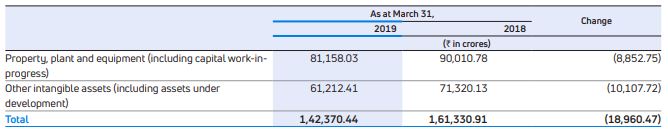

Property, plant and equipment and other intangible assets

There is decrease (net of depreciation and amortization) in the intangible and tangible assets in FY 2018-19. The decrease was due to impairment charge of Rs.27,837.91 crores at Jaguar Land Rover. Further, the decrease was due to unfavourable currency translation impact from GB£ to INR of Rs.2,215 crores. This was offset mainly at Jaguar Land Rover Slovakia plant, tooling and facilities for new products like E-Pace, Evoque, I-Pace etc. At Tata Motors Ltd, the additions were mainly in dies, tooling’s, and product development cost for new products.

Investments in equity accounted investees were Rs.5,334.88 crores as at March 31, 2019, as compared to Rs.5,385.24 crores as at March 31, 2018.

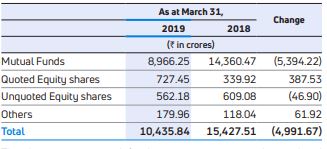

Financial Assets (Current + Non-current)

Investments (Current + Non-current) were Rs.10,435.84 crores as at March 31, 2019, as compared to Rs.15,427.51 crores as at March 31, 2018. The details are as follows:

The decrease in mutual fund investments was at Jaguar Land Rover and Tata Motors Limited. Increase in quoted equity shares is due to fair value gain.

Finance receivables (current + non-current) were Rs.33,624.69 crores as at March 31, 2019, as compared to Rs.23,881.18 crores as at March 31, 2018, an increase of 40.8%, primarily due to increased vehicle financing business. The Gross finance receivables were Rs.34,457.74 crores as at March 31, 2019, as compared to Rs.25,070.75 crores as at March 31, 2018.

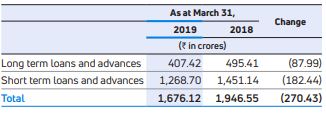

Loans and Advances

Loans and advances include advances to suppliers and contractors etc. which has decreased to Rs. 1,177.45 crores as at March 31, 2019 from Rs. 1,431.98 crores as at March 31, 2018.

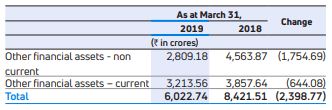

Other Financial Assets

These included Rs. 2,146.68 crores of derivative financial instruments, mainly attributable to Jaguar Land Rover as at March 31, 2019 compared to Rs. 5,323.02 crores as at March 31, 2018, reflecting notional asset due to the valuation of derivative contracts. Recovery from suppliers has decreased to Rs. 1,927.28 crores as at March 31, 2019, as compared to Rs. 2,038.42 crores as at March 31, 2018. Further, there is deposit with financial institution of Rs. 500.00 crores as at March 31, 2019.

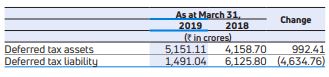

Deferred tax assets / liability: Deferred tax assets represent timing differences for which there will be future current tax benefits due to unabsorbed tax losses and expenses allowable on a payment basis in future years. Deferred tax liabilities represent timing differences where current benefit in tax will be offset by a debit in the statement of profit and loss.

A deferred tax credit (net) of Rs.4,662.68 crores was recorded in the income statement, mainly at JLR due to impairment charge during FY 2018-19 and Rs.700.99 crores in other comprehensive income, which mainly includes post-retirement benefits and cash flow hedges in FY 2018-19.

Inventories as at March 31, 2019, were Rs.39,013.73 crores as compared to Rs.42,137.63 crores as at March 31, 2018, a decrease of 7.4%. Inventory at Tata and other brand vehicles (including vehicle financing) was Rs.6,399.94 crores as at March 31, 2019 as compared to Rs.7,318.87 crores as at March 31, 2018. Inventory at Jaguar Land Rover was Rs.32,613.86 crores as at March 31, 2019, a decrease of 6.3%, as compared to Rs.34,805.01 crores as at March 31, 2018. In terms of number of days of sales, finished goods represented inventory of 39 days in FY 2018-19 as compared to 40 days in FY 2017-18.

