TO THE MEMBERS OF TATA MOTORS LIMITED

The Directors present their Seventy First Annual Report alongwith the Audited Statement of Accounts for Fiscal 2016.

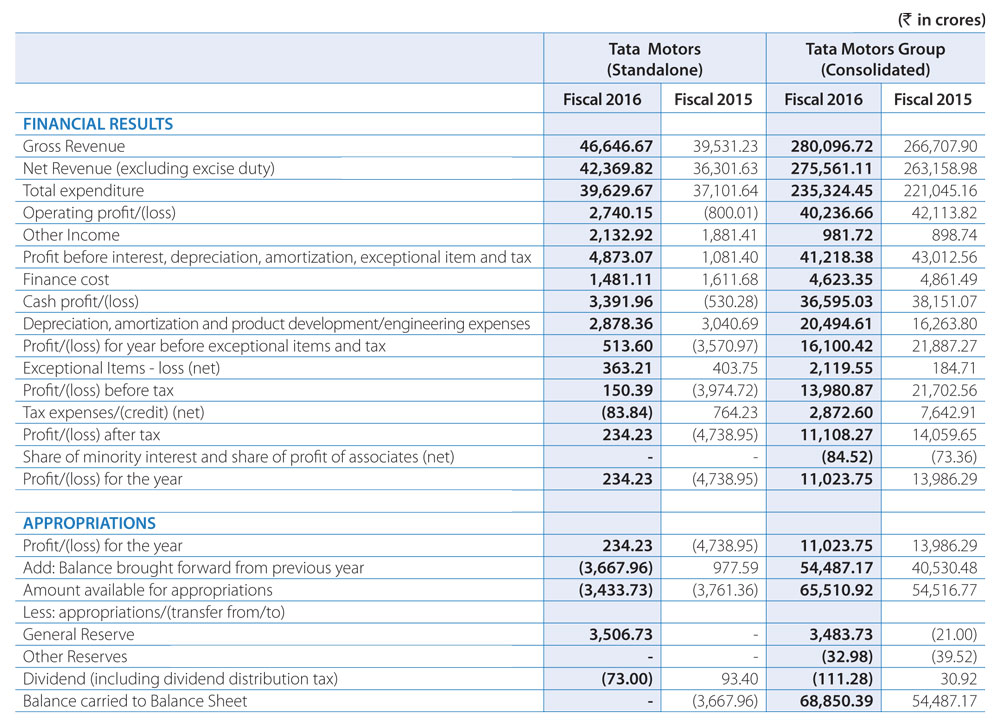

FINANCIAL PERFORMANCE SUMMARY

DIVIDEND

Considering the Company's financial performance, the Directors have recommended a dividend of Rs. 0.20 per share (10%) on the capital of 2,887,203,602 Ordinary Shares of Rs. 2/- each (Nil for last year) and Rs. 0.30 per share (15%) on the capital of 508,476,704 'A' Ordinary Share of Rs. 2/- each for Fiscal 2016 (Nil for last year) and the same will be paid on or after August 11, 2016. The said dividend, if approved by the Members, would involve a cash outflow of Rs. 73 crores including dividend distribution tax (net of credit), resulting in a payout of 31.2% of standalone profits for Fiscal 2016 of the Company.

TRANSFER TO RESERVES

The profit for the Fiscal 2016 is Rs. 234.23 crores. As the dividend has been declared from Reserves, a part of General Reserve has been adjusted against the accumulated loss in the Profit and Loss Account. Accordingly, the balance of Rs. 3,506.73 crores is transferred from General Reserves to the Profit and Loss Account.

OPERATING RESULTS AND PROFITS

The global macroeconomic landscape in Fiscal 2016 was rough and uncertain and characterized by weak growth of world output. The situation has been compounded by; (i) declining prices of a number of commodities, with reduction in crude oil prices being the most visible of them, (ii) turbulent financial markets (specially the equity markets) and (iii) volatile exchange rates. Global growth remained moderate with uneven prospects across the major economies. The outlook for advanced economies is improving, while growth in emerging market and developing economies is projected to be lower, primarily reflecting weaker prospects for certain large emerging market economies alongside oil and raw material exporting economies. Oil prices have declined during Fiscal 2016 due to weaker than expected global activity and a weaker demand for oil. Exchange rate movements in recent months have been sizable, reflecting changes in expectations about growth and monetary policy across major economies. Long-term government bond yields have declined in major advanced economies, reflecting in part lower inflation expectations, the sharp decline in oil prices and weak domestic demand.

