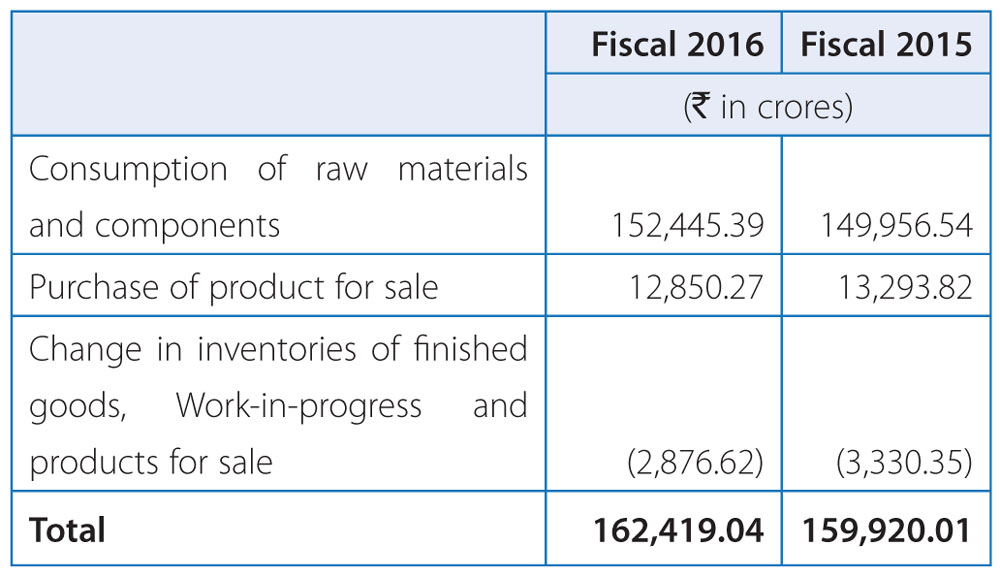

Cost of materials consumed (including change in stock)

Cost of material consumed decreased from 61.4% of total revenue (excluding income from vehicle financing) in Fiscal 2015 to 59.5% in Fiscal 2016. For Tata Motors Standalone, costs of materials consumed was 69.8% of net revenue in Fiscal 2016 of total revenue as compared to 74.5% in Fiscal 2015, representing a decrease of 470 bps, which was mainly attributable to a change in product mix that includes a relatively higher proportion of M&HCV sales and cost reduction measures. For Jaguar Land Rover, costs of materials consumed was 58.8% of total revenue in Fiscal 2016 compared to 60.2% in Fiscal 2015, representing a decrease of 140 bps, driven by cost-reduction measures and the general weakening of the Euro in Fiscal 2016.

Employee Costs were Rs. 29,198.89 crores in Fiscal 2016 as compared to Rs. 25,548.96 crores in Fiscal 2015 an increase of 14.3%. At Jaguar Land Rover the increase in employee cost is by 17.6% to GB£2,368.62 million (Rs. 23,349.68 crores) in Fiscal 2016 as compared to GB£2,013.22 million (Rs. 19,792.27 crores) in Fiscal 2015, primarily reflects the increase in the employee head count to support the higher production volume in Fiscal 2016.

For Tata Motors Standalone, the employee cost decreased marginally by 2.1% to Rs. 3,026.75 crores as compared to Rs. 3,091.46 crores in Fiscal 2015. The increase due to annual increments was offset by the lower charge for defined benefit employee plans, as a result of stable discount rates.

Employee costs at TDCV were Rs. 672.16 crores in Fiscal 2016, as compared to Rs. 518.82 crores in the same period in Fiscal 2015, an increase of 29.6%. Fiscal 2015 cost included reversal of Rs. 264.19 crores following a favourable decision by the Supreme Court of South Korea and resolution of the lawsuit filed by TDCV union employees, pursuant to which the employees had demanded inclusion of some elements of salary and bonuses as part of wages. However, in Fiscal 2015, there was a loss in actuarial valuations of the severance plan at TDCV of Rs. 69.92 crores as compared to a gain of Rs. 61.22 crores in Fiscal 2016.

