OPPORTUNITIES:

The Company expects that sales of M&HCVs in India to grow in line with the continuing trend toward the replacement of ageing fleet vehicles and an anticipated increase in demand from the infrastructure and industrial sectors due to reforms being initiated by the Government of India. The Company expects that the demand for new commercial vehicles will also be driven by gradual acceptance of advance trucking platforms and the introduction of technologies, such as anti-lock braking systems. The Company is focusing on increasing its offerings in the commercial vehicle segment. Furthermore, new product launches in the coming year with innovative features, design and competitive pricing will better position the Company in new height.

The Company is focusing on increasing its offerings in the defence sector from providing only pure logistics solutions to tactical and combat solutions. The Company believes these efforts will provide the opportunity to capture a larger share in a growing market.

Growing wealth in rural markets in India also provides an opportunity to expand sales reach and volumes. The sales reported in rural areas is growing year-on-year. The overall gap of the volume of automobile purchase between rural and urban areas is narrowing in India. The Company is focusing on reaching rural target market to address demand in rural markets in cost-effective ways.

Certain non-vehicular products and services such as spare parts, after-sale services and annual maintenance contracts are also gaining popularity due to increased consumer awareness. The Company believes it is poised to address this growing need, thereby providing additional sources of revenue, which are non-cyclical in nature to hedge for otherwise cyclical demand in the automotive industry.

The Company believes it is poised to address growing demands and changing preferences of customers in the intermediate and light commercial vehicle categories with its new range of vehicles in those categories, as the evolving infrastructure in India is expected to change the way the transportation industry matures and as the Company expects increased demand for better quality and more comfortable vehicles.

India has emerged as a major hub for global manufacturing with its advantage of lower input costs, availability of local supplier base and high domestic demand. As an established domestic manufacturer, the Company believes that is ideally placed to take advantage for targeting lucrative international markets, either through fully-built or complete knock-down exports.

In addition, the Company believes it has the advantage of strong in-house design and development facilities and professionals. Thus the Company believes that its research and development group is capable of developing solutions for different regulatory and emission norms in accordance with market demands in timely manner.

The Company is focusing on increasing its global presence to hedge against domestic downturns as well as a growth opportunity. While the Company is already present in Africa and some parts of the Association of Southeast Asian Nations, or ASEAN, it is focusing on increasing presence in more key markets in ASEAN and Latin America. The Company is also actively considering expanding its global manufacturing footprint in key international markets to take advantage of import duty differentials and local sourcing benefits.

Jaguar Land Rover intends to grow its business by diversifying its product range to compete in new segments, for example, the new Jaguar XE sports saloon ensures that Jaguar Land Rover competes in the largest premium saloon segment with a class-leading product and the new Jaguar F-PACE luxury performance SUV, which went on sale in April 2016. In addition, Jaguar Land Rover expects to launch the Range Rover Evoque convertible in June 2016, further expanding the product offering to existing and new customers.

FINANCIAL PERFORMANCE ON A CONSOLIDATED BASIS

The financial information discussed in this section is derived from the Company's Audited Consolidated Financial Statements.

