Intellectual Property

The Company creates, owns, and maintains a wide array of intellectual property assets throughout the world that are among its most valuable assets. The Company's intellectual property assets include patents, trademarks, copyrights designs, trade secrets and other intellectual property rights. The Company proactively and aggressively seeks to protect its intellectual property in India and other countries.

The Company owns a number of patents and it has applied for new patents which are pending for grant in India as well as in other countries. The Company has also filed a number of patent applications outside India under the Patent Cooperation Treaty, which will be effective in different countries going forward. The Company obtains new patents as part of its ongoing research and development activities.

The Company owns registrations for a number of trademarks and have pending applications for registration of these in India as well as other countries. The registrations mainly include trademarks for its vehicle models and other promotional initiatives. The Company uses the "Tata" brand, which has been licensed to the Company by Tata Sons Limited. The Company believes that establishment of the "Tata" word mark and logo mark, in India and internationally, is material to its operations. As part of the Company's acquisition of TDCV, it has the rights to the perpetual and exclusive use of the "Daewoo" brand and trademarks in Korea and overseas markets for the product range of TDCV.

As part of the acquisition of the Jaguar Land Rover business, ownership (or co-ownership, as applicable) of core intellectual property associated with Jaguar Land Rover was transferred to the Company; however such intellectual property is still ultimately owned by Jaguar Land Rover entities. Additionally, perpetual royalty free licenses to use other essential intellectual properties have been granted for use in Jaguar and Land Rover vehicles. Jaguar Land Rover entities own registered designs to protect the design of its vehicles in several countries.

In varying degrees, all of the Company's intellectual property is important. In particular, the Tata brand is integral to the conduct of its business, a loss of which could lead to dilution of the Company brand image and have a material adverse effect on the business.

Components and Raw Materials

The principal materials and components required for use in Tata and other brand vehicles are steel sheets (for in-house stampings) and plates, iron and steel castings and forgings, alloy wheels, tires, fuel injection systems, batteries, electrical wiring systems, electronic information systems and displays, interior systems such as seats, cockpits, doors, plastic finishers and plastic functional parts, glass and consumables (such as paints, oils, thinner, welding consumables, chemicals, adhesives and sealants) and fuels. The Company also requires aggregates axles, engines, gear boxes and cams for its vehicles, which are manufactured in-house or by its subsidiaries, affiliates, joint ventures/operations and strategic suppliers. The Company has long-term purchase agreements for some critical components such as transmissions and engines. The Company has established contracts with some commodity suppliers to cover its own as well as its suppliers' requirements in order to moderate the effect of volatility in commodity prices. The Company has also undertaken special initiatives to reduce material consumption through value engineering and value analysis techniques.

The Company has reorganised the sourcing department in India under four divisions, namely, Purchasing, Supplier Quality, Supply Chain and Production and Planning Management, or PPM. The reorganisation was done in order to establish and define responsibility and accountability in the sourcing department. Purchasing oversees the commercial aspects of product sourcing; Supplier Quality is primarily responsible for maintaining the quality of supplies that the Company purchases; Supply Chain oversees the logistics of the supply and delivery of parts for its vendors while PPM oversees execution of new projects.

As part of the Company's strategy to become a low-cost vehicle manufacturer, it has undertaken various initiatives to reduce its fixed and variable costs. The Company uses an e-sourcing initiative to procure supplies through reverse auctions. The Company uses external agencies such as third-party logistics providers. This has resulted in space and cost savings. The Company's initiatives to leverage information technology in supply chain activities have resulted in improved efficiency through real-time information exchanges and processing with its suppliers.

The Company has an established a sixteen-step supplier quality process in order to ensure the quality of outsourced components. The Company formalised the component development process using Automotive Industry Action Group guidelines. The Company also has a program for assisting vendors from whom the Company purchases raw materials or components to maintain quality. Preference is given to vendors with TS 16949 certification. The Company also maintains a stringent quality assurance program that includes random testing of production samples, frequent recalibration of production equipment and analysis of post-production vehicle performance, as well as an ongoing dialogue with workers to reduce production defects.

