TO THE MEMBERS OF TATA MOTORS LIMITED

The Directors present their Seventy Second Annual Report along with the Audited Statement of Accounts for Fiscal 2017.

Pursuant to the notification issued by the Ministry of Corporate Affairs on February 16, 2015 and under the Companies (Indian Accounting Standards) Rules, 2015 and other accounting principles generally accepted in India, the Company has adopted Indian Accounting Standards on April 1, 2016, with the transition date as April 1, 2015. Fiscal 2016 Financial Statements have been prepared in accordance with the recognised and measurement principles stated therein.

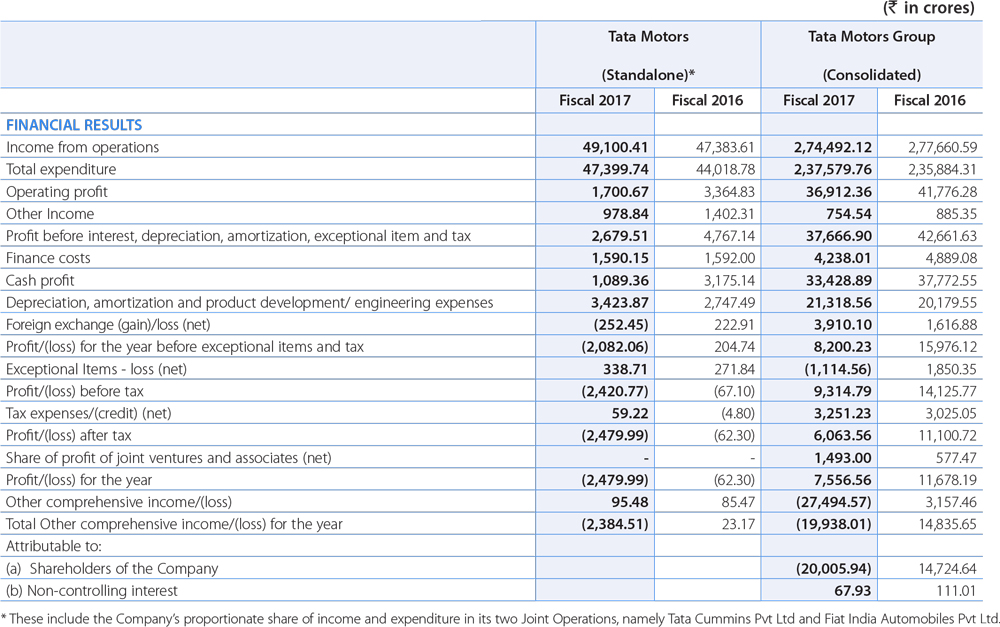

FINANCIAL PERFORMANCE SUMMARY

DIVIDEND

Considering the continued weak operating environment in the standalone business and in view of the losses for the year, no dividend is permitted to be paid to the Members for Fiscal 2017, as per the Companies Act, 2013 ("the Act") and the Rules framed thereunder.

TRANSFER TO RESERVES

In Fiscal 2016, an additional amount has been transferred from retained earnings to Debenture Redemption Reserve (DRR) on outstanding Non-Convertible Debentures (NCDs) and Senior Notes (including interest accrued where applicable) of Rs. 43.79 crores. Due to losses in Fiscal 2017, resulting in debit balance in retained earnings no amount has been transferred to DRR on the NCDs allotted in Fiscal 2017.

OPERATING RESULTS AND PROFITS

Fiscal 2017 has been marked by couple of 'Black Swan' events (like Brexit -UK decision to exit EU and Demonetization in India) having a large impact on the future course of developments. This year was marked by the way for the long awaited and transformational Goods and Service Tax (GST).

Growth of World GDP has been 3.1% in Fiscal 2016. A recovery in commodity prices has provided some relief to commodity exporters and helped in reducing the deflationary pressures. The Orgainisation of the Petroleum Exporting Countries (OPEC) ability to increase price by cutting down production has been curtailed by rising Shale gas output in US. Moreover, structural problems such as low productivity growth and high-income inequality persisted and are likely to be continued. Activity rebounded strongly in the United States in second half of calendar 2016 compared to weaker first half. However, output remained below potential in a number of other advanced economies, notable in the European area. The picture of emerging market and developing economies remained much more diverse. The growth rate in China was a bit stronger than expected, supported by continued policy stimulus. Activity was weaker than expected in some Latin American countries such as Brazil, whereas, activity in Russia was slightly better than expected, in part reflecting firmer oil prices.

India's economy has grown at a strong pace in recent years owing to the implementation of critical structural reforms and lower external vulnerabilities. It has grown by 7.1% in Fiscal 2017, compared to 7.9% in Fiscal 2016 primarily because of the temporary consumption shock induced by cash shortages and payment disruptions from demonetisation. Private investment continues to remain weak due to over capacity. In order to propel the economy the government has been trying to give a thrust to the investment by allocating a higher sum towards gross fixed capital formation.

