Inventories as at March 31, 2015, were Rs. 29,272.34 crores as compared to Rs. 27,270.89 crores as at March 31, 2014, an increase of 7.3%. Inventory at Tata and other brand vehicles (including vehicle financing) was Rs. 4,802.08 crores as at March 31, 2015 crores as compared to Rs. 3,862.53 crores as at March 31, 2014. Inventory at Jaguar Land Rover was Rs. 22,877.62 crores as at March 31, 2015 as compared to Rs. 21,634.06 crores as at March 31, 2014. In terms of number of days of sales, finished goods represented 31 inventory days in Fiscal 2015 as compared to 30 days in Fiscal 2014.

Trade Receivables (net of allowance for doubtful debts) were Rs. 12,579.20 crores as at March 31, 2015, representing an increase of 19.0% compared to Rs. 10,574.23 crores as at March 31, 2014. Trade Receivables have decreased at Tata and other brand vehicles (including vehicle financing) by Rs. 102.22 crores in Fiscal 2015. The allowances for doubtful debts were Rs. 737.86 crores as at March 31, 2015 compared to Rs. 621.70 crores as at March 31, 2014.

Cash and bank balances were Rs. 32,115.76 crores, as at March 31, 2015 compared to Rs. 29,711.79 crores as at March 31, 2014, an increase of 8.1%. The Company holds cash and bank balances in Indian rupees, GBP, and Chinese Renminbi The cash balances include bank deposits maturing within one year of Rs. 23,638.08 crores compared to Rs. 21,628.97 crores as at March 31, 2014.

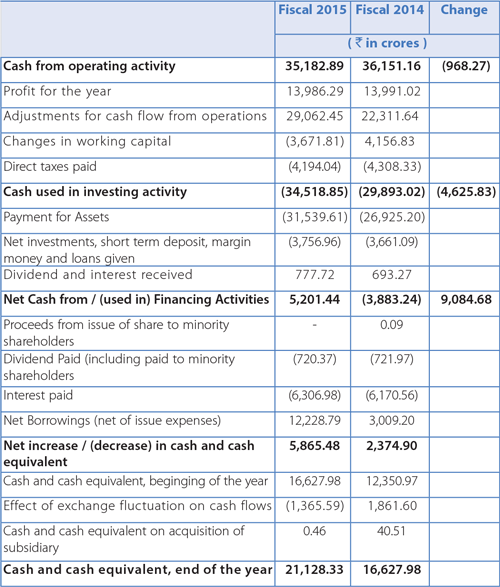

Consolidated Cash Flow

The following table sets forth selected items from consolidated cash flow statement:

Analysis:

- Cash generated from operations before working capital changes was Rs. 43,048.74 crores as compared to Rs. 36,302.66 crores in the previous year, representing an increase in cash generated through consolidated operations, consistent with the growth in revenue on a consolidated basis. After considering the impact of working capital changes and net movement of vehicle financing portfolio, the net cash generated from operations was Rs. 35,182.89 crores as compared to Rs. 36,151.16 crores in the previous year. The following factors contributed to net decrease in the change in working capital for the year:

- Increase in trade receivables and other assets amounting to Rs. 3,632.63 crores mainly due to increase in sales.

- Decrease in trade and other payables amounting to Rs. 4,021.65 crores which was partially off set by increase in provisions amounting to Rs. 197.45 crores.

- The above was off set by increase in the inventories amounting to Rs. 3,692.41 crores.

- The net cash outflow from investing activity increased to Rs. 34,518.85 crores in Fiscal 2015 from Rs. 29,893.02 crores in Fiscal 2014.

- Capital expenditure was at Rs. 31,539.61 crores in Fiscal 2015 compared to Rs. 26,925.20 in Fiscal 2014, related mainly to capacity/expansion of facilities, quality and reliability projects and product development projects.

- Net investment, short term deposits, margin money and loans given has increased by Rs. 3,661.96 crores in Fiscal 2015 mainly due to investment of surplus funds in mutual funds by Jaguar Land Rover.

