ANNEXURE "A" TO THE INDEPENDENT AUDITOR'S REPORT

(Referred to in paragraph 1(f) under 'Report on Other Legal and Regulatory Requirements' section of our report of even date to the Members of Tata Motors Limited)

Report on the Internal Financial Controls Over Financial Reporting under Clause (i) of Sub-section 3 of Section 143 of the Companies Act, 2013 ("the Act")

We have audited the internal financial controls over financial reporting of TATA MOTORS LIMITED ("the Company") as of March 31, 2017 in conjunction with our audit of the standalone Ind AS financial statements of the Company for the year ended on that date which includes internal financial controls over financial reporting of the Company's Joint Operations which are companies incorporated in India.

Management's Responsibility for Internal Financial Controls

The respective Boards of Directors of the Company and its Joint Operation Companies incorporated in India are responsible for establishing and maintaining internal financial controls based on the internal control over financial reporting criteria established by the respective companies considering the essential components of internal control stated in the Guidance Note on Audit of Internal Financial Controls Over Financial Reporting issued by the Institute of Chartered Accountants of India. These responsibilities include the design, implementation and maintenance of adequate internal financial controls that were operating effectively for ensuring the orderly and efficient conduct of its business, including adherence to respective company's policies, the safeguarding of its assets, the prevention and detection of frauds and errors, the accuracy and completeness of the accounting records, and the timely preparation of reliable financial information, as required under the Companies Act, 2013.

Auditor's Responsibility

Our responsibility is to express an opinion on the internal financial controls over financial reporting of the Company and its Joint Operation Companies incorporated in India based on our audit. We conducted our audit in accordance with the Guidance Note on Audit of Internal Financial Controls Over Financial Reporting (the "Guidance Note") issued by the Institute of Chartered Accountants of India and the Standards on Auditing prescribed under Section 143(10) of the Companies Act, 2013, to the extent applicable to an audit of internal financial controls. Those Standards and the Guidance Note require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether adequate internal financial controls over financial reporting was established and maintained and if such controls operated effectively in all material respects.

Our audit involves performing procedures to obtain audit evidence about the adequacy of the internal financial controls system over financial reporting and their operating effectiveness. Our audit of internal financial controls over financial reporting included obtaining an understanding of internal financial controls over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. The procedures selected depend on the auditor's judgement, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error.

We believe that the audit evidence we have obtained, is sufficient and appropriate to provide a basis for our audit opinion on the internal financial controls system over financial reporting of the Company and its Joint Operation Companies incorporated in India.

Meaning of Internal Financial Controls Over Financial Reporting

A company's internal financial control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal financial control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorisations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorised acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements.

Inherent Limitations of Internal Financial Controls Over Financial Reporting

Because of the inherent limitations of internal financial controls over financial reporting, including the possibility of collusion or improper management override of controls, material misstatements due to error or fraud may occur and not be detected. Also, projections of any evaluation of the internal financial controls over financial reporting to future periods are subject to the risk that the internal financial control over financial reporting may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Opinion

In our opinion, to the best of our information and according to the explanations given to us, the Company and its Joint Operation Companies have, in all material respects, an adequate internal financial controls system over financial reporting and such internal financial controls over financial reporting were operating effectively as at March 31, 2017, based on the internal control over financial reporting criteria established by the Company and its Joint Operation Companies considering the essential components of internal control stated in the Guidance Note on Audit of Internal Financial Controls Over Financial Reporting issued by the Institute of Chartered Accountants of India.

For DELOITTE HASKINS & SELLS LLP

Chartered Accountants

(Firm Registration No. 117366W/W-100018)

B. P. SHROFF

Partner

(Membership No. 34382)

Mumbai, May 23, 2017

ANNEXURE "B" TO THE INDEPENDENT AUDITOR'S REPORT

(Referred to in paragraph 2 under "Report on Other Legal and Regulatory Requirements" section of our report of even date to the Members of Tata Motors Limited)

- In respect of its property, plant and equipment:

- The Company has maintained proper records showing full particulars, including quantitative details and situation of property, plant and equipment.

