(Referred to in paragraph 1 under "Report on Other Legal and Regulatory Requirements" section of our report of even date to the Members of Tata Motors Limited)

- In respect of its fixed assets:

- The Company has maintained proper records showing full particulars, including quantitative details and situation of fixed assets;

- The fixed assets were physically verified during the year by the Management in accordance with a regular programme of verification which, in our opinion, provides for physical verification of all the fixed assets at reasonable intervals. According to the information and explanations given to us, no material discrepancies were noticed on such verification.

- In respect of its inventories:

- As explained to us, the stock of finished goods and work-in-progress in the Company's custody have been physically verified by the Management as at the end of the financial year, before the year-end or after the year-end, other than a significant part of the spare parts held for sale, and raw materials in the Company's custody for both of which, there is a perpetual inventory system and a substantial portion of the stocks have been verified during the year. In our opinion, the frequency of verification is reasonable. In case of materials and spare parts held for sale lying with third parties, certificates confirming stocks have been received periodically for stocks held during the year and for a substantial portion of such stocks held at the year-end;

- In our opinion and according to the information and explanations given to us, the procedures of physical verification of inventories followed by the Management were reasonable and adequate in relation to the size of the Company and the nature of its business;

- In our opinion and according to the information and explanations given to us, the Company has maintained proper records of its inventories and no material discrepancies were noticed on physical verification.

- According to the information and explanations given to us, the Company has granted loans, secured or unsecured, to companies, firms or other parties covered in the Register maintained under Section 189 of the Companies Act, 2013. In respect of such loans:

- The receipts of principal amounts and interest have been as per stipulations.

- There is no overdue amount in excess of Rs. 1 lakh remaining outstanding as at the year-end.

- In our opinion and according to the information and explanations given to us, having regard to the explanations that some of the items purchased are of special nature and suitable alternative sources are not readily available for obtaining comparable quotations, there is an adequate internal control system commensurate with the size of the Company and the nature of its business with regard to purchases of inventory and fixed assets and the sale of goods and services. During the course of our audit, we have not observed any major weakness in such internal control system.

- According to the information and explanations given to us, the Company has not accepted any deposit during the year. In respect of unclaimed deposits, the Company has complied with the provisions of Sections 73 to 76 or any other relevant provisions of the Companies Act.

- We have broadly reviewed the cost records maintained by the Company pursuant to the Companies (Cost Accounting Records) Rules, 2014 as amended and prescribed by the Central Government under sub-section (1) of Section 148 of the Companies Act, 2013, and are of the opinion that prima facie, the prescribed cost records have been made and maintained. We have, however, not made a detailed examination of the cost records with a view to determine whether they are accurate or complete.

- According to the information and explanations given to us, in respect of statutory dues:

- The Company has generally been regular in depositing undisputed statutory dues, including Provident Fund, Employees' State Insurance, Income tax, Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty, Cess and other material statutory dues applicable to it with the appropriate authorities. We are informed by the Company that the Employees' State Insurance Act, 1948 is applicable only to certain locations of the Company. With regard to the contribution under the Employees' Deposit Linked Insurance Scheme, 1976 (the Scheme), we are informed that the Company has its own Life Cover Scheme, and consequently, an application has been made seeking an extension of exemption from contribution to the Scheme, which is awaited.

- There were no undisputed amounts payable in respect of Provident Fund, Investor Education and Protection Fund, Employees' State Insurance, Income-tax, Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty, Cess and other material statutory dues in arrears as at March 31, 2015 for a period of more than six months from the date they became payable.