- The net change in financing activity was an inflow of Rs. 5,201.44 crores in Fiscal 2015 as compared to an outflow of Rs. 3,883.24 crores in Fiscal 2014.

- During Fiscal 2015, Rs. 8,934.47 crores were raised from long-term borrowings (net) as compared to Rs. 5,925.53 crores in Fiscal 2014, as described in further detail below.

- Net increase in short-term borrowings of Rs. 3,351.58 crores in Fiscal 2015 as compared to a decrease of Rs. 2,466.25 crores in Fiscal 2014, mainly at Tata and other brand vehicles (including vehicle financing).

As at March 31, 2015, the Company's borrowings (including shortterm debt) were Rs. 73,610.39 crores compared with Rs. 60,642.28 crores as at March 31, 2014.

Principal Sources of Funding Liquidity

The Company finances its capital expenditures and research and development investments through cash generated from operations, cash and cash equivalents, debt and equity funding. The Company also raises funds through sale of investments, including divestment in stakes of subsidiaries on a selective basis.

The Company's cash and bank balances on a consolidated basis were Rs. 32,115.76 crores as at March 31, 2015, as compared to Rs. 29,711.79 crores as at March 31, 2014. These enable the Company to cater to business needs in the event of changes in market conditions.

The Company's capital expenditures was Rs. 34,889.61 crores, and Rs. 28,278.99 crores for Fiscal 2015 and 2014, respectively, and the Company currently plans to invest approximately Rs. 388 Billion in Fiscal 2016 in new products and technologies. The Company intends to continue to invest in new products and technologies to meet consumer and regulatory requirements. The Company is currently investing in a new assembly plant in Brazil, a joint venture in China, the Ingenium engine plant at Wolverhampton, United Kingdom, a capacity expansion at Solihull, United Kingdom and construction of a GBP 320 million aluminium body shop at Castle Bromwich, United Kingdom for manufacturing of the new Jaguar XF, among other projects. These investments are intended to enable the Company to pursue further growth opportunities and improve the Company's competitive positioning. The Company expects to meet most of its investments out of operating cash flows and cash liquidity available. In order to meet the remaining funding requirements, the Company may be required to raise funds through additional loans and by accessing capital markets from time to time, as deemed necessary.

In view of the prolonged economic downturn in India, the operating margins for Tata Motors Limited on a standalone basis are expected to remain under pressure. With the ongoing need for investments in products and technologies, the Company was free cash flow (a non-GAAP financial measure, measured at cash flow from operating activities less payments for property, plant and equipment and intangible assets) negative in Fiscal 2015 of Rs. 5,269.09 crores. The Company expects that with an improvement in macroeconomic conditions and business performance, combined with steps like raising funds at subsidiary levels, reviewing non-core investments and raising additional long-term resources at Tata Motors Limited on a standalone basis, the funding gap could be appropriately addressed.

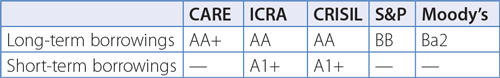

The following table provides information for the credit rating of Tata Motors Limited for short-term borrowing and long-term borrowing from the following rating agencies as of March 31, 2015: Credit Analysis and Research Ltd Ratings, or CARE, Information and Credit Rating Agency of India Ltd, or ICRA, Credit Rating Information Services of India Limited, or CRISIL Ltd, Standard & Poor's Ratings Group, or S&P, and Moody's Investor Services, or Moody's. A credit rating is not a recommendation to buy, sell or hold securities. A credit rating may be subject to withdrawal or revision at any time. Each rating should be evaluated separately of any other rating:

The Company believes that it has sufficient liquidity available to meet its planned capital requirements. However, the Company's sources of funding could be materially and adversely affected by an economic slowdown, as was witnessed in Fiscal 2009, or other macroeconomic factors in India and abroad, such as in the United Kingdom, the United States, Europe, Russia and China, all of which are beyond the Company's control. A decrease in the demand for the Company's vehicles could affect its ability to obtain funds from external sources on acceptable terms or in a timely manner.

