Automotive operations

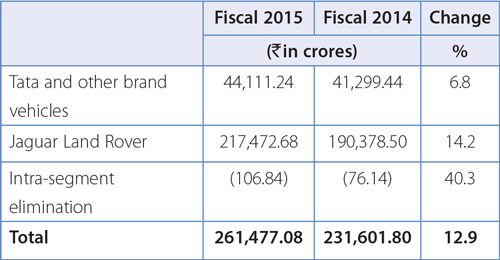

Automotive operations are the Company most significant segment, accounting for 99.5% of the Company's total revenues in Fiscal 2015 and 2014 respectively. In Fiscal 2015, revenue from automotive operations before inter-segment eliminations was Rs. 261,477.08 crores in Fiscal 2015 as compared to Rs. 231,601.80 crores in Fiscal 2014, an increase of 12.9%.

The Company's automotive operations segment is further divided into Tata and other brand vehicles (including vehicle financing) and Jaguar Land Rover. In Fiscal 2015, Jaguar Land Rover contributed 83.2% of the Company's total automotive revenue (before intra segment elimination) compared to 82.2% in Fiscal 2014 and the remaining 16.8% was contributed by Tata and other brand vehicles in Fiscal 2015 compared to 17.8% in Fiscal 2014.

The Company's revenue from Tata and other brand vehicles (including vehicle financing) and Jaguar Land Rover in Fiscals 2014 and 2015 and the percentage change from period to period (before intra-segment eliminations) is set forth in the table below.

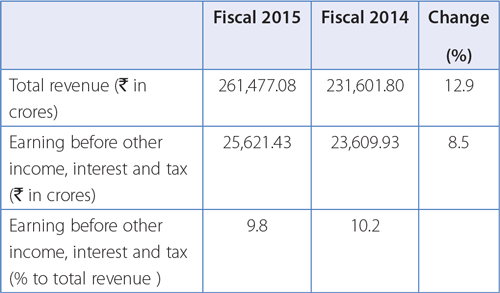

The following table sets forth selected data regarding the Company's automotive operations for the periods indicated, and the percentage change from period to period (before inter-segment eliminations).

Other operations

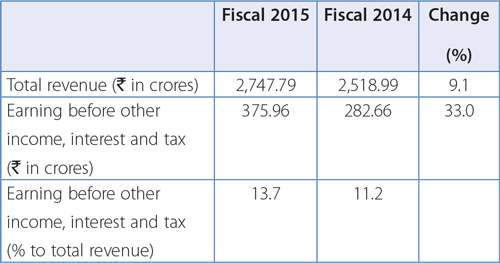

The following table sets forth selected data regarding the Company's other operations for the periods indicated and the percentage change from period to period (before inter-segment eliminations).

The other operations business segment includes information technology, machine tools and factory automation solutions. In Fiscal 2015, revenue from other operations before inter-segment eliminations was Rs. 2,747.79 crores compared to Rs. 2,518.99 crores in Fiscal 2014. Results for the other operations business segment before other income, finance cost, tax and exceptional items (before inter-segment eliminations) were Rs. 375.96 crores in Fiscal 2015 as compared to Rs. 282.66 crores for Fiscal 2014.

Results of Operations

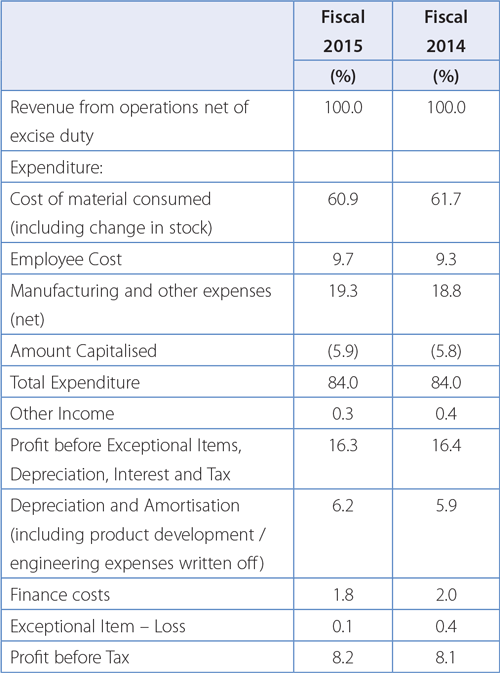

The following table sets forth selected items from the Company's consolidated statements of income for the periods indicated and shows these items as a percentage of total revenues:

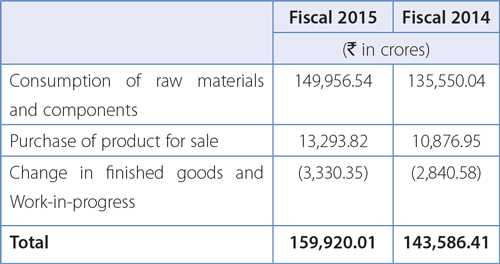

Cost of materials consumed (including change in stock)

Costs of material consumed decreased from 62.4% of total revenue (excluding income from vehicle financing) in Fiscal 2014 to 61.4% in Fiscal 2015. For Tata Motors Standalone, costs of materials consumed was 74.5% of net revenue in Fiscal 2015 of total revenue as compared to 75.6% in Fiscal 2014, representing a decrease of 110 bps, which was mainly attributable to a change in product mix that includes a relatively higher proportion of M&HCV sales. For Jaguar Land Rover, costs of materials consumed was 60.2% of total revenue in Fiscal 2015 compared to 61.4% in Fiscal 2014, representing a decrease of 120 bps.

Employee Costs were Rs. 25,548.96 crores in Fiscal 2015 as compared to Rs. 21,556.42 crores in Fiscal 2014 an increase of 18.5%. Of the increase, approximately Rs. 296.5 crores relates to foreign currency translation from GBP to Indian rupees for Jaguar Land Rover operations. At Jaguar Land Rover the increase in employee cost is attributable to increases in the permanent and contractual head count to support the volume increases, new launches, product development projects and wage negotiations in November 2014. For Tata and other brand vehicles (including vehicle financing), the employee cost increased by 7.4% to Rs. 3,091.46 crores as compared to Rs. 2,877.69 crores in Fiscal 2014, mainly due to change in discounting rate for employee benefit plans and normal yearly increments.

Employee costs at TDCV were Rs. 518.81 crores in Fiscal 2015, as compared to Rs. 570.67 crores in the same period in Fiscal 2014, a decrease of 9.1%. The decrease was mainly due to reversal of Rs. 264.19 crores in Fiscal 2015 following a favourable decision by the Supreme Court of South Korea and resolution of the lawsuit filed by TDCV union employees, pursuant to which the employees had demanded inclusion of some elements of salary and bonuses as part of wages. This was partly offset by loss in actuarial valuations for severance plan at TDCV by Rs. 69 crores.

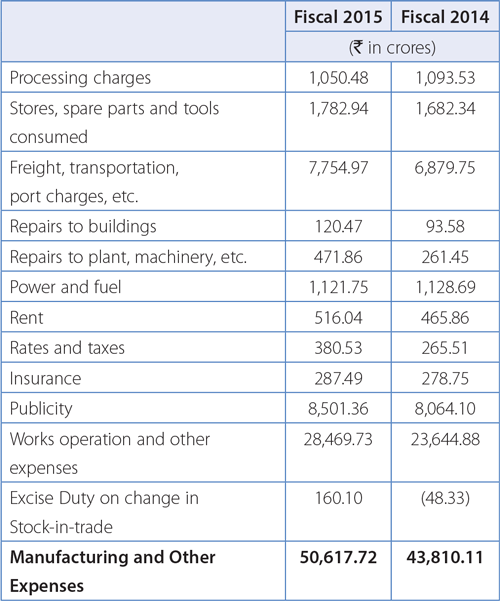

Manufacturing and Other Expenses includes all works operations, indirect manufacturing expenses, freight cost, fixed marketing costs and other administrative costs. These expenses have increased to Rs. 50,617.72 crores from Rs. 43,810.11 crores in Fiscal 2014. Each line item includes the element of an unfavorable foreign currency translation impact of Jaguar Land Rover operations of approximately Rs. 699.12 crores in aggregate in Fiscal 2015. The breakdown is provided below:

Manufacturing and other expenses increased to 19.3% of total revenues in Fiscal 2015 compared to 18.8% in Fiscal 2014, in terms of percentage to revenue. The increases are mainly driven by volumes and the size of operations.

- Processing charges were mainly incurred by Tata and other brand vehicles (including vehicle financing) which, due to lower volumes, led to lower expenditures.

- Freight, transportation, port charges etc. have increased, mainly for Jaguar Land Rover, predominantly due to increased sales in China. Freight, transportation and port charges etc. represented 3.0% of total revenues for Fiscal 2015 and Fiscal 2014.

- The publicity expenses represented 3.2% and 3.5% of total revenues in Fiscal 2015 and Fiscal 2014, respectively. In addition to routine product and brand campaigns, the Company incurred expenses relating to new product introduction campaigns for the new Range Rover, the new Range Rover Sport, the Range Rover Evoque, the Jaguar F-TYPE, smaller powertrain derivatives of the XF and XJ models, the XF Sportbrake, the Ultra trucks, the Zest and Bolt.

