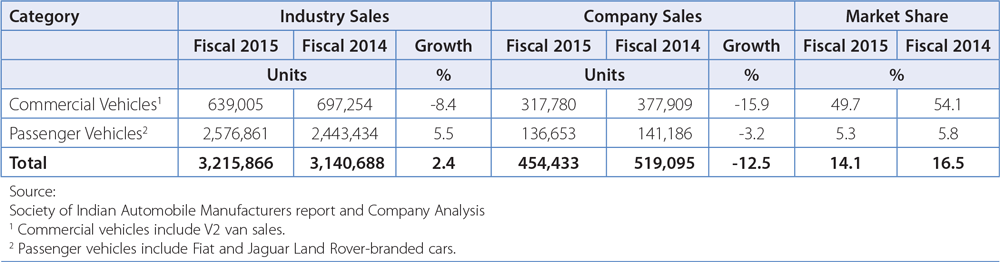

Vehicle Sales in India

The following table sets forth the Company's (on standalone basis) sales, industry sales and relative market share in vehicle sales in India. Passenger vehicles includes passenger cars and utility vehicles. Commercial vehicles includes medium and heavy commercial vehicles and light commercial vehicles.

Passenger Vehicles in India

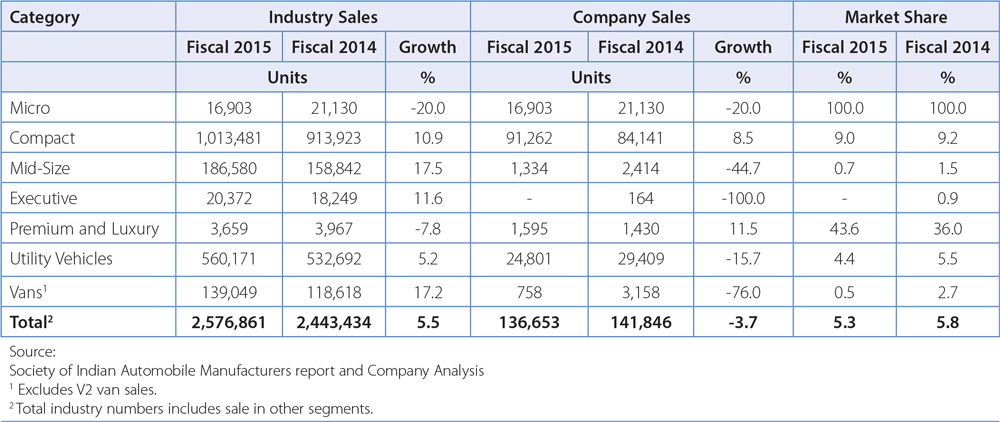

Sales in the passenger vehicles industry in India increased by 5.5% in Fiscal 2015, compared to a decline of 4.7% in Fiscal 2014. The growth in sales volumes was reflected across both passenger vehicle categories and was primarily attributable to reduced fuel prices, improved consumer sentiments, and lower interest rates. Hatchback sales remained flat, but sedans continued to show significant growth with new launches.

The utility vehicle segment has also shown growth, mainly with strong performances in soft-road SUVs and multi-purpose vehicles.

Notwithstanding growth in the Indian passenger vehicle sector, the Company's passenger vehicle sales in India decreased by 3.7% to 136,653 units in Fiscal 2015 from 141,846 units in Fiscal 2014, due to fewer new-product offerings by the Company compared to its competitors.

The domestic performance in passenger vehicle segment is given below:

The Company's passenger vehicle category consists of (i) passenger cars and (ii) utility vehicles. The Company sold 111,094 units in the passenger car category in Fiscal 2015, representing an increase of 1.7% compared to 109,279 units in Fiscal 2014. The Company sold 16,903 Nano cars in Fiscal 2015, a decrease of 20.0% compared to 21,130 units in Fiscal 2014. On August 12, 2014, the Company launched the Zest, a compact sedan, and sold 23,991 units during the period from August 12, 2014 to March 31, 2015. In January 2015, the Company began sales of the Bolt hatchback, which sold 6,744 units from its launch to March 31, 2015. In the utility vehicles category, the Company sold 25,559 units in Fiscal 2015, representing a decrease of 21.5% from 32,567 units in Fiscal 2014.

