Commercial Vehicles in India

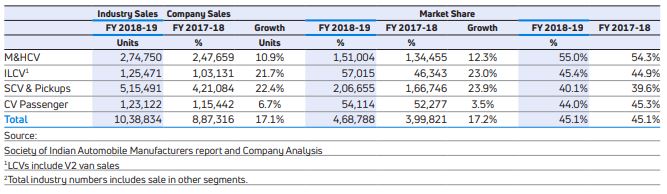

Industry sales of commercial vehicles increased by 17.1% to 10,38,834 units in FY 2018-19 from 8,87,316 units in FY 2017-18. Industry sales in the medium and heavy commercial vehicle segment has grown by 10.9% at 2,74,750 units in FY 2018-19, as compared to 2,47,659 in FY 2017-18. The M&HCV industry has shown signs of recovery since July 2017. The implementation of GST, restrictions on overloading and infrastructure growth supported by the Government has boosted the demand. Industry sales of ILCV reported an increase of 21.7% to 1,25,471 units in FY 2018-19, from 1,03,131 units in FY 2017-18. Industry sales of SCV & Pickups reported an increase of 22.4% to 5,15,491 units in FY 2018-19, from 4,21,084 units in FY 2017-18. The ILCV & SCV industry growth is mainly due to high investments in e-commerce segments which is driving demand for last mile transportation requirements, growth in replacement demand, improved financing and recovery in rural demand. Industry sales of CV Passenger reported an increase of 6.7% to 1,23,122 units in FY 2018-19, from 1,15,442 units in FY 2017-18.

The following table sets forth the Company’s commercial vehicle sales, industry sales and relative market share in commercial vehicle sales in India.

The sales of the Company’s commercial vehicles in India grew by 17.2% to 4,68,788 units in FY 2018-19 from 3,99,821 units in FY 2017-18. The Company’s sales in the M&HCV category increased by 12.3% to 1,51,004 units in FY 2018-19, as compared to sales of 134,455 units in FY 2017-18. The Company’s sales in the ILCV segment increased by 23.0% to 57,015 units in FY 2018-19, from 46,343 units in FY 2017-18. The sales in SCV & Pickups segment increased by 23.9% to 2,06,655 units in FY 2018-19 from 1,66,746 units in FY 2017-18.The CV Passenger segment grew by 3.5% to 54,114 units in FY 2018-19 from 52,277 units in FY 2017-18.

Tata and other brand vehicles — Exports

International business has consistently expanded since its inception in 1961. The Company have a global presence in more than 46 countries, including all South Asian Association for Regional Cooperation countries, South Africa, Africa, Middle East, Southeast Asia and Ukraine. The Company markets a range of products including M&HCV trucks, LCV trucks, buses, pickups and small commercial vehicles.

The Company’s exports (on standalone basis) grew marginally by 1.4% to 53,140 units in FY 2018-19 as compared to 52,404 units in FY 2017-18. Commercial vehicles exports were 51,119 units in FY 2018-19, as compared to 50,106 units in FY 2017-18. The new regulations and political uncertainty in Sri Lanka and slump in Middle East, resulted in significant drop in the market, affecting the Company’s sales. However, the Company’s market share in both these markets improved for the commercial vehicles. The Company bagged several prestigious orders in FY 2018-19. Passenger vehicles exports stood at 2,021 units in FY 2018-19, compared to 2,298 units in FY 2017-18. Two large markets remain non-operational - Sri Lanka due to high import duties, tight retail financing and South Africa due to the closure of the distribution channel. Tata Motors made the first ever supply to Bangladesh Army with 18 Units of Hexa.