The US economy growth was stronger than with accompanying job growth, resulting in a decline in the unemployment rate. The Eurozone showed signs of economic improvement in 2015, with consumption supported by lower oil prices and higher net exports, driven by lower energy prices, a weaker Euro and a loose monetary policy by the European Central Bank. In Fiscal 2015, GDP in the UK slowed a little, but consumer spending growth remained relatively strong, partially due to lower oil prices. China recorded a pronounced deceleration in growth in Fiscal 2015, which suggests that China's slowdown over the past few years shows little sign of abating. The GDP growth rate moderated to 6.9% for Fiscal 2015 and coincided, with growing debt and excess housing and factory capacity. Brazil's economy sank into the deepest recession in recent history in 2015, amid low prices for key exports, soaring inflation and depressed confidence levels. Economic performance in Russia was impacted by the increase in geopolitical tensions, lower crude oil prices and economic sanctions.

However, India has registered a robust and steady pace of economic growth in Fiscal 2016 with GDP increased by 7.6%. Wholesale price inflation has been in negative territory for more than a year and the all important consumer prices inflation has declined to nearly half of what it was a few years ago. However, weak growth in advanced and emerging economies has taken its toll on India's exports. As imports have also declined, principally on account of reduced prices of crude oil for which the country is heavily dependent on imports, trade and current account deficits continue to be moderate. Growth in agriculture has slackened due to two successive years of less than-normal monsoon rains. The rupee has depreciated vis-à-vis the US dollar, like most other currencies in the world, although less so in magnitude. At the same time, it has appreciated against a number of other major currencies.

The Tata Motors Group registered a growth of 5.0% in gross turnover to Rs. 280,097 crores in Fiscal 2016 as compared to Rs. 266,708 crores in Fiscal 2015. The consolidated revenue (net of excise) for Fiscal 2016 Rs. 275,561 crores grew by 4.7% over last year on the back of strong growth in wholesale volumes across products of Jaguar Land Rover and complemented by strong M&HCV sales in India. The consolidated EBITDA margins for Fiscal 2016 stood at 14.6%. Consequently, Profit Before and After Tax were Rs. 13,981 crores and Rs. 11,024 crores respectively.

Tata Motors Limited recorded a gross turnover of Rs. 46,647 crores, 18.0% higher from Rs. 39,531 crores in the previous year. Tailwinds from improving macros - softening interest rates, lower fuel cost and inflation, steady replacement demand from large fleet operators has supported sales growth in M&HCV resulting in significant improvement in EBITDA margins to 6.5% in Fiscal 2016 as against negative 2.2% in Fiscal 2015. Profit Before and After Tax for Fiscal 2016 was at Rs. 150 crores and Rs. 234 crores respectively, as compared to Loss Before and After Tax of Rs. 3,975 crores and Rs. 4,739 crores, respectively for last Fiscal.

Jaguar Land Rover (JLR) (as per IFRS) recorded revenue of GB£22,208 million (Rs. 219,019 crores) for Fiscal 2016, up 1.6% from the £21,866 million (Rs. 215,646 crores) in the last Fiscal Year, primarily reflecting the successful introduction of new products.

Consolidated EBITDA for Fiscal 2016 was strong at GB£3,147 million (Rs. 31,036 crores) but down compared to Fiscal 2015 of GB£4,132 million (Rs. 40,750 crores), primarily driven by softer market and model mix and as well as one-time reserves and charges of GB£166 million (Rs. 1,637 crores) including the US recall of potentially faulty passenger airbags supplied by Takata, doubtful debts and previously capitalised investment.

Profit Before Tax (PBT) in Fiscal 2016 was GB£1,557 million (Rs. 15,355 crores) down by GB£1,057 million compared to the record PBT of GB£2,614 million (Rs. 25,780 crores) in Fiscal 2015 primarily reflecting the lower EBITDA, higher depreciation and amortisation and the net exceptional charge of GB£157 million (Rs. 1,638 crores) related to vehicles damaged or destroyed in the Tianjin port explosion in August 2015, partially offset by favourable revaluation of US Dollar debt and unrealised FX and commodity hedges as well as profits earned in the China Joint Venture.

