Reducing operating costs: The Company believes that its scale of operations provides it with a significant advantage in reducing costs and it plans to continue to sustain and enhance this cost advantage. The Company's ability to leverage its technological capabilities and its manufacturing facilities among it's commercial vehicle and passenger vehicle businesses enables it to reduce cost. For example, the diesel engine used in its Indica was modified to engineer a new variant for use in the Ace platform, which helped to reduce the project cost. Similarly, platform sharing for the manufacture of pickup trucks and UVs enables the Company to reduce capital investment that would otherwise be required, while allowing it to improve the utilization levels at it's manufacturing facilities. Where appropriate for the Company to do so, it intends to apply its existing low-cost engineering and sourcing capability to Jaguar Land Rover vehicles.

The Company's vendor relationships also contribute to its cost reductions. For example, the Company believes that the vendor rationalization program that it is undertaking will provide economies of scale to its vendors, which would benefit it's cost programs. The Company is also undertaking various internal and external benchmarking exercises that would enable it to improve the cost effectiveness of its components, systems and sub-systems.

The Company is intensified efforts to review and realign its cost structure through a number of measures such as reduction of labour costs and rationalization of other fixed costs The Jaguar Land Rover business continues to focus on cost management initiatives, such as streamlining its purchasing processes and building on its strong relationships with suppliers while increasing employee deployment and flexibility across its sites. In addition, Jaguar Land Rover continues to increase its use of its new modular aluminium architecture across vehicle platforms, which it expect will result in the use of common technology more widely across products lines and a reduction in engineering complexity.

Enhancing capabilities through the adoption of superior processes: Tata Sons and the entities promoted by Tata Sons, including the Company, aim at improving quality of life through leadership in various sectors of national economic significance. In pursuit of this goal, Tata Sons and the Tata Sons-promoted entities have institutionalized an approach, called the Tata Business Excellence Model, which has been formulated along the lines of the Malcolm Baldrige National Quality Award to enable the Company to improve performance and attain higher levels of efficiency in the Company's businesses and in discharging Company's social responsibility. The model aims to nurture core values and concepts embodied in various focus areas such as leadership, strategic planning, customers, markets and human resources, and to translate them to operational performance. The Company's adoption and implementation of this model seeks to ensure that its business is conducted through superior processes.

The Company has deployed a balance scorecard system for measurement-based management and feedback. The Company has also deployed a new product introduction process for systematic product development and a PLM system for effective product data management across its organization. The Company has adopted various processes to enhance the skills and competencies of its employees. The Company has also enhanced it's performance management system, with appropriate mechanisms to recognize talent and sustain its leadership base. The Company believes these will enhance company's way of doing business, given the dynamic and demanding global business environment.

Expanding customer financing activities: With financing a critical factor in vehicle purchases and in light of the rising aspirations of consumers in India, the Company intends to expand it's vehicle financing activities to enhance its vehicle sales. In addition to improving its competitiveness in customer attraction and retention, the Company believes that expansion of its financing business would also contribute toward moderating the impact on it's financial results from the cyclical nature of vehicle sales. To spur growth in the small commercial vehicles category, the Company has teamed up with various public sector and cooperative banks and Grameen banks to introduce new finance schemes. TMFL has increased its reach by opening a number of limited services branches in tier 2 and 3 towns. This has reduced turnaround times and, the Company believes, improved customer satisfaction. TMFL's channel finance initiative and fee-based insurance support business have also helped improve profitability.

Similarly, the Company is working on arranging financing tie-ups in international market, which is critical in ramping up retails.