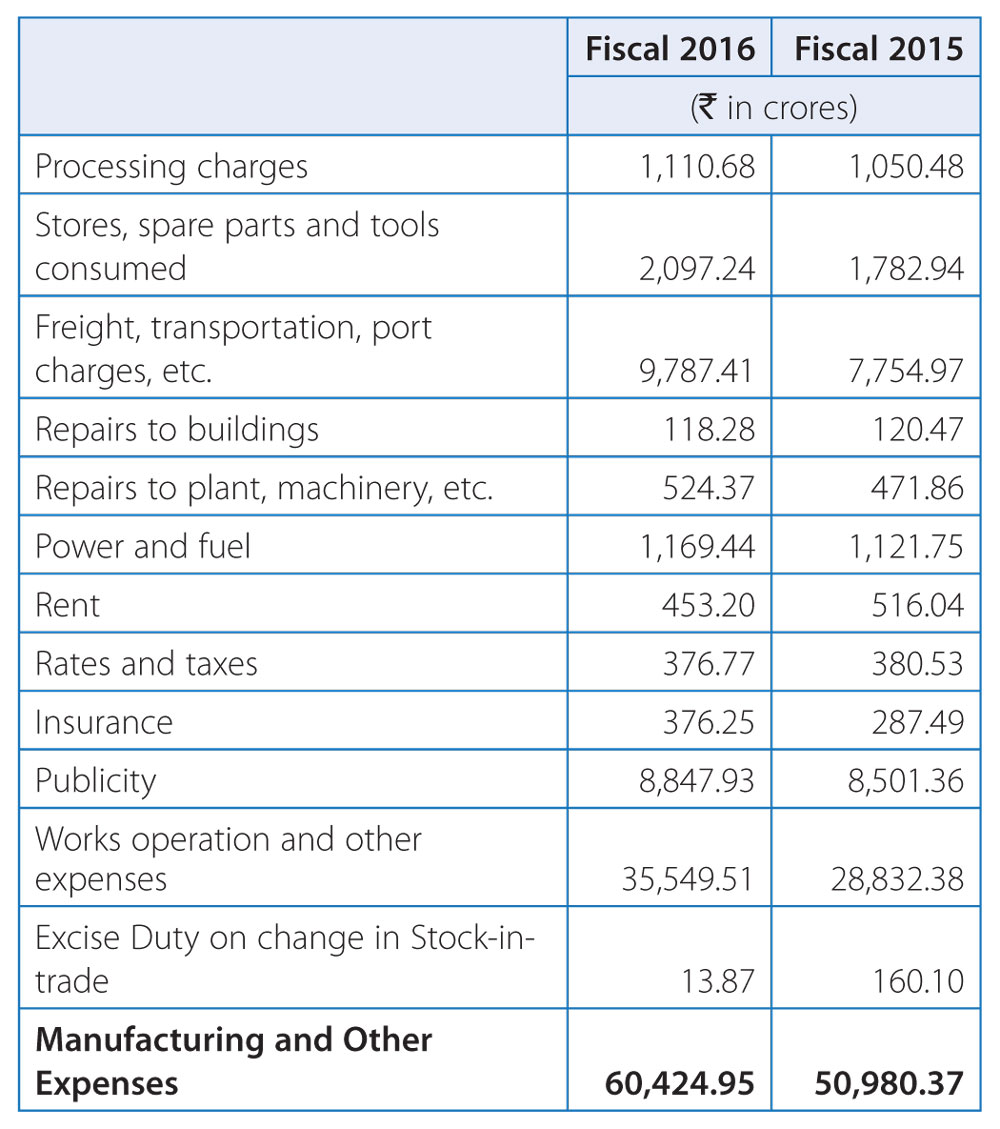

Manufacturing and Other Expenses includes all works operations, indirect manufacturing expenses, freight cost, fixed marketing costs and other administrative costs. These expenses have increased by 18.5% to Rs. 60,424.95 crores in Fiscal 2016 from Rs. 50,980.37 crores in Fiscal 2015. Each line item includes the element of foreign currency translation impact of Jaguar Land Rover operations of approximately Rs. 615.16 crores in aggregate in Fiscal 2016. The breakdown is provided below:

Manufacturing and other expenses increased to 21.9% of total revenues in Fiscal 2016 compared to 19.4% in Fiscal 2015. The increases are mainly driven by volumes and the size of operations.

- Processing charges were mainly incurred by Tata and other brand vehicles (including vehicle financing) which, due to higher volumes, led to higher expenditures.

