Vehicle Sales in India

During Fiscal 2016, sales in the domestic CV industry registered a growth of 9.6% in volumes, in comparison to a decline of 8.4% in Fiscal 2015. The recovery was driven by the continuation of healthy replacement-led demand in case of M&HCV (Trucks) and the renewal as well as fleet expansion by various State Regional Transport Undertakings as well as some pickup in demand from the mining and construction related sectors. In addition, the industry also benefitted from the implementation of BS-IV emission norms, which became mandatory across North India and some nearby regions starting in October 2015. The year also witnessed mandatory implementation of Anti-Lock Braking Systems in M&HCVs and Uniform Bus Body Code in buses. These along with the roll-out of BS-IV norms generated some pre-buying during the year.

The domestic PV industry sales registered a growth of 7.6%, supported by growth in both passenger cars and utility vehicles.

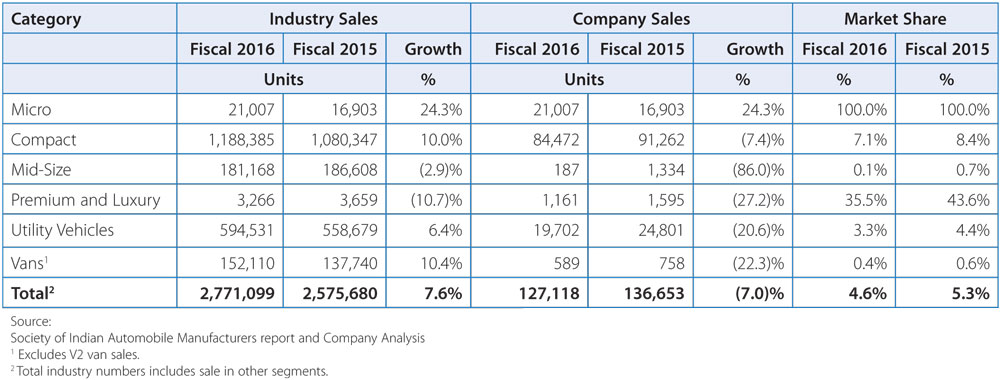

The following table sets forth the Company's (on standalone basis) sales, industry sales and relative market share in vehicle sales in India. Passenger vehicles includes passenger cars and utility vehicles. Commercial vehicles include Medium & Heavy Commercial Vehicles and Light Commercial Vehicles.

Passenger Vehicles in India

Sales in the passenger vehicles industry in India increased by 7.6% in Fiscal 2016, primarily attributable to reduced fuel prices, improved consumer sentiments, and lower interest rates. Hatchback sales witnessed significant growth during Fiscal 2016, while the sedan segment experiences negative growth. The utility vehicle segment also showed growth, mainly with strong performances in soft-road SUVs and multipurpose vehicles

Notwithstanding growth in the Indian passenger vehicle sector, the Company's passenger vehicle sales in India decreased by 7.0% to 127,118 units in Fiscal 2016 from 136,653 units in Fiscal 2015, due to fewer new product offerings by the Company as compared to its competitors.

The Company's passenger vehicle category consists of (i) passenger cars and (ii) utility vehicles. The Company sold 106,827 units in the passenger car category in Fiscal 2016, representing a decrease of 3.8% compared to 111,094 units in Fiscal 2015.

The Company sold 21,007 Nano cars in Fiscal 2016, an increase of 24.3% compared to 16,903 units in Fiscal 2015. In the utility vehicles category, the Company sold 20,291 units in Fiscal 2016, representing a decrease of 20.6% from 25,559 units in Fiscal 2015.

Commercial Vehicles in India

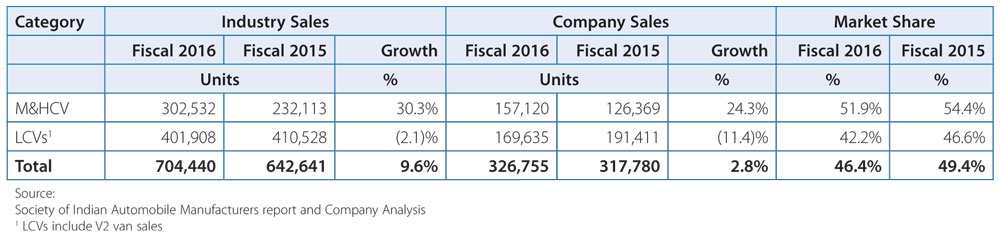

The following table sets forth the Company's commercial vehicle sales, industry sales and relative market share in commercial vehicle sales in India.