Overview

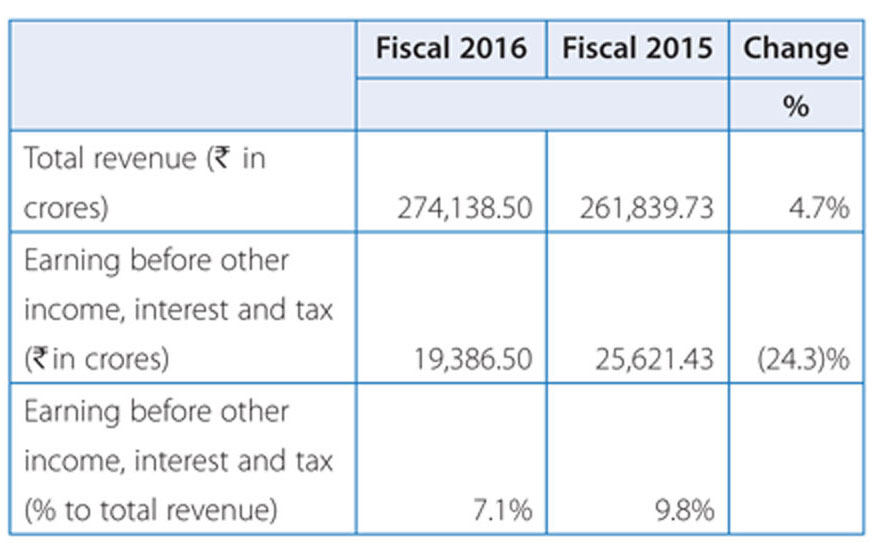

The Company total revenue (net of excise duties) including finance revenues increased by 4.7% to Rs. 275,561.11 crores in Fiscal 2016 from Rs. 263,158.98 crores in Fiscal 2015. However, the Company's net income (attributable to shareholders of the Company) declined by 21.2% to Rs. 11,023.75 crores in Fiscal 2016 from Rs. 13,986.29 crores in Fiscal 2015. Overall, earnings before other income, interest and tax before inter-segment eliminations, were Rs. 19,825.99 crores in Fiscal 2016 compared to Rs. 25,997.39 crores in Fiscal 2015, a decrease of 23.7%. The decrease in net income was primarily driven by higher depreciation and amortization, as well as factors impacting the Jaguar land Rover business, most notably less favourable market and model mix, an exceptional one time charge relating to vehicles destroyed or damaged in the Tianjin port explosion in August 2015, and one time reserves and charges for an industry-wide passenger airbag safety recall announced in the United States by National Highway Traffic System Administration (NHTSA) in respect of airbags from a supplier (Takata), provision for doubtful debts and previously capitalized investment.

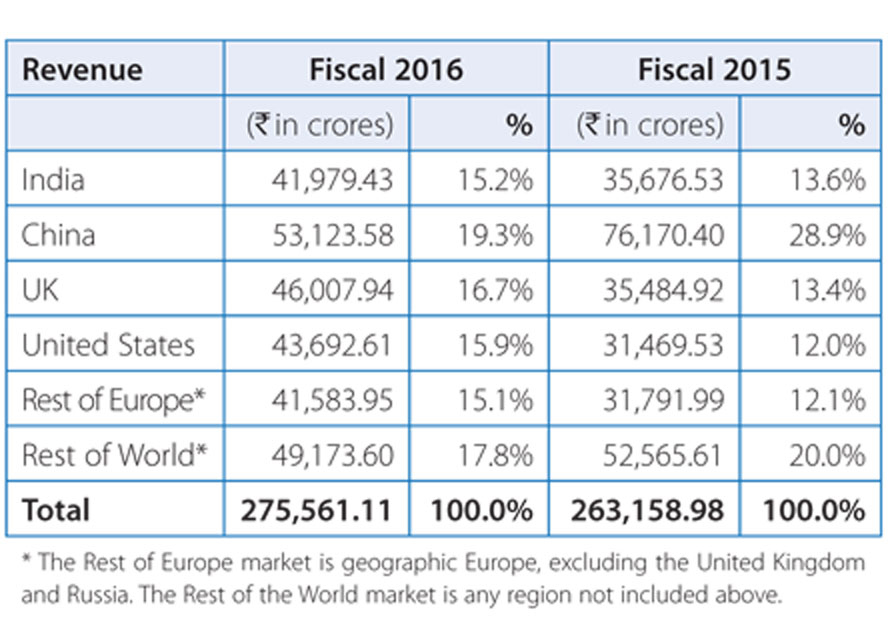

The Company has pursued a strategy of increasing exports of Tata and other brand vehicles to new and existing markets. The performance of the Company's subsidiary in South Korea, TDCV, and TTL, its specialized subsidiary engaged in engineering, design and information technology services, contributed to its revenue from international markets. Improved market sentiment in certain countries to which the Company exports and the strong sales performance of Jaguar Land Rover has enabled the Company to increase its sales in these international markets in Fiscal 2016. However, Jaguar Land Rover's sales in China, has decreased in Fiscal 2016 by 17.3% to 98,650 units, compared to 119,310 units in Fiscal 2015. This resulted in the proportion of the Company's net sales earned from markets outside of India decreased to 84.8% in Fiscal 2016 from 86.4% in Fiscal 2015.

