Results of Operations

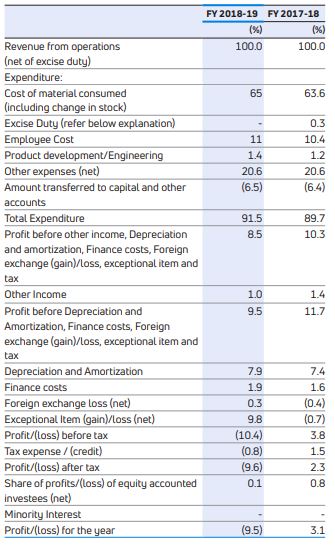

The following table sets forth selected items from the Company’s consolidated statements of income for the periods indicated and shows these items as a percentage of total revenues:

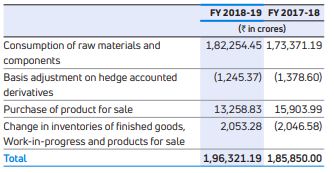

Cost of materials consumed (including change in stock)

Cost of material consumed increased from 63.6% of total revenue (excluding income from vehicle financing) in FY 2017-18 to 65.0% in FY 2018-19. For Tata Motors Standalone (including Joint Operations), costs of materials consumed was 73.1% of net revenue in FY 2018-19 of total revenue as compared to 72.7% in FY 2017-18, representing an increase of 40 bps, which was mainly attributable to a change in product mix. For Jaguar Land Rover, costs of materials consumed was 63.8% of total revenue in FY 2018-19 compared to 61.9% in FY 2017-18, representing an increase of 190 bps, mainly driven by product mix.

Employee Costs were Rs. 33,243.87 crores in FY 2018-19 as compared to Rs. 30,300.09 crores in FY 2017-18, an increase of 9.7%. There was unfavourable translation impact of GB£ to INR of Jaguar Land Rover operation of Rs. 1,691.23 crores. At Jaguar Land Rover the increase in employee cost is by 3.5% to GB£2,822 million (Rs. 25,903.78 crores) in FY 2018-19 as compared to GB£2,726 million (Rs. 23,392.69 crores) in FY 2017-18, primarily reflects the average increase in the employee head count all across functions. For Tata Motors Standalone (including joint operations), the employee cost increased by 7.7% to Rs. 4,273.10 crores as compared to Rs. 3,966.73 crores in FY 2017-18, mainly due to annual increments, higher bonus and performance payment accruals and wage revisions. To manage, employee costs, in FY 2018-19, Jaguar Land Rover announced the voluntary redundancy program, resulting in a charge of Rs. 1,367.22 crores (considered in exceptional items).

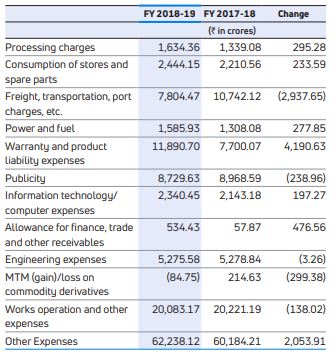

Other Expenses includes all works operations, indirect manufacturing expenses, freight cost, fixed marketing costs and other administrative costs. These expenses have increased to Rs.62,238.12 crores in FY 2018-19 from Rs.60,184.21 crores in FY 2017-18. The breakdown is provided below:

The changes are mainly driven by volumes and the size of operations.

- Processing charges were mainly incurred by Tata and other brand vehicles, which, due to higher volumes, led to higher expenditures

- Freight, transportation, port charges etc. have decreased, for Jaguar Land Rover, predominantly due to decreased sales in certain geographies. As a percentage to total revenue, Freight, transportation and port charges etc. were at 2.6% in FY 2018- 19, as compared to 3.7% in FY 2017-18. The decrease is also due to presentation change on adoption of Ind AS 115.

- Publicity expenses decreased by 2.7% mainly due to decrease in JLR and represented 2.9% of total revenues in FY 2018-19 and 3.1% in FY 2017-18. In addition to routine product and brand campaigns, the Company incurred expenses relating to new product introduction campaigns for the I-Pace, E-Pace, Velar and the all new Jaguar XF, the Harrier, Tiago/Tigor JTP range at Tata Motors.

