Consolidated Balance Sheet

Shareholders' fund was Rs. 80,782.67 crores and Rs. 56,261.92 crores as at March 31, 2016 and 2015, respectively, an increase of 43.5%.

Reserves increased by 44.0% from Rs. 55,618.18 crores as at March 31, 2015 to Rs. 80,103.49 crores as at March 31, 2016. Apart from the Profit for Fiscal 2016 of Rs. 11,023.75 crores, the increase in Reserves of Rs. 24,485.35 crores was primarily attributable to following reasons:

- Securities premium increased by Rs. 7,400.66 crores due to issuances of shares at premium in the Company's Rights offering in Fiscal 2016.

- Accumulated actuarial losses in Pension Reserve have decreased by 35.7% to Rs. 6,659.25 crores as at March 31, 2016 compared to Rs. 10,361.85 crores as at March 31, 2015, due to increase in the interest rates for Jaguar Land Rover pension funds.

- The exchange losses on foreign currency borrowings (net of amortisation of past losses) recognised in Foreign Currency Monetary Item Translation Difference Account of Rs. 2,847.84 crores as at March 31, 2016, as compared to Rs. 4,227.07 crores as at March 31, 2015.

- Translation gain of Rs. 1,730.87 crores recognised in Translation Reserve on consolidation of subsidiaries further contributed to an increase in Reserves and Surplus.

- Partially offset by a reduction in Hedging Reserves by Rs. 693.76 crores, primarily due to mark-to-market losses on forwards and options in Jaguar Land Rover, primarily due to decline in the US dollar-GBP forward rates.

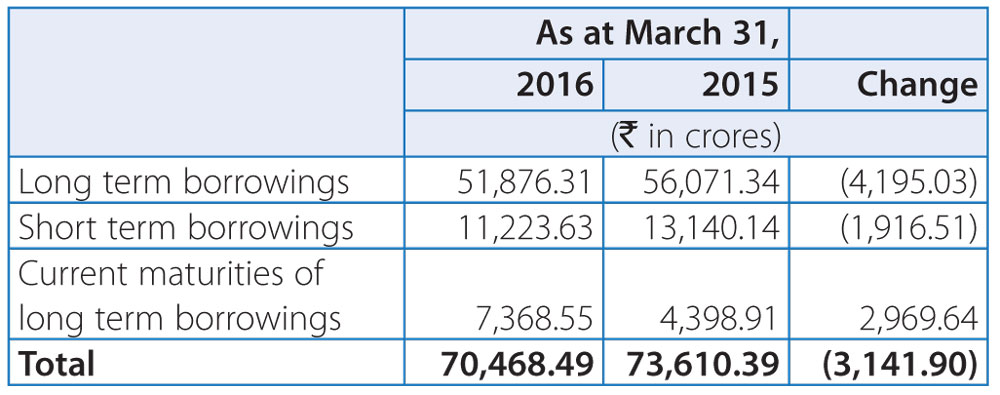

Borrowings:

- Current maturities of long-term borrowings represent the amount of loan repayable within one year.

- During the year TML Holdings Pte. Ltd., a subsidiary of the Company, has

- Refinanced existing unsecured multi-currency loan of US$600 million (US$250 million and SG$62.8 million maturing in November 2017 and US$210 million and SG$114 million maturing in November 2019) with a new unsecured loan of US$600 million (US$300 million maturing in October 2020 and US$300 million maturing in October 2022); and

- Refinanced the existing SG$350 million 4.25% Senior notes due in May 2018 with a new syndicated loan of US$250 million maturing in March 2020.

- Further, the Company has paid certain of its borrowings from the Rights issue.

Other long-term liabilities were Rs. 9,946.52 crores as at March 31, 2016, as compared to Rs. 9,141.92 crores as at March 31, 2015. These included Rs. 7,744.11 crores of derivative financial instruments, mainly attributable to Jaguar Land Rover as at March 31, 2016 compared to Rs. 7,721.94 crores as at March 31, 2015, reflecting notional liability due to the valuation of derivative contracts.