Tata Motors Finance Limited (TMFL) (consolidated) the Company's captive financing subsidiary, registered a growth in revenues by 8.0% to Rs. 2,968 crores (previous year: Rs. 2,743 crores) and reported a Profit After Tax of Rs. 267 crores in Fiscal 2016, as compared to Loss after Tax of Rs. 611 crores in Fiscal 2015. TMFL's concerted efforts on collection and NPA management strategy has helped to reduce credit losses and gross non-performing assets during Fiscal 2016.

Tata Daewoo Commercial Vehicle Company Limited (TDCV) (as per Korean GAAP) South Korea registered revenues of KRW 880 billion (Rs. 5,096 crores), a decline of 11% over the previous year mainly due to lower export sales partially offset by increase in domestic sales. The Profit after tax was KRW 46 billion (Rs. 264 crores) compared to KRW 54 billion (Rs. 304 crores) of previous year which included one-time reversal of provisions pertaining to ordinary wage lawsuit KRW 24 billion (Rs. 136 crores). Better profitability of Euro 6 vehicles, better mix, favourable exchange realizations, continuous material cost reduction, various cost control and inventory initiatives helped in improving profits.

VEHICLE SALES AND MARKET SHARES

The Tata Motors Group sales for the year stood at 1,064,596 vehicles, up by 6.7% as compared to Fiscal 2015. Global sales of all Commercial Vehicles were 390,953 vehicles, while sales of Passenger Vehicles were at 673,643 vehicles.

TATA MOTORS

Tata Motors recorded sales of 511,931 vehicles, a growth of 1.5% over Fiscal 2015. The Indian Auto Industry, grew in Fiscal 2016 by 8%, resulting in the Company's market share decreasing to 13.1% in Fiscal 2016 from 14.1% in the previous year. The Company's exports on standalone basis grew by 16.3% to 58,058 vehicles in Fiscal 2016 as compared to 49,936 vehicles in Fiscal 2015.

Commercial Vehicles

Within the domestic market, the Company sold 326,755 Commercial Vehicles (CV), a growth of 2.8% from Fiscal 2015 driven by volume expansion across segments. While M&HCVs have been growing through the year, the LCV segment witnessed positive growth during the second half of the Fiscal 2016, both in goods and passenger carrier segment. M&HCV trucks continued strong growth, registering a 30.0% rise over last Fiscal Year and the Company has been able to retain a strong market share of 56% in this category.

Some of the highlights for the year were:

- Launched the new SIGNA range of M&HCV, at the SIAM Auto Expo 2016. Offered in various configurations, the SIGNA range of commercial vehicles is engineered and built to offer M&HCV buyers, a newly designed cabin, with proven Tata Motors aggregates, for a world-class trucking experience

- Launch of ACE Mega, the all-new Smart and Small Pick-up Truck with superior performance, enhanced looks, strong cabin with rated payload of 1Tonne, which offers the best-in-class fuel efficiency and lowest cost of ownership

- Achieved a new feat in the last mile public transport portfolio by reaching a remarkable sales mark of 3 Lakh Tata Magic, our most popular public transport vehicle

- Celebrated the 10th anniversary of the Tata Ace (launched in 2005) as the 'Decade of Trust' throughout the country

- The Company has been honoured with the 'Best Telematics Product or Launch in the Emerging Market' Award for its Telematics solution, based on the popular Android platform developed for the Tata Magic Iris Electric

- This year, the Company won 4 prestigious awards at the Apollo CV Awards:

- Cargo carrier of the year - Tata LPS 4923

- School Bus of the year - Tata Cityride Skool Bus

- Special Application CV of the year - Tata MHC 2038

- CV dealer of the year - Bhandari Automotive (Tata Motors dealership).