The Company is also exploring opportunities for increasing the global sourcing of parts and components from low-cost countries, and has in place a vendor management program that includes vendor base rationalisation, vendor quality improvement and vendor satisfaction surveys. The Company has begun to include its supply chain in its initiatives on social accountability and environment management activities, including its Conflict Minerals Compliance Program, supply chain carbon footprint measurement and knowledge sharing on various environmental aspects.

The principal materials and components required for use in Jaguar Land Rover vehicles are steel and aluminum sheets (for in-house stamping) or externally pre-stamped forms, aluminium castings and extrusions, iron and steel castings and forgings and items such as alloy wheels, tires, fuel injection systems, batteries, electrical wiring systems, electronic information systems and displays, leather-trimmed interior systems such as seats, cockpits, doors, plastic finishers and plastic functional parts, glass and consumables (paints, oils, thinner, welding consumables, chemicals, adhesives and sealants) and fuels.

The Jaguar Land Rover business works with a range of strategic suppliers to meet its requirements for parts and components. The Jaguar Land Rover business has established quality control programmes to ensure that externally purchased raw materials and components are monitored and meet its quality standards. Such programes include site engineers who regularly interface with suppliers and carry out visits to supplier sites and ensure that the relevant quality standards are being met. Site engineers are also supported by persons in other functions, such as program engineers who interface with new model teams as well as resident engineers located at the Jaguar Land Rover plants, who provide the link between the site engineers and the Jaguar Land Rover plants. The Company has in the past worked, and expects to continue to work, with its suppliers to optimise its procurements, including by sourcing certain raw materials and component requirements from low-cost countries.

Suppliers

The Company has an extensive supply chain for procuring various components. The Company also outsources many manufacturing processes and activities to various suppliers. In such cases, the Company provides training to external suppliers who design and manufacture the required tools and fixtures. The Company sources certain highly-functional components such as axles, engines and gear boxes for its vehicles from strategic suppliers. The Company has long-term purchase agreements with its key suppliers. The components and raw materials in its cars include steel, aluminium, copper, platinum and other commodities. The Company has established contracts with certain commodity suppliers to cover its own and its suppliers' requirements to mitigate the effect of high volatility in commodity prices.

The Company's associate company Tata AutoComp Systems Ltd. manufactures automotive components and encourages the entry of internationally acclaimed automotive component manufacturers into India by setting up joint ventures with them.

The Company's other suppliers include some of the large Indian automotive supplier groups with multiple product offerings, such as the Anand Group, the Sona Group, and the TVS Group, as well as large multinational suppliers, such as Bosch, Continental, Delphi and Denso, Johnson Controls Limited (for seats) and Yazaki AutoComp Limited (for wiring harnesses). The Company continues to work with its suppliers of Jaguar Land Rover to optimise procurements and enhance the Company's supplier base, including the sourcing of certain of the Company's raw material and component requirements from low-cost countries. In addition, the co-development of various components, such as engines, axles and transmissions, is also being evaluated, which the Company believes may lead to the development of a low-cost supplier base for Jaguar Land Rover.

In India, the Company has established vendor parks in the vicinity of its manufacturing operations, and vendor clusters have been formed at its facilities at Pantnagar, Uttarakhand and Sanand, Gujarat. This initiative is aimed at ensuring flow of component supplies on a real-time basis, thereby reducing logistics and inventory costs as well as reducing uncertainties in the long-distance supply chain. Efforts are being taken to replicate the model at new upcoming locations as well as a few existing plant locations.

As part of the Company's pursuit of continued improvement in procurement, it has integrated its system for electronic interchange of data with the Company's suppliers. This has facilitated realtime information exchange and processing, which enables the Company to manage its supply chain more effectively.

The Company has established processes to encourage improvements through knowledge sharing among its vendors through an initiative called the Vendor Council, consisting of the Company's senior executives and representatives of major suppliers. The Vendor Council also helps in addressing common concerns through joint deliberations. The Vendor Council works on four critical aspects of engagement between the Company and its suppliers: quality, efficiency, relationship and new technology development.

