Leveraging brand equity: The Company believes customers associate the Tata name with reliability, trust and ethical values, and that the Company brand name gains significant international recognition due to the international growth strategies of various Tata companies. The Tata brand is used and its benefits are leveraged by Tata companies to their mutual advantage. The Company recognises the need for enhancing its brand recognition in highly competitive markets in which it compete with internationally recognized brands. The Company, along with Tata Sons and other Tata companies, will continue to promote the Tata brand and leverage its use in India and various international markets where the Company plans to increase its presence. Supported by the Tata brand, the Company believes its brands such as Indica, Indigo, Sumo, Safari, Aria, Venture, Nano, Prima, Ace, and Magic, along with Daewoo, Jaguar, Range Rover and Land Rover, are highly regarded, which the Company intends to nurture and promote further. At the same time, the Company will continue to build new brands, such as the newly launched Ultra range of LCVs, the Zest and the Bolt to further enhance its brand equity.

The Company's commercial vehicle initiative, Project Neev, provides a growth program for rural India designed to promote self-employment. Local, unemployed rural youth have been enrolled and trained to work from homes as promoters of the Company's commercial vehicles. Project Neev is currently operational in twelve states of India and has engagement in 365 districts and 2,981 sub-districts, which covers more than 427,000 villages. The rural penetration drive initiated through Project Neev has deployed an approximately 5,000 member dedicated team and 600 dedicated rural outlets in towns and villages with populations of less than 50,000. More than 71,144 small commercial vehicles have been sold since the commencement of this program, to which the Company attributes a 20% increase in volumes of small commercial vehicle sales. Project Neev currently completed its fourth wave of expansion, and the Company anticipates that it will operate in all major states across the country within the next couple of years. This programme has been appreciated and recognized in various forums such as Rural Marketing Association of India Flame Awards for excellence in the field of rural marketing.

Another initiative through the Company's commercial Vehicles business is TATA-OK. TATA-OK seeks to promote the Company's commercial vehicles by capturing new customer segments (such as economical and used vehicle buyers), promoting the sale of new vehicles through the exchange of used commercial vehicles at the Company's dealerships, increasing the resale value of its commercial vehicles products, and facilitating deeper customer engagement and thereby promoting brand loyalty. TATA-OK has completed four years of operation, including a pilot year, with retailed over 10,600 transactions in Fiscal 2015 through over 220 retailers. The Company offers a variety of support products and services for its customers. TataFleetMan, the Company's telematics and fleet management service, is designed to enable the commercial sector to boost productivity and profitability. With the goal of bringing the most advanced technology in this area to its customers, the Company has entered into a partnership with U.K.-based Microlise Limited to introduce global standards of telematics and fleet management solutions into the Indian logistics and transport industry, to enhance TataFleetMan's telematics systems through upgrades of the underlying technology and to develop the next generation of fleet telematics solutions for the Indian transport industry.

In Fiscal 2015, Tata Alert Service providing breakdown assistance by promising to return vehicle on road within 48 hours was extended to all National highway and State highways. The service now covers 45 models ( including M&HCV trucks, ICV trucks and Buses) and cover 24,50,000 + Kms Pan India.

The Company's flagship safety program, Humare Bus Ki Baat Hain, won several accolades this year, such as Global Marketing Excellence Awards and Brand Excellence Awards in the Sustainable Marketing Excellence and Effective Use Of Marketing Communication categories from World Marketing Congress, and has reached out to over 15,000 school bus staff on school bus safety. The Company also launched Tata SKOOLMAN, a student and school bus safety initiative, which is a telematics-based tracking solution, as a standard accessory for Tata Ultra range of school buses.

The Company also organized the Prima Truck Racing Championship Season 2, which drew in over 45,000 spectators.

Environmental performance: The Company's strategy is to invest in products and technologies with the goal of positioning it ahead of expected stricter environmental regulations and ensuring that the Company benefits from a shift in consumer awareness of the environmental impact of the vehicles that consumers drive. The Company is the largest investor in automotive research and development in the United Kingdom as measured by GBP.