Industry sales of commercial vehicles increased by 9.6% to 704,440 units in Fiscal 2016 from 642,641 units in Fiscal 2015. Industry sales in the medium and heavy commercial vehicle segment increased by 30.3% to 302,532 units in Fiscal 2016, as compared to sales of 232,113 units in Fiscal 2015 primarily due to replacements of fleet vehicles, which was impacted by stable freight rates across key routes, lower diesel prices, higher quantities of cargo transported, a renewal of mining activities in the states of Karnataka and Goa, a renewal of construction activities, and expectations of increased investments in infrastructure and manufacturing. Industry sales of light commercial vehicles reported a decline of 2.1% to 401,908 units in Fiscal 2016, from 410,528 units in Fiscal 2015, mainly due to lower freight transportation needs due to high-capacity additions to fleets over recent years, financing defaults and tightened lending norms, all of which continues to impede the recovery in sales of light commercial vehicles, particularly small commercial vehicles sales, which are heavily dependent on funding availability.

Overall, sales of the Company's commercial vehicles in India increased by 2.8% to 326,755 units in Fiscal 2016 from 317,780 units in Fiscal 2015. The Company's sales in the medium and heavy commercial vehicle category increased by 24.3% to 157,120 units in Fiscal 2016, as compared to sales of 126,369 units in Fiscal 2015. However, sales in the light commercial vehicles segment declined by 11.4% to 169,635 units in Fiscal 2016, from 191,411 units in Fiscal 2015. Financing constraints and over capacity still continues to impede the recovery in the SCV segment, which has impacted the Company's volume growth.

Tata and other brand vehicles — International Markets

The Company's exports (on standalone basis) grew by 16.3% to 58,058 units in Fiscal 2016 as compared to 49,936 units in Fiscal 2015. While there were some incidents of geo-political tensions and economic uncertainties, such as the Madhesi agitation and the earthquake in Nepal and the duty change in Sri Lanka, the upsurge in investment in capital goods, in the South Asian Association for Regional Cooperation, has helped the Company to improve volumes in this region generally, and particularly in Bangladesh. In addition, the launch of new models in the Middle East and Africa region, along with the opening of new markets in these regions, contributed to an increase in international sales volumes. The Company's top five (quantity terms) export destinations for vehicles manufactured in India - Bangladesh, Sri lanka, Nepal, South Africa and Indonesia accounted for approximately 79% of the exports of commercial vehicles and passenger vehicles.

In Fiscal 2016, TDCV's overall vehicles sales decreased by 22.2% to 9,116 units, from 11,710 units in Fiscal 2015, mainly due to lower export sales being partially compensated by an increase in domestic sales. TDCV continued to have strong performance in the domestic market despite increased competition and increased sales to 7,036 vehicles, second highest in TDCV history, compared to sales of 6,808 vehicles in Fiscal 2015. The newly introduced Euro 6 models were well accepted in the market, which resulted in the combined market share of HCV and MCV Segments increased to 31% as compared to 28.7% in the previous year. However, the export market was very challenging. Factors, such as- low oil prices, local currency depreciation against the US Dollar, new statutory regulations to reduce imports, slowdown in Chinese economy impacting commodity exporting countries and increased dealer inventory, adversely impacted TDCV's exports in major markets, such as Algeria, Russia, Vietnam, South Africa and Gulf Cooperation Council countries. The export sales were 2,080 units in Fiscal 2016, compared to 4,902 units in Fiscal 2015.

Tata and other brand vehicles — Sales, Distribution and Support

The sales and distribution network in India as of March 31, 2016 comprised 3,887 sales and service contact points for passenger and commercial vehicles sales. The Company has deployed a Customer Relations Management, or CRM, system at all the Company's dealerships and offices across the country, the largest such deployment in the automotive market in India. The combined online CRM and distributor management system supports users both within the Company and among distributors in India and abroad.

