Results of Operations

The following table sets forth selected items from the Company's consolidated statement of profit and loss for the periods indicated and shows these items as a percentage of total revenues:

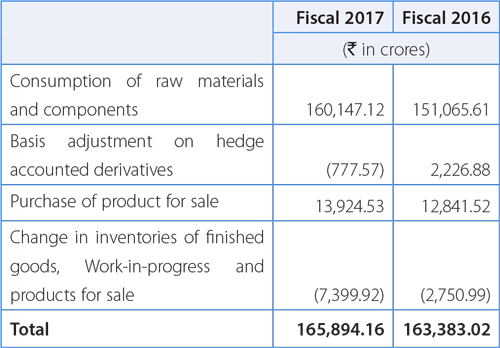

Cost of materials consumed (including change in stock)

Cost of material consumed increased from 58.8% of total revenue (excluding income from vehicle financing) in Fiscal 2016 to 60.4% in Fiscal 2017. For Tata Motors Standalone (including Joint Operations), costs of materials consumed was 63.8% of net revenue in Fiscal 2017 of total revenue as compared to 61.4% in Fiscal 2016, representing an increase of 240 bps, which was mainly attributable to a change in product mix that includes a relatively lower proportion of M&HCV sales. For Jaguar Land Rover, costs of materials consumed was 60.7% of total revenue in Fiscal 2017 compared to 59.1% in Fiscal 2016, representing an increase of 160 bps, driven by linear volumes and the general weakening of the Euro in Fiscal 2017.

Excise duty were Rs. 4,799.61 crores in Fiscal 2017 as compared to Rs. 4,614.99 crores in Fiscal 2016, an increase of 4.0%, primarily due to increase in revenues at the Company's India operations.

Employee Costs were Rs. 28,332.89 crores in Fiscal 2017 as compared to Rs. 28,880.39 crores in Fiscal 2016, a marginal decrease of 1.9% primarily due to favourable translation impact of GB£ to INR of Jaguar Land Rover operation of Rs. 2,765.01 crores. At Jaguar Land Rover the increase in employee cost is by 7.1% to GB£ 2,495 million (Rs. 21,829.15 crores) in Fiscal 2017 as compared to GBP 2,328 million (Rs. 22,930.37 crores) in Fiscal 2016, primarily reflects the increase in the employee head count to support the higher production volume in Fiscal 2017. For Tata Motors Standalone (including joint operations), the employee cost increased by 11.6% to Rs. 3,558.52 crores as compared to Rs. 3,188.97 crores in Fiscal 2016, mainly due to annual increments and wage revisions. Employee costs at TDCV were Rs. 775.83 crores in Fiscal 2017, as compared to Rs. 736.98 crores in Fiscal 2016, an increase of 5.3%.

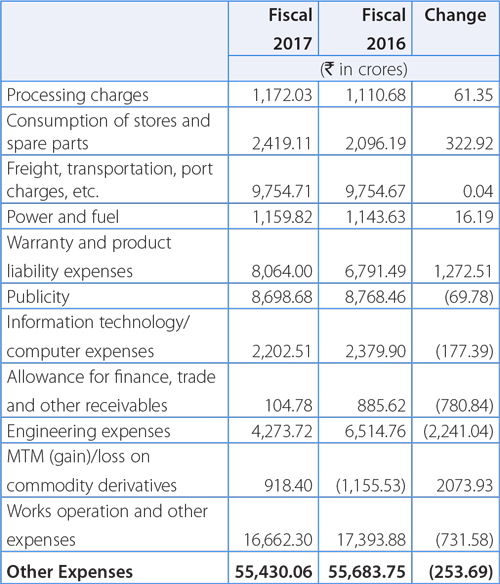

Other Expenses includes all works operations, indirect manufacturing expenses, freight cost, fixed marketing costs and other administrative costs. These expenses have decreased marginally to Rs. 55,430.06 crores in Fiscal 2017 from Rs. 55,683.75 crores in Fiscal 2016. Each line item includes the element of foreign currency translation favourable impact of Jaguar Land Rover operations of approximately Rs. 6,007.94 crores in aggregate in Fiscal 2017. The breakdown is provided below:

The changes are mainly driven by volumes and the size of operations.

- Processing charges were mainly incurred by Tata and other brand vehicles (including vehicle financing) which, due to higher volumes, led to higher expenditures.

- Freight, transportation, port charges etc. have increased, mainly for Jaguar Land Rover, predominantly due to increased sales in certain geographies. As a percentage to total revenue, Freight, transportation and port charges etc. were flat at 3.6% in Fiscal 2017.

- Publicity expenses remained flat and represented 3.2% of total revenues in Fiscal 2017 and 2016. In addition to routine product and brand campaigns, the Company incurred expenses relating to new product introduction campaigns for the new Jaguar XE, the all new Jaguar XF, refreshed 2016 Model year the Jaguar XJ, the new Jaguar F-PACE, the Range Rover Evoque (including convertible), the Tiago, Hexa, Tigor, Yodha at Tata Motors.