The Company's cash is located at various subsidiaries within the Tata Motors Group. There may be legal, contractual or economic restrictions on the ability of subsidiaries to transfer funds to the Company in the form of cash dividends, loans, or advances. Brazil, Russia, South Africa and other jurisdictions have regulatory restrictions, disincentives or costs on pooling or transferring of cash. However, such restrictions have not had and are not estimated to have a significant impact on the Company's ability to meet its cash obligations.

In order to refinance the Company's acquisition-related borrowings and for supporting long-term fund needs, the Company continued to raise funds in Fiscal 2014 and Fiscal 2015, through issue of various debt securities described below.

During Fiscal 2014, the Company issued rated, listed, unsecured, non-convertible debentures of Rs. 1,100 crores.

During Fiscal 2014, Jaguar Land Rover Automotive plc issued USD 700 million 4.125% senior notes, due 2018 and GBP 400 million 5.0% senior notes, due 2022. The net proceeds from these issues have been utilised to refinance existing debt of GBP 750 million equivalent senior notes issued in May 2011.

During Fiscal 2014, TML Holdings Pte. Ltd. issued SGD 350 million 4.25% senior notes, due 2018. The net proceeds from these issues have been utilised for redemption of preference shares issued to the Company and for general corporate purposes. TML Holdings Pte. Ltd. further raised equivalent USD 600 million (USD 460 million and SG$ 176.8 million) syndicated loan facility with equivalent USD 300 million (USD 250 million and SGD 62.8 million) maturing in November 2017 and equivalent USD 300 million (USD 210 million and SG$ 114 million) in November 2019. The net proceeds from these have been utilised for acquiring certain offshore manufacturing subsidiaries/joint ventures from the Company at fair value and for general corporate purposes.

During Fiscal 2015, the Company has issued USD 500 million 4.625% senior unsecured notes due 2020 and USD 250 million 5.750% senior unsecured notes due 2024. The proceeds have been used to refinance existing external commercial borrowing, or ECB, of the Company of USD 500 million with the balance of the proceeds and other permitted purposes as per RBI ECB guidelines.

The Company has prepaid 2% NCDs of Rs. 1,250.00 crores (due March 31, 2016) with a redemption premium of Rs. 744.18 crores.

During Fiscal 2015, Jaguar Land Rover Automotive plc, an indirect subsidiary of the Company, issued USD 500 million 4.250% senior notes due 2019, USD 500 million 3.50% senior notes due 2020 and GBP 400 million 3.875% senior notes due 2023. The proceeds were used for part prepayment of USD 326 million 8.125% senior notes due 2021 and GBP 442 million 8.250% senior notes due 2020 as well as for general corporate purposes, including support for the on-going growth and capital spending plan.

The Tata Motors Group funds its short-term working capital requirements with cash generated from operations, overdraft facilities with banks, short-and medium-term borrowings from lending institutions, banks and commercial paper. The maturities of these short-and medium-term borrowings and debentures are generally matched to particular cash flow requirements. The working capital limits are Rs. 14,000 crores from banks in India as at March 31, 2015. The working capital limits are secured by hypothecation of certain existing current assets of the Company. The working capital limits are renewed annually.

Jaguar Land Rover Automotive plc established a 3-5 year committed revolving credit facility with a syndicate of more than 20 banks. The outstanding balance under the facility which is completely undrawn, is GBP 1,485 million as of March 31, 2015.

Some of the Company's financing agreements and debt arrangements set limits on and/or require prior lender consent for, among other things, undertaking new projects, issuing new securities, changes in management, mergers, sales of undertakings and investment in subsidiaries. In addition, certain negative covenants may limit the Company's ability to borrow additional funds or to incur additional liens, and/or provide for increased costs in case of breach. Certain of the Company's financing arrangements also include financial covenants to maintain certain debt-to-equity ratios, debt-to-earnings ratios, liquidity ratios, capital expenditure ratios and debt coverage ratios.