The following table sets forth the Company's revenues from its key geographical markets and the percentage of total revenues that each key geographical market contributes for the periods indicated:

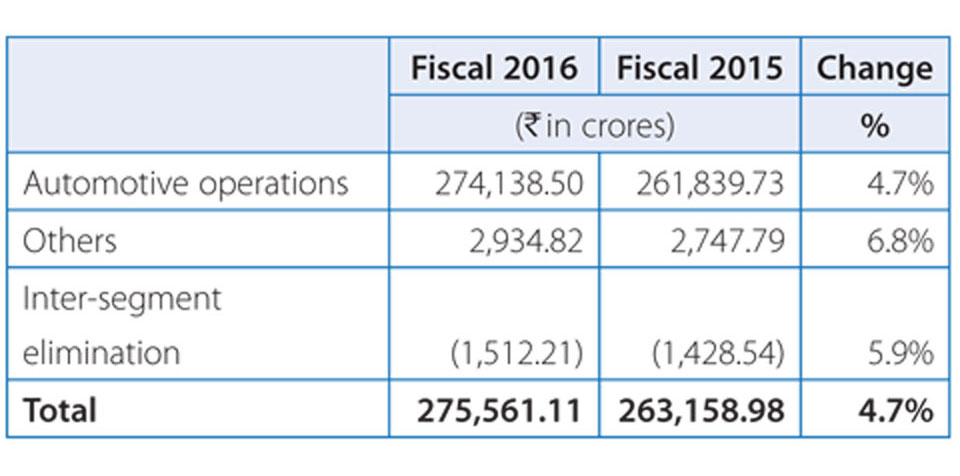

The Company's operations are divided into automotive operations and other operations as described further below. The table below sets forth the breakdown in revenues between the Company automotive operations and other operations in Fiscal 2016 and 2015 and the percentage change from period to period.

Automotive operations

Automotive operations are the Company most significant segment, accounting for 99.5% of the Company's total revenues in Fiscal 2016 and 2015. In Fiscal 2016, revenue from automotive operations before inter-segment eliminations was Rs. 274,138.50 crores as compared to Rs. 261,839.73 crores in Fiscal 2015, an increase of 4.7%.