- Warranty and product liability expenses represented 2.9% and 2.4% of the Company's revenues in Fiscal 2017 and 2016, respectively. The warranty expenses at Jaguar Land Rover represented 3.31% of the revenue as compared to 2.6% last year, primarily due to product and market mix, whereas Tata Motors India operations represent 1% of revenue for Fiscal 2017 and 2016.

- Works operation and other expenses have decreased to 6.1% of net revenue in Fiscal 2017 from 6.3% in Fiscal 2016.

- Engineering expenses at Jaguar Land Rover reflect investment in the development of new vehicles. A significant portion of these costs are capitalized and shown under the line item "Amount capitalized".

- Allowances for finance, trade and other receivables have decreased to Rs. 104.78 crores in Fiscal 2017, as compared to Rs. 885.62 crores in Fiscal 2016, mainly reflect provisions for finance receivables, where the collections have improved in Fiscal 2017.

Amount capitalized represents expenditure transferred to capital and other accounts allocated out of employee cost and other expenses, incurred in connection with product development projects and other capital items. The expenditure transferred to capital and other accounts has increased by 1.2% to Rs. 16,876.96 crores in Fiscal 2017 from Rs. 16,678.34 crores in Fiscal 2016, mainly due to various product development projects undertaken by the Company for the introduction of new products and the development of engine and products variants.

Other Income decreased by 14.8% to Rs. 754.54 crores in Fiscal 2017 from R885.35 crores in Fiscal 2016. Interest income decreased to Rs. 562.21 crores in Fiscal 2017, compared to Rs. 718.98 crores in Fiscal 2016, whereas profit on sale of investment increased to Rs. 176.14 crores in Fiscal 2017, compared to Rs. 101.00 crores in Fiscal 2016. The increase is primarily due to profit on the sale of mutual funds, mainly at Tata and other brand vehicles (including vehicle financing).

Profit before finance cost, Depreciation and Amortization expence, Foreign Exchange (gain)/loss, Exceptional Items and Tax is Rs. 37,666.90 crores in Fiscal 2017, representing 13.7% of revenue in Fiscal 2017 compared to Rs. 42,661.63 crores in Fiscal 2016.

Depreciation and Amortization expence (including product development / engineering expenses): During Fiscal 2017, expenditures increased by 5.6% to Rs. 21,318.56 crores from Rs. 20,179.55 crores in Fiscal 2016. The depreciation has increased by 13.7% to Rs. 9,048.62 crores as compared to Rs. 7,959.95 crores in Fiscal 2016 is due to new product launches both at Jaguar Land Rover and Tata and other brand vehicles (including vehicle financing). The amortization expenses have marginally increased by 1.2% to Rs. 8,856.37 crores in Fiscal 2017 from Rs. 8,750.83 crores in Fiscal 2016, and are attributable to new products introduced during the year. Expenditure on product development/engineering expenses decreased marginally by 1.6% to Rs. 3,413.57 crores in Fiscal 2017 from Rs. 3,468.77 crores in Fiscal 2016.

Finance Cost decreased by 13.3% to Rs. 4,238.01 crores in Fiscal 2017 from Rs. 4,889.08 crores in Fiscal 2016. The decrease was mainly achieved by refinancing certain senior notes and other long-term loans with loans with lower interest rates.

Foreign exchange loss increased to Rs. 3,910.10 crores in Fiscal 2017 from Rs. 1,616.88 crores in Fiscal 2016. The increase was mainly due to depreciation of GB£ as compared to US$.

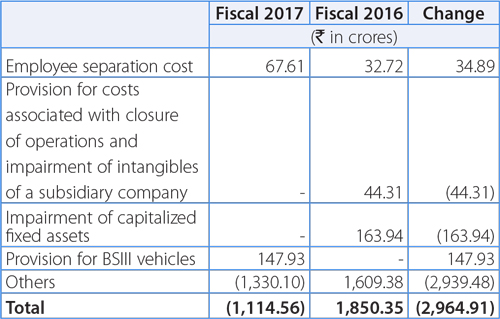

Exceptional items

The credit of Rs. 1,330.10 crores (GB£ 151 million) during the Fiscal 2017, relates to the explosion at the port of Tianjin (China) in August 2015. This relates to the receipt of insurance proceeds, recovery of import duties and taxes and to an updated assessment of the condition of the remaining vehicles, which led to a reversal of initial provision recorded in the quarter ended September 30, 2015 in Fiscal 2016.

Consolidated Profit Before Tax (PBT) decreased to Rs. 9,314.79 crores in Fiscal 2017, compared to Rs. 14,125.77 crores in Fiscal 2016. The reduction in PBT is primarily driven by less favourable market and model mix, mainly at the Company's India operations, including higher marketing expenses, depreciation and amortization and other operating costs. Further, the reduction was also due to translation impact from GB£ to INR of Rs. 1,263.04 crores. Furthermore, the decrease in profitability at Jaguar Land Rover operations were due to higher manufacturing expenses and other operating costs including higher marketing expenses, higher depreciation and amortization expenses related to significant capital expenditure incurred in prior periods, more unfavourable revaluation of unrealized foreign currency debt and hedges, offset by lower net finance expenses, favourable revaluation of commodity hedges and further insurance recoveries related to Tianjin.