The Company monitors compliance with its financial covenants on an ongoing basis. The Company also reviews its refinancing strategy and continues to plan for deployment of long-term funds to address any potential non-compliance.

In Fiscal 2014, the Company was not in compliance with one covenant contained in its 2009 Indian rupee NCDs relating to the Company's ratio of total outside liabilities to tangible net worth, which was waived by the lenders and did not result in any default or penalties. Under the terms of the bank guarantee agreement, a breach of one covenant is not an event of default and also does not require the Company to pay increased costs. This NCD has been prepaid in March 2015.

Cash and liquidity at Jaguar Land Rover is located at various subsidiaries in different jurisdictions as well as with balances in India. Jaguar Land Rover's subsidiary in China is subject to foreign exchange controls and thereby has some restrictions on transferring cash to other companies of the group outside of China. Certain debt issued by Jaguar Land Rover is subject to customary covenants and events of default, which include, among other things, restrictions or limitations on the amount of cash which may be transferred outside the Jaguar Land Rover group of companies in the form of dividends, loans or investments. These are referred to as restricted payments in the relevant Jaguar Land Rover financing documentation. In general, the amount of cash which may be transferred outside the Jaguar Land Rover group is limited to 50% of its cumulative consolidated net income (as defined in the relevant financing documentation) from January 2011. As of March 31, 2015, the estimated amount that is available for dividend payments, other distributions and restricted payments outside the Jaguar Land Rover group of companies is approximately GBP 2,578 million.

FINANCIAL PERFORMANCE ON A STANDALONE BASIS

The financial information discussed in this section is derived from the Company's Audited Standalone Financial Statements.

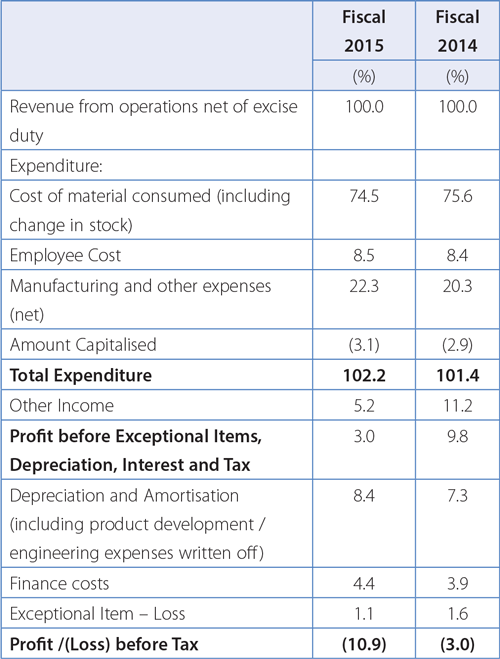

Revenues (net of excise duty) were Rs. 36,294.74 crores in Fiscal 2015, as compared to Rs. 34,288.11 crores in Fiscal 2014, representing an increase of 5.9%, mainly due to an increase in the volume of M&HCV sales by 14.9% as compared to a decrease of 23.0% in Fiscal 2014. The total number of vehicles sold during the Fiscal 2015 has decreased by 12.6% to 454,433 vehicles compared to 519,755 vehicles in Fiscal 2014 and export volumes were flat at 49,936 vehicles in Fiscal 2015 compared to 49,922 vehicles in Fiscal 2014.