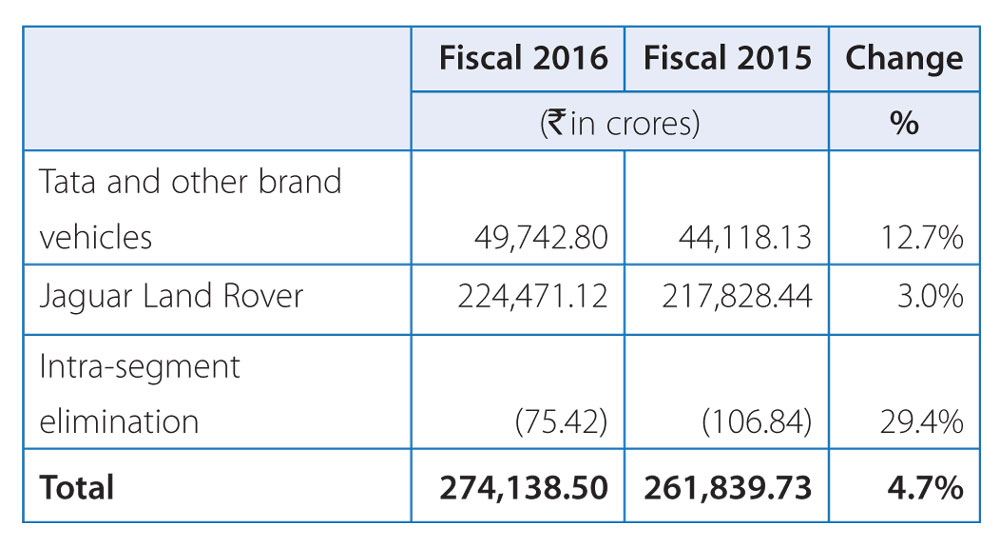

The following table sets forth selected data regarding the Company's automotive operations for the periods indicated, and the percentage change from period to period (before inter-segment eliminations).

The Company's automotive operations segment is further divided into Tata and other brand vehicles (including vehicle financing) and Jaguar Land Rover. In Fiscal 2016, Jaguar Land Rover contributed 81.9% of the Company's total automotive revenue compared to 83.2% in Fiscal 2015 and the remaining 18.1% was contributed by Tata and other brand vehicles in Fiscal 2016 compared to 16.8% in Fiscal 2015.

The Company's revenue from Tata and other brand vehicles (including vehicle financing) and Jaguar Land Rover in Fiscals 2016 and 2015 and the percentage change from period to period (before intra-segment eliminations) is set forth in the table below.

Other operations

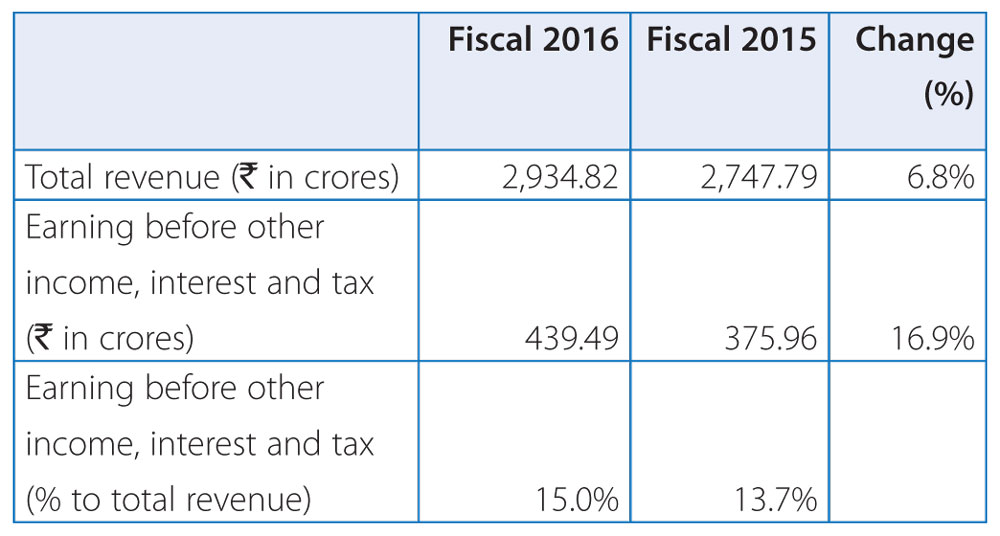

The following table sets forth selected data regarding the Company's other operations for the periods indicated and the percentage change from period to period (before inter-segment eliminations).

The other operations business segment includes information technology, machine tools and factory automation solutions. In Fiscal 2016, revenue from other operations before inter-segment eliminations was Rs. 2,934.82 crores compared to Rs. 2,747.79 crores in Fiscal 2015. Results for the other operations business segment before other income, finance cost, tax and exceptional items (before inter-segment eliminations) were Rs. 439.49 crores in Fiscal 2016 as compared to Rs. 375.96 crores for Fiscal 2015.