In India, sales of Jaguar Land Rover vehicles increased by 0.8% to 2,827 units in Fiscal 2015, compared to 2,805 units in Fiscal 2014.

Commercial Vehicles in India

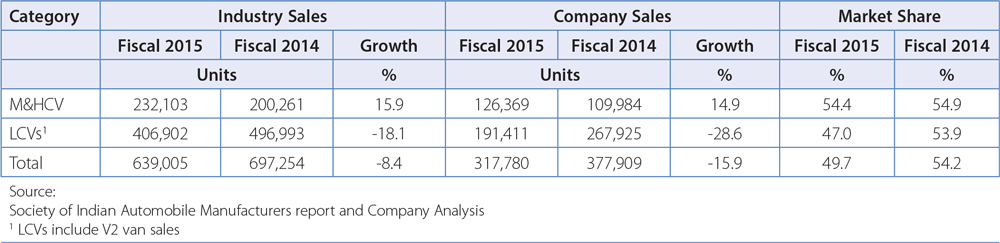

The following table sets forth the Company's commercial vehicle sales, industry sales and relative market share in commercial vehicle sales in India.

Industry sales of commercial vehicles decreased by 8.4% to 639,005 units in Fiscal 2015 from 697,254 units in Fiscal 2014. However, there is some evidence of a recovery in the commercial vehicle industry in India, where volumes grew by 2.5% in the fourth quarter of Fiscal 2015. Industry sales in the medium and heavy commercial vehicle segment increased by 15.9% to 232,103 units in Fiscal 2015 as compared to sales of 200,261 units in Fiscal 2014 primarily due to replacements of fleet vehicles, which was impacted by stable freight rates across key routes, lower diesel prices, higher quantities of cargo transported, a renewal of mining activities in the states of Karnataka and Goa, a renewal of construction activities, and expectations of increased investments in infrastructure and manufacturing. However, industry sales of light commercial vehicles contracted by 18.1% to 406,902 units in Fiscal 2015 from 496,993 units in Fiscal 2014, mainly due to lower freight transportation needs due to high-capacity additions to fleets over recent years, financing defaults and tightened lending norms, all of which continues to impede the recovery in sales of light commercial vehicles, particularly small commercial vehicles sales, which are heavily dependent on funding availability.

Overall, sales of the Company's commercial vehicles in India decreased by 15.9% to 317,780 units in Fiscal 2015 from 377,709 units in Fiscal 2014. The Company's sales in the medium and heavy commercial vehicle category increased by 14.9% to 126,369 units in Fiscal 2015 as compared to sales of 109,984 units in Fiscal 2014. However, sales in the light commercial vehicles segment declined by 28.6% to 191,411 units in Fiscal 2015, from 267,925 units in Fiscal 2014, primarily due to the factors affecting the commercial vehicle market industry-wide.

Tata and other brand vehicles — International Markets

The Company's exports (on standalone basis) remained flat at 49,936 units in Fiscal 2015, compared to 49,922 units in Fiscal 2014. The improvement of the geopolitical situation in the South Asian Association for Regional Cooperation region has contributed to an upsurge in investment in capital goods, which has helped the Company to improve volumes in this region generally, and particularly in Bangladesh. In addition, the launch of new models in the Middle East and Africa region, along with the opening up of new markets in these regions, contributed to an increase in international sales volumes. The Company's top five export destinations for vehicles manufactured in India that is Bangaladesh, Sri lanka, Nepal, South africa and Indonesia accounted for approximately 56% and 79% of the exports of commercial vehicles and passenger vehicles, respectively.