Continuing to invest in technology and technical skills: The Company believes it is one of the most technologically advanced indigenous vehicle manufacturers in India. Over the years, the Company has enhanced its technological strengths through extensive in-house research and development activities. Further, the Company's research and development facilities at its subsidiaries, such as TMETC, TDCV, TTL and Trilix, together with the two advanced engineering and design centers of Jaguar Land Rover, have increased its capabilities in product design and engineering. The Jaguar Land Rover business is committed to continue to invest in new technologies to develop products that meet the opportunities of the premium market, including developing sustainable technologies (i.e. plug-in hybrids and battery electric vehicles) that improve fuel economy and reduce CO2 emissions. The Company considers technological leadership to be a significant factor in its continued success, and therefore intends to continue to devote significant resources to upgrade its technological base.

Maintaining financial strength: The Company's cash flow (consolidated basis) from operating activities in Fiscal 2017 and 2016 was Rs. 30,199.25 crores and Rs. 337,899.54 crores, respectively. The Company's operating cash flows are primarily due to company's Jaguar Land Rover business, implementation of cost reduction programs, and prudent working capital management. The Company has established processes for project evaluation and capital investment decisions with an objective to enhance its long-term profitability.

Automotive Operations

Automotive operations is the Company's most significant segment, accounting for 99.3% and 99.5% of its total revenues in Fiscal 2017 and 2016 respectively. Revenue from automotive operations before inter-segment eliminations decreased by 1.3% to Rs. 2,72,692.41 crores in Fiscal 2017 as compared to Rs. 2,76,221.67 crores in Fiscal 2016.

The Company's automotive operations include:

- activities relating to the development, design, manufacture, assembly and sale of vehicles as well as related spare parts and accessories;

- distribution and service of vehicles; and

- financing of the Company's vehicles in certain markets.

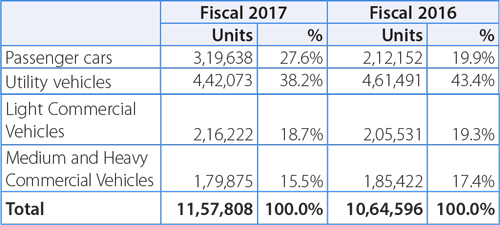

The Company's consolidated total retail sales (including international business sales and Jaguar Land Rover sales, including Chery Jaguar Land Rover) for Fiscal 2017 and 2016 are set forth in the table below:

The automotive operations segment is further divided into (i) Tata and other brand vehicles (including vehicle financing) and (ii) Jaguar Land Rover.

Tata and other brand vehicles (including vehicle financing)

India is the primary market for Tata and other brand vehicles (including vehicle financing). During Fiscal 2017, there was a robust and steady pace of economic growth in the geographic markets in which the Tata and other brand vehicles segment has operations.

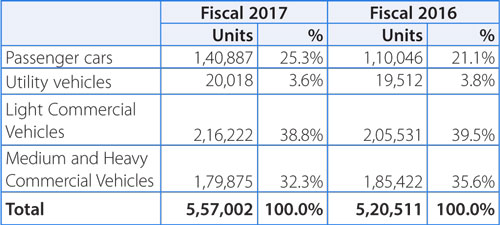

As per the advance estimates, the Indian economy experienced a GDP growth of 7.1% in Fiscal 2017, compared to 7.9% in Fiscal 2016 (based on data from the Ministry of Statistics and Program Implementation). The Indian automobile industry experienced an increase of 8.2% in Fiscal 2017, as compared to 8.0% in Fiscal 2016. The growth of the automobile sector was affected by demonetization in third quarter of the fiscal and ban on sale and registration of BSIII vehicles in March 2017. This has affected the performance of Tata and other brand vehicles, mainly the Medium and Heavy Commercial vehicles sales. The following table sets forth the Company consolidated total sales of Tata and other brand vehicles:

The Company's overall sales of Tata and other brand vehicles increased by 7.0% to 5,57,002 units in Fiscal 2017 from 5,20,511 units in Fiscal 2016, and the revenue (before inter-segment elimination) increased by 5.6% to Rs. 56,448.78 crores during Fiscal 2017, compared to Rs. 53,462.52 crores in Fiscal 2016.

