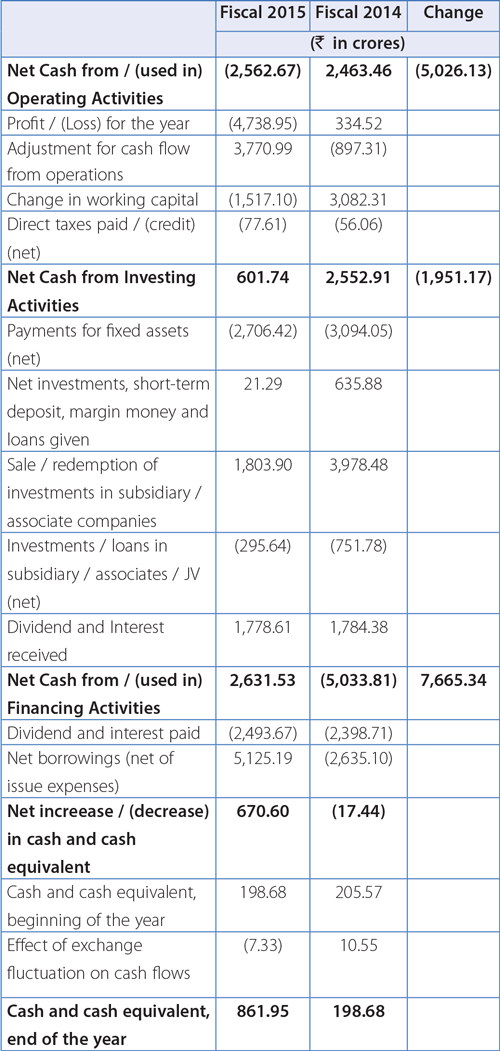

Standalone cash Flow

The Following table sets forth selected items from standalone cash flow statement:

- Reduction in net cash generated from operations reflects impact of reduction in profitability. The cash used in operations before working capital changes was Rs. 967.96 crores in Fiscal 2015 compared to Rs. 562.79 crores in Fiscal 2014. There was a net outflow of Rs. 1,517.10 crores in Fiscal 2015 towards working capital changes mainly attributable to increase in Inventories and other current and non-current assets.

- The net cash inflow from investing activity was Rs. 601.74 crores in Fiscal 2015 compared to Rs. 2,552.91 crores in Fiscal 2014, mainly attributable to:

- Inflow by way of divestments in foreign subsidiary companies to TML Holdings Pte. Ltd. and a redemption of preference shares by TML Holdings Pte. Ltd., resulting in cash inflow of Rs. 1,803.90 crores in Fiscal 2014 compared to Rs. 3,978.48 crores in Fiscal 2014;

- Inflow due to dividends and interest was Rs. 1,778.61 crores in Fiscal 2015 compared to Rs. 1,784.38 crores in Fiscal 2014;

- The cash used for payments for fixed assets was Rs. 2,706.42 crores (net) in Fiscal 2015 compared to Rs. 3,094.05 crores in Fiscal 2014, a decrease of 12.5%; and

- There was an outflow (net) of Rs. 295.64 crores in Fiscal 2015 compared to Rs. 903.33 crores for Fiscal 2014 towards investments in subsidiary, joint ventures and associates companies.

- The net change in financing activity was an inflow of Rs. 2,631.53 crores in Fiscal 2015 against outflow of Rs. 5,033.81 crores in Fiscal 2014. The inflow is attributable to the following:

- The Company repaid fixed deposits of Rs. 9.31 crores in Fiscal 2015 compared to Rs. 362.19 crores for Fiscal 2014;

- The long-term borrowings (net) increased to Rs. 2,227.38 crores in Fiscal 2015 compared to Rs. 579.84 crores to Fiscal 2014; and

- Short-term borrowings – net inflow of Rs. 2,955.08 crores in Fiscal 2015 compared to outflow of Rs. 1,605.27 crores in Fiscal 2014.