Trade payables were Rs. 63,632.89 crores as at March 31, 2016, as compared to Rs. 57,407.28 crores as at March 31, 2015.

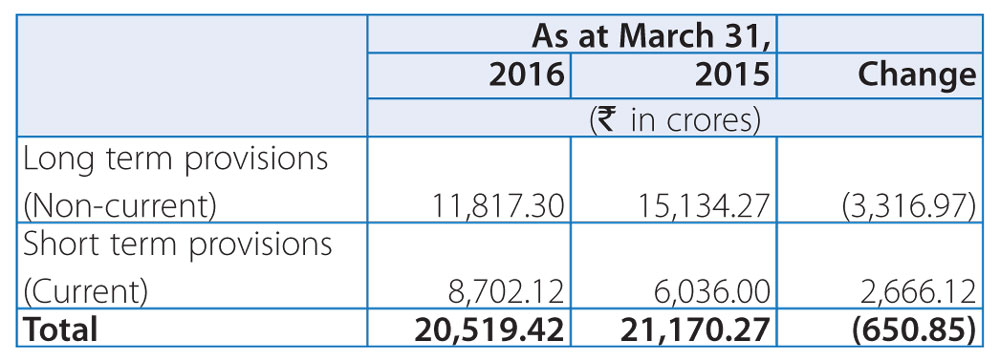

Provisions (current and non-current) were made towards warranty and employee benefit schemes. Short-term provisions are those which are expected to be settled during next financial year.

The details are as follows:

- Provision for warranty and product liability increased by Rs. 2,087.48 crores or 20.2% mainly on account of increased volumes at Jaguar Land Rover and M&HCV volume at TML.

- The provision for employee benefits obligations decreased by Rs. 2,823.1 crores or 30.3% on account of changes in actuarial factors.

Other current liabilities were Rs. 27,261.82 crores as at March 31, 2016 as compared to Rs. 23,688.58 crores as at March 31, 2015, representing an increase of 15.1%. These mainly includes liabilities towards vehicles sold under repurchase arrangements, liabilities for capital expenditure, statutory dues, current liabilities of long-term debt, derivative liabilities and advance/progress payment from customers. The increase was mainly due to increase in current maturites of long-term borrowings.

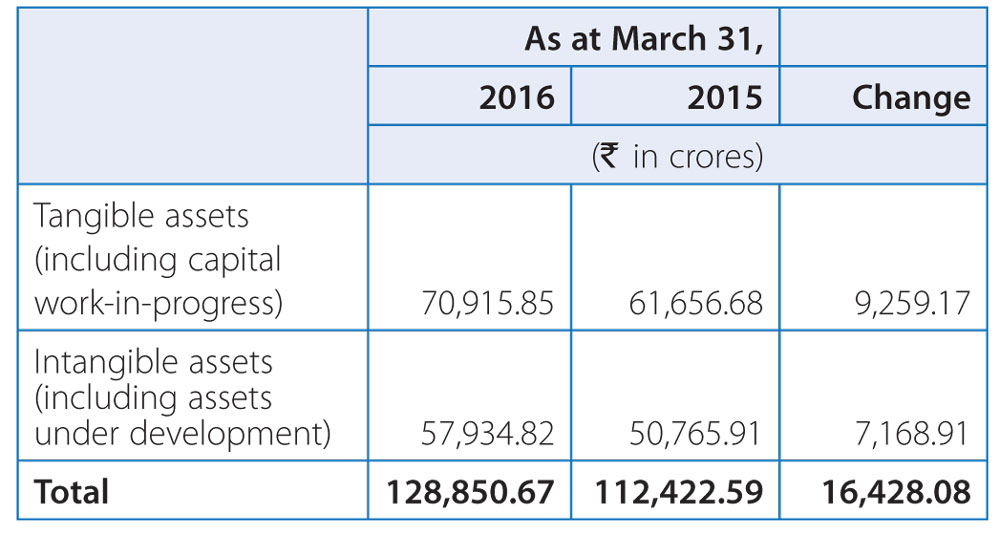

Fixed Assets:

The increase (net of depreciation) in the tangible assets mainly represented additions towards new product plans and the new engine manufacturing facility and Brazil plant at Jaguar Land Rover and the increase (net of amortisation) in the intangible assets was Rs. 7,168.91 crores, mainly attributable to new product developments projects and new product launches during Fiscal 2016.