- The property, plant and equipment were physically verified during the year by the Management in accordance with a regular programme of verification which, in our opinion, provides for physical verification of all the property, plant and equipment at reasonable intervals. According to the information and explanations given to us, no material discrepancies were noticed on such verification.

- According to the information and explanations given to us, the records examined by us and based on the examination of the registered sale deed/transfer deed/conveyance deed/confirmation from custodians/court orders approving schemes of arrangements/amalgamations provided to us, we report that, the title deeds, comprising all the immovable properties of land and buildings which are freehold, are held in the name of the Company as at the balance sheet date. In respect of immovable properties that have been taken on lease and disclosed as property, plant and equipment in the financial statements, the lease agreements are in the name of the Company, where the Company is the lessee in the agreement.

- As explained to us, the stock of finished goods and work-in-progress in the Company's custody have been physically verified by the Management as at the end of the financial year, before the year-end or after the year-end, other than a significant part of the spare parts held for sale, and raw materials in the Company's custody for both of which, there is a perpetual inventory system and a substantial portion of the stocks have been verified during the year. In our opinion, the frequency of verification is reasonable. In case of materials and spare parts held for sale lying with third parties, certificates confirming stocks have been received periodically for stocks held during the year and for a substantial portion of such stocks held at the year-end.

- According to the information and explanations given to us, the Company has granted loans, secured or unsecured, to companies, firms, or other parties covered in the Register maintained under Section 189 of the Companies Act, 2013, in respect of which:

- The terms and conditions of the grant of such loans are, in our opinion, prima facie, not prejudicial to the Company's interest.

- The schedule of repayment of principal and payment of interest has been stipulated and repayments or receipts of principal amounts and interest have been regular as per stipulations.

- There is no amount overdue for more than 90 days at the balance sheet date.

- In our opinion and according to the information and explanations given to us, the Company has complied with the provisions of Sections 185 and 186 of the Companies Act, 2013 in respect of grant of loans, making investments and providing guarantees and securities, as applicable.

- According to the information and explanations given to us, the Company has not accepted any deposit during the year. In respect of unclaimed deposits, the Company has complied with the provisions of Sections 73 to 76 or any other relevant provisions of the Companies Act, 2013.

- The maintenance of cost records has been specified by the Central Government under Section 148(1) of the Companies Act, 2013 in respect of its products. We have broadly reviewed the cost records maintained by the Company pursuant to the Companies (cost records and audit) Rules, 2014 and amended Companies (cost records and audit) Amendment Rules, 2016 as prescribed by the Central Government under sub-section (1) of Section 148 of the Companies Act, 2013, and are of the opinion that prima facie, the prescribed cost records have been made and maintained. We have, however, not made a detailed examination of the cost records with a view to determine whether they are accurate or complete.

- According to the information and explanations given to us, in respect of statutory dues:

- The Company has generally been regular in depositing undisputed statutory dues, including Provident Fund, Employees' State Insurance, Incometax, Sales Tax, Service Tax, Customs Duty, Excise Duty, Cess and other material statutory dues applicable to it with the appropriate authorities. We are informed by the Company that the Employees' State Insurance Act, 1948 is applicable only to certain locations of the Company. With regard to the contribution under the Employees' Deposit Linked Insurance Scheme, 1976 (the Scheme), we are informed that the Company has sought exemption from making contribution to the Scheme since it has its own Life Cover Scheme. The Company has made an application on March 28, 2017 seeking an extension of exemption from contribution to the Scheme for a period of 3 years which is awaited.

- There were no undisputed amounts payable in respect of Provident Fund, Employees' State Insurance, Income-tax, Sales Tax, Service Tax, Customs Duty, Excise Duty, Cess and other material statutory dues in arrears as at March 31, 2017 for a period of more than six months from the date they became payable.