FINANCIAL PERFORMANCE OF JAGUAR LAND ROVER (AS PER IFRS)

The financial statements of Jaguar Land Rover are prepared in accordance with International Financial Reporting Standards (IFRS) applicable in the United Kingdom. This information is given to enable the readers to understand the performance of Jaguar Land Rover [on a consolidated basis for the Jaguar Land Rover group]

Revenues for Jaguar Land Rover for Fiscal 2015 were GBP 21,866 million, an increase of 12.8% compared to GBP 19,386 million in Fiscal 2014, driven primarily by increased wholesale volumes and a strong product and market mix.

Material and other cost of sales in Fiscal 2015 increased 10.8% to GBP 13,185 million compared to GBP 11,904 million in Fiscal 2014 primarily due to increased production. However, it fell as a proportion of revenue to 60.3% as compared to 61.4% in Fiscal 2014, due to a favorable product and market mix.

Employee costs increased by 19.5% to GBP 1,977 million in Fiscal 2015 as compared to GBP 1,654 million in Fiscal 2014. This was driven by headcount increases in manufacturing (due to production increases) and in product development as Jaguar Land Rover continued to expand its future product portfolio. Wage increases agreed at the latest round of pay negotiations in November 2014, also contributed to a rise in employee costs during the year.

Other expenses increased by 10.6% to GBP 4,109 million in Fiscal 2015 compared to GBP 3,717 million in Fiscal 2014, as costs related to manufacturing, freight and distribution, warranty, product development, selling and fixed marketing grew to support Jaguar Land Rover's growth and launch costs increased as the products were brought to market partially offset by realized foreign exchange and commodity gains.

Product development costs capitalized increased by 12.4% to GBP 1,158 million in Fiscal 2015 compared to GBP 1,030 million in Fiscal 2014. This is due to increased expenditure on the development of more future products and technologies to support the future growth of Jaguar Land Rover's product portfolio.

Profit before tax ("PBT") increased 4.5% in Fiscal 2015 to GBP 2,614 million compared to GBP 2,501 million in Fiscal 2014, reflecting increase in operations in Fiscal 2015 and lower net finance expenses, which decreased GBP 60 million in Fiscal 2015, due to higher finance income and the removal of the embedded derivative in Fiscal 2014, which represented a loss of GBP 47 million in Fiscal 2014, which was offset partially by higher depreciation and amortization expenses of GBP 176 million and an unfavourable foreign exchange revaluation of US dollar-denominated debt of GBP 265 million and unmatured foreign exchange and commodity hedges not eligible for hedge accounting of GBP 245 million in Fiscal 2015.

Profit after tax ("PAT") increased 8.5% to GBP 2,038 million in Fiscal 2015 compared to GBP 1,879 million in Fiscal 2014, reflecting a lower effective tax rate of 22% due to reduced withholding taxes in China from 10% to 5%.

Cash Flow: Net cash from operating activities was GBP 3,627 million in Fiscal 2015, which was in line with profits less negative working capital of GBP 47 million in Fiscal 2015, as compared to positive GBP 393 million in Fiscal 2015, less tax paid of GBP 389 million in Fiscal 2015, as compared to GBP 402 million in Fiscal 2014. This compares to operating cash flow of GBP 3,422 million in Fiscal 2014. Jaguar Land Rover invested significantly in the year, up 17.6% to GBP 2,767 million in Fiscal 2015 compared to GBP 2,352 million in Fiscal 2014. These capital expenditures are intended to promote product development and capacity increases, including for facilities in China and the UK. Net cash used in financing activities was GBP 38 million in Fiscal 2015, compared to GBP 498 million in Fiscal 2014. In Fiscal 2015 financing activities included early redemption of GBP 653 million equivalent of higher coupon senior notes through a tender offer in the fourth quarter of Fiscal 2015, the issuance of USD 500 million bond in October 2014, GBP 400 million bond in February 2015 and a USD 500 million bond in March 2015. Financing activities also included a dividend paid to parent company of GBP 150 million and interest and fees of GBP 230 million.