- The works operation and other expenses have increased to 10.8% of net revenue in Fiscal 2015 from 10.2% in Fiscal 2014. During Fiscal 2015, there was a net loss on the mark-to-market value of trading forward and options of Rs. 39.48 crores as compared to a gain of Rs. 1,629.12 crores in Fiscal 2014. The provision and write off of various debtors, vehicle loans and advances (net) mainly relate to operations of Tata and other brand vehicles (including vehicle financing), which has increased to Rs. 1,800.78 crores in Fiscal 2015 as compared to Rs. 1,185.90 crores in Fiscal 2014. These mainly reflect provisions for finance receivables, where rate of defaults increased due to prolonged unanticipated deterioration in the economic environment in India, which severely affected fleet owners and transporters. Furthermore, engineering expenses at Jaguar Land Rover have increased, reflecting increased investment in the development of new vehicles. A significant portion of these costs are capitalized and shown under the line item "Amount capitalized".

Amount capitalized represents expenditure transferred to capital and other accounts allocated out of employee cost and other expenses, incurred in connection with product development projects and other capital items. The expenditure transferred to capital and other accounts has increased by 13.8% to Rs. 15,404.18 crores in Fiscal 2015 from Rs. 13,537.85 crores in Fiscal 2014, mainly due to various product development projects undertaken by the Company for the introduction of new products and the development of engine and products variants.

Other Income increased by 8.5% to Rs. 898.74 crores in Fiscal 2015 from Rs. 828.59 crores in Fiscal 2014, and mainly includes interest income of Rs. 714.96 crores in Fiscal 2015 compared to Rs. 675.45 crores in Fiscal 2014 and profit on sale of investment of Rs. 119.57 crores in Fiscal 2015 compared to Rs. 114.58 crores in Fiscal 2014. The increase is due to profit on the sale of mutual funds, mainly at Tata and other brand vehicles (including vehicle financing).

Profit before Interest, Depreciation, Exceptional Items and Tax increased by 12.5% to Rs. 43,012.56 crores in Fiscal 2015, representing 16.4% of revenue in Fiscal 2015 compared to Rs. 38,247.16 crores in Fiscal 2014.

Depreciation and Amortization (including product development/engineering expenses written off): During Fiscal 2015, expenditures increased by 19.2% to Rs. 16,263.80 crores from Rs. 13,643.37 crores in Fiscal 2014. This increase includes an unfavorable currency translation impact from GBP to Indian rupees of Rs. 163.03 crores. The increase in depreciation of 18.1% to Rs. 6,498.13 crores in Fiscal 2015 from Rs. 5,504.22 crores in Fiscal 2014 is due to the new engine plant at Jaguar Land Rover and new product launches both at Jaguar Land Rover and Tata and other brand vehicles (including vehicle financing). The amortization expenses have increased by 23.6% to Rs. 6,890.50 crores in Fiscal 2015 from Rs. 5,573.94 crores in Fiscal 2014, attributable to new products introduced during the year. Expenditure on product development/engineering expenses written off increased by 12.1% to Rs. 2,875.17 in Fiscal 2015 from Rs. 2,565.21 in Fiscal 2014

Finance Cost increased by 2.4% to Rs. 4,861.49 crores in Fiscal 2015 from Rs. 4,749.44 crores in Fiscal 2014. The increase mainly represented borrowings for the short-term and long-term needs of the Company.

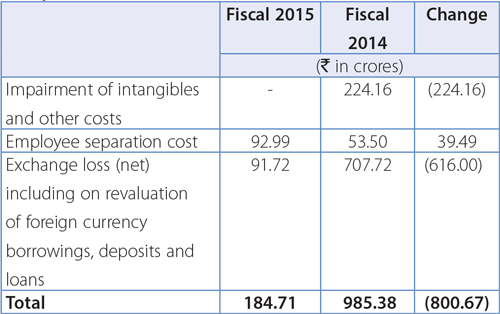

Exceptional Items

- Foreign exchange loss (net) represents impact on account of revaluation of foreign currency borrowings, deposits and loans, and amortisation of loss/gain, on such foreign currency monetary items that were deferred in previous years.

- In Fiscal 2014, impairment of intangibles and other costs were with respect to a subsidiary company, triggered by continuous under performance, mainly due to challenging market conditions in which the subsidiaries operate.

- Employee separation cost: The Company implemented an organisation-wide cost optimisation programme, which included employee cost as an important component. Accordingly, the Company has given early retirement to various employees.