Results of Operations

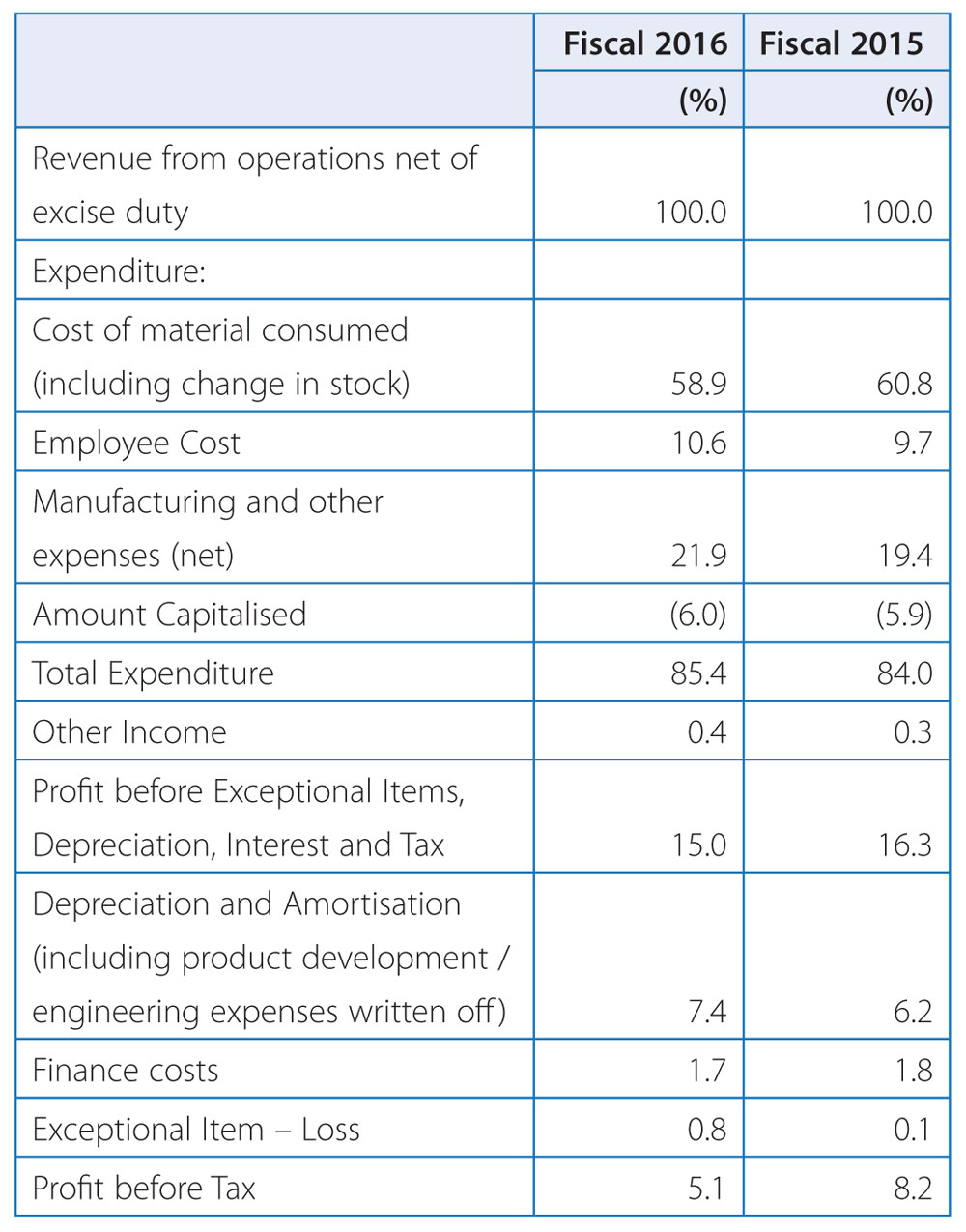

The following table sets forth selected items from the Company's consolidated statements of income for the periods indicated and shows these items as a percentage of total revenues: