FINANCIAL PERFORMANCE ON A STANDALONE BASIS

The financial information discussed in this section is derived from the Company's Audited Standalone Financial Statements.

Revenues (net of excise duty) were Rs. 42,369.82 crores in Fiscal 2016, as compared to Rs. 36,301.63 crores in Fiscal 2015, representing an increase of 16.7%, mainly due to an increase in the volume of M&HCV sales by 24.3% as compared to Fiscal 2015. However, the total number of vehicles sold in India during the Fiscal 2016 was flat at 453,873 vehicles compared to 454,433 vehicles in Fiscal 2015. The export volumes grew by 16.3% to 58,058 vehicles in Fiscal 2016 compared to 49,936 vehicles in Fiscal 2015.

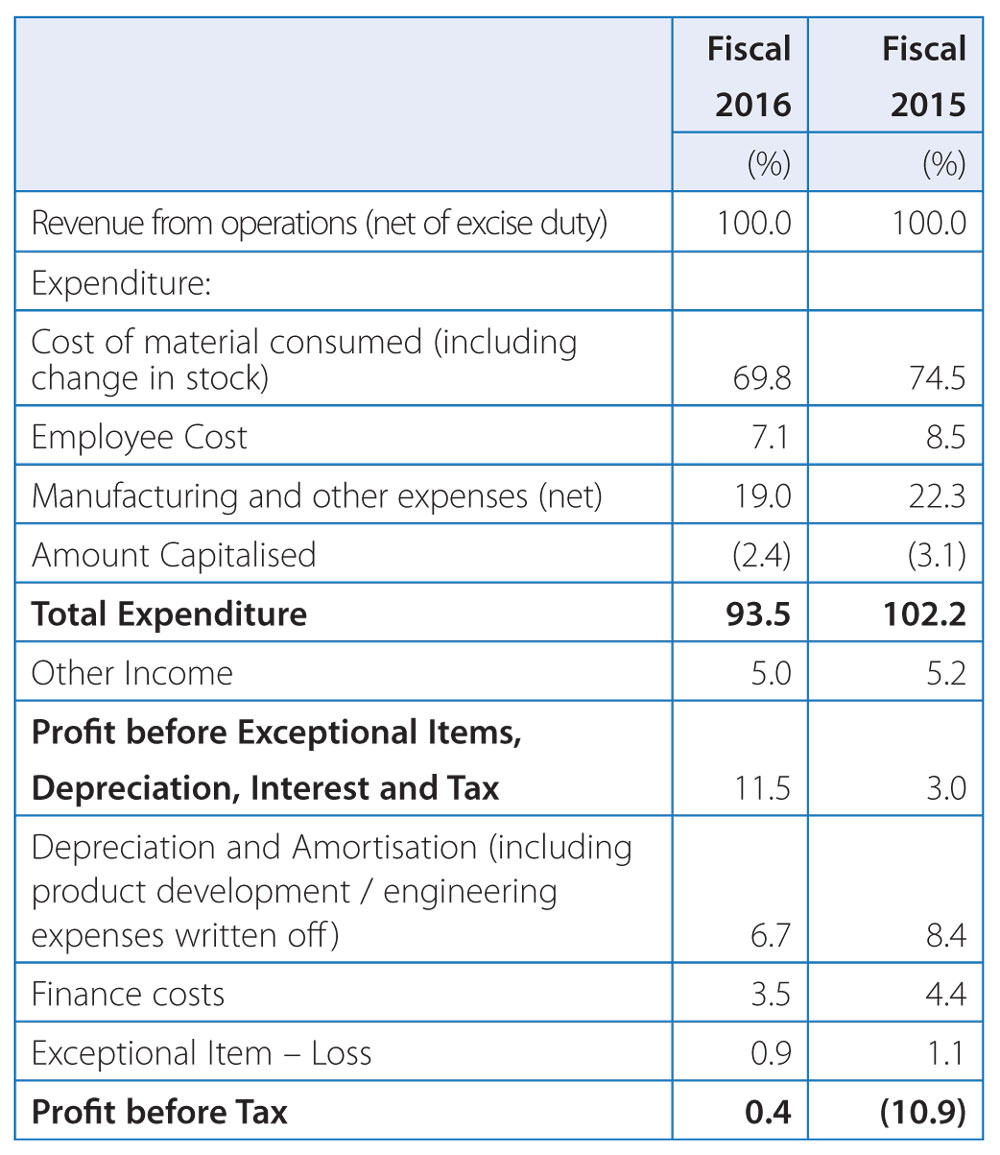

Due to the increase in revenue in Fiscal 2016, the Company has achieved a positive operating margin of 6.5% as compared to a negative margin of 2.2% of sales in Fiscal 2015. As a result the Profit before Tax in Fiscal 2016 was Rs. 150.39 crores as compared to loss before tax of Rs. 3,974.72 crores in Fiscal 2015. Furthermore, there was a tax credit of Rs. 83.84 crores in Fiscal 2016 as compared to a charge of Rs. 764.23 crores due to the write-off of MAT credit in Fiscal 2015. The profit after tax in Fiscal 2016 was Rs. 234.23 crores as compared to a loss of Rs. 4,738.95 crores in Fiscal 2015. The analysis of performance is given below as a percentage to revenue from operations.

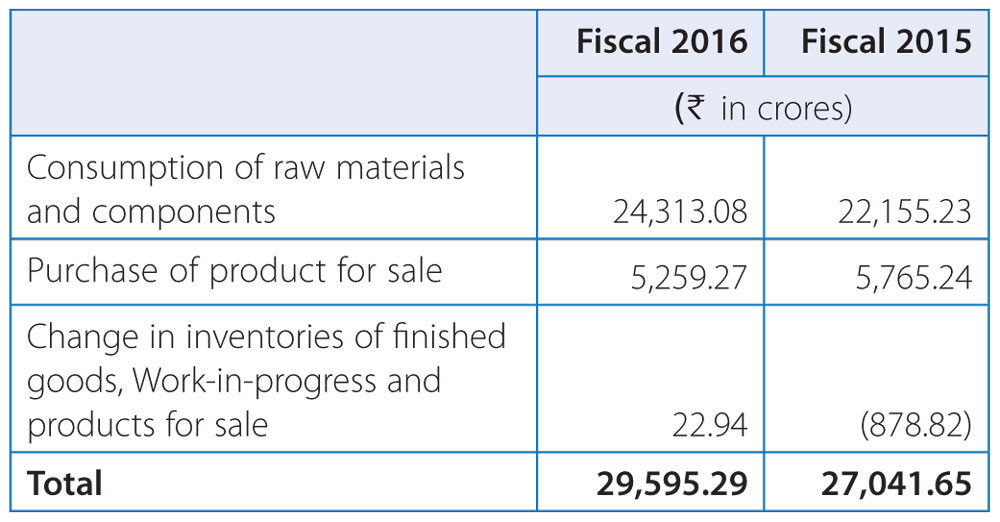

Cost of materials consumed (including change in stock)

The decrease in terms of cost of materials consumed (including change in stock) as a percentage to revenue was mainly due to a more favourable product mix which included a relatively higher proportion of M&HCV sales.

Employee costs decreased by 2.1% in Fiscal 2016 to Rs. 3,026.75 crores compared to Rs. 3,091.46 crores in Fiscal 2015. The decrease was primarily due to no changes in the discount rate assumptions for defined employee benefit plans in Fiscal 2016, as compared to lower discount rate in Fiscal 2015. Further, due to higher revenues, the percentage of employee cost to revenue reduced in Fiscal 2016 to 7.1% as compared to 8.5% in Fiscal 2015.

Manufacturing and Other Expenses relate to manufacturing, operations and incidental expenses other than raw materials and employee cost. This expenditure mainly includes job work charges, advertisements and publicity and other selling and administrative costs. The expenses were flat at Rs. 8,041.81 crores in Fiscal 2016 compared to Rs. 8,087.28 crores in Fiscal 2015. It represented 19.0% of the revenue in Fiscal 2016 compared to 22.3% of the revenue in Fiscal 2015. Freight, transportation and port charges, represented 3.0% and 2.9% of total revenues for Fiscal 2016 and Fiscal 2015, respectively. The increase in freight and transportation expenses is primarily due to trailers used for the transportation of vehicles. Publicity expenses represented 1.6% and 2.1% of total revenues in Fiscal 2016 and Fiscal 2015, respectively. In addition to routine product and brand campaigns and Auto Expo, the Company incurred expenses relating to new product introductions, namely, SIGNA and "Made of Great" campaign in Fiscal 2016. Warranty expenses increased to Rs. 482.72 crores in Fiscal 2016 as compared to Rs. 428.68 crores in Fiscal 2015, due to increased M&HCV sales during Fiscal 2016. In Fiscal 2015, manufacturing and other expenses included a provision for carrying capital cost of building at the Singur plant amounted to Rs. 309.88 crores.

Amount capitalised represents the expenditures transferred to capital and other accounts allocated out of employee costs and other expenses incurred in connection with product development projects and other capital items. The expenditures transferred to capital and other accounts decreased by 7.6% to Rs. 1,034.18 crores in Fiscal 2016 from Rs. 1,118.75 crores in Fiscal 2015, mainly related to ongoing development of new products and product variants.

Other Income totaled Rs. 2,132.92 crores in Fiscal 2016 compared to Rs. 1,881.41 crores in Fiscal 2015. This includes profit of Rs. 656.36 crores from divestment of investments in subsidiary companies and dividend income of Rs. 1,005.53 crores from subsidiary companies.

Profit before Exceptional Item, Depreciation, Interest and Tax (PBDIT) was Rs. 4,873.07 crores in Fiscal 2016, compared to Rs. 1,081.40 crores in Fiscal 2015. Increased M&HCV volumes coupled with improved market conditions resulted in an increase in operating profit as compared to the previous year.

Depreciation and Amortisation expense (including product development/engineering expenses) decreased by 5.3% in Fiscal 2016 to Rs. 2,878.36 crores compared to Rs. 3,040.69 crores in Fiscal 2015. Depreciation decreased by Rs. 113.34 crores, whereas amortization decreased by Rs. 36.13 crores in Fiscal 2016.

Finance costs decreased by 8.1% to Rs. 1,481.11 crores in Fiscal 2016 from Rs. 1,611.68 crores in Fiscal 2015, mainly due to reduction in borrowings as well as reduced interest rate.

Exceptional Items

- In accordance with the accounting policy followed by the Company, the exchange gain/loss on foreign currency long-term monetary items is amortised over the tenor of such monetary item. The net exchange loss including on revaluation of foreign currency borrowings, deposits and loans and amortisation was Rs. 91.37 crores in Fiscal 2016 compared to Rs. 320.50 crores in Fiscal 2015.

- In Fiscal 2016, impairment of capitalized assets pertaining to certain vehicle models of Rs. 163.94 crores has been debited to the statement of profit and loss.

- Exceptional items also include Rs. 97.86 crores provided for investments and cost associated with closure of a foreign subsidiary company.

- Employee separation cost: The Company has given early retirement to various employees which resulted in a charge of Rs. 10.04 crores in Fiscal 2016 compared to Rs. 83.25 crores in Fiscal 2015.

Profit before tax was Rs. 150.39 crores in Fiscal 2016 as compared to loss before tax of Rs. 3,974.72 crores in Fiscal 2015. The profit was mainly attributable to higher sales volumes of M&HCV and effective cost management through various cost reduction initiatives, resulted in higher operating margins and profit on sale of certain investments.

Tax expenses - There was a tax credit of Rs. 83.84 crores in Fiscal 2016 as compared to tax expense of Rs. 764.23 crores in Fiscal 2015.

Profit after tax was Rs. 234.23 crores in Fiscal 2016 as compared to loss of Rs. 4,738.95 crores in Fiscal 2015. Consequently, basic Earnings Per Share (EPS) returned to a positive Rs. 0.68 in Fiscal 2016 as compared to negative Rs. 14.57 in Fiscal 2015 for Ordinary Shares and to positive Rs. 0.78 in Fiscal 2016 as compared to negative Rs. 14.57 in Fiscal 2015 for 'A' Ordinary Shares.

Standalone Balance Sheet

Shareholders' funds increased to Rs. 22,368.08 crores as at March 31, 2016 compared to Rs. 14,862.59 crores as at March 31, 2015.

Reserves increased to Rs. 21,688.90 crores as at March 31, 2016 from Rs. 14,218.81 crores as at March 31, 2015, primarily due to increase in the securities premium account of Rs. 7,400.66 crores for the premium from the Company's rights offering in Fiscal 2016 and profit after tax in Fiscal 2016 of Rs. 234.23 crores, offset by the debit balance in Foreign Currency Translation Reserve Account of Rs. 82.50 crores (net) and the proposed dividend of Rs. 73.00 crores in Fiscal 2016.

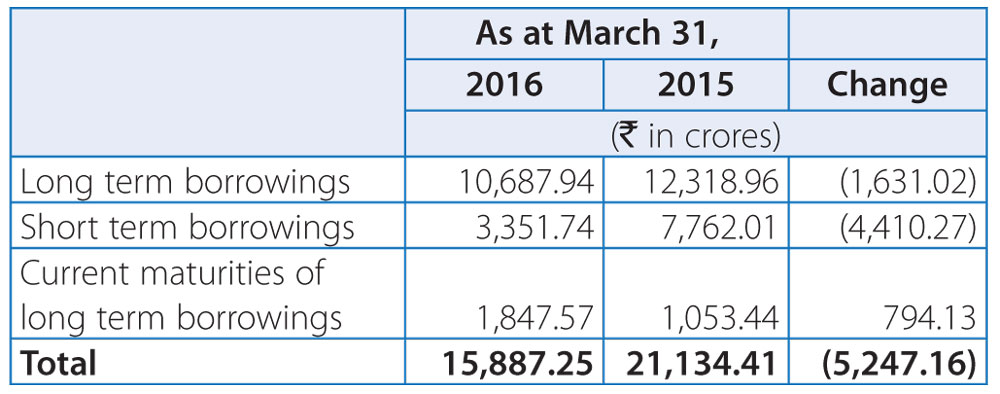

Borrowings:

During Fiscal 2016, the reduction in borrowings was due to repayment of commercial paper issuances from the proceeds of Rights issue.

Trade payables were Rs. 8,916.60 crores as at March 31, 2016 as compared to Rs. 8,852.65 crores as at March 31, 2015, representing minor movement in Fiscal 2016.

Provision (current and non-current) were Rs. 2,624.54 crores as at March 31, 2016 and Rs. 2,717.28 crores as at March 31, 2015. The provisions were mainly towards warranty, employee retirement benefits, delinquency and proposed dividends.

Fixed Assets include tangible and intangible assets. The tangible assets (net of depreciation and including capital work in progress) increased marginally to Rs. 13,722.49 crores as at March 31, 2016 compared to Rs. 13,610.45 crores as at March 31, 2015. The intangible assets (net of amortisation, including the projects under development), increased to Rs. 8,522.37 crores as at March 31, 2016 compared to Rs. 8,213.57 crores as at March 31, 2015. The intangible assets under development were Rs. 5,011.18 crores as at March 31, 2016, and relate to new products planned in the future.

Investments (Current + Non-current) increased by 10.2% to Rs. 18,711.46 crores as at March 31, 2016 as compared to Rs. 16,987.17 crores as at March 31, 2015 due to investment in mutual funds of Rs. 1,736.00 crores.

Inventories increased by 2.1% to Rs. 4,902.20 crores as at March 31, 2016 compared to Rs. 4,802.08 crores as at March 31, 2015. However, the total inventory decreased to 38 days of sales in Fiscal 2016 as compared to 44 days in Fiscal 2015 due to increase in sales volumes in Fiscal 2016.

Trade Receivables (net of allowance for doubtful debts) increased by 40.7% to Rs. 1,568.46 crores as at March 31, 2016 compared to Rs. 1,114.48 crores as at March 31, 2015. The receivables represented 14 days as at March 31, 2016 compared to 11 days as at March 31, 2015. The amount outstanding for more than six months (gross) increased to Rs. 870.19 crores as at March 31, 2016 from Rs. 759.23 crores as at March 31, 2015. These represented dues from Government-owned transport companies and some of the Company's dealers. The overdue amounts are monitored and the Company has taken steps to recover these. However, based on the Company's assessment on non-recoverability of these overdues, these have been provided and the allowances for doubtful debts were Rs. 598.04 crores as at March 31, 2016, compared to Rs. 572.27 crores as at March 31, 2015, an increase of 4.5%.

Cash and bank balances decreased to Rs. 452.08 crores as at March 31, 2016 compared to Rs. 944.75 crores as at March 31, 2015, mainly due to utlisation of proceeds from Senior Notes, issued in Fiscal 2015.