Consolidated Profit Before Tax (PBT) increased to Rs. 21,702.56 crores in Fiscal 2015, compared to Rs. 18,868.97 crores in Fiscal 2014, representing an increase of Rs. 2,833.59 crores. Due to contraction in domestic volumes, TML's contribution to PBT was negative. Jaguar Land Rover by virtue of its strong performance, contributed to PBT. The increase also includes a favorable foreign currency translation impact of Rs. 328.90 crores.

Tax Expense represents a net charge of Rs. 7,642.91 crores in Fiscal 2015, as compared to net charge of Rs. 4,764.79 crores in Fiscal 2014. The tax expense is not comparable with the profit before tax, since it is consolidated on a line-by-line addition for each subsidiary company and no tax effect is recorded in respect of consolidation adjustments. The effective tax rate in Fiscal 2015 was 35.2% as compared to 25.3% in Fiscal 2014.

Consolidated Profit for the year was flat at Rs. 13,986.29 crores in Fiscal 2015 from Rs. 13,991.02 crores in Fiscal 2014, after considering the profit from associate companies and shares of minority investees.

Consolidated Balance Sheet

Shareholders' fund was Rs. 56,261.92 crores and Rs. 65,603.45 crores as at March 31, 2015 and 2014, respectively, a decrease of 14.2%.

Reserves decreased by 14.4% from Rs. 64,959.67 crores as at March 31, 2014 to Rs. 55,618.14 crores as of March 31, 2015. The decrease in Reserves is primarily attributable to following reasons:

- There was a reduction in Hedging Reserves by Rs. 11,729.34 crores, primarily due to mark-to-market losses on forwards and options in Jaguar Land Rover, primarily due to fall in the US dollar-GBP forward rates.

- Accumulated actuarial losses in Pension Reserve have increased by 36.9% to Rs. 10,361.85 crores as at March 31, 2015 compared to Rs. 7,568.38 crores as at March 31, 2014, due to a fall in the interest rates for Jaguar Land Rover pension funds.

- The exchange losses on foreign currency borrowings (net of amortisation of past losses) recognised in Foreign Currency Monetary Item Translation Difference Account of Rs. 4,227.07 crores as at March 31, 2015, as compared to a gain of Rs. 573.88 crores as at March 31, 2014.

- Translation losses of subsidiaries of Rs. 4,193.93 crores recognised in Translation Reserve further contributed to a reduction in Reserves and Surplus.

The decreases described above were partly offset by the increase of Rs. 14,005.46 crores in Balance in Profit and Loss Account and General Reserves representing profits for the year.

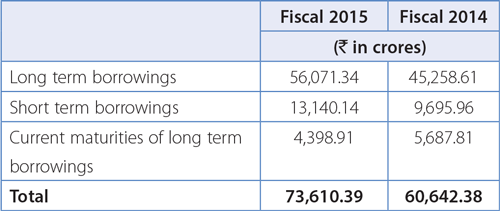

Borrowings:

- Current maturities of long-term borrowings represents amount of loan repayable within one year.

- The Company has prepaid 2% non-convertible debentures, or NCDs, of an aggregate principal amount of Rs. 1,250.00 crores (due March 31, 2016) with a redemption premium of Rs. 744.18 crores.

- During the year, Jaguar Land Rover Automotive plc, an indirect subsidiary of the Company, issued USD 500 million 4.250% senior notes due 2019, USD 500 million 3.50% senior notes due 2020 and GBP 400 million 3.875% senior notes due 2023. The proceeds were used for part prepayment of USD 326 million 8.125% senior notes due 2021 and GBP 442 million 8.250% senior notes due 2020 and are being used for general corporate purposes, including support for the on-going growth and capital spending plan.

- TML Holdings Pte. Ltd., a subsidiary of the Company, issued USD 300 million 5.750% Senior Notes due 2021.

- During the year, the Company issued USD 500 million 4.625% Senior Unsecured Notes due 2020 and USD 250 million 5.750% Senior Unsecured Notes due 2024. The proceeds have been used to refinance existing External Commercial Borrowing, or ECB, of the Company of USD 500 million and the balance of the proceeds is being used to incur new additional capital expenditure and other permitted purposes as per RBI ECB guidelines.

Other Long-term liabilities were Rs. 9,141.92 crores as at March 31, 2015, as compared to Rs. 2,596.86 crores as at March 31, 2015. These included Rs. 7,721.94 crores of derivative financial instruments, mainly attributable to Jaguar Land Rover as at March 31, 2015 compared to Rs. 548.36 crores as at March 31, 2014, reflecting a decreased notional liability due to the valuation of derivative contracts.