Trade Receivables ( (net of allowance for doubtful debts) were Rs.18,996.17 crores as at March 31, 2019, representing a decrease of 4.5% compared to Rs.19,893.30 crores as at March 31, 2018. Trade Receivables have increased at Tata and other brand vehicles (including vehicle financing) to Rs.6,473.72 crores as at March 31, 2019 as compared to Rs.5,492.78 crores as at March 31, 2018. The increase was mainly due to higher sales in FY 2018-19. Trade receivables at Jaguar Land Rover was Rs.12,063.57 crores as at March 31, 2019, as compared to Rs.14,374.03 crores as at March 31, 2018, due to lower receivables in UK. The allowances for doubtful debts were Rs.970.10 crores as at March 31, 2019 compared to Rs.1,261.67 crores as at March 31, 2018. In terms of number of day’s sales, trade receivable represented 24 days in FY 2018-19 as compared to 21 days of 2018.

Cash and cash equivalents were Rs.21,559.80 crores, as at March 31, 2019, compared to Rs.14,716.75 crores as at March 31, 2018. The Company holds cash and bank balances in Indian rupees, GB£, Chinese Renminbi, etc.

Other bank balances were Rs.11,089.02 crores, as at March 31, 2019, compared to Rs.19,897.16 crores as at March 31, 2018. These include bank deposits maturing within one year of Rs.10,574.21 crores as at March 31, 2019, compared to Rs.19,361.58 crores as at March 31, 2018.

Current tax assets (net) (current + non-current) were Rs.1,208.93 crores, as at March 31, 2019, compared to Rs.1,108.81 crores as at March 31, 2018.

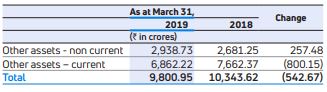

Other Assets

These mainly includes prepaid expenses, including rentals on operating lease of Rs.2,341.67 crores as at March 31, 2019, as compared to Rs.2,584.66 crores as at March 31, 2018. Taxes recoverable, statutory deposits and dues from government were Rs.6,153.85 crores as at March 31, 2019, as compared to Rs.6,724.43 crores as at March 31, 2018.

Shareholders’ fund was Rs.60,179.56 crores and Rs.95,427.91 crores as at March 31, 2019 and 2018, respectively, a decrease of 36.9% mainly due to losses in FY 2018-19 of Rs.28,826.23 crores, due to performance and impairment charge for Jaguar Land Rover business.

Reserves decreased by 37.2% from Rs.94,748.69 crores as at March 31, 2018 to Rs.59,500.34 crores as at March 31, 2019. Though, the loss for FY 2018-19 was Rs.28,826.23 crores, decrease in Reserves of Rs.35,248.35 crores was primarily attributable to following reasons:

- Debits for remeasurement of employee benefit plans was Rs.2,174.01 crores in FY 2018-19.

- Translation loss of Rs.2,068.84 crores recognized in translation reserve on consolidation of subsidiaries further contributed to a decrease in reserves and surplus

- Further decrease in hedging reserves by Rs.2,191.36 crores, primarily due to mark-to-market gains on forwards and options in Jaguar Land Rover, primarily due to Strengthening in the US$-GB£ forward rates.

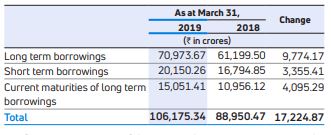

Borrowings

- Current maturities of long-term borrowings represent the amount of loan repayable within one year.

- The closing net automotive debt increased to Rs.28,394 crores at March 31, 2019 from Rs.13,889 crores as at March 31, 2018 mainly due to cumulative negative free cash flow primary at JLR.

- During Fiscal 2018,

- the Company raised Rs.1,500 crores through Buyer’s line of credit from banks with a tenor ranging from 4 years to 5 years.

- Jaguar land rover Automotive plc, arranged and draw down on a USD1 billion (Rs. 6,834 crores) syndicated loan of USD 200 million (Rs. 1,367.63 crores) and USD 800 million (Rs. 5,466.74 crores) maturing in October 2022 and January 2025 respectively.

- Jaguar land rover Automotive plc, issued a €500 million (Rs.3,898.95 crores) bond in September 2018 maturing in January 2026 with a coupon of 4.5%.

- Tata Motors Finance group had raised Rs.2,066 crores by issuing NCD and through secured term loan amounting to Rs.6,306 crores.