In Fiscal 2015, TDCV's overall vehicles sales increased by 10.5% to 11,710 units, from 10,600 units in Fiscal 2014. In the South Korean market, TDCV's sales increased by 3.4% to 6,808 units in Fiscal 2015 from 6,584 units in Fiscal 2014, primarily due to higher sales in October to December 2014, prompted by emissions norms effective from January 1, 2015. TDCV exported 4,902 units in Fiscal 2015, compared to 4,016 units in Fiscal 2014, an increase of 22.1%. Sluggish market conditions in Russia, South Africa, Algeria and Laos due to adverse sociopolitical conditions were partially offset by increases in sales volumes in Vietnam, the Philippines, and UAE. The Ukraine crisis and financial sanctions contributed to sluggish market conditions in Russia, which affected currency exchange rates and lessened demand for automobiles and for new large projects. Overall sales in South Africa have been affected by the depreciation of the South African Rand and overall limited economic growth. In Algeria and Laos, vehicle demand has been affected by continued political and economic uncertainties, general economic conditions and the absence of major projects. In Vietnam, TDCV has been able to develop new fleet customers to take advantage of a shift in demand to more lightweight commercial vehicles due to stricter application of vehicle-weight regulations.

Tata and other brand vehicles — Sales, Distribution and Support

The sales and distribution network in India as of March 31, 2015 comprised 3,904 sales and service contact points for passenger and commercial vehicles sales. The Company has deployed a Customer Relations Management, or CRM, system at all the Company's dealerships and offices across the country, the largest such deployment in the automotive market in India. The combined online CRM and distributor management system supports users both within the Company and among distributors in India and abroad.

The Company's 100% owned subsidiary, TML Distribution Company Ltd, or TDCL, acts as a dedicated distribution and logistics management company to support the sales and distribution operations of vehicles in India. The Company believes TDCL helps it improve planning, inventory management, transport management and timely delivery.

The Company markets its commercial and passenger vehicles in several countries in Africa, the Middle East, South East Asia, South Asia, Australia, and Russia and the Commonwealth of Independent States countries. The Company has a network of distributors in all such countries where it export its vehicles. Such distributors have created a network of dealers, branch offices and facilities for sales and after-sales servicing of the Company's products in their respective markets. The Company has also stationed overseas resident sales and service representatives in various countries to oversee its operations in the respective territories. The Company uses a network of service centres on highways and a toll-free customer assistance centre to provide 24-hour on-road maintenance (including replacement of parts) to vehicle owners. The Company believes that the reach of its sales, service and maintenance network provides it with a significant advantage over its competitors.

Through the Company's vehicle financing division and wholl-owned subsidiary, TMFL, it provides financing services to purchasers of its vehicles through independent dealers, who act as the Company's agents for financing transactions, and through the Company's branch network. Revenue from the Company's vehicle financing operations decreased by 9.4% to Rs. 2,742.88 crores in Fiscal 2015 as compared to Rs. 3,026.47 crores in Fiscal 2014, mainly due to the generation of fewer automotive-financing loans in India. The decrease in loans was primarily attributable to lower volumes in the light commercial vehicles category, resulting in a reduction of finance receivables.

Due to a sluggish economic environment, total disbursements (including refinancing) by TMFL declined by 16.6% in Fiscal 2015 to Rs. 7,316 crores as compared to Rs. 8,768 crores in Fiscal 2014. TMFL financed a total of 112,788 vehicles in Fiscal 2015, reflecting a decline of 28.6% from the 157,886 vehicles financed in the previous year. Disbursements for commercial vehicles declined by 23.5% to Rs. 5,741 crores (72,853 vehicles) in Fiscal 2015 as compared to Rs. 7,504 crores (123,989 vehicles) for the previous year. However, disbursements of passenger vehicles increased by 23.5% to Rs. 1,498 crores (38,444 vehicles) in Fiscal 2015 as compared to Rs. 1,213 crores (32,637 vehicles) in the previous year. Disbursements achieved for refinancing were Rs. 77 crores (1,491 vehicles) in Fiscal 2015 as against Rs. 50 crores (1,260 vehicles) in the previous year.