However, intense competition among all product categories impacted the Company's operating margin, which recorded a negative margin of 2.2% of sales in Fiscal 2015 compared to a negative margin of 1.4% for Fiscal 2014. As a result the Loss before Tax in Fiscal 2015 was Rs. 3,974.72 crores compared to Loss before Tax of Rs. 1,025.80 crores in Fiscal 2014. Furthermore, there was a tax expense of Rs. 764.23 crores in Fiscal 2015 due to a write-off of MAT credit. The Loss after tax in Fiscal 2015 was Rs. 4,738.95 crores as compared to profit of Rs. 334.52 crores in Fiscal 2014. The analysis of performance is given below:

Percentage to revenue from operations

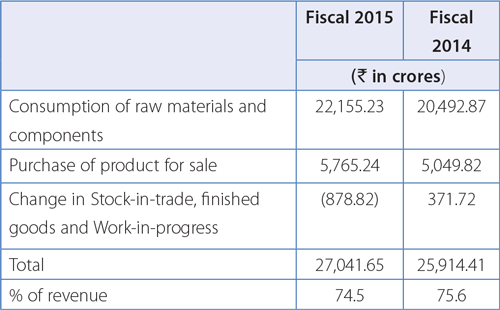

Cost of materials consumed (including change in stock)

The decrease in terms of cost of materials consumed (including change in stock) as a percentage to revenue was mainly due to a more favorable product mix which included a relatively higher proportion of M&HCV sales.

Employee Cost: Employee costs increased 7.4% in Fiscal 2015 to Rs. 3,091.46 crores compared to Rs. 2,877.69 crores in Fiscal 2014. The increase was mainly attributable to normal yearly increases, promotions, and wage agreements and changes in the discount rates for defined employee benefit plans. The Company has taken steps to contain employee costs by reducing the number of permanent and temporary employees. However, due to higher revenues, the percentage of employee cost to revenue has remained almost the same in Fiscals 2015 and 2014 at 8.5% and 8.4%, respectively.

Manufacturing and Other Expenses: These expenses relate to manufacturing, operations and incidental expenses other than raw materials and employee cost. This expenditure mainly includes job work charges, advertisements and publicity and other selling and administrative costs. The expenses increased by 15.9% to Rs. 8,080.39 crores in Fiscal 2015 compared to Rs. 6,971.87 crores in Fiscal 2014. It represented 22.3% of the revenue in Fiscal 2015 compared to 20.3% of the revenue in Fiscal 2014. Freight, transportation and port charges, represented 2.9% and 2.6% of total revenues for Fiscal 2015 and Fiscal 2014, respectively. The increase in freight and transportation expenses is primarily due to increases in car volume sales and for trailers used for the transportation of vehicles. Publicity expenses represented 2.1% and 1.8% of total revenues in Fiscal 2015 and Fiscal 2014, respectively. In addition to routine product and brand campaigns, the Company incurred expenses relating to new product introductions, namely, the Ultra trucks, Zest and Bolt. Warranty expenses increased to Rs. 428.68 crores in Fiscal 2015 as compared to Rs. 343.78 crores in Fiscal 2015, due to new models launched during Fiscal 2015. Furthermore, the increase was also due to provision for carrying capital cost of building at the Singur plant amounting to Rs. 309.88 crores.

Amount capitalised: This amount represents the expenditures transferred to capital and other accounts allocated out of employee costs and other expenses incurred in connection with product development projects and other capital items. The expenditures transferred to capital and other accounts increased 10.9% to Rs. 1,118.75 crores in Fiscal 2015 from Rs. 1,009.11 crores in Fiscal 2014, mainly related to ongoing development of new products and product variants.

Other Income: Other Income totaled Rs. 1,881.41 crores in Fiscal 2015 compared to Rs. 3,833.03 crores in Fiscal 2014. In Fiscal 2014, the Company has divested its investments in certain foreign subsidiaries to TML Holdings Pte. Ltd., a wholly owned subsidiary resulting in a profit of Rs. 1,966.12 crores.

Profit before Exceptional Item, Depreciation, Interest and Tax (PBDIT) was Rs. 1,081.40 crores in Fiscal 2015, compared to Rs. 3,366.28 crores in Fiscal 2014. Lower volumes and intense competition resulted in negative operating profit. This was offset by dividends from subsidiaries and profit from divestments of investments in certain foreign subsidiaries.