- Warranty and product liability expenses represented 3.9% and 2.6% of the Company’s revenues in FY 2018-19 and FY 2017- 18, respectively. The warranty expenses at Jaguar Land Rover represented 4.2% of the revenue as compared to 2.7% last year, primarily due to new campaigns, whereas Tata Motors India operations these represent 1.5% and 1.3% of revenue for FY 2018-19 and FY 2017-18, respectively.

- Works operation and other expenses have decreased to 6.7% of net revenue in FY 2018-19 from 6.9% in FY 2017-18.

- Engineering expenses at Jaguar Land Rover have been flat, reflecting the continued investment in the development of new vehicles. A significant portion of these costs are capitalized and shown under the line item “Amount transferred to capital and other accounts”.

- The provision and write off of various debtors, vehicle loans and advances (net), has increased to Rs.534.43 crores in FY 2018-19 as compared to Rs.57.87 crores in FY 2017-18. Allowances for trade and other receivables for FY 2018-19 increased to Rs.211.81 crores, as compared to Rs.14.57 crores. In FY 2017-18, there was reversal of certain provisions for trade receivables due to favourable litigation award. Allowances for finance receivables has increased to Rs.320.24 crores in FY 2018-19, as compared to Rs.43.30 crores in FY 2017-18. The increase is due to higher finance receivables, due to increased volumes, lower calculations on percentage terms of finance receivables and there was a reversal of provision in FY 2017-18.

Amount transferred to capital and other accounts represents expenditure transferred to capital and other accounts allocated out of employee cost and other expenses, incurred in connection with product development projects and other capital items. The expenditure transferred to capital and other accounts has increased by 5.8% to Rs.19,659.59 crores in FY 2018-19 from Rs.18,588.09 crores in FY 2017-18, mainly due to various product development projects undertaken by the Company for the introduction of new products and the development of engine and products variants.

Other Income decreased by 25.1% to Rs.2,965.31 crores in FY 2018- 19 from Rs.3,957.59 crores in FY 2017-18. Interest income increased to Rs.786.46 crores in FY 2018-19, compared to Rs.711.81 crores in FY 2017-18, whereas profit on sale of investment marginally decreased to Rs.128.61 crores in FY 2018-19, compared to Rs.129.26 crores in FY 2017-18. Fair value gain in investments has increased to Rs.238.54 crores in FY 2018-19, as compared to Rs.32.05 crores in FY 2017-18. During FY 2018-19, the fair value of the investment in Lyft has increased by GB£24.35 million (Rs.223.45 crores), due to IPO lisiting on the NASDAQ stock exchange.

Profit before Depreciation and Amortization, Finance costs, Foreign exchange (gain)/loss, exceptional item and tax is Rs.28,535.55 crores in FY 2018-19, representing 9.5% of revenue in FY 2018-19 compared to Rs.34,229.99 crores in FY 2017-18.

Depreciation and Amortization: During FY 2018-19, depreciation and amortization expenditures increased by 9.5% to Rs.23,590.63 crores from Rs.21,553.59 crores in FY 2017-18. The depreciation increase of 12.2% to Rs.12,200.42 crores as compared to Rs.10,874.34 crores in FY 2017-18 is mainly at Jaguar Land Rover due to new product launches and opening of new facilities (Slovakia). The amortization expenses have also increased by 6.7% to Rs.11,390.21 crores in FY 2018-19 from Rs.10,679.25 crores in FY 2017-18, and are attributable to new products introduced during the year, mainly at Jaguar Land Rover business.

Product development/engineering expenses The Company introduced the factor of “affordability” of investments w.e.f. April 1, 2018 for capitalization of product development costs. Accordingly, charge off increased by 19.6% to Rs.4,224.57 crores in FY 2018-19 from Rs.3,531.87 crores in FY 2017-18.

Finance Cost Increased by 23% to Rs.5,758.60 crores in FY 2018- 19 from Rs.4,681.79 crores in FY 2017-18. The Increase was mainly attributable to higher interest rates and borrowings. The finance cost at JLR is higher from Rs.724.65 crores to Rs.1010.68 crores due to $1bn syndicated loan facility drawn down in October 2018.

Foreign exchange loss of Rs.905.91 crores in FY 2018-19 as compared to gain of Rs.1,185.28 crores in FY 2017-18. The loss was mainly due to depreciation of GBP and INR as compared to USD.