Tax Expense represents a net charge of Rs. 3,251.23 crores in Fiscal 2017, as compared to Rs. 3,025.05 crores in Fiscal 2016. The effective tax rate in Fiscal 2017 was 34.9% as compared to 21.4% in Fiscal 2016. For Tata Motors Ltd and certain subsidiaries, the Company has not recognized deferred tax assets due to uncertainty of future taxable profits. In Fiscal 2017, there was a reduction in the UK Corporation tax from 20% to 19% for Fiscal 2018 to 2020 and to 17% thereafter, resulting in a deferred tax credit. Further, higher tax expenses, reflected the non-recurrence of favourable deferred tax credits in Fiscal 2016 (GB£ 74 million related to UK Patent Box legislation).

Consolidated Profit for the year declined by 35.6% to Rs. 7,454.36 crores in Fiscal 2017 from Rs. 11,579.31 crores in Fiscal 2016, after considering the profit from associate companies and shares of minority investees. The decrease was mainly attributable to negative earnings before other income, interest and tax for Tata and other brand vehicles (including financing thereof) of Rs. 207.05 crores in Fiscal 2017 from Rs. 2,188.15 crores in Fiscal 2016.

Consolidated Balance Sheet

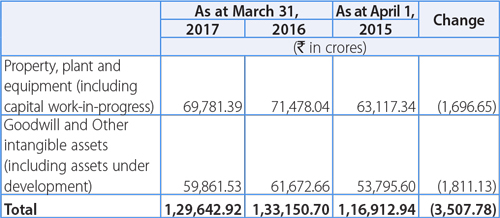

Property, plant and equipment, Goodwill and other intangible assets

There is decrease (net of depreciation and amortization) in the intangible and tangible assets in Fiscal 2017, due to unfavourable currency translation impact from GB£ to INR of Rs. 17,849 crores. The decrease was offset by additions in the Brazil manufacturing facility, tooling and facilities for new Range Rover Velar, Slovakia plant and product development cost at Jaguar Land Rover. At Tata Motors Ltd, the additions were mainly in dies, toolings, and product development cost for new products.

Investments in equity accounted investees were Rs. 4,606.01 crores as at March 31, 2017, as compared to Rs. 3,763.95 crores as at March 31, 2016. The increase was mainly due to profits at the Company's joint venture at China of GB£ 159 million (Rs. 1,384.36 crores). During Fiscal 2017, Jaguar Land Rover purchased 32% of CloudCar Inc. for GB£ 12 million (Rs. 107.15 crores).

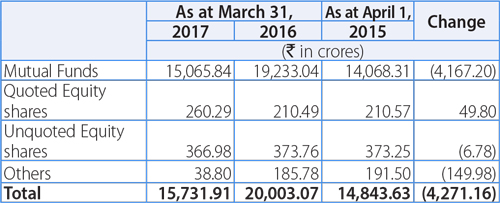

Investments (Current + Non-current) were Rs. 15,731.91 crores as at March 31, 2017, as compared to Rs. 20,003.07 crores as at March 31, 2016. The details are as follows:

The decrease in mutual fund investments was mainly at Jaguar Land Rover.

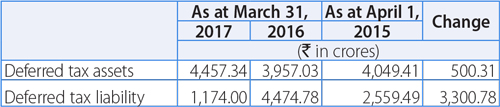

Deferred tax assets / liability: Deferred tax assets represent timing differences for which there will be future current tax benefits due to unabsorbed tax losses and expenses allowable on a payment basis in future years. Deferred tax liabilities represent timing differences where current benefit in tax will be offset by a debit in the statement of profit and loss.

A deferred tax liability (net) of Rs. 113.57 crores was recorded in the income statement and Rs. 3,774.28 crores in other comprehensive income, which mainly includes deferred tax towards post-retirement benefits and cash flow hedges in Fiscal 2017.

Finance receivables (current + non-current) were Rs. 17,563.25 crores as at March 31, 2017, as compared to Rs. 15,751.47 crores as at March 31, 2016, an increase of 11.5%, primarily due to decrease in allowances for vehicle financing due to improved collections. The Gross finance receivables were Rs. 21,160.76 crores as at March 31, 2017, as compared to Rs. 20,758.16 crores as at March 31, 2016.

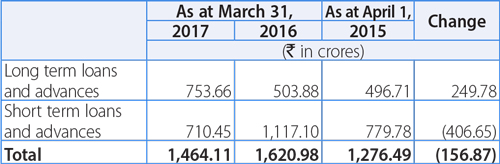

Loans and Advances

Loans and advances include advance to suppliers, contractors etc.