In FY 2018-19, Tata Daewoo Commercial Vehicle Co. Ltd or TDCV’s vehicles sales were 6,672 units compared to 8,870 units in FY 2017- 18, a drop of 24.8%.The domestic sales at 4,371 units in FY 2018- 19, reduced by 36.3% as compared to 6,859 units in FY 2017-18, primarily due to lower industry volumes and aggressive discounting and marketing strategies of importers. The combined market share was 21.1% in FY 2018-19 as compared to 26.5% in FY 2017-18. The export market scenario continued to remain challenging in FY 2018-19, with factors like local currency depreciation against the US Dollar, continuing statutory regulations to reduce imports, the slowdown in Chinese economy impacting commodity exporting countries and increased dealer inventory and impact of US sanction on Iran. However, TDCV could increase its export sales to 2,301 units, 14.4% higher compared to 2,011 units in FY 2017-18. TDCV is working on an aggressive turnaround plan to get back to sustainable profitable growth in the coming years.

Tata and other brand vehicles — Sales and Distribution

The Company’s sales and distribution network in India as at March 2019 comprised approximately over 6,600 touch points for sales and service for its passenger and commercial vehicle business. The Company’s subsidiary, TML Distribution Company Limited, or TDCL, acts as a dedicated distribution and logistics management Company to support the sales and distribution operations of its vehicles in India. The Company believes this has improved the efficiency of its selling and distribution operations and processes. The Company uses a network of service centers on highways and a toll-free customer assistance center to provide 24-hour roadside assistance, including replacement of parts, to vehicle owners.

TDCL provides distribution and logistics support for vehicles manufactured at the Company’s facilities and has set up stocking points at some of Company’s plants and at different places throughout India. TDCL helps us improve planning, inventory management, transport management and timing of delivery. The Company has customer relations management system, or CRM, at all of its dealerships and offices across the country, which supports users both at its Company and among its distributors in India and abroad.

The Company markets its commercial and passenger vehicles in several countries in Africa, the Middle East, South East Asia, South Asia, Australia, Latin America, Russia and the Commonwealth of Independent States countries. The Company has a network of distributors in all such countries, where it exports its vehicles. Such distributors have created a network of dealers and branch offices and facilities for sales and after-sales servicing of the Company’s products in their respective markets. The Company has also stationed overseas resident sales and service representatives in various countries to oversee its operations in the respective territories.

Tata and other brand vehicles – Vehicle Financing

Through the Company’s wholly owned subsidiary TMF Holdings Ltd and its step down subsidiaries Tata Motors Finance Ltd (TMFL) and Tata Motors Finance Solutions Ltd (TMFSL), the Company provides financing services to purchasers of its vehicles through independent dealers, who act as the Company’s agents for financing transactions, and through the Company’s branch network. TMF group disbursed Rs.21,993 crores and Rs.15,406 crores in vehicle financing during FY 2018-19 and FY 2017-18, respectively. During FY 2018-19 and FY 2017-18, approximately 26% and 25%, respectively, of the Company’s vehicle unit sales in India were made by the dealers through financing arrangements with Company’s captive financing subsidiary. As at March 31, 2019 and 2018, the Company’s customer finance receivable portfolio comprised 5,77,399 and 488,456 contracts, respectively. The Company follow specified internal procedures, including quantitative guidelines, for selection of its finance customers and assist in managing default and repayment risk in the Company’s portfolio. The Company originate all of the contracts through its authorized dealers and direct marketing agents with whom the Company have agreements. All the Company’s marketing, sales and collection activities are undertaken through dealers or by TMF group.

TMFL securitize or sell its finance receivables on the basis of the evaluation of market conditions and funding requirements. The constitution of these pools is based on criteria that are decided by credit rating agencies and/or based on the advice that we receive regarding the marketability of a pool. TMFL undertake these securitizations of its receivables due from purchasers by means of private placement.

