Principal Sources of Funding Liquidity

The Company finances its capital expenditures and research and development investments through cash generated from operations, cash and cash equivalents, debt and equity funding. The Company also raises funds through sale of investments, including divestment in stakes of subsidiaries on a selective basis.

The Company's cash and bank balances on a consolidated basis were Rs. 32,879.98 crores as at March 31, 2016, as compared to Rs. 32,115.76 crores as at March 31, 2015. These enable the Company to cater to business needs in the event of changes in market conditions.

The Company's capital expenditures were Rs. 32,024.42 crores and Rs. 34,889.61 crores for Fiscal 2016 and 2015, respectively, and the Company currently plans to invest approximately Rs. 398 billion in Fiscal 2017 in new products and technologies. The Company intends to continue to invest in new products and technologies to meet consumer and regulatory requirements. These investments are intended to enable the Company to pursue further growth opportunities and improve the Company's competitive positioning. The Company expects to meet most of its investments out of operating cash flows and cash liquidity available. In order to meet the remaining funding requirements, the Company may be required to raise funds through additional loans and by accessing capital markets from time to time, as deemed necessary.

With the ongoing need for investments in products and technologies, the Company (on a standalone basis) was free cash flow (a non-GAAP financial measure, measured at cash flow from operating activities less payments for property, plant and equipment and intangible assets) negative in Fiscal 2016 of Rs. 635.80 crores. The Company expects that with an improvement in macroeconomic conditions and business performance, combined with steps like raising funds at subsidiary levels, reviewing non-core investments and raising additional long-term resources at Tata Motors Limited on a standalone basis, the funding gap could be appropriately addressed.

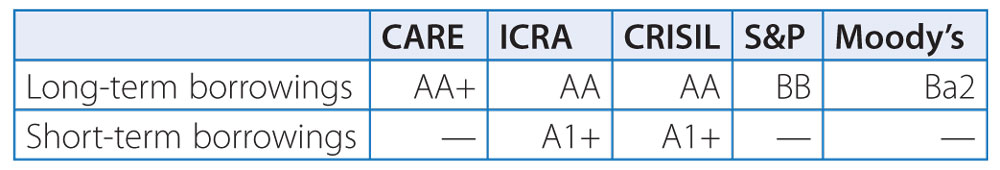

The following table provides information for the credit rating of Tata Motors Limited for short-term borrowing and long-term borrowing from the following rating agencies as at March 31, 2016: Credit Analysis and Research Ltd Ratings, or CARE, Information and Credit Rating Agency of India Ltd, or ICRA, Credit Rating Information Services of India Limited, or CRISIL Ltd, Standard & Poor's Ratings Group, or S&P, and Moody's Investor Services, or Moody's. A credit rating is not a recommendation to buy, sell or hold securities. A credit rating may be subject to withdrawal or revision at any time. Each rating should be evaluated separately of any other rating:

The Company believes that it has sufficient liquidity available to meet its planned capital requirements. However, the Company's sources of funding could be materially and adversely affected by an economic slowdown, as was witnessed in Fiscal 2009, or other macroeconomic factors in India and abroad, such as in the United Kingdom, the United States, Europe, Russia and China, all of which are beyond the Company's control. A decrease in the demand for the Company's vehicles could affect its ability to obtain funds from external sources on acceptable terms or in a timely manner.

The Company's cash is located at various subsidiaries within the Tata Motors Group. There may be legal, contractual or economic restrictions on the ability of subsidiaries to transfer funds to the Company in the form of cash dividends, loans, or advances. Brazil, Russia, South Africa and other jurisdictions have regulatory restrictions, disincentives or costs on pooling or transferring of cash. However, such restrictions have not had and are not estimated to have a significant impact on the Company's ability to meet its cash obligations.

In order to refinance the Company's borrowings and for supporting long-term fund needs, the Company continued to raise funds in Fiscal 2015 and 2016, through issue of various debt securities and Rights issue of shares described below.

During Fiscal 2015, the Company issued US$500 million 4.625% senior unsecured notes due 2020 and US$250 million 5.750% senior unsecured notes due 2024. The proceeds have been used to refinance existing external commercial borrowing, or ECB, of the Company of US$500 million with the balance of the proceeds and other permitted purposes as per RBI ECB guidelines.

Further, in March 2015, the Company prepaid 2% NCDs of Rs. 1,250 crores (due March 31, 2016) with a redemption premium of Rs. 744.19 crores.

During Fiscal 2015, Jaguar Land Rover Automotive plc, an indirect subsidiary of the Company, issued US$500 million 4.250% senior notes due 2019, US$500 million 3.50% senior notes due 2020 and GB£400 million 3.875% senior notes due 2023. The proceeds were used for part prepayment of US$326 million 8.125% senior notes due 2021 and GB£442 million 8.250% senior notes due 2020 as well as for general corporate purposes, including support for the ongoing growth and capital spending plan. On March 15, 2016, Jaguar Land Rover Automotive plc redeemed the remaining GB£58 million of the 8.25% GBP notes due 2020 by exercising the bond's early redemption option. In addition, Jaguar Land Rover Automotive plc redeemed the remaining GB£84 million of the 8.125% USD notes due 2021 by exercising the bond’s early redemption option on May 16, 2016.

During Fiscal 2016, the Company allotted 15,04,90,480 Ordinary shares (including 3,20,49,820 shares underlying the ADRs) of R2 each at a premium of Rs. 448 per share, aggregating Rs. 6,772.07 crores and 2,65,09,759 'A' Ordinary shares of Rs. 2 each at a premium of Rs. 269 per share, aggregating Rs. 718.42 crores pursuant to the Rights issue. 1,54,279 Ordinary shares and 20,531 'A' Ordinary shares have been kept in abeyance.

Out of the proceeds of the Rights issue, Rs. 500 crores have been used for funding expenditure towards plant and machinery, Rs. 1,500 crores towards research and product development, Rs. 4,000 crores towards repayment in full or in part of certain long-term and short-term borrowings, and Rs. 1,401.10 crores towards general corporate purposes.

During Fiscal 2016, TML Holdings Pte. Ltd., a subsidiary of the Company, has

- refinanced an existing unsecured multi-currency loan of US$600 million (US$250 million and SG$62.8 million maturing in November 2017 and US$210 million and SG$114 million maturing in November 2019) with a new unsecured loan of US$600 million (US$300 million maturing in October 2020 and US$300 million maturing in October 2022); and

- refinanced the existing SG$350 million 4.25% Senior notes due in May 2018 with a new syndicated loan of US$250 million maturing in March 2020.

The Tata Motors Group funds its short-term working capital requirements with cash generated from operations, overdraft facilities with banks, short-and medium-term borrowings from lending institutions, banks and commercial paper. The maturities of these short-and medium-term borrowings and debentures are generally matched to particular cash flow requirements. The working capital limits are Rs. 14,000 crores from various banks in India as at March 31, 2016. The working capital limits are secured by hypothecation of certain existing current assets of the Company. The working capital limits are renewed annually.

Jaguar Land Rover Automotive plc refinanced its revolving credit facility with a syndicate of more than 28 banks, increasing the size of revolving credit facility to GB£1.8 billion, all maturing in 5 years (2020) and subsequently upsized the facility to GB£1.87 billion in September 2015, by including an additional bank. The outstanding balance under the facility which is completely undrawn, is GB£1.87 billion as at March 31, 2016.

Some of the Company's financing agreements and debt arrangements set limits on and/or require prior lender consent for, among other things, undertaking new projects, issuing new securities, changes in management, mergers, sales of undertakings and investment in subsidiaries. In addition, certain negative covenants may limit the Company's ability to borrow additional funds or to incur additional liens, and/or provide for increased costs in case of breach. Certain of the Company's financing arrangements also include financial covenants to maintain certain debt-to-equity ratios, debt-to-earnings ratios, liquidity ratios, capital expenditure ratios and debt coverage ratios.

The Company monitors compliance with its financial covenants on an ongoing basis. The Company also reviews its refinancing strategy and continues to plan for deployment of long-term funds to address any potential non-compliance.

Cash and liquidity at Jaguar Land Rover is located at various subsidiaries in different jurisdictions as well as with balances in India. The cash in some of these jurisdictions is subject to certain restrictions on cash pooling, intercompany loan arrangements or interim dividends. However, annual dividends are generally permitted and the Company does not believe that these restrictions have, or are expected to have, any impact on Jaguar Land Rover's ability to meet its cash obligations.

Certain debt issued by Jaguar Land Rover is subject to customary covenants and events of default, which include, among other things, restrictions or limitations on the amount of cash which may be transferred outside the Jaguar Land Rover group of companies in the form of dividends, loans or investments. These are referred to as restricted payments in the relevant Jaguar Land Rover financing documentation. In general, the amount of cash which may be transferred outside the Jaguar Land Rover group is limited to 50% of its cumulative consolidated net income (as defined in the relevant financing documentation) from January 2011. As at March 31, 2016, the estimated amount that is available for dividend payments, other distributions and restricted payments outside the Jaguar Land Rover group of companies is approximately GB£3,458 million.