Vehicle Sales in India

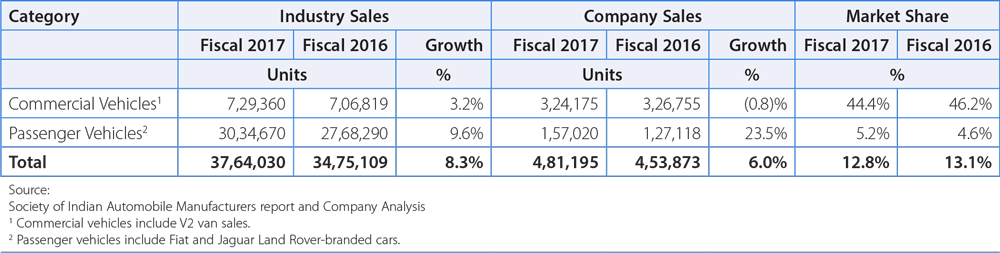

Automobile sales across categories domestically rose by 8.2% in Fiscal 2017. Sale of passenger vehicles grew by 9.6% in Fiscal 2017, as compared to Fiscal 2016 whereas Commercial vehicle sales expanded by 3.2% in Fiscal 2017.

The following table sets forth the Company's (on standalone basis) sales, industry sales and relative market share in vehicle sales in India. Passenger vehicles includes passenger cars and utility vehicles. Commercial vehicles include Medium & Heavy Commercial Vehicles and Light Commercial Vehicles.

Passenger Vehicles in India

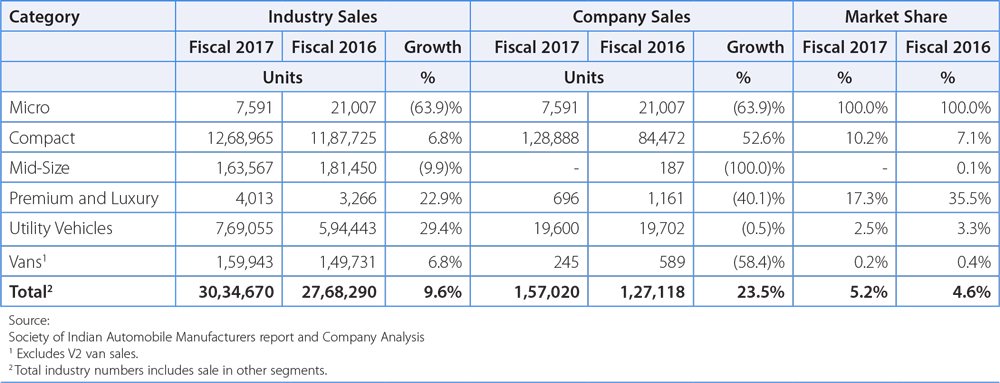

Sales in the passenger vehicles industry in India increased by 9.6% in Fiscal 2017, primarily attributable to reduced fuel prices, improved consumer sentiments, and lower interest rates. Utility Vehicles sales witnessed significant growth during Fiscal 2017. Further, the van segment is also experiencing growth.

Reflecting the growth in the Indian passenger vehicle sector, the Company's passenger vehicle sales in India increased by 23.5% to 1,57,020 units in Fiscal 2017 from 1,27,118 units in Fiscal 2016, due to new product offerings by the Company.

The Company's passenger vehicles category consists of: (i) passenger cars and (ii) utility vehicles. The Company sold 1,37,175 units in the passenger car category in Fiscal 2017, representing an increase of 28.4% compared to 1,06,827 units in Fiscal 2016. In the utility vehicles (including vans), the Company sold 19,845 units in Fiscal 2017, representing a decrease of 2.2% from 20,291 units in Fiscal 2016. During Fiscal 2017, the Company launched Tiago and sold 58,227 units. Hexa, a crossover was launched in January 2017 and Tata Tigor was launched in last week of March 2017. All these new product launches has helped Company increasing its market share and volumes in passenger vehicles category.