TMFL act as collection agents on behalf of the investors, representatives, special purpose vehicles or banks, in whose favor the receivables have been assigned, for the purpose of collecting receivables from the purchasers on the terms and conditions contained in the applicable deeds of securitization, in respect of which pass-through certificates are issued to investors in case of special purpose vehicles, or SPVs. TMFL also secure the payments to be made by the purchasers of amounts constituting the receivables under the loan agreements to the extent specified by rating agencies by any one or all of the following methods:

- furnishing collateral to the investors, in respect of the obligations of the purchasers and the undertakings to be provided by TMFL;

- furnishing, in favor of the investors, 14.39% of the future principal in the receivables as collateral, for securitizations done through FY 2018-19, either by way of a fixed deposit or bank guarantee or subordinate tranche to secure the obligations of the purchasers and our obligations as the collection agent, based on the quality of receivables and rating assigned to the individual pool of receivables by the rating agency(ies); and

- by way of over-collateralization or by investing in subordinate pass-through certificates to secure the obligations of the purchasers.

Tata and other brand vehicles — Competition

The Company faces competition from various domestic and foreign automotive manufacturers in the Indian automotive market. Improving infrastructure and robust growth prospects compared to other mature markets has attracted a number of international companies to India that either have formed joint ventures with local partners or have established independently owned operations in India. Global competitors bring with them decades of international experience, global scale, advanced technology and significant financial resources, and, as a result, competition is likely to further intensify in the future. The Company has designed its products to suit the requirements of the Indian market based on specific customer needs such as safety, driving comfort, fuel-efficiency and durability. The Company believes that its vehicles are suited to the general conditions of Indian roads and the local climate. Its vehicles have also been designed to comply with applicable environmental regulations currently in effect. The Company also offers a wide range of optional configurations to meet the specific needs of its customers and intends to develop and is developing products to strengthen its product portfolio in order to meet the increasing customer expectations of owning world-class products

Tata and other brand vehicles — Seasonality

Demand for the Company’s vehicles in the Indian market is subject to seasonal variations. Demand for the Company’s vehicles generally peaks between January and March, although there is a decrease in demand in February just before release of the Indian fiscal budget. Demand is usually lean from April to July and picks up again in the festival season from September onwards, with a decline in December due to year-end.

Jaguar Land Rover

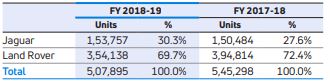

Total wholesales of Jaguar Land Rover vehicles (excluding Chery Jaguar Land Rover and JLR CKD operations) with a breakdown between Jaguar and Land Rover brand vehicles, in FY 2018-19 and FY 2017-18 are set forth in the table below:

In FY 2018-19, Jaguar Land Rover wholesale volumes (excluding sales from Chery Jaguar Land Rover) were 5,07,895 units, down 6.9%, compared to FY 2017-18, primarily reflecting weak market conditions in China as well as production downtime to reduce inventory, partially offset by growth in UK sales volumes. The introduction of new and refreshed models led by the Jaguar E-PACE, award winning I-PACE, Range Rover Velar and the refreshed Range Rover and Range Rover Sport were offset by lower sales of more established models, mainly in China, and the run-out of the first generation Range Rover Evoque in the third quarter ahead of with the launch of the new Evoque now available. Wholesale volumes (excluding sales from Chery Jaguar Land Rover) were up in the UK (4.1%), but down in other regions including North America (2.4%), Overseas markets (5.5%), Europe (6.1%) and China (38.8%).

Jaguar wholesale volumes were 1,53,757 units, up 2.2% compared to FY 2017-18, as the introduction of the E-Pace and award winning all electric I-PACE, were partially offset by lower sales volume other more established models, primarily F-PACE and XE.

Land Rover wholesale volumes were 3,54,138 units, down 10.3% compared to the previous year, as sales of the refreshed Range Rover and Range Rover Sport (including hybrid models) as well as a full year of Range Rover Velar sales were offset by lower volumes of more established models, mainly in China, and the run out of the first generation Range Rover Evoque in the 3rd quarter ahead with the launch of the new Evoque now available.