- Organized the Prima Truck Racing Championship Season 3, which drew in over 55,000 spectators. The highlight this year was the first ever race of Indian truck racing talent, trained and nurtured in India. The Company has conceptualized and introduced an Indian Driver Training and Selection program - "T1 Racer Program" to induct and mold Indian truck drivers as 'racers'

- Participated in the SIAM Auto Expo 2016 and the following vehicles were showcased:

- SIGNA range of M&HCV Trucks

- Tata ULTRA 1518 Sleeper from the Ultra range with 15.7T GVW and furnished with a spacious cabin and a fully trimmed power steering, seating three, along with a bed, ensures a safe and comfortable working design for the driver

- ACE MEGA XL – Last mile cargo transport with a rated payload of 1Ton, 8-feet loading deck, with a top speed of 80 km/hr

- MAGIC IRIS ZIVA – gearless, clutchless with futuristic Hydrogen Fuel Cell technologies, for zero emissions

- ULTRA 1415 4X4 – A 4X4 rugged performer, with a snow plough and a hydraulic crane

- STARBUS HYBRID – World's first commercially produced CNG Hybrid Bus, using Electric and CNG modes (BS IV compliant) as fuel

- ULTRA ELECTRIC – First full-electric bus from the Company, with zero emissions and noiseless operations.

- Participated in EXCON 2015 and showcased four new construction vehicles - Tata PRIMA 3138.K 32 CuM Coal Tipper, Tata PRIMA LX 2523.K RePTO, Tata PRIMA LX 3128.K 19 CuM Scoop HRT and Tata SAK 1613

- Tata Motors Loyalty Program (Tata Delight and Tata Emperor) was recognized by DMA Asia ECHO™ Awards and PMAA Dragons of Asia in December 2015

- Awarded contract for 1,239 indigenously developed 6X6 high mobility multi-axle vehicles, from the Indian Army which was recently followed up with a repeat order for 619 units

- Signed a contract to supply 25 Tata Starbus Diesel Series Hybrid Electric Bus with Full Low floor configuration, with the Mumbai Metropolitan Region Development Authority (MMRDA) – the single largest order awarded for Hybrid Electric vehicle technology.

Passenger Vehicles

The domestic passenger vehicle industry grew by 7.6% during Fiscal 2016. Correction in fuel prices and easing financing cost has resulted in lower operating cost, which should further aid domestic PV growth in near to medium term. During the year, the Company's Passenger Vehicles sales were lower by 7.0% at 127,118 vehicles, registering a 4.6% market share. The Company sold 106,827 cars (lower by 3.8%) and 20,291 utility vehicles and vans (lower by 20.6%). The Company's sales in the Utility Vehicle segment suffered as competitive activity intensified with multiple new launches mainly in the soft-roader category in this segment. The Company has taken various initiatives to improve its performance such as product refreshes/launch programs, operational efficiency, dealer effectiveness, working capital management and restructuring customer facing functions.

Some of the highlights of this year's performance were:

- Product Launches/Refreshes continued under the Horizonext Strategy

- GenX-Nano range was launched in May 2015, with latest technological advancements and design upgrade

- Safari Storme 400Nm was launched in November 2015, with high power/torque engine and new six speed manual gearbox.

- The Made of Great Brand Campaign was launched to uplift the Tata Motors brand in conjunction with Lionel Messi

- Hexa SUV, Kite 5 compact sedan and Nexon compact SUV were displayed at Auto Expo 2016.

- As a part of the overall social responsibility, the Company had to postpone the launch of "Tiago", due to the change in name responding against the epidemic "Zika".

The above new/refreshed product launches were in-line with the Company's objective of taking the brand to a higher level, while making it relevant for the younger buyer. The Company continued to focus on building brand strengths, refreshing products and enhancing sales and service experience.

Exports

The Company exported 58,058 vehicles (Fiscal 2015: 49,936 vehicles) comprising 54,052 units of Commercial Vehicles and 4,006 units of Passenger Vehicles during Fiscal 2016.