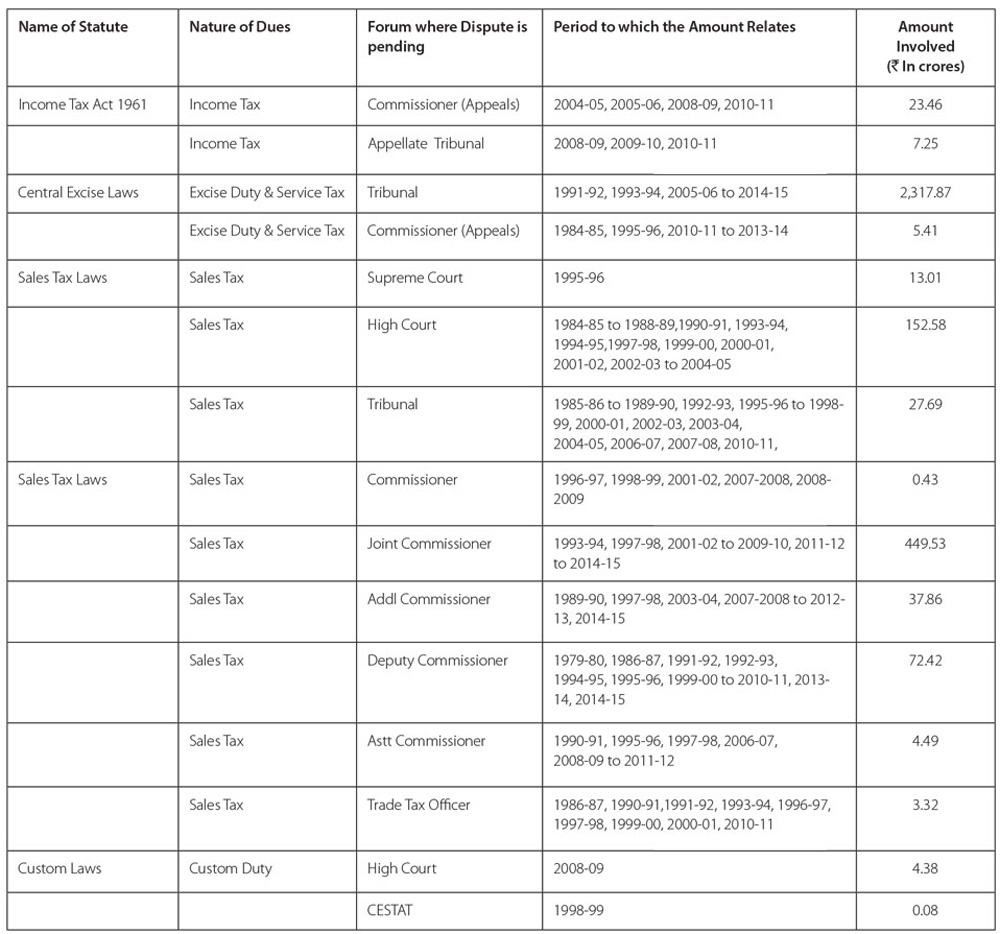

- Details of dues of Income-tax, Sales Tax, Service Tax, Customs Duty, Excise Duty and Cess which have not been deposited as on March 31, 2015 on account of disputes are given below:

- The Company has been generally regular in transferring amounts to the Investor Education and Protection Fund in accordance with the relevant provisions of the Companies Act, 1956 (1 of 1956) and Rules made thereunder within time.

- The accumulated losses of the Company at the end of the financial year are less than fifty per cent of its net worth and the Company has incurred cash losses during the financial year covered by our audit but has not incurred cash losses in the immediately preceding financial year.

- In our opinion and according to the information and explanations given to us, the Company has not defaulted in the repayment of dues to financial institutions, banks and debenture holders.

- According to the information and explanations given to us, the Company has not given guarantees for loans taken by others from banks or financial institutions.

- In our opinion and according to the information and explanations given to us, the term loans have been applied by the Company during the year for the purposes for which they were obtained, other than temporary deployment pending application.

- To the best of our knowledge and according to the information and explanations given to us, no fraud by the Company and no material fraud on the Company has been noticed or reported during the year.

For DELOITTE HASKINS & SELLS LLP

Chartered Accountants

(Firm's Registration No.117366W / W100018)

B.P. SHROFF

Partner

(Membership No. 34382)

Place: Mumbai

Date: May 26, 2015