INTERNAL CONTROL SYSTEMS AND THEIR ADEQUACY

The Company has an adequate system of internal controls in place. It has documented policies and procedures covering all financial and operating functions. These controls have been designed to provide a reasonable assurance with regard to maintaining of proper accounting controls for ensuring reliability of financial reporting, monitoring of operations, protecting assets from unauthorized use or losses, compliances with regulations. The Company has continued its efforts to align all its processes and controls with global best practices.

Some significant features of the internal control of systems are:

- The Audit Committee of the Board of Directors, comprising of independent directors and functional since August 1988, regularly reviews the audit plans, significant audit findings, adequacy of internal controls, compliance with accounting standards as well as reasons for changes in accounting policies and practices, if any;

- Documentation of major business processes and testing thereof including financial closing, computer controls and entity level controls, as part of compliance programme towards Sarbanes-Oxley Act, as required by the listing requirements at New York Stock Exchange;

- An ongoing programme, for the reinforcement of the Tata Code of Conduct is prevalent across the organisation. The Code covers integrity of financial reporting, ethical conduct, regulatory compliance, conflicts of interest's review and reporting of concerns

- State-of-the-art Enterprise Resource Planning, supplier relations management and customer relations management connect the Company's different locations, dealers and vendors for efficient and seamless information exchange. The Company also maintains a comprehensive information security policy and undertakes continuous upgrades to its IT systems;

- Detailed business plans for each segment, investment strategies, year-on-year reviews, annual financial and operating plans and monthly monitoring are part of the established practices for all operating and service functions;

- A well-established, independent, multi-disciplinary Internal Audit team operates in line with governance best practices. It reviews and reports to management and the Audit Committee about compliance with internal controls and the efficiency and effectiveness of operations as well as the key process risks. The scope and authority of the Internal Audit division is derived from the Audit Charter, duly approved by the Audit Committee; and Anti-fraud programmes including whistle blower mechanisms are operative across the Company.

The Board takes responsibility for the overall process of risk management throughout the organisation. Through an Enterprise Risk Management programme, the Company's business units and corporate functions address opportunities and the attendant risks through an institutionalised approach aligned to the Company's objectives. This is also facilitated by internal audit. The Business risk is managed through cross functional involvement and communication across businesses. The results of the risk assessment and residual risks are presented to the senior management. The Audit Committee reviews business risk areas covering operational, financial, strategic and regulatory risks.

During Fiscal 2016, the Company conducted an assessment of the effectiveness of the Internal Control over Financial Reporting and has determined that the Company's Internal Control over Financial Reporting as at March 31, 2016 is effective.

HUMAN RESOURCES/INDUSTRIAL RELATIONS

The Company considers its human capital a critical factor to its success. Under the aegis of Tata Sons and the Tata Sons promoted entities, the Company has drawn up a comprehensive human resource strategy which addresses key aspects of human resource development such as:

- The code of conduct and fair business practices;

- A fair and objective performance management system linked to the performance of the businesses which identifies and differentiates employees by performance level;

- Creation of a common pool of talented managers across Tata Sons and the Tata Sons promoted entities with a view to increasing their mobility through job rotation among the entities;

- Evolution of performance based compensation packages to attract and retain talent within Tata Sons and the Tata Sons promoted entities; and

- Development of comprehensive training programmes to improve industry-and function-specific skills.

- Introduction of the annual Employee Pulse Survey to gauge the engagement levels of employees followed by action planning to make Tata Motors a more caring and engaging employer.

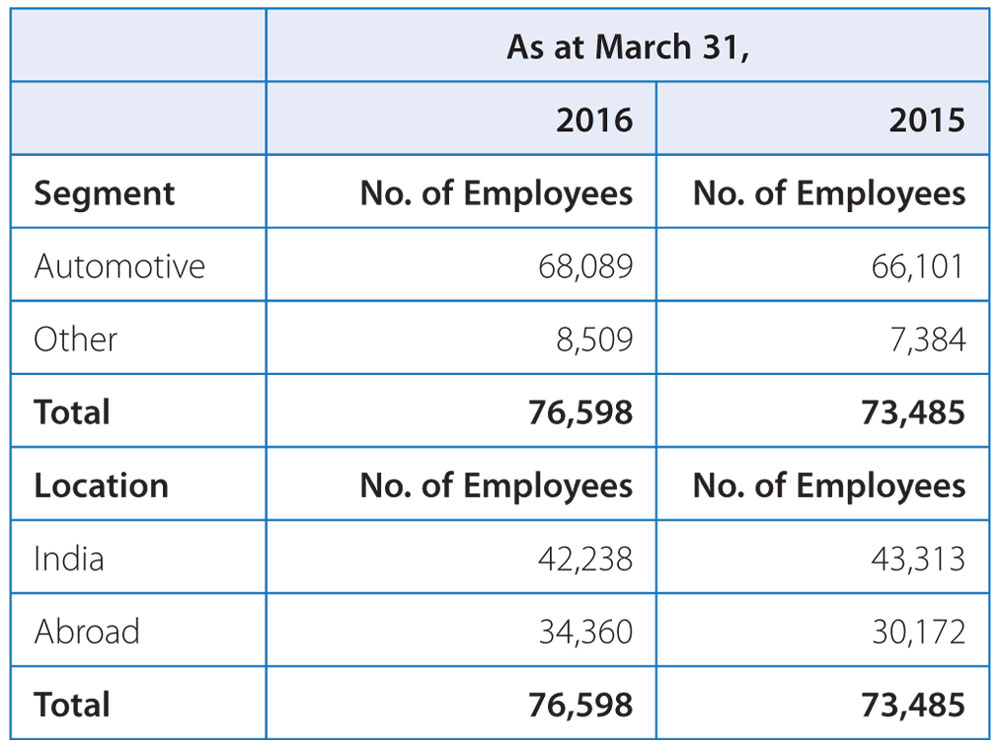

The Company employed approximately 76,598 and 73,485 permanent employees as at March 31, 2016 and 2015 respectively. The average number of flexible (temporary, trainee and contractual) employees for Fiscal 2016, was approximately 40,205 (including joint operations) compared to 40,213 in Fiscal 2015.

