Product development/engineering expenses The Company introduced the factor of “affordability” of investments w.e.f. April 1, 2018 for capitalization of product development costs. Accordingly, the amount written off increased by 20.4% to Rs.571.76 crores in FY 2018-19 from Rs.474.98 crores in FY 2017-18

Amount transferred to capital and other account represents expenditure transferred to capital and other accounts allocated out of employee cost and other expenses, incurred in connection with product development projects and other capital items. The expenditure transferred to capital and other accounts has increased by 27.8% to Rs.1,093.11 crores in FY 2018-19 from Rs.855.08 crores in FY 2017-18, mainly due to various product development projects undertaken by the Company for the introduction of new products, BS6 and the development of engine and products variants

Other Income increased by 2.5% to Rs.2,554.66 crores in FY 2018- 19 from Rs.2,492.48 crores in FY 2017-18. This includes interest income of Rs.335.87 crores in FY 2018-19, compared to Rs.397.71 crores in FY 2017-18. Dividend income increased to Rs.1,526.25 crores in FY 2018-19 from Rs.1,054.69 crores in FY 2017-18, whereas profit on sale of investment decreased to Rs.69.27 crores in FY 2018-19, compared to Rs.103.17 crores in FY 2017-18.

Profit before depreciation and amortization, finance costs, foreign exchange loss, exceptional items and tax is Rs.7,709.43 crores in FY 2018-19, representing 11.1% of revenue, compared to Rs.4,883.20 crores (8.3% of revenue) in FY 2017-18.

Depreciation and amortization: During FY 2018-19, expenditures decreased marginally to Rs.3,098.64 crores from Rs.3,101.89 crores in FY 2017-18. The depreciation has increased by 2.2% to Rs.2,017.45 crores as compared to Rs.1,973.94 in FY 2017-18. The amortization expenses have decreased by 4.1% to Rs.1,081.19 crores in FY 2018-19 from Rs.1,127.95 crores in FY 2017-18, and are mainly attributable to product development costs.

Finance Cost has increased by 2.8% to Rs.1,793.57 crores in FY 2018-19 from Rs.1,744.43 crores in FY 2017-18. The increase is attributable to higher interest rates.

Foreign exchange loss of Rs.215.22 crores in FY 2018-19 as compared to loss of Rs.17.14 crores in FY 2017-18. The loss was due to depreciation on INR as compared to US$.

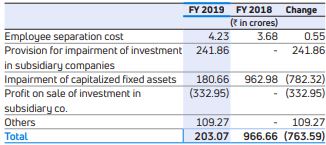

Exceptional items

- Employee separation cost: The Company has given early retirement to certain employees resulting in expenses in FY 2018-19 and FY 2017-18.

- The Company has made provision of Rs.241.86 crores during FY 2018-19 for certain of its investments in subsidiary companies, due to continued losses.

- In order to make the Company fit for future certain product development programs were reviewed and accordingly an impairment charge of Rs.180.66 crores were taken during FY 2018-19, as compared to Rs.962.98 crores in FY 2017-18.

- In FY 2018-19, the Company has sold investment in TAL Manufacturing Solutions Limited to Tata Advanced Systems Ltd.

- The Company has entered into an agreement for transfer of its Defence undertaking, which had a value of Rs.209.27 crores as at December 31, 2017 to Tata Advanced Systems Ltd (transferee company), for an upfront consideration of Rs.100 crores and a future consideration of 3% of the revenue generated from identified Specialized Defence Projects for upto 15 years from FY 2019-20 subject to a maximum of Rs.1,750 crores. The future consideration of 3% of revenue depends on future revenue to be generated from the said projects by the transferee company. On account of the same, the Company has recognized a provision of Rs.109.27 crores, which may get reversed in future once projects start getting executed from FY 2019-20 onwards

Profit before tax was Rs.2,398.93 crores in FY 2018-19, compared to a loss of Rs.946.92 crores in FY 2017-18. In FY 2017-18, though the Company performed well in terms of sales and revenue and reducing the costs, the losses were due to certain one-time charges to make the Company “fit for future”.

Tax Expense represents a net charge of Rs.378.33 crores in FY 2018- 19, as compared to Rs.87.93 crores in FY 2017-18. The increase was mainly due to better performance of the Company including its Joint operations.

Profit after tax was Rs.2,020.60 crores in FY 2018-19 as compared loss of Rs.1,034.85 crores in FY 2017-18.