The wholesale volumes of Chery Jaguar Land Rover (China joint venture) were 57,428 units in FY 2018-19, down 34.9% compared to the 88,212 units in FY 2017-18, primarily reflecting the challenging market conditions in China. By model, the introduction of the Jaguar E-Pace and a full year of long wheelbase XEL sales were offset by lower sales of the more established Land Rover Discover Sport, Range Rover Evoque and long wheelbase Jaguar XFL.

Jaguar Land Rover’s performance in key geographical markets on a retail basis

Retail volumes (including retail sales from the China Joint Venture) in FY 2018-19 declined by 5.8% to 5,78,915 units from 6,14,309 units in FY 2017-18 as the introduction of new and refreshed models led by the Jaguar E-PACE, award winning I-PACE, Range Rover Velar and the refreshed Range Rover and Range Rover Sport were offset by lower sales of more established models, mainly in China, and the run-out of the first generation Range Rover Evoque in the third quarter ahead of with the launch of the new Evoque now available.

United Kingdom

Industry vehicle sales fell 3.7% in FY 2018-19 in the United Kingdom as diesel (sales down 25.9% year on year) and Brexit uncertainty continued, with the Brexit deadline extended to the end of October but uncertainty remaining over any potential deal. Jaguar Land Rover retail volumes increased by 8.4% to 1,17,915 units in FY 2018-19 compared to 1,08,759 units in FY 2017-18.By brand, Jaguar retails were 38,515 vehicles in FY 2018-19, up 20.1% compared to 32,078 vehicles in FY 2017-18, and Land Rover retails were 79,400, up 3.5% compared to 76,681 last year.

North America

Economic performance in North America remained generally favourable in FY 2018-19 with solid GDP but industry vehicle sales were slightly lower (0.5%) year on year. Jaguar Land Rover retails increased significantly, up 8.1% year on year, to 1,39,778 units in FY 2018-19 compared to 1,29,319 units in FY 2017-18. By brand, Jaguar retails were 36,768 vehicles in FY 2018-19, down 10.0% compared to 40,855 vehicles in FY 2017-18, offset by Land Rover retails, which were 1,03,010, up 16.4% compared to 88,464 last year.

Europe

GDP growth in Europe was mixed in FY 2018-19 and slowed by the end of the year as economic growth in Germany slowed, and Italy entered recession. Industry volumes in Europe were down 0.9% and Jaguar Land Rover retail sales fell 4.5% year on year to 1,27,566 vehicles in FY 2018-19 from 1,33,592 in FY 2017-18, primarily as a result of continuing diesel uncertainty, Brexit and the change to more stringent World Harmonized Light Vehicle Testing Procedure (WLTP) emissions testing regime. By brand, Jaguar retails were 49,474 vehicles in FY 2018-19, up 36.5% compared to 36,248 vehicles in FY 2017-18, and Land Rover retails were 78,092, down 19.8% compared to 97,344 last year.

China

Economic growth continued to slow in China during FY 2018-19 as weaker market conditions and trade tension with the US continued. As a result, and compounded by uncertainty driven by import duties in July, industry vehicle sales declined by 8.3% year on year and Jaguar Land Rover retail volumes (including sales from the China Joint Venture) decreased by 34.1% to 98,922 units in FY 2018-19 from 1,50,116 units in FY 2017-18. By brand, Jaguar retails were 32,797 vehicles in FY 2018-19, down 26.6% compared to 44,705 vehicles in FY 2017-18, and Land Rover retails were 66,125, down 37.3% compared to 1,05,411 last year.

Other Overseas markets

Jaguar Land Rover’s retail volumes in other overseas markets increased by 2.4% to 94,734 vehicles in FY 2018-19 compared to 92,523 units in the prior year. By brand, Jaguar retails were 22,644 vehicles in FY 2018-19, up 9.5% compared to 20,674 vehicles in FY 2017-18, and Land Rover retails were 72,090, up 0.3% compared to 71,849 last year.