COMPANY'S PHILOSOPHY ON CORPORATE GOVERNANCE

As a Tata Company, the Company's philosophy on Corporate Governance is founded upon a rich legacy of fair, ethical and transparent governance practices, many of which were in place even before they were mandated by adopting the highest standards of professionalism, honesty, integrity and ethical behavior. As a global organization, the Corporate Governance practices followed by the Company and its subsidiaries are compatible with international standards and best practices. Through the Governance mechanism in the Company, the Board along with its Committees undertakes its fiduciary responsibilities to all its stakeholders by ensuring transparency, fairplay and independence in its decision making.

The Corporate Governance philosophy is further strengthened with the adherence to the Tata Business Excellence Model as a means to drive excellence and the Balanced Scorecard methodology for tracking progress on long term strategic objectives. The Tata Code of Conduct, which articulates the values, ethics and business principles, serves as a guide to the Company, its directors and employees is supplemented with an appropriate mechanism to report any concern pertaining to non-adherence to the said Code. The Company is in full compliance with the requirements of Corporate Governance under Clause 49 of the Listing Agreement with the Indian Stock Exchanges ("the Listing Agreement"). The Company's Depositary Programme is listed on the New York Stock Exchange and the Company also complies with US regulations as applicable to Foreign Private Issuers (non-US listed companies) which cast upon the Board of Directors and the Audit Committee, onerous responsibilities to improve the Company's operating efficiencies. Risk management and the internal control process focus areas continue to meet the progressive governance standards.

During the year, the Company has adopted Governance Guidelines based on current and emerging best practices from both within and outside the Tata Group of companies. These guidelines inter alia incorporate corporate governance requirements prescribed under the Companies Act, 2013 ("Act") and the Listing Agreement.

The Company continues to undertake an Audit of its secretarial records and documents by a Practicing Company Secretary in respect of compliance with the applicable provisions of the Act, Listing Agreement with the Indian Stock Exchanges and the applicable regulations and guidelines issued by Securities and Exchange Board of India. A copy of the Secretarial Audit Report for the period under review is a part of the Annual Report.

BOARD OF DIRECTORS

The Board of Directors along with its Committees provide leadership and guidance to the Company's management as also direct, supervise and control the performance of the Company. The Board currently comprises of ten Directors out of which eight Directors (80%) are Non-Executive Directors. The Company has a Non-Executive Chairman and the six Independent Directors comprise at least one half of the total strength of the Board. All the Independent Directors have confirmed that they meet the 'independence' criteria as mentioned under Clause 49 of the Listing Agreement and Section 149 of the Act.

None of the Directors on the Company's Board is a Member of more than ten Committees and Chairman of more than five Committees [Committees being, Audit Committee and Stakeholder Relationship Committee] across all the Indian public limited companies in which he/she is a Director. All the Directors have made necessary disclosures regarding Committee positions held by them in other companies and do not hold the office of Director in more than twenty companies, including ten public companies. None of the Directors of the Company are related to each other. All Non-Executive Non Independent Directors, excluding the 'Steel' Director (Tata Steel representative) are liable to retire by rotation. The appointment of the Managing Director and Executive Directors including the tenure and terms of remuneration are also approved by the members at the first meeting after the said appointment.

The required information, including information as enumerated in Annexure X to Clause 49 of the Listing Agreement is made available to the Board of Directors for discussions and consideration at Board Meetings. The Board reviews the declaration made by the Executive Director and the Chief Financial Officer regarding compliance with all applicable laws on a quarterly basis as also steps taken to remediate instances of non-compliance, if any. The Executive Director and the Chief Financial Officer (CFO) have certified to the Board upon inter alia, the accuracy of the financial statements and adequacy of internal controls for the financial reporting, in accordance with Clause 49 (IX) of the Listing Agreement, pertaining to CEO and CFO certification for the Financial Year ended March 31, 2015.

During the year under review, ten Board Meetings were held on May 29, 2014, July 15, 2014, August 11, 2014, October 8, 2014, November 14, 2014, January 9, 2015, January 27, 2015, February 5, 2015, March 25, 2015 and March 30, 2015. The maximum time-gap between any two consecutive meetings did not exceed 120 days.