The Company's 100% owned subsidiary, TML Distribution Company Ltd, or TDCL, acts as a dedicated distribution and logistics management company to support the sales and distribution operations of vehicles in India. The Company believes TDCL helps it improve planning, inventory management, transport management and timely delivery.

The Company markets its commercial and passenger vehicles in several countries in Africa, the Middle East, South East Asia, South Asia, Australia, and Russia and the Commonwealth of Independent States countries. The Company has a network of distributors in all such countries where it exports its vehicles. Such distributors have created a network of dealers, branch offices and facilities for sales and after-sales servicing of the Company's products in their respective markets. The Company has also stationed overseas resident sales and service representatives in various countries to oversee its operations in the respective territories. The Company uses a network of service centres on highways and a toll-free customer assistance centre to provide 24-hour on-road maintenance (including replacement of parts) to vehicle owners. The Company believes that the reach of its sales, service and maintenance network provides it with a significant advantage over its competitors.

Through the Company's vehicle financing division and wholly owned subsidiary, TMFL along with Tata Motors Finance Solutions Ltd or TMFSL, the Company provides financing services to purchasers of its vehicles through independent dealers, who act as the Company's agents for financing transactions, and through the Company's branch network. Revenue from the Company's vehicle financing operations increased by 11.7% to Rs. 3,063.08 crores in Fiscal 2016 as compared to Rs. 2,742.88 crores in Fiscal 2015, which was mainly driven by the growth in the commercial vehicle segment.

The total disbursements (including refinancing) by TMFL, along with its subsidiary, increased by 22.8% in Fiscal 2016 to R8,985 crores as compared to Rs. 7,316 crores in Fiscal 2015. TMFL financed a total of 112,114, vehicles in Fiscal 2016, reflecting a slight decline of 0.6% from the 112,788 vehicles financed in Fiscal 2015. Disbursements for commercial vehicles increased by 30.4% to Rs. 7,485 crores (75,970 vehicles) in Fiscal 2016 as compared to Rs. 5,741 crores (72,853 vehicles) for the previous year. However, disbursements of passenger vehicles declined by 9.9% to Rs. 1,350 crores (33,185 vehicles) in Fiscal 2016 as compared to Rs. 1,498 crores (38,444 vehicles) in the previous year. Disbursements achieved for refinancing were Rs. 150 crores (2,959 vehicles) in Fiscal 2016 as compared to Rs. 77 crores (1,491 vehicles) in Fiscal 2015.

Tata and other brand vehicles — Spare Parts and After sales Activity

The Company's consolidated spare parts and after-sales activity revenue was Rs. 4,088.74 crores in Fiscal 2016, compared to Rs. 4,053.46 crores in Fiscal 2015. The Company's spare parts and after-sales activity experienced limited growth due to weak sales of both commercial vehicles and passenger vehicles in recent years.

Tata and other brand vehicles — Competition

The Company faces competition from various domestic and foreign automotive manufacturers in the Indian automotive market. Improving infrastructure and robust growth prospects compared to other mature markets has attracted a number of international companies to India that have either formed joint ventures with local partners or have established independently owned operations in India. Global competitors bring with them decades of international experience, global scale, advanced technology and significant financial resources, and, as a result, competition is likely to further intensify in the future. The Company has designed its products to suit the requirements of the Indian market based on specific customer needs such as safety, driving comfort, fuel-efficiency and durability. The Company believes that its vehicles are suited to the general conditions of Indian roads and the local climate. It's vehicles have also been designed to comply with applicable environmental regulations currently in effect. The Company also offers a wide range of optional configurations to meet the specific needs of its customers and intends to develop and is developing products to strengthen its product portfolio in order to meet the increasing customer expectations of owning world-class products.

Tata and other brand vehicles — Seasonality

Demand for the Company's vehicles in the Indian market is subject to seasonal variations. Demand for the Company's vehicles generally peaks between January and March, although there is a decrease in demand in February just before release of the Indian fiscal budget. Demand is usually lean from April to July and picks up again in the festival season from September onwards, with a decline in December due to year end.