Tata and other brand vehicles — Spare Parts and After-sales Activity

The Company's consolidated spare parts and after-sales activity revenue was Rs. 4,053.46 crores in Fiscal 2015, compared to Rs. 4,079.79 crores in Fiscal 2014. The Company's spare parts and after-sales activity experienced limited growth due to weak sales of both commercial vehicles and passenger vehicles in recent years.

Tata and other brand vehicles — Competition

The Company faces competition from various domestic and foreign automotive manufacturers in the Indian automotive market. Improving infrastructure and robust growth prospects compared to other mature markets has attracted a number of international companies to India that have either formed joint ventures with local partners or have established independently owned operations in India. Global competitors bring with them decades of international experience, global scale, advanced technology and significant financial resources, and, as a result, competition is likely to further intensify in the future. The Company has designed its products to suit the requirements of the Indian market based on specific customer needs such as safety, driving comfort, fuel-efficiency and durability. The Company believes that its vehicles are suited to the general conditions of Indian roads and the local climate. The Company's vehicles have also been designed to comply with applicable environmental regulations currently in effect. The Company also offers a wide range of optional configurations to meet the specific needs of its customers. The Company intends to develop and is developing products to strengthen its product portfolio in order to meet the increasing customer expectations of owning worldclass products.

Tata and other brand vehicles — Seasonality

Demand for the Company's vehicles in the Indian market is subject to seasonal variations. Demand for the Company's vehicles generally peaks between January and March, although there is a decrease in demand in February just before release of the Indian fiscal budget. Demand is usually lean from April to July and picks up again in the festival season from September onwards, with a decline in December due to year end.

Jaguar Land Rover

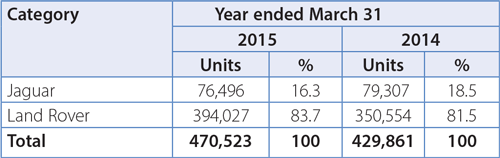

The Company total sales of Jaguar Land Rover vehicles (including Chery JLR) with a breakdown between Jaguar and Land Rover brand vehicles, in the years ended March 31, 2014 and 2015 are set forth in the table below:

In Fiscal 2015, Jaguar Land Rover continued to experience growth in all its geographical markets, including both developing and developed markets, and particularly in the United Kingdom. Growth in volume has been driven by the continued success of the Range Rover, Range Rover Sport and the Jaguar F-TYPE. More established models such as the Range Rover Evoque and the Land Rover Discovery have also been performing well, however more mature products such as the Jaguar XF and XJ experienced lower sales in anticipation of the introduction of the all new Jaguar XE and the new Jaguar XF. Production of Jaguar XK and the Land Rover Freelander were terminated during the year, with the latter replaced by the Land Rover Discovery Sport.

Wholesale volumes in Fiscal 2015 were 470,523 units, an increase of 9.5% from 429,861 units in Fiscal 2014. Wholesale volumes for Jaguar brand vehicles declined by 3.5% to 76,496 units in Fiscal 2015 from 79,307 units sold in Fiscal 2014. Wholesale volumes for Land Rover brand vehicles in Fiscal 2015 were 394,027 units, an increase of 12.4% from 350,554 units in Fiscal 2014, driven by strong sales of all Land Rover models,.

Jaguar Land Rover's performance in key geographical markets on retail basis

Retail volumes in Fiscal 2015 were 462,209 units, an increase of 6.4% compared to Fiscal 2014. Retail volumes in Fiscal 2015 were 76,930 units as compared to 80,522 units in Fiscal 2014 for Jaguar and 385,279 units in Fiscal 2015 as compared to 353,789 units in Fiscal 2014 for Land Rover. Sales in all major markets increased, primarily due to strong sales of the Range Rover, Range Rover Sport and the Jaguar F-TYPE vehicles, which was partially offset by the lack of available Freelander inventory. However, Jaguar volumes were down 3.5% as increased sales of the Jaguar F-TYPE were offset by a fall in volume of the maturing Jaguar XF and XJ models in advance of the introduction of the Jaguar XE and the all new Jaguar XF. Jaguar Land Rover exported 378,427 units in Fiscal 2015, compared to 354,005 units in Fiscal 2014, an increase of 6.9%.