The Tata Motors Group registered a de-growth of 1.1% in income from operations to Rs. 2,74,492 crores in Fiscal 2017 as compared to Rs. 2,77,661 crores in Fiscal 2016, due to negative translation impact from Great British Pound (GB£) to Indian Rupee (Rs.) of Rs. 27,686 crores and de-growth in the M&HCV segment in India was offset by higher wholesale volumes in Jaguar and Land Rover and growth in Passenger Vehicle segment in India. The consolidated EBITDA margins for Fiscal 2017 stood at 13.4%. Consequently, Profit Before Tax (PBT) and Profit After Tax (PAT) [post share of profit of joint ventures and associates (net)] were Rs. 9,315 crores and Rs. 7,557 crores, respectively.

Tata Motors Limited recorded income from operations (including joint operations) of Rs. 49,100 crores, 3.6% higher from Rs. 47,384 crores in the previous year. Muted demand of M&HCV and LCV due to weak replacement demand, subdued freight demand from industrial segment, which took a further hit post demonetization and lower than expected pre-buying ahead of the implementation of BS-IV, resulting in lower EBITDA margins of 3.5% in Fiscal 2017 as against 7.1% in Fiscal 2016. Loss Before and After Tax (including joint operations) for Fiscal 2017 were at Rs. 2,421 crores and Rs. 2,480 crores, respectively, as compared to Loss Before and After Tax (including joint operations) of Rs. 67 crores and Rs. 62 crores, respectively in Fiscal 2016. The losses were primarily driven by less favourable market and model mix, including higher marketing expenses, depreciation and amortization and other operating cost.

Jaguar Land Rover (JLR) (as per IFRS) recorded revenues of GB£24.3 billion compared to GB£22.3 billion in Fiscal 2016, driven by higher sales volumes and weaker GB£.

Consolidated EBITDA for Fiscal 2017 at GB£3.0 billion, was marginally lower as compared to EBITDA of GB£3.1 billion for Fiscal 2016, as the higher revenue was more than offset by higher marketing, manufacturing and other operating expenses. EBIT was GB£1.5 billion in Fiscal 2017 lower than GB£1.8 billion in Fiscal 2016, due to higher depreciation and amortization which were partially offset by higher profits from the Chinese joint venture.

PBT in Fiscal 2017 was GB£1.6 billion in-line with the PBT of GB£1.6 billion in Fiscal 2016, the lower EBIT and unfavourable foreign exchange revaluation was more than offset by a favourable revaluation of commodity hedges and of GB£151 million further recoveries relating too to Tianjin fire in this year compared to GB£157 million net charge than in Fiscal 2016.

In May 2016, JLR redeemed the remaining US$84 million (GB£57 million equivalent) of the 8.125% US$ bond maturing in 2021 by exercising its call option, the majority of which was successfully tendered and redeemed in March 2015. In January 2017, JLR issued a €650 million 7-year bond with a coupon of 2.20% and a GB£300 million 4-year bond with a coupon of 2.75%. In addition, JLR successfully undertook a consent solicitation in March 2017 to align the terms of three of their older bonds to the terms of the Euro and GB£ bonds issued in January 2017.

Tata Motors Finance Limited (TMFL) (consolidated) (as per Indian GAAP) the Company's captive financing subsidiary, reported revenue of Rs. 2,721 crores (Fiscal 2016 Rs. 3,229 crores) and reported a Loss After Tax Rs. 1,182 crores in Fiscal 2017, as compared to PAT Rs. 267 crores in Fiscal 2016.

Tata Daewoo Commercial Vehicle Company Limited South Korea (TDCV), (as per Korean GAAP) registered revenues of KRW 1,032 billion in Fiscal 2017, a growth of 17.3% over Fiscal 2016 mainly due to increase in domestic sales. The PAT was KRW 50 billion compared to KRW 46 billion in Fiscal 2016. Higher domestic volume, better mix, favourable exchange realizations and material cost reduction helped in improving profits.

VEHICLE SALES AND MARKET SHARES

The Tata Motors Group sales for this year stood at 11,57,808 vehicles, up by 8.8% as compared to Fiscal 2016. Globally the Company sold 3,96,097 Commercial Vehicles and Passenger Vehicles were 7,61,711.

TATA MOTORS

Tata Motors recorded sales of 545,416 vehicles, a growth of 6.5% over Fiscal 2016. In Fiscal 2016 Industry in India, grew by 8.3%, resulting in the Company's market share decreasing to 12.8% in Fiscal 2017 in the Indian Automotive Industry from 13.1% in the Fiscal 2016. The Company's exports on standalone basis grew by 10.6% to 64,221 vehicles in Fiscal 2017 as compared to 58,058 vehicles in Fiscal 2016.