Item No. 7

Pursuant to Section 148 of the Companies Act, 2013 ("the Act") read along with the Companies (Audit and Auditors) Rules, 2014 as amended from time to time, the Company is required to have the audit of its cost records for specified products conducted by a Cost Accountant in Practice. Based on the recommendation of the Audit Committee, the Board had on May 23, 2017, approved the appointment and remuneration of M/s Mani & Co., the Cost Auditors (Firm Registration No. 000004) to conduct the audit of the Cost records maintained by the Company, pertaining to the relevant products prescribed under the Companies (Cost Records and Audit) Rules, 2014, for the Financial Year ending March 31, 2018 at a remuneration of Rs. 5,00,000/- (Rupees Five Lakhs).

It may be noted that the records of the activities under Cost Audit is no longer prescribed for "Motor Vehicles and certain parts and accessories thereof". However, based on the recommendations of the Audit Committee, the Board has also approved the appointment of M/s Mani & Co. for submission of reports to the Company on cost records pertaining to these activities for a remuneration of Rs. 15,00,000/- (Rupees Fifteen Lakhs) for the said financial year.

In accordance with the provisions of Section 148 of the Act read along with Rule 14 of the Companies (Audit and Auditors) Rules, 2014, as amended from time to time, ratification for the remuneration payable to the Cost Auditors to audit the cost records of the Company for the said financial year by way of an Ordinary Resolution is being sought from the Members as set out at Item No. 7 of the Notice.

M/s Mani & Co. have furnished a certificate dated May 12, 2017 regarding their eligibility for appointment as Cost Auditors of the Company.

The Board commends the Ordinary Resolution set out at Item No. 7 of the Notice for approval by the Members.

None of the Directors, Key Managerial Personnel or their relatives are, in any way, concerned or interested, financially or otherwise, in the resolution set out at Item No. 7 of the Notice.

Item No. 8

The Non-Convertible Debentures ("NCDs") issued on private placement basis is one of the cost effective sources of long term borrowings raised by the Company. The Company had obtained the approval of the Members vide Postal Ballot on June 27, 2014 to borrow from time to time any sum(s) of monies which, together with monies already borrowed by the Company (apart from temporary loans obtained or to be obtained from the Company's Bankers in the ordinary course of business) upto an amount not exceeding Rs. 30,000 crores. The borrowings of the Company (on stand-alone basis excluding Joint operations) as at March 31, 2017 aggregate approximately Rs. 18,578 crores, of which outstanding NCDs aggregate to Rs. 7,050 crores. The Company's Net Debt-Equity ratio (on standalone basis excluding Joint operations) as at March 31, 2017 is 0.78:1 and the Company believes that the aggregate borrowings would be well within acceptable levels.

Further, the Company had obtained Members' approval for borrowing up to Rs. 3,000 crores by way of NCDs at the Annual General Meeting ("AGM") held on August 09, 2016, which is valid for a period of one year from date of the said approval. The Company has borrowed Rs. 1,300 crores by way of unsecured NCDs up to May 2017, in accordance with the aforesaid Members' approval.

As per provisions of Sections 23, 42, 71 of the Act read with rule 14 of the Companies (Prospectus and Allotment of Securities) Rules, 2014, a company making a private placement of its securities is required to obtain the approval of the Members by way of a Special Resolution for each offer or invitation before making such offer. However, in case of offer for NCDs, it shall be sufficient if the Company passes a previous Special Resolution only once in a year for all the offers or invitation for such debentures during the year.

In continuation of its efforts to strengthen its capital structure, the Company intends to augment the resources through a mix of internal accruals and long term borrowings to insure that they are aligned in terms of quamtum, risk, maturity and cost with its earning profile. Accordingly, it is proposed to issue NCDs and / or Rupee Denominated Non-Convertible Foreign Currency Bonds on a private placement basis aggregating upto Rs. 3,000 crores, in one or more series/tranches during the 12-month period from the date of this AGM, with an intention to finance, inter-alia the repayment of certain NCDs / term loans from Banks, to fund part of the ongoing capital expenditure during the next 12 months and for general corporate purposes. The Company intends to raise NCDs for tenors ranging between 2 to 10 years and expects the borrowing cost of NCDs to be lower than 1 year MCLR rate of State Bank of India (prevailing at 8% p.a. as on June 1, 2017) plus a spread of 100 bps, considering the current credit rating of the Company of AA by ICRA and AA+ by CARE.