The following table set forth a breakdown of persons employed by the Company's business segments and by geographic location as at March 31, 2016 and 2015.

Union Wage Settlements: The Company has labour unions for operative grade employees at all its plant across India, except at the Sanand and Dharwad plant, which do not have unions as of the date of this Annual Report. The Company has generally enjoyed cordial relations with its employees at its factories and offices.

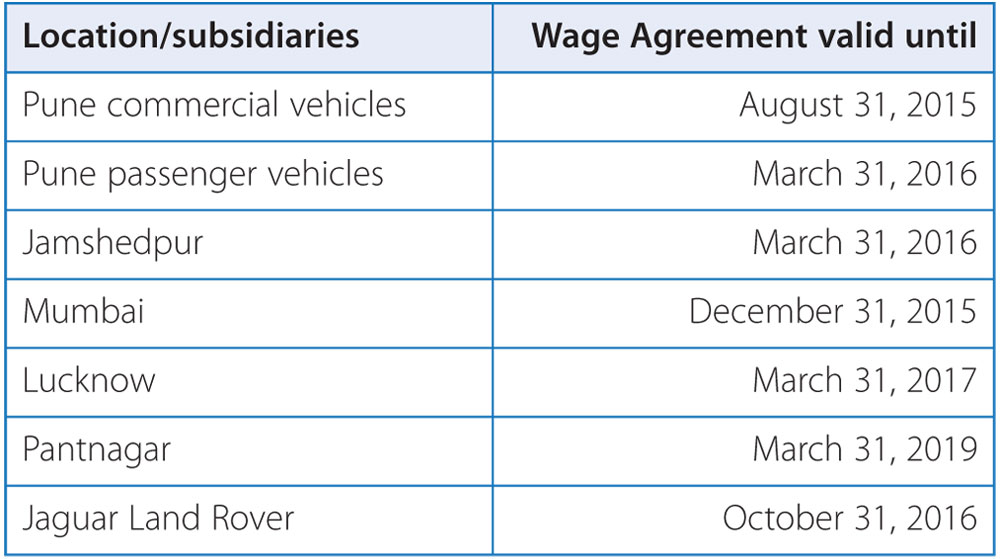

Employee wages are paid in accordance with wage agreements that have varying terms (typically three to four years) at different locations. The expiration dates of the wage agreements with respect to various locations/subsidiaries are as follows:

The wage agreement at Pune commercial vehicles and Mumbai has expired and negotiations are in progress for the new wage agreement. The Pune passenger vehicles and Jamshedpur agreement expired in the month of March 2016 and preparations for the new agreement are underway. The Company's wage agreements link an employee's compensation to certain performance criteria that are based on various factors such as quality, productivity, operating profit and an individual's performance and attendance. The Company has generally received union support in its implementation of reforms that impact quality, cost erosion and productivity improvements across all locations.

OUTLOOK

The Company expects the M HCV truck segment in India to grow in Fiscal 2017, driven by continuing trends towards the replacement of ageing fleet vehicles and anticipated increases in demand from the infrastructure and industrial sectors due to reforms being initiated by the Government of India. The Company expects that the demand for new commercial vehicles will also be driven by gradual acceptance of advance trucking platforms and the introduction of technologies, such as anti-lock braking systems. The Company also expect the LCV segment to witness positive growth in Fiscal 2017.

The Company expects that faster growth and improved consumer sentiments should boost sales of passenger cars and utility vehicles in India.

The improved sales outlook for utility vehicles, cars, buses and trucks comes against the backdrop of the Government of India's annual budget proposal to raise investment in infrastructure, including roads and railways. The Company expects infrastructure investment to be allocated to rural areas which will lead to increased automotive demand.

The Company expects that, due to pressures on volumes in India and limited headrooms in pricing, due to the intensely competitive market dynamics, the focus will be on effective cost management to maintain margins.

One of the key elements of this strategy is to improve the relationship with the customer – the experience the customer has with the Company at each touch point from sale to service and replacement sales experiences. This strategy includes, among other things, improving the physical appearances of contact points with customers and the creation of processes and forums for speedy resolution of customer issues.

The Company also focuses on reviewing the channel partner scoreboard for effective performance management and direct oversight oversight on the operations to drive volume growth and increase customer satisfaction and thereby driving dealership profitability.

The Company will also actively pursue growth in the right international markets and aims to consolidate its position in markets where it is already present.

Continued investment, by Jaguar Land Rover, in new products and technologies as well as expanding its production capacity in appropriate strategic locations, while balancing production with sales, is key for the success of the Company.

CAUTIONARY STATEMENT

Statements in the Management Discussion and Analysis describing the Company's objective, projections, estimates and expectations may be "forward-looking statements" within the meaning of applicable securities laws and regulations. Actual results could differ materially from those expressed or implied. Important factors that could make a difference to the Company operations include, among others, economic conditions affecting demand/supply and price conditions in the domestic and overseas markets in which the Company operates, changes in government regulations, tax laws and other statutes and incidental factors.