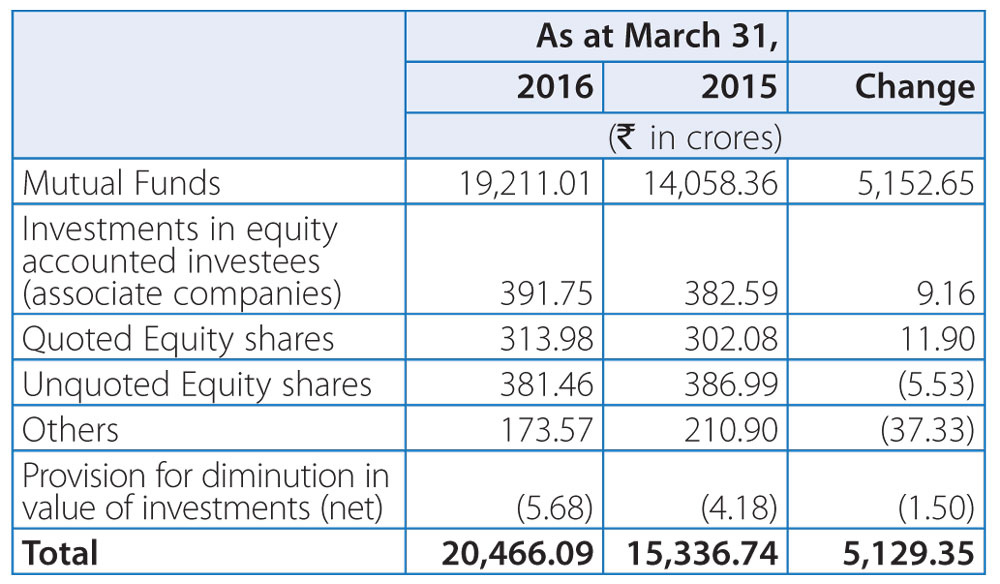

Investments (Current + Non-current) were Rs. 20,466.09 crores as at March 31, 2016, as compared to Rs. 15,336.74 crores as at March 31, 2015. The details are as follows:

The increase in mutual fund investments was mainly at the Company and at Jaguar Land Rover.

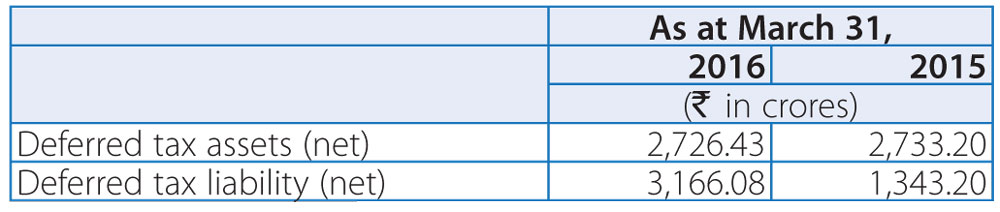

Deferred tax assets/liability: Deferred tax assets represent timing differences for which there will be future current tax benefits due to unabsorbed tax losses and expenses allowable on a payment basis in future years. Deferred tax liabilities represent timing differences where current benefit in tax will be off-set by a debit in the statement of profit and loss.

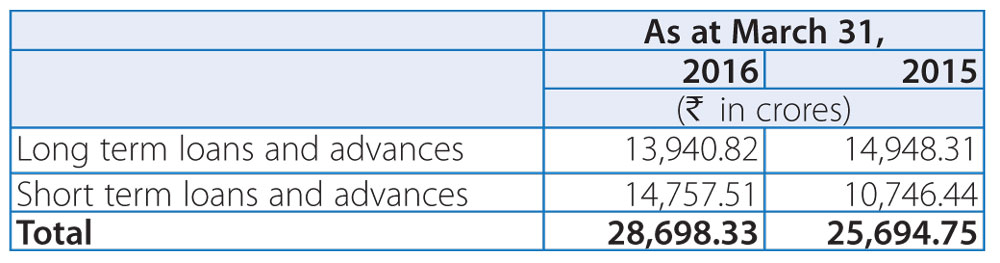

Loans and Advances

Loans and advances include:

- Receivables towards vehicle financing by TMFL increased to Rs. 18,999.38 crores as at March 31, 2016, as compared to Rs. 16,877.82 crores as at March 31, 2015, an increase of 12.6%, due to higher disbursements during the year;

- VAT, other taxes recoverable, statutory deposits and dues of Rs. 5,510.19 crores as at March 31, 2016, as compared to Rs. 5,442.38 crores as at March 31, 2015.

- Capital advances representing advances given capital purchases has increased to Rs. 470.31 crores as at March 31, 2016 from Rs. 234.93 crores as at March 31, 2015.

- Income tax assets have increased to Rs. 1,502.49 crores as at March 31, 2016 as compared to Rs. 1,159.78 crores as at March 31, 2015.

Inventories as at March 31, 2016, were Rs. 33,398.98 crores as compared to Rs. 29,272.34 crores as at March 31, 2015, an increase of 14.1%. Inventory at Tata and other brand vehicles (including vehicle financing) was Rs. 6,818.67 crores as at March 31, 2016 as compared to Rs. 6,155.33 crores as at March 31, 2015. Inventory at Jaguar Land Rover was Rs. 26,505.61 crores as at March 31, 2016, an increase of 15.9%, as compared to Rs. 22,877.62 crores as at March 31, 2015. In terms of number of days of sales, finished goods represented 34 inventory days in Fiscal 2016 as compared to 32 days in Fiscal 2015.

Trade Receivables (net of allowance for doubtful debts) were Rs. 12,989.96 crores as at March 31, 2016, representing an increase of 3.3% compared to Rs. 12,579.20 crores as at March 31, 2015. Trade Receivables have increased at Tata and other brand vehicles (including vehicle financing) to Rs. 2,882.54 crores as at March 31, 2016 as compared to Rs. 2,558.03 crores as at March 31, 2015. The allowances for doubtful debts were Rs. 1,240.35 crores as at March 31, 2016 compared to Rs. 737.86 crores as at March 31, 2015. The increase was mainly at Jaguar Land Rover for certain doubtful receivables.

Cash and bank balances were Rs. 32,879.98 crores, as at March 31, 2016 compared to Rs. 32,115.76 crores as at March 31, 2015, The Company holds cash and bank balances in Indian rupees, GBP, Chinese Renminbi, etc. The cash balances include bank deposits maturing within one year of Rs. 23,230.63 crores as at March 31, 2016, compared to Rs. 23,638.08 crores as at March 31, 2015.