It is therefore proposed to pass an enabling Resolution authorizing the Board of Directors to make specific issuances based on the Company's requirements, market liquidity and appetite at the opportune time.

The above proposal as set out in Item No. 8 of the Notice is in the interest of the Company and your Directors commend the same for approval by the Members.

None of the Directors, Key Managerial Personnel or their relatives are in any way concerned or interested, financially or otherwise in the resolution set out at Item No. 8 of the Notice.

| By Order of the Board of Directors | |

| H K SETHNA | |

| Mumbai | Company Secretary |

| June 5, 2017 | FCS No.: 3507 |

Registered Office:

Bombay House, 24, Homi Mody Street, Mumbai 400 001

Tel: +91 22 6665 8282; Fax: +91 22 6665 7799

Email: [email protected]; Website: www.tatamotors.com

CIN - L28920MH1945PLC004520

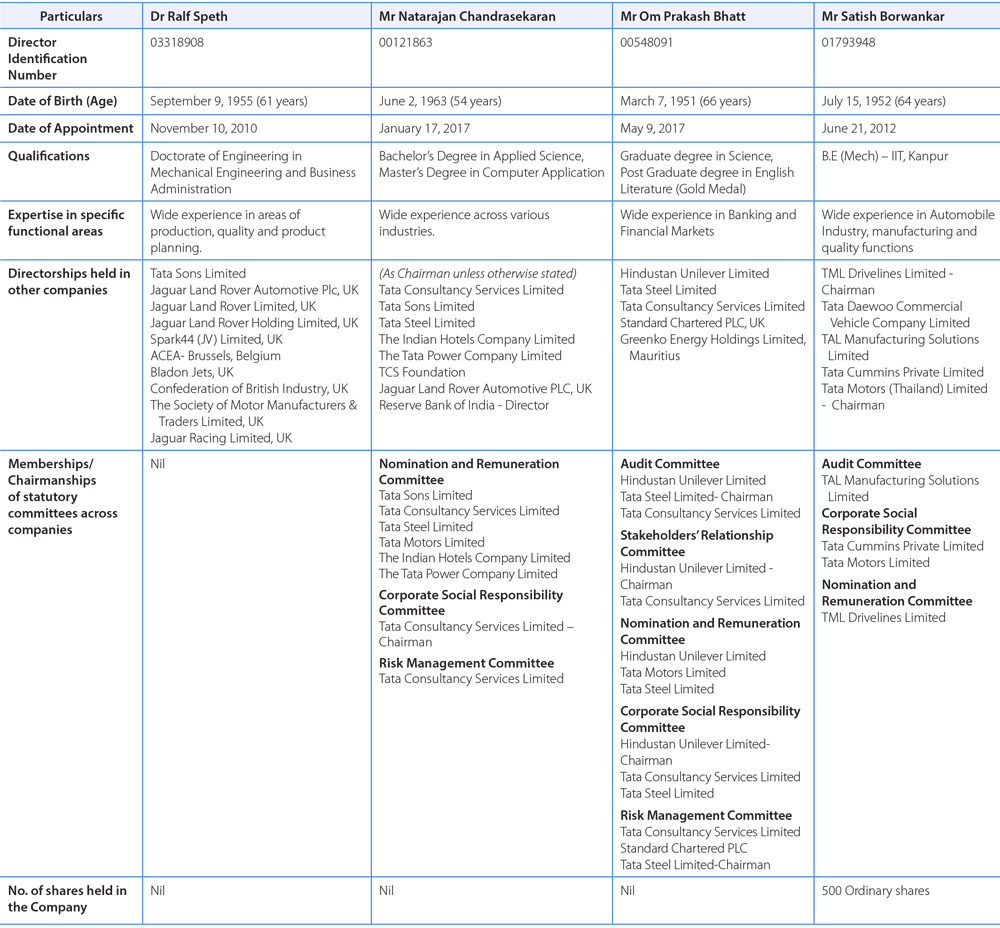

Details of Director seeking appointment and re-appointment at the Annual General Meeting Pursuant to SEBI Listing Regulations and Secretarial Standards – 2 on General Meetings

For other details, such as number of meetings of the Board attended during the year, remuneration drawn and relationship with other directors and key managerial personnel in respect of the above directors please refer to the Board’s Report and the Corporate Governance Report.