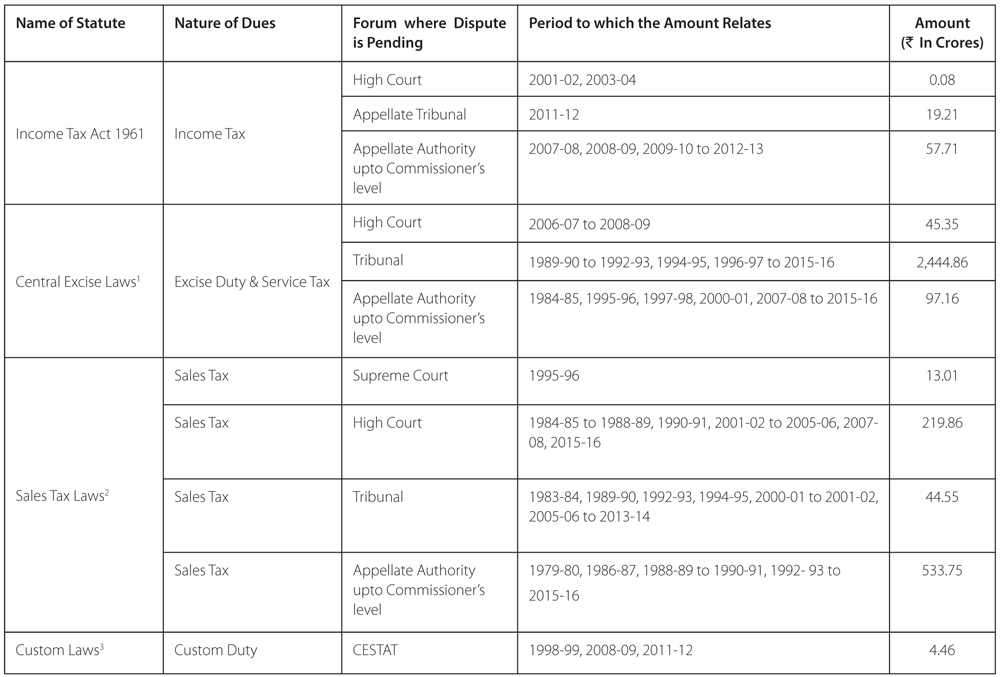

- Details of dues of Income-tax, Sales Tax, Service Tax, Customs Duty and Excise Duty which have not been deposited as on March 31, 2017 on account of disputes are given below:

1 Net of Rs. 76.94 crores paid under protest; 2 Net of Rs. 117.90 crores paid under protest; 3 Net of Rs. 7.01 crores paid under protest.

- In our opinion and according to the information and explanations given to us, the Company has not defaulted in the repayment of loans or borrowings to financial institutions, banks and government and dues to debenture holders.

- In our opinion and according to the information and explanations given to us, the Company has not raised moneys by way of initial public offer or further public offer (including debt instruments) and the term loans have been applied by the Company during the year for the purposes for which they were raised.

- To the best of our knowledge and according to the information and explanations given to us, no fraud by the Company and no material fraud on the Company by its officers or employees has been noticed or reported during the year.

- In our opinion and according to the information and explanations given to us, the Company has paid/provided managerial remuneration in accordance with requisite approval mandated by the provision of Section 197 read with Schedule V to the Companies Act, 2013 except for remuneration paid to the Managing Director which is in excess of prescribed limits. The Central Government approval is awaited.

- The Company is not a Nidhi Company and hence reporting under clause (xii) of the Order is not applicable.

- In our opinion and according to the information and explanations given to us, the Company is in compliance with Section 177 and 188 of the Companies Act, 2013, where applicable, for all transactions with the related parties and the details of related party transactions have been disclosed in the financial statements etc. as required by the applicable accounting standards.

- During the year the Company has not made any preferential allotment or private placement of shares or fully or partly convertible debentures and hence reporting under clause (xiv) of the Order is not applicable to the Company.

- In our opinion and according to the information and explanations given to us, during the year the Company has not entered into any non-cash transactions with its directors or directors of its holding, subsidiary or associate company or persons connected with them and hence provisions of Section 192 of the Companies Act, 2013 are not applicable.

- The Company is not required to be registered under Section 45-I of the Reserve Bank of India Act, 1934.

For DELOITTE HASKINS & SELLS LLP

Chartered Accountants

(Firm Registration No. 117366W/W-100018)

B. P. SHROFF

Partner

(Membership No. 34382)

Mumbai, May 23, 2017