Financial performance of TMFL (Consolidated)

During Fiscal 2015, TMFL earned a total income of Rs. 2,742.88 crores compared to Rs. 3,034.02 crores earned in Fiscal 2014, reflecting a decrease of 9.6%. The Loss Before Tax was Rs. 845.01 crores in Fiscal 2015 as compared to profit of Rs. 155.33 crores in Fiscal 2014. The Loss After Tax was Rs. 611.16 crores in Fiscal 2015, as compared to profit of Rs. 100.88 crores in the previous year. The results for Fiscal 2015 have been impacted due to tightness in the financial market, stress in the business environment and the consequent higher provision on account of non-performing assets.

Financial performance of TDCV (as per Korean GAAP)

In Fiscal 2015, TDCV's total revenue increased by 11.7% to KRW 987.95 billion (Rs. 5,563.03 crores) compared to KRW 884.08 billion (Rs. 4,951.88 crore) in Fiscal 2014. The positive impact of higher volume, various cost control initiatives, productivity improvement initiatives and reversal of provisions pertaining to the union wage lawsuit (KRW 24.20 billion), due to the of favorable judgment by the High Court of South Korea as described under the section entitled "Human Resources/Industrial Relations" below, helped TDCV to achieve Profit before taxes of KRW 69.13 billion (Rs. 389.25 crores) in Fiscal 2015 compared to KRW 30.52 billion (Rs. 170.96 crores) in Fiscal 2014. After providing for tax, the profit for Fiscal 2015 was KRW 54.00 billion (Rs. 304.09 crores) compared to KRW 23.50 billion (Rs. 131.64 crores) in Fiscal 2014.

Financial performance of TTL

The consolidated revenue of TTL in Fiscal 2015 increased 10.42% to Rs. 2,644.23 crores compared to Rs. 2,394.73 crores in Fiscal 2014. The profit before tax increased 27.3% to Rs. 429.76 crores in Fiscal 2015 compared to Rs. 337.57 crores in Fiscal 2014. The profit after tax increased by 22.3% to Rs. 334.07 crores in Fiscal 2015 compared to Rs. 273.22 crores in Fiscal 2014.

INTERNAL CONTROL SYSTEMS AND THEIR ADEQUACY

The Company has an adequate system of internal controls in place. It has documented policies and procedures covering all financial and operating functions. These controls have been designed to provide a reasonable assurance with regard to maintaining of proper accounting controls for ensuring reliability of financial reporting, monitoring of operations, protecting assets from unauthorized use or losses, compliances with regulations. The Company has continued its efforts to align all its processes and controls with global best practices.

Some significant features of the internal control of systems are:

- The Audit Committee of the Board of Directors, comprising of independent directors and functional since August 1988, regularly reviews the audit plans, significant audit findings, adequacy of internal controls, compliance with accounting standards as well as reasons for changes in accounting policies and practices, if any;

- Documentation of major business processes and testing thereof including financial closing, computer controls and entity level controls, as part of compliance programme towards Sarbanes-Oxley Act, as required by the listing requirements at New York Stock Exchange;

- An ongoing programme, for the reinforcement of the Tata Code of Conduct is prevalent across the organisation. The Code covers integrity of financial reporting, ethical conduct, regulatory compliance, conflicts of interests review and reporting of concerns.

- State-of-the-art Enterprise Resource Planning, supplier relations management and customer relations management connect the Company's different locations, dealers and vendors for efficient and seamless information exchange. The Company also maintains a comprehensive information security policy and undertakes continuous upgrades to its IT systems;

- Detailed business plans for each segment, investment strategies, year-on-year reviews, annual financial and operating plans and monthly monitoring are part of the established practices for all operating and service functions;

- A well-established, independent, multi-disciplinary Internal Audit team operates in line with governance best practices. It reviews and reports to management and the Audit Committee about compliance with internal controls and the efficiency and effectiveness of operations as well as the key process risks. The scope and authority of the Internal Audit division is derived from the Audit Charter, duly approved by the Audit Committee; and

- Anti-fraud programmes including whistle blower mechanisms are operative across the Company.