The Company uses aluminium and other lightweight materials to reduce vehicle weight and thus improve fuel and CO2 efficiency. The Company plans to continue to build on this expertise and extend the application of aluminium construction as it develops a range of new Jaguar products, including the new Jaguar XE and the recently announced Jaguar performance crossover, the F-PACE. Recognising the need to use resources responsibly, produce less waste and reduce the its carbon footprint, the Company is also taking measures to reduce emissions, waste and the use of natural resources in all of its operations. The Company is also developing more efficient powertrains and other technologies. This includes smaller and more efficient diesel and petrol engines, stop-start and hybrid engines, starting with a high-efficiency diesel hybrid engine in the Range Rover and Range Rover Sport and the introduction of the Ingenium four cylinder (2.0-litre) engines, which will first be installed in the new Jaguar XE.

The Company's current product line-up is the most efficient it has ever been. The most efficient version of the Range Rover Evoque emits less than 130 g/km. The all-aluminium Jaguar XJ 3.0 V6 twin-turbo diesel has CO2 emissions of 159 g/km. The 3.0-litre TDV6 Range Rover offers similar performance to the previous 4.4-litre TDV8 Range Rover while fuel consumption and CO2 emissions have been reduced (now 196 g/km). The 2.0-litre turbocharged petrol engine options in the Range Rover Evoque and the Jaguar XF and XJ also offer improved fuel efficiency. Equipped with stop-start and an eight-speed automatic transmission, the XF 2.2-litre diesel was further improved for the 2014 Model Year with CO2 emissions cut to 129 g/km. In addition Jaguar Land Rover launched first hybrid electric vehicles in the Range Rover and Range Rover Sport 3.0L TDV6 Hybrid with emissions of 169 g/km. The new Jaguar XE is expected to be the most fuel-efficient Jaguar yet with expected fuel consumption and CO2 emissions on the NEDC combined cycle of 76 mpg and 99g/km, respectively. The new Discovery Sport will be launched with a range of four-cylinder turbocharged petrol and diesel engines. The all-alloy Si4 2.0-litre petrol engine, a 2.2-litre turbo diesel engine featuring stop-start technology and a ED4 turbo diesel engine with expected CO2 emissions of just 119g/km is expected to be introduced in Fiscal 2016.

Mitigating cyclicality: The automobile industry is impacted by cyclicality. To mitigate the impact of cyclicality, the Company plans to continually strengthen its operations by gaining market share across different vehicle categories and offering a wide range of products in diverse geographies. For example, the Company is focusing on shifting its offerings in the defense sector from pure logistical solutions to tactical and combat solutions, which the Company believes will be less affected by cyclicality. The Company also plans to continue to strengthen its business operations other than vehicle sales, such as financing of its vehicles, spare part sales, service and maintenance contracts, sales of aggregates for non-vehicle businesses, reconditioning of aggregates and sales of castings, production aids, toolings and fixtures, to reduce this cyclical impact of the automotive industry on the Company's financial performance.

Expanding the Company international business: The Company's international expansion strategy involves entering new markets where it has an opportunity to grow and introducing new products to existing markets in order to grow its presence in such markets. The Company's international business strategy has already resulted in the growth of its international operations in select markets and chosen segments over the last five years. In recent years, the Company has grown its market share across various African markets such as Kenya, Nigeria, Tanzania, Congo and Senegal, introduced certain products in Australia, and is focused on increasing the presence in key markets in Southeast Asia and Latin America. The Company is also actively considering expanding its global manufacturing footprint in key international markets to take advantage of import duty differentials and local sourcing.

The Company has also expanded its range through acquisitions and joint ventures. Through Jaguar Land Rover, the Company now offer products in the premium performance car and premium all-terrain vehicle categories with globally-recognised brands and has diversified its business across markets and product categories. In Fiscal 2015, Jaguar Land Rover commenced operations at its manufacturing and assembly joint venture in China with Chery Automobile Company Ltd, which opened in October 2014. The Company will continue to build upon the internationally recognized brands of Jaguar Land Rover. TDCV continues to be the largest exporter of heavy commercial vehicles from South Korea. The Company has established a joint venture along with Thonburi in Thailand to manufacture pickup trucks and any other product lines that would be suitable for the market going forward. Tata Motors (SA) (Proprietary) Ltd., which caters to the domestic South African market, has produced and sold over 800 chassis as of the end of Fiscal 2015.

Jaguar Land Rover also has ambitious plans to continue to develop the product range, for example the new Jaguar F-PACE performance crossover, which goes on sale in 2016, will be a new product offering for the Jaguar portfolio. Similarly, Jaguar Land Rover continues to expand its Land Rover product offerings with the announcement of the Range Rover Evoque convertible, which also goes on sale in 2016.