- Freight, transportation, port charges etc. have increased, mainly for Jaguar Land Rover, predominantly due to increased sales in certain geographies. As a percentage to total revenue, Freight, transportation and port charges etc. increased to 3.6% in Fiscal 2016 as compared to 2.9% in Fiscal 2015, due to increased freights charges.

- Publicity expenses remained flat and represented 3.2% of total revenues in Fiscal 2016 and 2015. In addition to routine product and brand campaigns, the Company incurred expenses relating to new product introduction campaigns for the new Jaguar XE, the all new Jaguar XF, refreshed 2016 Model year the Jaguar XJ, the new Jaguar F-PACE, the Range Rover Evoque (including convertible), the SIGNA range of trucks, the ACE Mega and "Made of Great" campaign at Tata Motors.

- Works operation and other expenses have increased to 13.0% of net revenue in Fiscal 2016 from 11.0% in Fiscal 2015. During Fiscal 2016, there was a net loss on the mark-to-market value of trading forward and options of Rs. 3,716.03 crores as compared to Rs. 39.48 crores in Fiscal 2015. Furthermore, engineering expenses at Jaguar Land Rover have increased, reflecting its increased investment in the development of new vehicles. A significant portion of these costs are capitalised and shown under the line item "Amount capitalised". This was offset by the provision and write off of various debtors, vehicle loans and advances (net), which has decreased to Rs. 893.33 crores in Fiscal 2016 as compared to Rs. 1,800.78 crores in Fiscal 2015, mainly reflect provisions for finance receivables, where rate of defaults increased in Fiscal 2015, due to prolonged and unanticipated deterioration in the economic environment in India, which severely affected fleet owners and transporters.

Amount capitalised represents expenditure transferred to capital and other accounts allocated out of employee cost and other expenses, incurred in connection with product development projects and other capital items. The expenditure transferred to capital and other accounts has increased by 8.5% to Rs. 16,718.43 crores in Fiscal 2016 from Rs. 15,404.18 crores in Fiscal 2015, mainly due to various product development projects undertaken by the Company for the introduction of new products and the development of engine and products variants.

Other Income increased by 9.2% to Rs. 981.72 crores in Fiscal 2016 from Rs. 898.74 crores in Fiscal 2015, and mainly includes interest income of Rs. 755.66 crores in Fiscal 2016, compared to Rs. 714.96 crores in Fiscal 2015 and Profit on sale of investment increased to Rs. 181.39 crores in Fiscal 2016, compared to Rs. 119.57 crores in Fiscal 2015. The increase is primarily due to profit on the sale of mutual funds, mainly at Tata and other brand vehicles (including vehicle financing).

Profit before Interest, Depreciation, Exceptional Items and Tax is Rs. 41,218.38 crores in Fiscal 2016, representing 15.0% of revenue in Fiscal 2016 compared to Rs. 43,012.56 crores in Fiscal 2015.

Depreciation and Amortisation (including product development / engineering expenses written off): During Fiscal 2016, expenditures increased by 26.0% to Rs. 20,494.61 crores from Rs. 16,263.80 crores in Fiscal 2015. The increase in depreciation of 26.5% to Rs. 8,220.51 crores in Fiscal 2015 from Rs. 6,498.13 crores in Fiscal 2015 is due to full year depreciation of the new engine plant at Jaguar Land Rover and new product launches both at Jaguar Land Rover and Tata and other brand vehicles (including vehicle financing). The amortisation expenses have increased by 27.6% to Rs. 8,793.67 crores in Fiscal 2016 from Rs. 6,890.50 crores in Fiscal 2015, and are attributable to new products introduced during the year. Expenditure on product development/engineering expenses written off increased by 21.1% to Rs. 3,480.43 in Fiscal 2016 from Rs. 2,875.17 in Fiscal 2015.

Finance Cost decreased by 4.9% to Rs. 4,623.35 crores in Fiscal 2016 from Rs. 4,861.49 crores in Fiscal 2015. The decrease was mainly achieved by refinancing certain senior notes and other long term loans with loans with lower interest rates and repayments of borrowings from proceeds of the Company's rights issue in Fiscal 2016.