The Board takes responsibility for the overall process of risk management throughout the organisation. Through an Enterprise Risk Management programme, the Company's business units and corporate functions address opportunities and the attendant risks through an institutionalised approach aligned to the Company's objectives. This is also facilitated by internal audit. The Business risk is managed through cross functional involvement and communication across businesses. The results of the risk assessment and residual risks are presented to the senior management. The Audit Committee reviews business risk areas covering operational, financial, strategic and regulatory risks.

During Fiscal 2015, the Company conducted an assessment of the effectiveness of the internal control over financial reporting and identified a control weakness in relation to hedge accounting for complex derivatives for certain hedged contracts, in its subsidiary, Jaguar Land Rover. The Company has designed and implemented additional remediating controls subsequent to March 31, 2015, which are undergoing continuing testing to ensure sustainability.

HUMAN RESOURCES/INDUSTRIAL RELATIONS

The Company considers its human capital a critical factor to its success. Under the aegis of Tata Sons and the Tata Sons promoted entities, the Company has drawn up a comprehensive human resource strategy which addresses key aspects of human resource development such as:

- The code of conduct and fair business practices;

- A fair and objective performance management system linked to the performance of the businesses which identifies and differentiates employees by performance level;

- Creation of a common pool of talented managers across Tata Sons and the Tata Sons promoted entities with a view to increasing their mobility through job rotation among the entities;

- Evolution of performance based compensation packages to attract and retain talent within Tata Sons and the Tata Sons promoted entities; and

- Development of comprehensive training programs to improve industry- and function-specific skills.

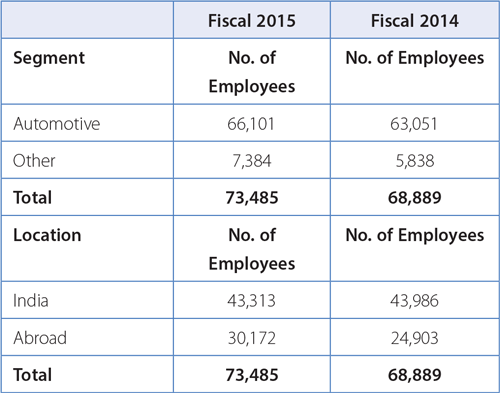

We employed approximately 73,485 and 68,889 permanent employees as at March 31, 2015 and March31, 2014 respectively. The average number of flexible (temporary, trainee and contractual) employees for Fiscal 2015, was approximately 40,213 (including joint operations) compared to 35,260 in Fiscal 2014.

The following table set forth a breakdown of persons employed by the Company's business segments and by geographic location as at March 31, 2015 and March 31, 2014.

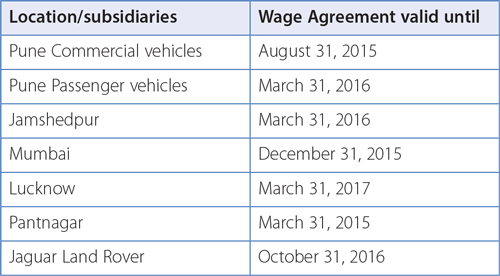

Union Wage Settlements: The Company has labour unions for operative grade employees at all its plant across India, except at Sanand and Dharwad plant, which do not have unions as of the date of this Annual Report. The Company has generally enjoyed cordial relations with its employees at its factories and offices.

Employee wages are paid in accordance with wage agreements that have varying terms (typically three years) at different locations. The expiration dates of the wage agreements with respect to various locations/subsidiaries are as follows

The wage agreement at Pantnagar has expired and negotiations are in progress for the new wage agreement. The Pune Commercial Vehicles agreement expires in the month of August 2015 and preparations for the new agreement are underway. The Company's wage agreements link an employee's compensation to certain performance criteria that are based on various factors such as quality, productivity, operating profit and an individual's performance and attendance. The Company has generally received union support in its implementation of reforms that impact quality, cost erosion and productivity improvements across all locations.