All Board and Committee meetings agenda papers are disseminated electronically on a real-time basis, by uploading them on a secured online application specifically designed for this purpose, thereby eliminating circulation of printed agenda papers. The composition of the Board, attendance at Board Meetings held during the Financial Year under review and at the last Annual General Meeting (AGM), number of directorships (including Tata Motors), memberships/chairmanships of the Board and Committees of public companies and their shareholding as on March 31, 2015 in the Company are as follows:

Annual Independent Directors Meeting: During the year under review, an annual Independent Directors meeting was convened on March 30, 2015, to review the performance of the Non-Independent Non-Executive Directors including the Chairman of the Board and performance of the Board as a whole. The Non-Independent Directors did not take part in the meeting.

Board Effectiveness Evaluation: Pursuant to the provisions of Clause 49 and the Act, Board evaluation involving evaluation of the Board of Directors, its Committees and individual Directors, including the role of the Board Chairman, was conducted during the year. For details pertaining to the same kindly refer to the Directors' Report.

Familiarisation Programme: The details of the programme for familiarisation of the Independent Directors with the Company in respect of their roles, rights, responsibilities in the Company, nature of the industry in which Company operates, business model of the Company and related matters are put up on the website of the Company (URL: www.tatamotors.com/investors/pdf/familiarisationprogramme-independent-directors.pdf).

THE COMMITTEES OF THE BOARD

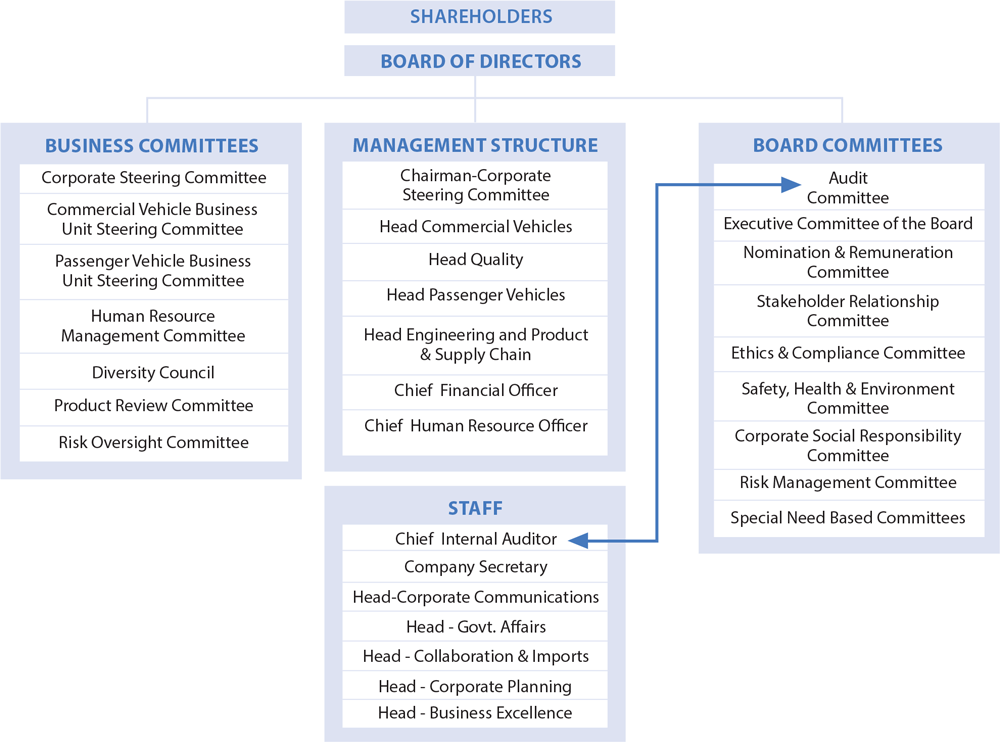

The Board has constituted a set of Committees with specific terms of reference/scope to focus effectively on the issues and ensure expedient resolution of diverse matters. The Committees operate as empowered agents of the Board as per their Charter/terms of reference. Targets set by them as agreed with the management are reviewed periodically and mid-course corrections are also carried out. The Board of Directors and the Committees also take decisions by circular resolutions which are noted at the next meeting. The minutes of the meetings of all Committees of the Board are placed before the Board for discussions/noting. An Organisation Chart depicting the relationship between the Board of Directors, the Committees and the senior management functions as on March 31, 2015 is illustrated below:

AUDIT COMMITTEE

The Audit Committee functions according to its Charter that defines its composition, authority, responsibility and reporting functions in accordance with the Act, listing requirements and US regulations applicable to the Company and is reviewed from time to time. Whilst, the full Charter is available on the Company's website, given below is a gist of the responsibilities of the Audit Committee:

- Reviewing the quarterly/annual financial statements before submission to the Board, focusing primarily on:

- Overseeing the Company's financial reporting process and the disclosure of its financial information, including earnings, press release, to ensure that the financial statements are correct, sufficient and credible;

- Review Reports on the Management Discussion and Analysis of financial condition, results of Operations and the Directors' Responsibility Statement;

- Compliance with accounting standards and changes in accounting policies and practices;

- Major accounting entries involving estimates based on exercise of judgment by Management;

- Draft Audit Report, qualifications, if any and significant adjustments arising out of audit;

- Analysis of the effects of alternative GAAP methods on the financial statements;

- Compliance with listing and other legal requirements concerning financial statements;

- Scrutinise inter corporate loans and investments; and

- Disclosures made under the CEO and CFO certification and related party transactions to the Board and Shareholders.

- Reviewing with the management, external auditor and internal auditor, adequacy of internal control systems and recommending improvements to the management.

- Reviewing, with the management, the statement of uses/application of funds raised through an issue (public issue, rights issue, preferential issue, etc.), the statement of funds utilized for purposes other than those stated in the offer document/prospectus/ notice and the report submitted by the monitoring agency monitoring the utilisation of proceeds of a public or rights issue and making appropriate recommendations to the Board to take up steps in this matter.

- Recommending the appointment/removal of the statutory auditor, cost auditor, fixing audit fees, name of Audit firm and approving non-audit/consulting services provided by the statutory auditors' firms to the Company and its subsidiaries; evaluating auditors' performance, qualifications, experience, independence and pending proceedings relating to professional misconduct, if any. It shall also ensure that the cost auditors are independent, have arm's length relationship and are also not otherwise disqualified at the time of their appointment or during their tenure.

- Reviewing the adequacy of internal audit function, coverage and frequency of internal audit, appointment, removal, performance and terms of remuneration of the chief internal auditor.

- Discussing with the internal auditor and senior management significant internal audit findings and follow-up thereon.

- Reviewing the findings of any internal investigation by the internal auditor into matters involving suspected fraud or irregularity or a failure of internal control systems of a material nature and report the matter to the Board.

- Discussing with the external auditor before the audit commences, the nature and scope of audit, as well as conduct post-audit discussions to ascertain any area of concern.

- Reviewing the Company's financial controls and risk management systems.

- Establish and review the functioning of the Vigil Mechanism under the Whistle-Blower policy of the Company and review the functioning of the legal compliance mechanism.

- Reviewing the financial statements and investments made by subsidiary companies and subsidiary oversight relating to areas such as adequacy of the internal audit structure and function of the subsidiaries, their status of audit plan and its execution, key internal audit observations, risk management and the control environment.

- Look into the reasons for any substantial defaults in payment to the depositors, debenture holders, shareholders (in case of non-payment of declared dividend) and creditors, if any.

- Reviewing the effectiveness of the system for monitoring compliance with laws and regulations.

- Approving the appointment of CFO after assessing the qualification, experience and background etc. of the candidate.

- Engage a registered valuer in case valuations are required in respect of any property, stocks, shares, debentures, securities, goodwill, assets, liabilities or net worth of the Company.

- Review and suitably reply to the report(s) forwarded by the auditors on the matters where auditors have sufficient reason to believe that an offence involving fraud, is being or has been committed against the Company by officers or employees of the Company.

- Review the system of storage, retrieval, display or printout of books of accounts maintained in electronic mode during the required period under law.

- Approve all or any subsequent modification of transactions with related parties.

- To approve policies in relation to the implementation of the Tata Code of Conduct for Prevention of Insider Trading and Code of Corporate Disclosure Practices ('Code') and to supervise implementation of the Code.

- To note and take on record the status reports, detailing the dealings by Designated Persons in Securities of the Company, as submitted by the Compliance Officer on a quarterly basis and to provide directions on any penal action to be initiated, in case of any violation of the Code, by any person.

During the year, the Committee reviewed key audit findings covering operational, financial and compliance areas. Management personnel presented their risk mitigation plan to the Committee. It also reviewed the internal control system in subsidiary companies, status on compliance of its obligations under the Charter and confirmed that it fulfilled its duties and responsibilities. The Committee, through self-assessment, annually evaluates its performance. The Chairman of the Audit Committee briefs the Board members about the significant discussions at Audit Committee meetings.