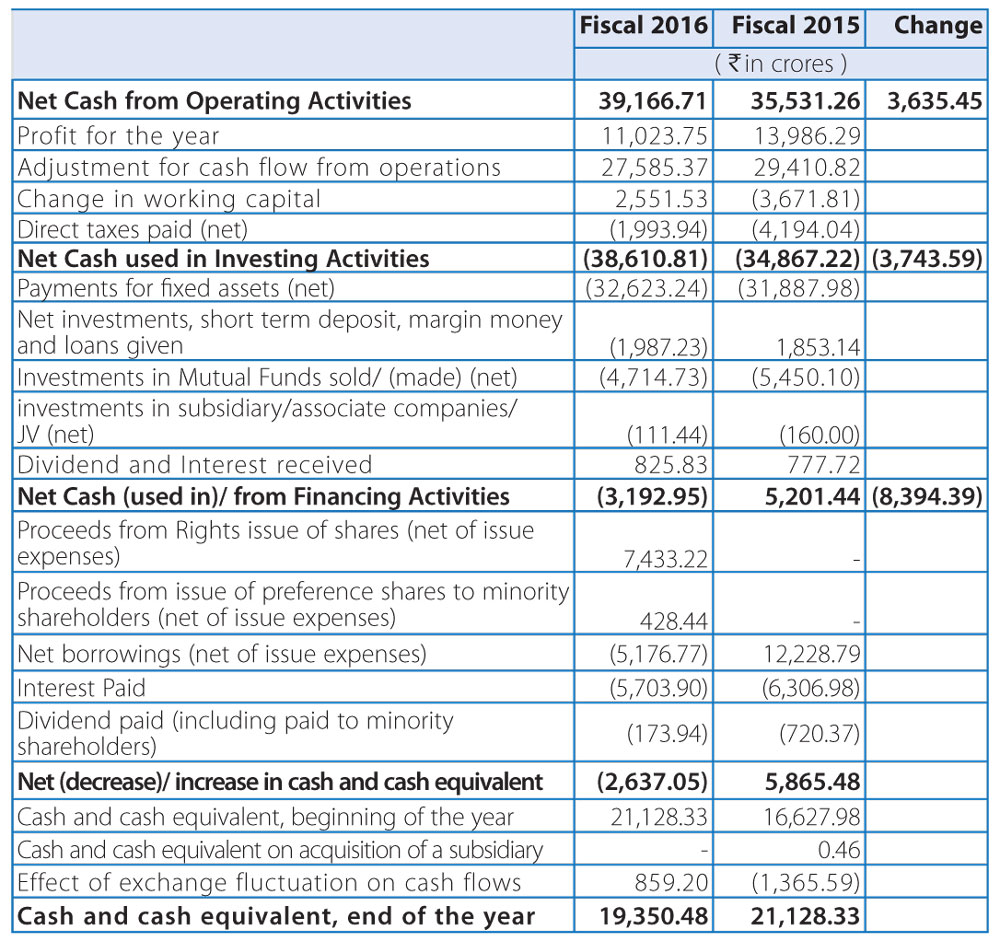

Consolidated Cash Flow

The following table sets forth selected items from consolidated cash flow statement:

Analysis:

- Cash generated from operations before working capital changes was Rs. 38,609.12 crores in Fiscal 2016, as compared to Rs. 43,397.11 crores in the previous year, representing a decrease in cash generated through consolidated operations, consistent with the reduction in profit on a consolidated basis. After considering the impact of working capital changes including the net movement of vehicle financing portfolio, the net cash generated from operations was Rs. 39,166.71 crores in Fiscal 2016, as compared to Rs. 35,531.26 crores in the previous year. The increase in trade receivables, inventories and other assets amounting to Rs. 7,845.79 crores mainly due to increase in sales was off set by increase in trade and other payables and provisions amounting to Rs. 10,397.32 crores.

- The net cash outflow from investing activity increased to Rs. 38,610.81 crores in Fiscal 2016 from Rs. 34,867.22 crores in Fiscal 2015.

- Capital expenditure (net) was at Rs. 32,623.24 crores in Fiscal 2016 compared to Rs. 31,887.98 in Fiscal 2015, related mainly to capacity/expansion of facilities, quality and reliability projects and product development projects.

- Net investment, short term deposits, margin money and loans given was an outflow of Rs. 1,987.23 crores in Fiscal 2016 as compared to an inflow of Rs. 1,853.14 crores in Fiscal 2015, mainly at Jaguar Land Rover.

- The net change in financing activity was an outflow of Rs. 3,192.95 crores in Fiscal 2016 as compared to an inflow of Rs. 5,201.44 crores in Fiscal 2015.

- During Fiscal 2016, the Company raised Rs. 7,433.22 crores through rights issue of shares and Rs. 428.44 crores through issue of preference shares to minority shareholders.

- In Fiscal 2015, Rs. 8,886.52 crores were raised from long-term borrowings (net) as compared to repayment of Rs. 3,074.08 crores (net) in Fiscal 2016 as described in further detail below.

- Net decrease in short-term borrowings of Rs. 2,099.95 crores in Fiscal 2016 as compared to an increase of Rs. 3,351.58 crores in Fiscal 2015, mainly at Tata and other brand vehicles (including vehicle financing).

As at March 31, 2016, the Company's borrowings (including short-term debt) were Rs. 70,468.49 crores, compared to Rs. 73,610.39 crores as at March 31, 2015.