Jaguar Land Rover

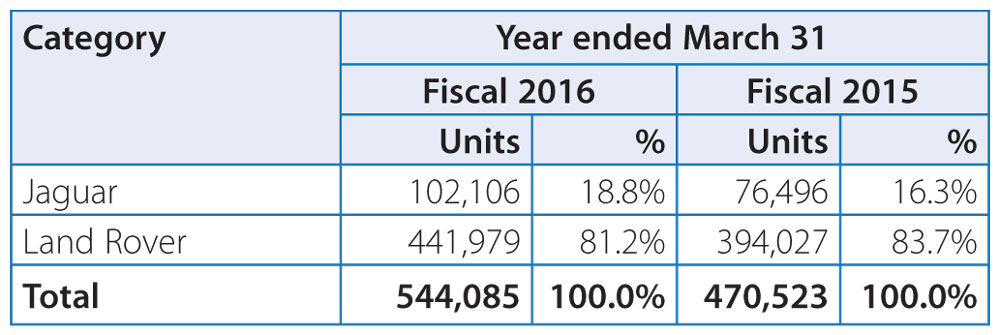

The total wholesale volumes of Jaguar Land Rover vehicles (including the Chery Joint Venture) with a breakdown between Jaguar and Land Rover brand vehicles, in Fiscal 2016 and 2015 are set forth in the table below:

In Fiscal 2016, Jaguar Land Rover continued to experience growth with wholesale volumes of 544,085 units, up by 15.6%, as compared to Fiscal 2015, with strong growth in Europe, North America and the United Kingdom, up year-on-year by 45.2%, 37.7% and 26.2%, respectively.

Wholesale volumes in overseas markets in Fiscal 2016 were broadly in line with those of the last fiscal year, while wholesale volumes in China were 17.3% lower year-on-year primarily reflecting the softer economic conditions and financial market volatility experienced there at the beginning of the year as well as the timing of new product launches.

In Fiscal 2016, Jaguar wholesale volumes were 102,106 units, up 33.5% compared to Fiscal 2015, reflecting the launch of the new Jaguar XE at the beginning of the year and solid sales of the F-TYPE. Land Rover wholesale volumes (including sales from the China Joint Venture) were 441,979 units, up 12.2% compared to the prior fiscal year, driven by continuing strong sales of the Land Rover Discovery Sport as well as solid sales from the more established Land Rover Discovery and Range Rover Sport.

Jaguar Land Rover's performance in key geographical markets on retail basis

Retail volumes (including retail sales from the China Joint Venture) in Fiscal 2016 increased by 12.8% to 521,571 units from 462,209 units in Fiscal 2015 primarily driven by strong sales of the Jaguar XE and Land Rover Discovery Sport, as well as a solid performance by the iconic Land Rover Defender in its run out year. Retail volumes of more established models such as the Land Rover Discovery, Range Rover and Range Rover Sport also grew year-on-year while the sales of the more mature Jaguar XF and XJ were impacted by the launch of the new lightweight XF and refreshed 2016 model year XJ in September 2015 and December 2015, respectively. Retail sales of the Range Rover Evoque were down 10.8% in Fiscal 2016 compared to Fiscal 2015, due to the transition of localised production to the China Joint Venture as well as a general slowdown in the Chinese economy. However, total retail sales of the Evoque strengthened in the final quarter (up 6.2%) as sales increased in China, Europe and the UK year-on-year. By brand, Jaguar retail volumes increased by 22.8% to 94,449 units in Fiscal 2016, compared to 76,930 units in Fiscal 2015 whilst Land Rover retail volumes increased by 10.9% to 427,122 units in Fiscal 2016, from 385,279 units in Fiscal 2015.

United Kingdom

Industry vehicle sales rose by 5.1% in Fiscal 2016 in the United Kingdom, compared to Fiscal 2015 as economic growth inflation and interest rates remained low and labor market conditions continued to stabilize. Jaguar Land Rover retail volumes increased by 23.8% to 107,371 units in Fiscal 2016 from 86,750 units in Fiscal 2015, with a strong sales performance from Jaguar, up 54.7% in Fiscal 2016, which was driven by sales of the new Jaguar XE and the XJ. Land Rover retail volumes increased by 15.7%, as all models experienced an increase in volumes, most notably the Land Rover Discovery Sport, Range Rover and Range Rover Sport.

North America

Economic performance in North America (the United States and Canada) generally continued to strengthen over the year as unemployment continued to fall, lower inflation driven by lower energy prices increased disposable incomes and consumer confidence continued to grow, despite the rise in interest rates in the United States, contributing to an industry-wide increase in passenger car sales of 3.1% in the United States in Fiscal 2016 compared to Fiscal 2015. Jaguar Land Rover retail volumes in North America increased by 27.1% to 99,606 units in Fiscal 2016 from 78,372 units in Fiscal 2015, with a 35.1% increase in Land.

Rover retail volumes primarily driven by the Land Rover Discovery Sport, Land Rover Discovery and Range Rover. Retail sales of the Range Rover Sport and Range Rover Evoque also grew, albeit more moderately, in Fiscal 2016. Jaguar retail volumes in North America decreased by 2.0% as the impact of the discontinued XK and also softer XJ sales were only partially offset by increased sales volumes of the XF and F-TYPE. The Jaguar XE and F-PACE have recently been launched in North America and both went on retail sale in May 2016.