Depreciation and Amortization expense (including product development/engineering expenses) increased by 21.7% in Fiscal 2015 to Rs. 3,040.69 crores compared to Rs. 2,499.04 crores in Fiscal 2014. Depreciation increased by Rs. 137.20 crores, whereas amortization increased by Rs. 395.72 crores in Fiscal 2015. This increase includes a one-time charge of Rs. 170.66 crores of accelerated depreciation and amortization on tangible and intangible assets, pertaining to certain vehicle models. Further, the increase is also due to new projects capitalized/launched in current year, such as Ultra Trucks, Zest and Bolt.

Finance Costs increased by 19.1% to Rs. 1,611.68 crores in Fiscal 2015 from Rs. 1,353.18 crores in Fiscal 2014, mainly due to an increase in borrowings. Furthermore, the increase was also attributable to charge of debt issue cost on prepayment of ECB and prepayment premium on 2% NCDs.

Exceptional Items

- In accordance with the accounting policy followed by the Company, the exchange gain/loss on foreign currency long-term monetary items is amortised over the tenor of such monetary item. The net exchange loss including on revaluation of foreign currency borrowings, deposits and loans and amortisation was Rs. 320.50 crores in Fiscal 2015 compared to Rs. 273.06 crores in Fiscal 2014. This includes the unamortised exchange loss of Rs. 216.07 crores pertaining to prepayment of ECB of USD 500 million.

- Employee separation cost: To address the challenges of business downturn, the Company introduced an organisation-wide cost optimisation programme, which included employee cost as important pillar and has given early retirement to various employees which resulted in a charge of Rs. 83.25 crores in Fiscal 2015 compared to Rs. 47.28 crores in Fiscal 2014.

Loss before Tax was Rs. 3,974.72 crores in Fiscal 2015 as compared to Loss before Tax of Rs. 1,025.80 crores in Fiscal 2014. The loss was mainly attributable to lower LCV volumes and increases in variable marketing expenses, which resulted in lower operating margins and under-absorption of fixed costs.

Tax expenses - There was a tax expense of Rs. 764.23 crores in Fiscal 2015 as compared to tax credit of Rs. 1,360.32 crores in Fiscal 2014. There was a tax expense after considering the tax benefit on R&D expenditure, provision of disallowances and the tax treatment of foreign exchange differences.

Loss After Tax was Rs. 4,738.95 crores in Fiscal 2015 as compared to profit of Rs. 334.52 crores in Fiscal 2014. Consequently, basic Earnings Per Share (EPS) decreased to negative Rs. 14.72 in Fiscal 2015 as compared to positive Rs. 1.03 in Fiscal 2014 for Ordinary Shares and to negative Rs. 14.72 in Fiscal 2015 as compared to positive Rs. 1.13 in Fiscal 2014 for 'A' Ordinary Shares.

Standalone Balance Sheet

Shareholders' funds decreased to Rs. 14,862.59 crores as at March 31, 2015 compared to Rs. 19,176.65 crores as at March 31, 2014.

Reserves decreased to Rs. 14,218.81 crores as at March 31, 2015 from Rs. 18,532.87 crores as at March 31, 2014, due to Loss after tax in Fiscal 2015 of Rs. 4,738.95 crores, off set by a reversal of redemption premium (credit to Securities Premium) of Rs. 175.05 in Fiscal 2015 and amortization of balance in Foreign Currency Translation Reserve Account of Rs. 186.29 crores (net) in Fiscal 2015.