Export of Commercial Vehicles grew by 16.5% in Fiscal 2016 with 54,052 units exported compared to 46,416 in Fiscal 2015. The traditional markets of SAARC remained stronger than last year growing by 26% with Sri Lanka, Bangladesh and Nepal contributing to the growth. However, the mid-term duty change in Sri Lanka and the lockdown in Nepal impacted the growth momentum. However, the subsequent opening of border and easing of pent up demand led to record shipments to Nepal in Q4 of Fiscal 2016. Low crude oil prices, Middle East geo-political situation, currency devaluations and political strife cast a big shadow over our strong markets of Middle East and Africa this year. The Company was able to grow market share in the key markets of Sri Lanka, Kenya, Nepal, Ghana, Congo and Senegal. In Fiscal 2016, the Company successfully bagged and executed several prestigious orders including 450 units Xenon troop carriers for the Ministry of Defence Myanmar taking the total order count to 1,450 units; 87 units of Elanza school buses in Saudi Arabia; 50 units Prima 4,438 in Saudi Arabia; 44 units Ultra truck delivery to Pran RFL Bangladesh and more that 1,000 units Tata Saathi, an application on the ACE platform to Bangladesh. Some of the key events in Fiscal 2016 were the launch of Tata Prima in Kenya, Uganda and Bangladesh; Ultra Bus in Sri Lanka; Ultra trucks in Bangladesh; Elanza bus in UAE and Ace Express, Ace Mega in Sri Lanka and Nepal. The Company also opened Assembly units with 3rd party vendors in Tunisia and Vietnam. In Fiscal 2016, the Company achieved a key milestone of 1,000 Prima retails in export markets.

During the period Fiscal 2016, the Company's exports of Passenger Vehicles at 4,006 units were 13.8% higher than in Fiscal 2015, mainly due to improved sales in key markets like Sri Lanka and South Africa. Aggressive efforts on the back of the launch of Nano GenX and retails of Indica Xeta gave us strong volume growth in Sri Lanka, whereas in South Africa sales were boosted by the launch of the Bolt (hatchback) and Zest (compact sedan).

In Nepal, the launch of Bolt has helped the Company to improve its share of the hatch segment whereas Zest helped to augment Company's presence in the compact sedan segment and Sumo continues to be the Number One selling brand in UVs in Nepal. Indigo also found an increased acceptance in the commercial segment in Bangladesh, the Philippines and Uruguay.

JAGUAR LAND ROVER (JLR)

In Fiscal 2016, JLR continued to experience growth in all geographical markets, except China with total wholesale sales of 544,085 units, a growth of 15.6% as compared to Fiscal 2015. JLR total retail sales were up 12.8%, with Jaguar up 22.8% and Land Rover up 10.9%. Sales were higher in the majority of markets in Fiscal 2016 as retails in the UK increased by 23.8% year on year, North America by 27.1% and Europe by 42.0% whilst sales growth in other Overseas markets were broadly similar to last year. However, retail sales in China were down 16.4% primarily reflecting softer economic conditions in China at the beginning of the year, the timing of new product launches and the transition of production to our China Joint Venture.

Some of the highlights of this year were:

- The new Jaguar XE went on general retail sale in May 2015

- The refreshed 16 Model Year Range Rover Evoque went on sale in August 2015

- Launch of the all new lightweight Jaguar XF went on sale in September 2015

- Production of the Land Rover Discovery Sport commenced at the China Joint Venture and went on sale locally in November 2015

- Launch of the refreshed 16 Model Year Jaguar XJ went on sale in December 2015

- Jaguar's all new luxury performance SUV was revealed to the public and went on sale at the end of the year

- Very own 4 cylinder diesel engine produced at the Engine Manufacturing Centre in Wolverhampton in the UK was first introduced into the Jaguar XE and is now available in some of other vehicles such as the Jaguar XF, Range Rover Evoque and Land Rover Discovery Sport

- Announced an additional GB£450 million investment in the Engine Manufacturing Centre in Wolverhampton to double capacity bringing total investment to almost GB£1 billion

- Announcement that an investment agreement has been signed to build a manufacturing plant in the city of Nitra in Slovakia with annual capacity of 150,000 units with production commencing in Fiscal 2018. The initial investment will be GB£1 billion with the option to invest a further GB£500 million to double capacity to 300,000 units per annum subject to a further feasibility study

- Jaguar will be competing in the FIA Formula E championship from August 2016 which presents a unique and exciting opportunity for Jaguar Land Rover to further the development of its future electric powertrain technology

- Announcement that the all new Jaguar XF L (Long wheel base XF) will be the third vehicle to be produced at the China Joint Venture.