In South Korea, the Company's union employees had filed a lawsuit to include some elements of non-ordinary salary and bonus as part of "ordinary wages" for the period December 2007 to May 2011. The district court ruled in favor of the union employees on January 2013 and ordered TDCV to pay the employees KRW 17.2 billion and interest, up to the period of lawsuit. The Company recorded a provision of KRW 45.8 billion as at March 31, 2014, in respect of this lawsuit and consequential obligation for all employees (including non-union employees). TDCV had filed an appeal against the order to High Court, which gave its verdict on December 24, 2014. The High Court, following the decision of the Supreme Court in a case of an unaffiliated company, determined that some elements of non-ordinary salary were part of "ordinary wages" and the need to be paid with retrospective effect. However, based on the "Good Faith Principle" and because any retrospective payment would have high financial impact on the Company, the court determined that the bonuses and work performance salary would be eligible for retrospective payment. Accordingly, the total liability was determined at KRW 99 million (Rs. 0.57 crore) and interest of KRW 20 million (Rs. 0.12 crore) thereon. The Union employees had period of up to January 27, 2015 to appeal to the Supreme Court of South Korea, which was not exercised.

Furthermore, in order to maintain the claim for the period from June 2011 to March 2014, TDCV union employees filed a case in the Seoul district court on November 24, 2014. In addition to the items included in the first lawsuit, one new item for additional 50% allowance for over time on Holiday (Saturday and Sunday) was added. However, after receipt of the final judgment of the Seoul High Court for the first lawsuit, which was not in their favour, the labor union decided to withdraw the second lawsuit and submitted the Case withdrawal confirmation on March 19, 2015. Accordingly, the provision created as at March 31, 2014 has been reversed in Fiscal 2015.

OUTLOOK

The Company expects that the M&HCV Truck segment in India will likely register a growth in Fiscal 2016, driven by continuing trends towards the replacement of ageing fleet vehicles and expectations of increases in demand from the infrastructure and industrial sectors due to reforms being initiated by the Government of India. The Company expects that the demand for new commercial vehicles will also be driven by gradual acceptance of advance trucking platforms, the progression to Bharat Stage V emissions norms and the introduction of technologies, such as anti-lock braking systems.

The Company expects that faster growth and improved consumer sentiments should boost sales of passenger cars and utility vehicles in India.

The improved sales outlook for utility vehicles, cars, buses and trucks comes against the backdrop of the Government of India's annual budget proposal to raise investment in infrastructure, including roads and railways. The Company expects infrastructure investment to be allocated to rural areas which will lead to increased automotive demand.

The Company expects that, due to pressures on volumes in India and limited headrooms in pricing, due to the intensely competitive market dynamics, the focus will be on effective cost management to maintain margins. Even in this challenging environment, as envisioned in its Mission statement, the Company is looking to "passionately anticipate" and provide vehicles and solutions that "excite customers globally". The objective remains to be the "most admired" Company by all stakeholders.

One of the key elements of this strategy is to improve the relationship with the customer – the experience the customer has with the Company at each touch point from sale to service and replacement sales experiences. This strategy includes, among other things, improving the physical appearances of contact points with customers and the creation of processes and forums for speedy resolution of customer issues.

The Company will also actively pursue growth in the right international markets and aims to consolidate its position in markets where it is already present.

Continued investment, by Jaguar Land Rover, in new products and technologies as well as expanding its production capacity in appropriate strategic locations, while balancing production with sales, is key for the success of the Company.

CAUTIONARY STATEMENT

Statements in the Management Discussion and Analysis describing the Company's objective, projections, estimates and expectations may be "forward-looking statements" within the meaning of applicable securities laws and regulations. Actual results could differ materially from those expressed or implied. Important factors that could make a difference to the Company operations include, among others, economic conditions affecting demand/supply and price conditions in the domestic and overseas markets in which the Company operates, changes in government regulations, tax laws and other statutes and incidental factors.