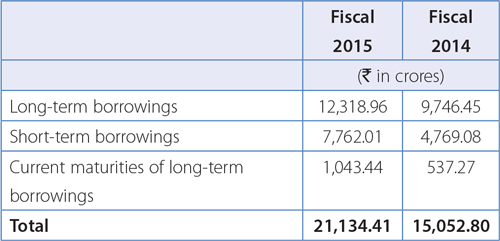

Borrowings:

During Fiscal 2015, the Company issued USD 500 million 4.625% senior unsecured notes due 2020 and USD 250 million 5.750% senior unsecured notes due 2024. The proceeds have been used to refinance existing USD 500 million of ECB, of the Company. The proceeds are being used to incur new additional capital expenditure and other permitted purposes as per RBI ECB guidelines. Furthermore, the Company prepaid 2% NCDs of Rs. 1,250 crores (due March 31, 2016) with a redemption premium of Rs. 744.18 crores.

There was an increase in short-term borrowings because of an increase in commercial paper issuances.

Trade payables were Rs. 8,852.65 crores as at March 31, 2015 as compared to Rs. 9,672.36 crores as at March 31, 2014, which is primarily attributable to a decrease in acceptances due to lower sales volumes.

Provision (current and non-current) were Rs. 2,717.28 crores as at March 31, 2015 and Rs. 2,708.11 crores as at March 31, 2014. The provisions are mainly towards warranty, employee retirement benefits, delinquency and proposed dividends. Provision for delinquency (100% manufacturer guaranteed financing) made during the year is Rs. 1,175.94 crores, as compared to Rs. 935.86 crores in Fiscal 2014, representing an increase of 2.6%, on account of defaults primarily by small commercial vehicle operators, suffering due to lack of cargos, reduced trips and waiting periods.

Fixed Assets include tangible and intangible assets. The tangible assets (net of depreciation and including capital work in progress) decreased a marginal 1.7% to Rs. 13,610.45 crores as at March 31, 2015 compared to Rs. 13,850.35 crores as at March 31, 2014. The intangible assets (net of amortisation, including the projects under development), increased 6.0% to Rs. 8,213.57 crores as at March 31, 2015 compared to Rs. 7,745.29 crores as at March 31, 2014. The intangible assets under development were Rs. 4,690.84 crores as at March 31, 2015, which relate to new products planned in the future.

Investments (Current + Non-current) decreased 8.0% to Rs. 16,987.17 crores as at March 31, 2015 as compared to Rs. 18,458.42 crores as at March 31, 2014.

During Fiscal 2015, there was a redemption of 6.25% cumulative redeemable preference shares of USD 1 each at par of TML Holdings Pte. Ltd., of Rs. 1,658.24 crores. The Company has also divested equity shares of certain foreign subsidiary companies to TML Holdings Pte. Ltd. of Rs. 145.66 crores. This was partly off set by increase in investments in subsidiaries and associates of Rs. 319.15 crores.

Inventories increased 24.3% to Rs. 4,802.08 crores as at March 31, 2015 compared to Rs. 3,862.53 crores as at March 31, 2014. The total inventory is to 44 days of sales both in Fiscal 2015 and Fiscal 2014.

Trade Receivables (net of allowance for doubtful debts) decreased 8.4% to Rs. 1,114.48 crores as at March 31, 2015 compared to Rs. 1,216.70 crores as at March 31, 2014. The reduction reflects lower volumes and steps taken by the Company to control credit. The receivables represented 12 days as at March 31, 2015 compared to 16 days as at March 31, 2014. The amount outstanding for more than six months (gross) has reduced to Rs. 759.23 crores as at March 31, 2015 from Rs. 786.21 crores as at March 31, 2014. These represented dues from Government-owned transport companies and some of the Company's dealers. The overdue amounts are monitored and the Company has taken steps to recover these. However, based on the Company's assessment on non-recoverability of these overdues, these have been provided and the allowances for doubtful debts were Rs. 572.27 crores as at March 31, 2015 against Rs. 511.36 crores as at March 31, 2014, an increase of 11.9%.

Cash and bank balances increased to Rs. 944.75 crores as at March 31, 2015 compared to Rs. 226.15 crores as at March 31, 2014. This increase is due to an increase in fixed deposits with banks, principally, a surplus fund of the proceeds of senior notes USD 250 million.