The Company imports some components that are either not available in the domestic market or when equivalent domestically-available components do not meet its quality standards. The Company also imports products to take advantage of lower prices in foreign markets, such as special steels, wheel rims and power steering assemblies.

Ford has been and continues to be a major supplier of parts and services to Jaguar Land Rover. In connection with the acquisition of Jaguar Land Rover in June 2008, long-term agreements were entered into with Ford for technology sharing and joint development, providing technical support across a range of technologies focused mainly around powertrain engineering such that it may continue to operate according to the existing business plan. Supply agreements, ranging in duration from seven to nine years, were entered into with Ford for (i) the long-term supply of engines developed by Ford, (ii) engines developed by the Company but manufactured by Ford and (iii) engines from the Ford-PSA cooperation.

Based on learning from the global financial crisis and its cascading effect on the financial health of the Company's suppliers, the Company has commenced efforts to assess supplier financial risk.

Suppliers are appraised based on the Company's long-term requirements through a number of platforms such as the Vendor Council meetings, council regional chapter meetings, national vendor meets and location-specific vendor meets.

OPPORTUNITIES:

Sales of M&HCVs in India may grow by the continuing trend towards the replacement of ageing fleet vehicles and expectations of increases in demand from the infrastructure and industrial sectors due to reforms being initiated by the Government of India. The Company expects that the demand for new commercial vehicles will also be driven by gradual acceptance of advance trucking platforms, the progression to Bharat Stage V emissions norms and the introduction of technologies, such as anti-lock braking systems. The Company is focusing on increasing its offerings in the commercial vehicle segment.

Furthermore, the Company is focusing on increasing its offerings in defence sector from providing only pure logistics solutions to tactical and combat solutions. The Company believes these efforts will provide the opportunity for capturing a larger share in a growing market.

Growing wealth in rural markets in India also provides an added opportunity to expand sales reach and volumes. The sales reported out of rural areas is growing year-on-year. The overall gap of the volume of automobile purchase between rural and urban areas is narrowing in India. The Company is focusing on reaching rural target market to address demand in rural markets in cost effective ways.

Certain non-vehicular products and services such as spare parts, after-sale services and annual maintenance contracts are also gaining popularity due to increased consumer awareness. The Company believes it is poised to address this growing need, thereby providing additional sources of revenue which are non-cyclical in nature to hedge for otherwise cyclical demand in the automotive industry.

The Company believes it is poised to address growing demands and changing preferences of customers in the intermediate and light commercial vehicle categories with its new range of vehicles in those categories, as the evolving infrastructure in India will change the way the transportation industry matures, as the Company expected increased demand for better quality and more comfortable vehicles.

India has emerged as a major hub for global manufacturing with its advantage of lower input costs, availability of local supplier base and high domestic demand. As an established domestic manufacturer, the Company believes that is ideally placed to take advantage for targeting lucrative international markets, either through fully-built or complete knock-down exports.

In addition, the Company believes it also has the advantage of strong in-house design and development facilities and professionals. Thus the Company believes that its R&D group is capable of developing solutions for different regulatory and emission norms in accordance with market demands in minimal time.

The Company is focusing on increasing its global presence to hedge against domestic downturns as well as a growth opportunity. While the Company is already present in Africa and some parts of the Association of Southeast Asian Nations, or ASEAN, it is focusing on increasing presence in more key markets in ASEAN and Latin America. The Company is also actively considering expanding its global manufacturing footprint in key international markets to take advantage of import duty differentials and local sourcing benefits.

Jaguar Land Rover intends to grow its business by diversifying its product range, for example, with the new Jaguar XE sports saloon, on sale from May 2015, which the Company believes will ensure that Jaguar Land Rover competes in the largest saloon segment with a class-leading product, and the recent launch of the Land Rover Discovery Sport, which went on sale in February 2015.