Tata Daewoo Commercial Vehicle Company Limited

Tata Daewoo Commercial Vehicle Company Limited (TDCV) sold 9,116 vehicles, lower by 22.2% over Fiscal 2015, mainly due to lower export sales partially compensated by increase in domestic sales. TDCV continued the strong performance, in the domestic market inspite of increased competition by selling 7,036 vehicles, 2nd highest in its history, registering a growth of 3.3% compared to sales of 6,808 vehicles in Fiscal 2015. The newly introduced Euro 6 models were well accepted in the market resulting in an increase in the market share for both HCV and MCV Segments put together increasing to 31.0% as compared to 28.7% in Fiscal 2015. However, the export market scenario was very challenging. Factors like low oil prices, local currency depreciation against the US Dollar, new statutory regulations to reduce imports, slowdown in Chinese economy impacting commodity exporting countries, increased dealer inventory etc. adversely impacted TDCV's exports in major markets like Algeria, Russia, Vietnam, South Africa, GCC etc. The export sales were 2,080 units, 57.6% lower compared to 4,902 units in Fiscal 2015.

Tata Motors (Thailand) Limited

Tata Motors (Thailand) Limited (TMTL) sold 1,312 units in Fiscal 2016 as compared to 1,305 units in Fiscal 2015. The domestic retail sales figure was 1,124 units. The Thai Automobile Industry has witnessed the 3rd year of drop of 9.0% in Fiscal 2016 due to poor performance of the economy but witnessed a slew of new pickup launches by major OEMs during the year. In spite of the slow-down, TMTL domestic volume decline was 6.0% compared to 9.0% of industry. TMTL has increased its market share in "CNG and Bi-Fuel Pickups segment" to 25.2% (Previous Year 24.0%) to become the second largest player in the segment.

TMTL has taken the opportunity to refresh its products, services and network as well as to expand the range of offerings to the Thailand customers. Fiscal 2016 saw the launch of the Xenon 150N Series with a host of new features, TDCV Novus and Super Ace Mint. During the year, TMTL exported 253 vehicles to Malaysia against specific order from POS Malaysia. TMTL is exploring similar opportunities in other parts of South East Asia and neighbouring continents.

Tata Motors (SA) (Pty) Limited

Tata Motors (SA) (Pty) Ltd (TMSA) sold 765 chassis in the South Africa market in Fiscal 2016 as compared to 839 chassis in Fiscal 2015. TMSA is in the process of homologating and introducing a range of new products including Prima and Ultra trucks as well as a couple of bus models for sale in South Africa.

Tata Motors Finance Limited

Tata Motors Finance Limited (TMFL) is a wholly owned subsidiary company is carrying out vehicle financing activity under the brand "Tata Motors Finance".

On March 31, 2016, TMFL has acquired from the Company, 100% shareholding in Sheba Properties Limited, a NBFC registered with the Reserve Bank of India as a part of restructuring and consolidation of financial services companies under the TMFL group.

The commercial vehicle business saw a growth during Fiscal 2016, majorly contributed by the M&HCV segment. As a result of which TMFL's total disbursements (including refinance) increased by 22.8% at Rs. 8,985 crores in Fiscal 2016 as compared to Rs. 7,316 crores in Fiscal 2015. TMFL financed a total of 1,12,114 vehicles reflecting a slight decline of 0.6% over 1,12,788 vehicles financed in Fiscal 2015. Disbursements for commercial vehicles increased by 30.4% and were at Rs. 7,485 crores (75,970 units) as compared to Rs. 5,741 crores (72,853 units) of Fiscal 2015. Disbursements of passenger vehicles declined by 9.9% to Rs. 1,350 crores (33,185 units) from a level of Rs. 1,498 crores (38,444 units). Disbursements achieved under refinance (through Tata Motors Finance Solutions Limited, a 100% subsidiary of TMFL) were at Rs. 150 crores (2,959 vehicles) during Fiscal 2016.

TMFL has increased its reach by opening limited services branches exclusively in Tier 2 and 3 towns, which have helped in reducing the turn-around-time to improve customer satisfaction. TMFL had 245 branches at the end of Fiscal 2016. The book size of TMFL's corporate lending business, which includes providing finance to TML's dealers & vendors, increased by 97.7%; Rs. 947 crores in Fiscal 2016 from Rs. 479 crores in Fiscal 2015.