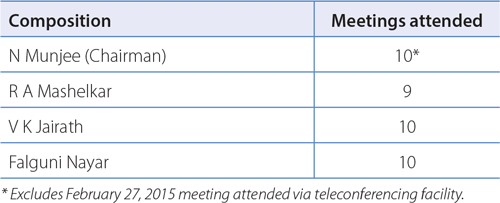

The Committee comprises of four Independent Directors, all of whom are financially literate and have relevant finance and/or audit exposure. Mr Munjee is the Financial Expert. The quorum of the Committee is two members or one-third of its members, whichever is higher. The Chairman of the Audit Committee also attended the last Annual General Meeting of the Company. During the period under review, eleven Audit Committee meetings were held on May 27, 2014, July 9, 2014, July 19, 2014, August 8, 2014, August 30, 2014, November 7, 2014, November 13, 2014, January 15 - 16, 2015, February 4, 2015, February 27, 2015 and March 31, 2015. The maximum gap between any two meetings was less than four months. Each Audit Committee meeting which considers financial results is preceded by a meeting of the Audit Committee members along with the Auditors only.

The composition of the Audit Committee and attendance at its meetings is as follows:

The Committee meetings are held at the Company's Corporate Headquarters or at its plant locations and are attended by Executive Directors, Chief Financial Officer, Company Secretary, Chief Internal Auditor, Statutory Auditors and Cost Auditors. The Chief Internal Auditor reports directly to the Audit Committee. The Business and Operation Heads are invited to the meetings, as and when required. The Company Secretary acts as the Secretary of the Audit Committee. The Chief Internal Auditor reports to the Audit Committee to ensure independence of the Internal Audit function.

The Committee relies on the expertise and knowledge of the management, the internal auditors and the independent Statutory Auditor in carrying out its oversight responsibilities. It also uses external expertise, if required. The management is responsible for the preparation, presentation and integrity of the Company's financial statements including consolidated statements, accounting and financial reporting principles. The management is also responsible for internal control over financial reporting and all procedures are designed to ensure compliance with accounting standards, applicable laws and regulations as well as for objectively reviewing and evaluating the adequacy, effectiveness and quality of the Company's system of internal control.

Deloitte Haskins & Sells LLP, Mumbai (ICAI Firm Registration No.117366W/W � 100018), the Company's Statutory Auditor, is responsible for performing an independent audit of the Financial Statements and expressing an opinion on the conformity of those financial statements with accounting principles generally accepted in India.

NOMINATION AND REMUNERATION COMMITTEE

The Nomination and Remuneration Committee (NRC) of the Company functions according to its Charter, that defines its objective, composition, meeting requirements, authority and power, responsibilities, reporting and evaluation functions in accordance with the Act and listing requirements, which are reviewed from time to time. The broad terms of reference of the Nomination and Remuneration Committee are as follows:

- Recommend to the Board the set up and composition of the Board and its Committees including the "formulation of the criteria for determining qualifications, positive attributes and independence of a director". The Committee will consider periodically reviewing the composition of the Board with the objective of achieving an optimum balance of size, skills, independence, knowledge, age, gender and experience.

- Devise a policy on Board diversity.

- Recommend to the Board the appointment or reappointment of Directors.

- Recommend to the Board on voting pattern for appointment and remuneration of Directors on the Boards of its material subsidiary companies.

- Recommend to the Board appointment of Key Managerial Personnel ("KMP") as defined by the Act and executive team members of the Company (as defined by this Committee).

- Carry out evaluation of every Director's performance and support the Board and Independent Directors in evaluation of the performance of the Board, its Committees and individual Directors. This shall include "formulation of criteria for evaluation of Independent Directors and the Board".

- Oversee the performance review process for the KMP and executive team of the Company with a view that there is an appropriate cascading of goals and targets across the Company.

- Recommend the Remuneration Policy for Directors, KMP, executive team and other employees.

- On an annual basis, recommend to the Board the remuneration payable to the Directors, KMP and executive team of the Company.

- Review matters related to voluntary retirement and early separation schemes for the Company.

- Provide guidelines for remuneration of Directors on material subsidiaries.

- Oversee familiarisation programmes for Directors.

- Oversee HR philosophy, HR and people strategy and efficacy of HR practices including those for leadership development, rewards and recognition, talent management and succession planning (specifically for the Board, KMP and executive team).

- Performing such other duties and responsibilities as may be consistent with the provisions of the Committee Charter.