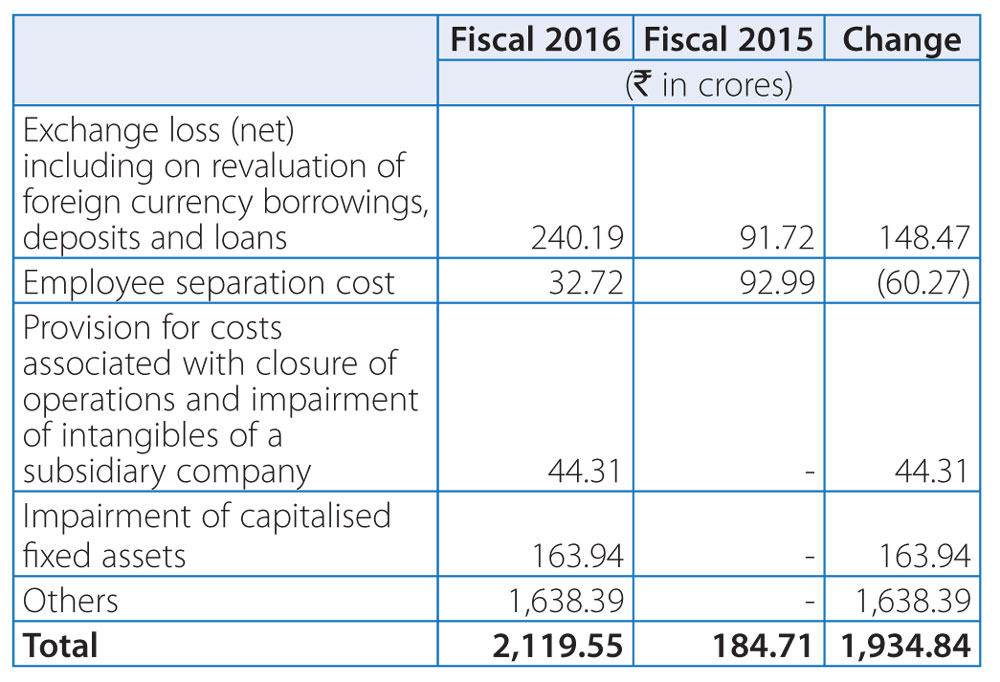

Exceptional items

- Foreign exchange loss (net) represents impact on account of revaluation of foreign currency borrowings, deposits and loans, and amortisation of loss/gain, on such foreign currency monetary items that were deferred in previous years.

- Employee separation cost: The Company has given early retirement to various employees resulting in an expense both in Fiscal 2016 and 2015.

- In Fiscal 2016, the Company decided to close operations of a subsidiary company, triggered by under performance and challenging market conditions.

- In Fiscal 2016, Rs. 163.94 crores of capitalised assets relating to certain vehicle models were written off.

- The carrying value of inventory (net of insurance recovery) of Rs. 1,638.39 crores (GB£157 million) was recognised in Fiscal 2016, following the assessment of the physical condition of the vehicles involved in the explosion at the port of Tianjin in China in August 2015.

Consolidated Profit Before Tax (PBT) decreased to Rs. 13,980.87 crores in Fiscal 2016, compared to Rs. 21,702.56 crores in Fiscal 2015. The reduction in PBT is primarily driven by less favourable market and model mix, an exceptional net charge relating vehicles destroyed or damaged in the Tianjin port explosion in August 2015, and one time reserves and charges for the U.S. recall of potentially faulty passenger airbags supplied by Takata, doubtful debts and previously capitalized investment impacting the Jaguar Land Rover business.

Tax Expense represents a net charge of Rs. 2,872.60 crores in Fiscal 2016, as compared to net charge of Rs. 7,642.91 crores in Fiscal 2015. The tax expense is not comparable with the profit before tax, since it is consolidated on a line-by-line addition for each subsidiary company and no tax effect is recorded in respect of consolidation adjustments. The effective tax rate in Fiscal 2016 was 20.6% as compared to 35.2% in Fiscal 2015. In Fiscal 2016, there was a reduction in the UK Corporation tax from 20% to 19% for Fiscal 2018 and to 18% thereafter, resulting in a deferred tax credit. In Fiscal 2015, there was tax charge of the Company's standalone performance due to write off of minimum alternate tax or MAT liability.

Consolidated Profit for the year declined by 21.2% to Rs. 11,023.75 crores in Fiscal 2016 from Rs. 13,986.21 crores in Fiscal 2015, after considering the profit from associate companies and shares of minority investees.