Jaguar Land Rover intends to expand its global footprint, particularly into emerging and developed markets by increasing marketing and dealer network in emerging markets. For example, in China, Jaguar Land Rover established a national sales company in 2010 to expand its presence in this key market and has increased network of sales dealerships to 189 dealerships as at March 31, 2015.

In addition, Jaguar Land Rover intends to establish new manufacturing facilities such as the manufacturing facility due to open in Brazil in 2016. Jaguar Land Rover also continues to explore further broadening its international manufacturing base.

Reducing operating costs: The Company's ability to leverage its technological capabilities and the manufacturing facilities among its commercial vehicle and passenger vehicle businesses enables it to reduce costs. As an example, the diesel engine used in the Indica platform was modified for use in the Ace platform, which helped to reduce development costs. Similarly, platform sharing for the manufacture of pickup trucks and utility vehicles enables the Company to reduce capital investment that would otherwise be required, while allowing it to improve the utilisation levels at its manufacturing facilities. Where it is advantageous for the Company to do so, it intends to add its existing low-cost engineering and sourcing capability to vehicles manufactured under the Jaguar and Land Rover brands.

The Company's vendor relationships also contribute to cost-reductions. For example, the Company believes that the vendor rationalisation program that it is undertaking will provide economies of scale to its vendors, which would benefit the Company's cost programmes. The Company is also undertaking various internal and external benchmarking exercises that would enable it to improve the cost effectiveness of its components, systems and sub-systems.

The Company has intensified efforts to review and realign its cost structure through a number of measures, such as reduction of manpower costs and rationalisation of other fixed costs. The Jaguar Land Rover business has undertaken several cost control and cost management initiatives, such as increased sourcing of materials from low-cost countries, reductions in the number of suppliers, the rationalisation of its marketing efforts, a reduction of manpower costs through increased employee flexibility between sites and several other initiatives. Furthermore, Jaguar Land Rover is exploring opportunities through reduction in number of platforms as well as engineering costs, increased use of off-shoring and several other initiatives.

Enhancing capabilities through the adoption of superior processes: Tata Sons and the entities promoted by Tata Sons, including the Company, aim at improving quality of life through leadership in various sectors of national economic significance. In pursuit of this goal, Tata Sons and the Tata Sons promoted entities have institutionalised an approach, called the Tata Business Excellence Model, which has been formulated along the lines of the Malcolm Baldridge National Quality Award, to enable the Company to improve performance and attain higher levels of efficiency in its businesses and in discharging the Company's social responsibility. The model aims to nurture core values and concepts embodied in various focus areas such as leadership, strategic planning, customers, markets and human resources, and to translate them to operational performance. The Company's adoption and implementation of this model seeks to ensure that its business is conducted through superior processes compared to its competitors.

The Company has deployed a balance score card system for measurement-based management and feedback. The Company has also deployed a product introduction process for systematic product development and a product lifecycle management system for effective product data management across its organisation. The Company has adopted various processes to enhance the skills and competencies of its employees. The Company has also enhanced its performance management system with appropriate mechanisms to recognise talent and sustain its leadership base. The Company believes these measures will enhance its way of doing business, given the dynamic and demanding global business environment.

Expanding customer financing activities: With financing a critical factor in vehicle purchases and the rising aspirations of consumers in India, the Company intends to expand its vehicle financing activities to enhance vehicle sales. In addition to improving its competitiveness in customer attraction and retention, the Company believes that expansion of its financing business would also contribute towards moderating the impact on its financial results from the cyclical nature of vehicle sales. To spur growth in the small commercial vehicles category, the Company has teamed up with various public sector and cooperative banks and Grameen banks to introduce new finance schemes. TMFL has increased its reach by opening a number of limited services branches in tier 2 and 3 towns. This has reduced turn-around times and improved customer satisfaction. TMFL's Channel Finance initiative and fee-based insurance support business has also helped improve profitability.