Europe

Passenger car sales increased by 8.1% industry-wide in Europe, driven by quantitative easing and other policy action, which support low but steady growth, despite the impact of terrorist attacks during the year. Jaguar Land Rover retail volumes in Europe increased by 42.0% to 124,734 units in Fiscal 2016 from 87,863 units in Fiscal 2015, with sales particularly strong in Germany, Italy, France and Spain. Land Rover volumes increased by 32.7% in Fiscal 2016 primarily driven by strong sales of the Discovery Sport, Range Rover and Range Rover Sport as well as the Defender. Retail sales of the Evoque also grew modestly in Fiscal 2016 compared to Fiscal 2015. Jaguar volumes increased in Fiscal 2016, as sales of the new XE more than doubled Jaguar sales volume in Europe despite being partially offset by softer sales of the XF and XJ, which were impacted by the transition to the new XF and refreshed XJ in the second half of the year.

China

Passenger car sales in China increased by 6.7% in Fiscal 2016 while Jaguar Land Rover retail volumes (including sales from the China Joint Venture) decreased by 16.4% to 96,912 units in Fiscal 2016 from 115,969 units in Fiscal 2015 as softer economic conditions in China as well as the timing of new product launches adversely impacted volumes in the first 9 months of the year. Retail sales of Land Rover decreased by 14.8% in Fiscal 2016, primarily driven by softer sales of the Evoque, Range Rover and Discovery, while Jaguar retail sales decreased by 23.9% primarily driven by softer sales of the XF and XJ due to the transition to sales of the new XF and refreshed XJ, which were only introduced in December 2015 and February 2016 respectively. However, sales in China improved during the last quarter of Fiscal 2016, and were up 18.9% as compared to the last quarter of Fiscal 2015 primarily driven by the continued success of new models such as the Discovery Sport and the imported Jaguar XE.

Other Overseas markets

Jaguar Land Rover's retail volumes in the other overseas markets declined slightly by 0.3% to 92,948 units in Fiscal 2016 from 93,255 units in Fiscal 2015, with Land Rover retail volumes down 2.4% to 79,218 units in Fiscal 2016 compared to 81,174 units in Fiscal 2015, as strong sales of the Discovery Sport and modest growth in Range Rover volumes were offset by softer sales of all other products. Jaguar retail volume grew to 13,730 units, up 13.6% from 12,081 units in Fiscal 2015, driven by the introduction of the XE partially off set by softer sales of all other Jaguar products. Year on-year growth in Australia (up 31%), Japan (up 20%), South Korea (up 43%) and South Africa (up 12%) were offset by softer sales in Russia (down 42%) and other importer markets in Latin America and Sub Saharan Africa.

In Fiscal 2016, 2,844 units of Jaguar Land Rover vehicles were sold in India, through its exclusive dealerships, up 0.6% compared to 2,827 units sold in Fiscal 2015, which was supported by the by the assembly of the Jaguar XE, XF, XJ, Range Rover Evoque and Land Rover Discovery Sport in India (vehicles manufactured and sold in India are not subject to certain import duties).

Jaguar Land Rover's Sales & Distribution

As at March 31, 2016, Jaguar Land Rover distribute its Jaguar vehicles in approximately 123 markets across the world and its Land Rover vehicles in approximately 153 markets across the world. Sales locations for vehicles are operated as independent franchises. Jaguar Land Rover is represented in its key markets through its National Sales Companies ("NSC") as well as third party importers. Jaguar and Land Rover have regional offices in select countries. These regional offices manage customer relationships and vehicle supplies and provide marketing and sales support to their regional importer markets. The remaining importer markets are managed from the United Kingdom.

Jaguar Land Rover products are sold through a variety of sales channels: retail customers through its dealerships; for sale to fleet customers, including daily rental car companies; commercial fleet customers; leasing companies; and governments. Jaguar Land Rover do not depend on a single customer or small group of customers to the extent that the loss of such a customer or group of customers would have a material adverse effect on its business.

As at March 31, 2016, Jaguar Land Rover global sales and distribution network comprised of 20 NSCs, 74 importers, 33 export partners and 2,720 franchise sales dealers, of which 1,026 are joint Jaguar and Land Rover dealers.

Jaguar Land Rover — Competition

Jaguar Land Rover operates in a globally competitive environment and faces competition from established premium and other vehicle manufacturers who aspire to move into the premium performance car and premium SUV markets, some of which are much larger than the Company. Jaguar vehicles compete primarily against other European brands such as Audi, BMW, Porsche and Mercedes Benz. Land Rover and Range Rover vehicles compete largely against SUVs manufactured by companies such as Audi, BMW, Infiniti, Lexus, Mercedes Benz, Porsche, Volvo and Volkswagen. The Land Rover Defender competes with vehicles manufactured by companies such as Isuzu, Nissan and Toyota.

Jaguar Land Rover — Seasonality

Jaguar Land Rover volumes are impacted by the biannual change in age related registration plates of vehicles in the United Kingdom, in which new age related plate registrations take effect in March and September. This has an impact on the resale value of the vehicles because sales are clustered around the time of the year when the vehicle registration number change occurs. Seasonality in most other markets is driven by introduction of new model year vehicles and derivatives. Furthermore, Western European markets tend to be impacted by summer and winter holidays, and the Chinese market tends to be aff ected by the Chinese New Year holiday in either January or February, the PRC National Day holiday and the Golden Week holiday in October. The resulting sales profile influences operating results on a quarter to quarter basis.

Other Operations Overview

The Company's other operations business segment mainly includes information technology services, machine tools and factory automation services. The Company's revenue from other operations before inter-segment eliminations was Rs. 2,934.82 crores in Fiscal 2016, an increase of 6.8% from Rs. 2,747.79 crores in Fiscal 2015. Revenues from other operations represented 1.1% of total revenues, before inter-segment eliminations, in Fiscal 2015 and 2016.