Trade payables were Rs. 57,407.28 crores as at March 31, 2015, as compared to Rs. 57,315.73 crores as at March 31, 2014.

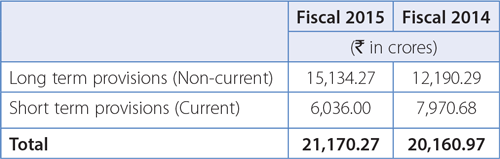

Provisions (current and non-current) were towards warranty and employee benefit schemes. Short-term provisions are those which are expected to be settled during next financial year. The details are as follows:

- Provision for warranty and product liability increased by Rs. 875.08 crores or 9.2% mainly on account of increased volumes at Jaguar Land Rover.

- The provision for employee benefits obligations increased by Rs. 1,240.65 crores or 15.4% on account of changes in actuarial factors.

Other current liabilities were Rs. 23,688.58 crores as at March 31, 2015 as compared to Rs. 17,373.86 crores as at March 31, 2014 an increase of 36.3%. These mainly includes liabilities towards vehicles sold under repurchase arrangements, liabilities for capital expenditure, statutory dues, current liabilities of long-term debt, derivative liabilities and advance/progress payment from customers. The increase was mainly due to an increase in derivative liabilities as a result of mark-to-market losses of options and forwards at Jaguar Land Rover.

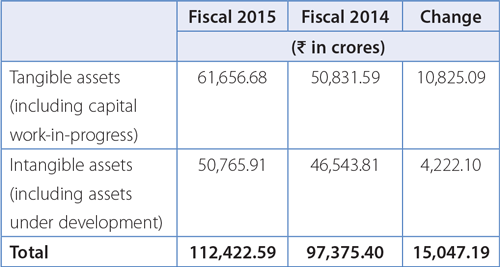

Fixed Assets:

The increase (net of depreciation) in the tangible assets mainly represented additions towards new product plans and the new engine manufacturing facility at Jaguar Land Rover. The increase (net of amortisation) in the intangible assets was Rs. 4,222.10 crores, mainly attributable to new product developments projects and new product launches during Fiscal 2015.

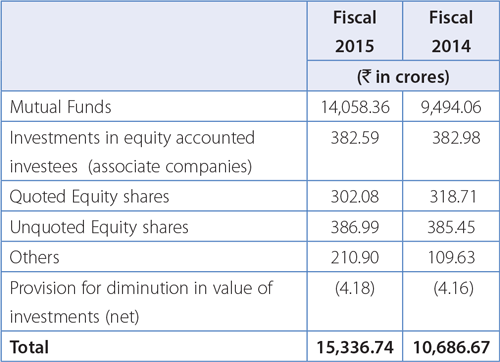

Investments (Current + Non-current) were Rs. 15,336.74 crores as at March 31, 2015, as compared to Rs. 10,686.67 crores as at March 31, 2014. The details are as follows:

The increase in mutual fund investments is mainly at Jaguar Land Rover.

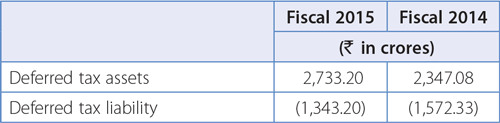

Deferred tax assets/liability: Deferred tax assets represents timing differences for which there will be future current tax benefits due to unabsorbed tax losses and expenses allowable on a payment basis in future years. Deferred tax liabilities represent timing differences where current benefit in tax will be off-set by a debit in the statement of profit and loss.

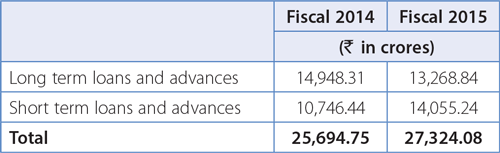

Loans and Advances

Loans and advances include:

- Credit entitlement of Minimum Alternate Tax (MAT) of Rs. 89.88 crores as at March 31, 2015 (compared to Rs. 787.59 crores as at March 31, 2014). The credit/refund will be against tax paid at normal rate, within time limit as per the Income Tax Act. During the year, Rs. 777.18 crores of MAT credit was written off at Tata Motors Limited on a standalone basis.

- Receivables towards vehicle financing by TMFL reduced to Rs. 16,877.82 crores as at March 31, 2015, as compared to Rs. 18,294.32 crores as at March 31, 2014, a decrease of 7.7%, due to lower disbursements during the year; and

- VAT, other taxes recoverable, statutory deposits and dues of Rs. 5,442.38 crores as at March 31, 2015, as compared to Rs. 5,263.44 crores as at March 31, 2014.