Jaguar Land Rover also plans to continue to develop its product range, for example the new Jaguar F-PACE performance crossover, which is expected to commence sales in Fiscal 2016. Similarly, Jaguar Land Rover expects to continue to expand its Land Rover product offerings with the announcement of the Range Rover Evoque convertible, which is also expected to commence sales in Fiscal 2016.

Jaguar Land Rover intends to expand its global footprint in order to grow sales potential and appetite for the Company's products, notably by:

- Increasing marketing and dealer networks in emerging markets. For example, in China, Jaguar Land Rover established a national sales company in 2010 to expand its presence in this key market and has increased network of sales dealerships to 189 dealerships as at March 31, 2015.

- Establish new manufacturing facilities, assembly points and suppliers in selected markets, for example an assembly facility in India operated by Tata Motors; the manufacturing and assembly joint venture in China with Chery Automobile Company Ltd, which opened in October 2014 and the manufacturing facility expected to open in Brazil in Fiscal 2016. Jaguar Land Rover also continues to explore the further expansion of its international manufacturing base.

FINANCIAL PERFORMANCE ON A CONSOLIDATED BASIS

The financial information discussed in this section is derived from the Company's Audited Consolidated Financial Statements.

Overview

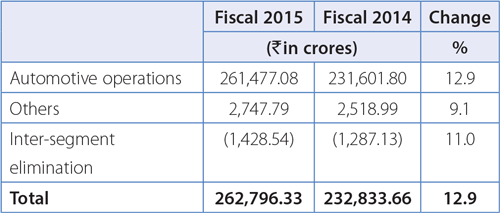

The Company total revenue (net of excise duties) including finance revenues increased by 12.9% to Rs. 262,796.33 crores in Fiscal 2015 from Rs. 232,833.66 crores in Fiscal 2014. The Company's net income (attributable to shareholders of the Company) was flat at Rs. 13,986.29 crores in Fiscal 2015 from Rs. 13,991.02 crores in Fiscal 2014. Overall, earnings before other income, interest and tax before inter-segment eliminations, were Rs. 25,997.39 crores in Fiscal 2015 compared to Rs. 23,892.59 crores in Fiscal 2014, an increase of 8.8%.

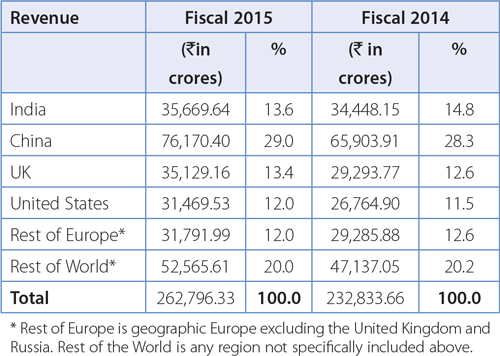

The Company has pursued a strategy of increasing exports of Tata and other brand vehicles to new and existing markets. Improved market sentiment in certain countries to which the Company exports and a strong portfolio of Jaguar Land Rover vehicles has enabled the Company to increase its sales in these international markets in Fiscal 2015. However, Jaguar Land Rover's sales in China, which is its second largest single market in terms of volumes after India, decreased in Q4 of Fiscal 2015 by 20% to 23,526 units from 29,567 units compared to the same period in Fiscal 2014. The performance of the Company's subsidiary in South Korea, TDCV, and TTL, its specialized subsidiary engaged in engineering, design and information technology services, contributed to its revenue from international markets. The proportion of the Company's net sales earned from markets outside of India has increased to 86.4% in Fiscal 2015 from 85.2% in Fiscal 2014. The increase in sales from markets outside India includes a favorable currency translation from GBP to Indian rupees of Rs. 3,080.65 crores pertaining to Jaguar Land Rover.

The following table sets forth the Company's revenues from its key geographical markets and the percentage of total revenues that each key geographical market contributes for the periods indicated:

The Company's operations are divided into automotive operations and other operations as described further below. The table below sets forth the breakdown in revenues between the Company automotive operations and other operations in the years ended March 31, 2014 and 2015 and the percentage change from period to period.