, banks and commercial paper. The maturities of these short-and medium-term borrowings and debentures are generally matched to particular cash flow requirements. The working capital limits are Rs. 14,000 crores from various banks in India as at March 31, 2017. The working capital limits are secured by hypothecation of certain existing current assets of the Company. The working capital limits are renewed annually.

Jaguar Land Rover Automotive plc currently has a GB£ 1.87 billion revolving credit facility with a syndicate of 30 banks, maturing in 2020. The revolving credit facility remained undrawn as at March 31, 2017.

Some of the Company's financing agreements and debt arrangements set limits on and/or require prior lender consent for, among other things, undertaking new projects, issuing new securities, changes in management, mergers, sales of undertakings and investment in subsidiaries. In addition, certain negative covenants may limit the Company's ability to borrow additional funds or to incur additional liens, and/or provide for increased costs in case of breach. Certain of the Company's financing arrangements also include financial covenants to maintain certain debt-to-equity ratios, debt-to-earnings ratios, liquidity ratios, capital expenditure ratios and debt coverage ratios.

The Company monitors compliance with its financial covenants on an ongoing basis. The Company also reviews its refinancing strategy and continues to plan for deployment of long-term funds to address any potential non-compliance.

As at March 31, 2017, GB£ 687 million of cash was held by Jaguar Land Rover subsidiaries outside of the UK. The cash in some of these jurisdictions is subject to certain restrictions on cash pooling, intercompany loan arrangements or interim dividends. However, annual dividends are generally permitted and JLR do not believe that these restrictions have, or are expected to have, any impact on Jaguar Land Rover's ability to meet it's cash obligations.

Certain debt issued by Jaguar Land Rover is subject to customary covenants and events of default, which include, among other things, restrictions or limitations on the amount of cash, which may be transferred outside the Jaguar Land Rover group of companies in the form of dividends, loans or investments to the Company and its subsidiaries. These are referred to as restricted payments in the relevant Jaguar Land Rover financing documentation. In general, the amount of cash which may be transferred as restricted payments from the Jaguar Land Rover group to the Company and its subsidiaries is limited to 50% of its cumulative consolidated net income (as defined in the relevant financing documentation) from January 2011. As at March 31, 2017, the estimated amount that is available for dividend payments, other distributions and restricted payments was approximately GB£ 4,841 million.