Continuing to invest in technology and technical skills: The Company believes it is one of the most technologically advanced indigenous vehicle manufacturers in India. Over the years, the Company has enhanced its technological strengths through extensive in-house research and development activities. Further, the Company's research and development facilities at its subsidiaries, such as TMETC, TDCV, TTL, and Trilix, together with the two advanced engineering and design centres of Jaguar Land Rover, have increased its capabilities in product design and engineering. The Jaguar Land Rover business is committed to continue to invest in new technologies to develop products that meet the opportunities of the premium market, including developing sustainable technologies to improve fuel economy and reduce CO2 emissions. The Company considers technological leadership to be a significant factor in its continued success, and therefore intends to continue to devote significant resources to upgrade its technological base.

Maintaining financial strength: The Company's cash flow from operating activities in Fiscal 2015 and Fiscal 2014 was Rs. 35,182.89 crores and Rs. 36,151.16 crores, respectively. The Company's operating cash flows is primarily due to volumes at Jaguar Land Rover business. The Company has established processes for project evaluation and capital investment decisions with the objective of enhancing its long-term profitability.

Automotive Operations

Automotive operations is the Company's most significant segment, accounting for 99.5% of its total revenues in Fiscal 2014 and 2015. Revenue from automotive operations before inter-segment eliminations increased by 12.9% to Rs. 261,477.08 crores in Fiscal 2015 as compared to Rs. 231,601.80 crores in Fiscal 2014.

The Company's automotive operations include:

- activities relating to the development, design, manufacture, assembly and sale of vehicles as well as related spare parts and accessories;

- distribution and service of vehicles; and

- financing of the Company's vehicles in certain markets.

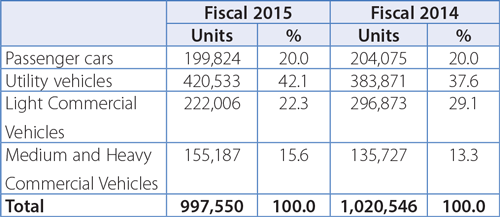

The Company's consolidated total sales (including international business sales and Jaguar Land Rover sales, including Chery JLR) for Fiscals 2014 and 2015 are set forth in the table below:

The automotive operations segment is further divided into (i) Tata and other brand vehicles (including vehicle financing) and (ii) Jaguar Land Rover.

Tata and other brand vehicles (including vehicle financing)

India is the primary market for Tata and other brand vehicles (including vehicle financing). During Fiscal 2015, there was generally a slight and gradual economic recovery in the geographic markets in which Tata and other brand vehicles segment has operations. However, competitive pressures continued across all major products of the Tata and other brand vehicle segment leading to a decrease in vehicle sales volumes.

The Indian economy experienced a GDP growth of 7.3% in Fiscal 2015, compared to 6.9% in Fiscal 2014 (based on data from the Ministry of Statistics and Program Implementation). The Indian automobile industry experienced an increase of 2.5% in Fiscal 2015, as compared to a 9.3% decrease in Fiscal 2014. Falling crude oil prices, lower inflation, resumption of manufacturing and mining activities, and lower interest rates appear to be helping the Indian auto industry revive after two years of decline.

Nevertheless, demand in the light commercial vehicles product category was affected due to the lack of financing for potential customers in Fiscal 2015. In addition, high default rates for loans along with early delinquencies has led financiers to tighten lending norms—for example, by lowering the loan-to-value ratio on new financings and by focusing on collection of existing loans instead of extending new loans for small commercial vehicles. This has impacted the sales volumes for light commercial vehicles overall.

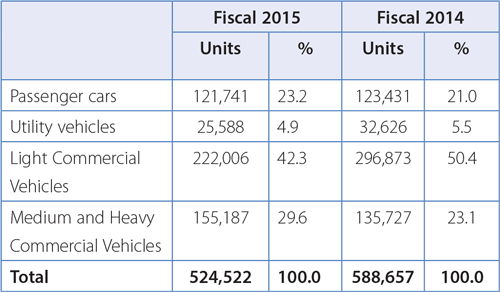

The following table sets forth the Company consolidated total sales of Tata and other brand vehicles:

The Company's overall sales of Tata and other brand vehicles decreased by 10.9% to 524,522 units in Fiscal 2015 from 588,657 units in Fiscal 2014, however, the revenue (before inter-segment elimination) increased by 6.8% to Rs. 44,111.24 crores during Fiscal 2015, compared to Rs. 41,299.44 crores in Fiscal 2014, due to a better product mix, primarily due to relatively more sales of M&HCVs as a proportion of overall sales in Fiscal 2015 compared to Fiscal 2014.