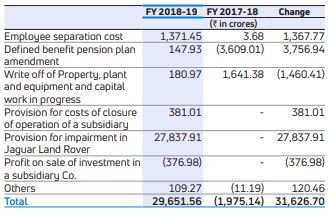

Exceptional items (gain)/loss

- In FY 2018-19, Jaguar Land Rover announced the voluntary redundancy program, resulting in a charge of Rs.1,367.22 crores.

- The debit of GB£16.5 million (Rs.147.93 crores) in FY 2018-19 as compared to credit of GB£437 million (Rs.3,609.01 crores) in FY 2017-18, related to the amendment of the Defined Benefit scheme of Jaguar Land Rover as past service costs.

- In FY 2018-19, the Company has taken an impairment charge of £3,105 million (Rs.27,837.91 crores). The Company assessed the recoverable amount of the Jaguar Land Rover business, which represent a single cash-generating unit (CGU), as the higher of Fair Value Less Cost of Disposal (‘FVLCD’) and Value in Use (‘VIU’) of the relevant assets of the CGU, due to change in market conditions especially in China, technology disruptions and rising cost of debt.

- On July 31, 2018, the Company decided to cease the current manufacturing operations of Tata Motors Thailand Ltd. The Company will address the Thailand market with a revamped product portfolio, suitable to the local market needs, delivered through a CBU distribution model. Accordingly, the relevant restructuring costs have been accounted in FY 2018-19.

- In FY 2018-19, the Company has sold investment in TAL Manufacturing Solutions Limited to Tata Advanced Systems Ltd.

Earnings Before Interest Tax (EBIT) decreased to Rs.3,643 crores in FY 2018-19, compared to Rs.11,846 crores in FY 2017-18. EBIT is defined to include the revaluation of current assets and liabilities and realized foreign exchange and commodity hedges as well as profits from equity accounted investees but excludes the revaluation of foreign currency debt, mark to market (MTM) on foreign exchange and commodity hedges, other income and exceptional items.

Consolidated loss Before Tax (PBT) Rs.31,371.15 crores in FY 2018-19, compared to profit of Rs.11,155.03 crores in FY 2017-18. The loss before tax is primarily driven by -

- The profitability at Jaguar Land Rover operations were lower due to product mix, higher manufacturing expenses and other operating costs including higher marketing expenses, higher depreciation and amortization expenses related to significant capital expenditure incurred in prior periods.

- Impairment charge of Rs.27,837.91 crores for Jaguar Land Rover.

- Improvement in the Tata Motors Ltd Standalone business in India, mainly favourable model mix and better management of other operating costs.

- The increase in profits in FY 2017-18 was also due to exceptional gain of Rs.3,609.01 crores of pension cost

Tax Expense represents a net credit of Rs.2,437.45 crores in FY 2018-19, as compared to net charge of Rs.4,341.93 crores (effective tax rate of 32.3%) in FY 2017-18. Due to impairment charge at Jaguar Land Rover, there is a write down of previously recognized deferred tax asset of Rs.2,698.15 crores. Further, for Tata Motors Ltdand certain subsidiaries, the Company has not recognized deferred tax assets due to uncertainty of future taxable profits.

Consolidated loss after tax of Rs.28,826.23 crores in FY 2018-19 from profit of Rs.8,988.91 crores in FY 2017-18, after considering the profits from associate companies and shares of minority investees. The losses was mainly attributable to Jaguar Land Rover business performance, including impairment charge.

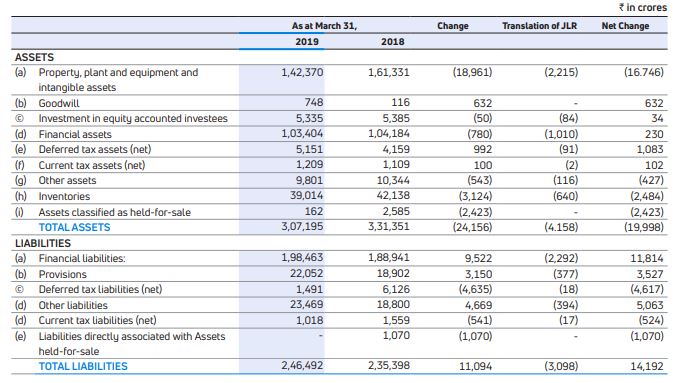

Consolidated Balance Sheet