United Kingdom

Industry vehicle sales rose by 7.5% in the UK compared to last year as economic growth improved inflation and interest rates remained low and labour market conditions continued to strengthen. Jaguar Land Rover retail volumes increased by 13.1% to 86,750 units in Fiscal 2015 from 76,721 units in Fiscal 2014, with a strong sales performance from Jaguar, up 7.0% in Fiscal 2015 compared to Fiscal 2014, driven by the Jaguar F-TYPE and the XF. Land Rover retail volumes grew significantly, up 14.8% in Fiscal 2015, as all models experienced an increase in volumes, most notably the Range Rover Sport and the Discovery.

North America

Economic performance in North America continued to strengthen over the year as unemployment continued to fall, lower inflation driven by lower energy prices increased disposable income and consumer confidence continued to grow, contributing to an industry-wide increase in passenger car sales, up 6.8% in Fiscal 2015 compared to Fiscal 2014. Jaguar Land Rover retail volumes grew by 3.6% to 78,372 units in Fiscal 2015 from 75,671 units in Fiscal 2015, with a 9.5% increase in Land Rover sales as Range Rover, Range Rover Sport and Range Rover Evoque sales continued to perform strongly. Jaguar volumes in the United States fell by 13.6% as sales of the aging XF and XJ models slowed partially, offset by strong sales of the popular F-TYPE.

Europe (Excluding United Kingdom and Russia)

Passenger car sales increased by 5.5% industry-wide in Fiscal 2015 compared to Fiscal 2014 in Europe despite low growth, recessionary pressures and ambiguity over the Greek national debt negotiations. Quantitative easing, announced by the ECB in January 2015, has provided a boost in economic activity. Jaguar Land Rover volumes in Rest of Europe that is i.e geographic europe excluding Russia and the UK, increased by 6.0% to 87,863 units in Fiscal 2015 from 82,854 units in Fiscal 2014, with sales particularly strong in Germany, Italy and France. Land Rover volumes were up 9.2% in Fiscal 2015 compared to Fiscal 2014 as sales of the Range Rover Sport and Range Rover grew significantly. Jaguar volumes fell 14.2% in Fiscal 2015 compared to Fiscal 2014, most notably in Germany and Belgium, as sales of the aging XF sedan and Sportbrake fell, which was partially offset by solid sales of the F-TYPE.

China

Jaguar Land Rover retail volumes (which include CJLR) increased by 12.5% in Fiscal 2015 to 115,969 units compared from 103,077 units Fiscal 2014, as Land Rover sales grew by 14.8% with sales of the majority of models up, most notably the Range Rover and Range Rover Sport, while Jaguar volumes increased by 2.8% as both the XF and F-TYPE performed well. However, in the fourth quarter of Fiscal 2015, retail sales of Jaguar Land Rover in China decreased by 20% to 23,526 units from 29,567 units compared to the same period in Fiscal 2014.

Asia Pacific

Jaguar Land Rover retail volumes increased significantly in the Asia Pacific region which includes Australia, Brunei, Indonesia, Japan, South Korea, Malaysia, New Zealand, the Philippines, Singapore, Sri Lanka and Thailand, increased by 16.8% in Fiscal 2015 to 26,919 units compared to 22,795 units in Fiscal 2014, most notably in South Korea (up 46.7%) and in Australia (up 16.4%) as consumer demand for Jaguar Land Rover products continues to rise, which were partially offset by a fall in volumes in Japan as a higher consumption tax impacted consumer spending and economic reforms have yet to have a significant impact. Retail sales of the Range Rover, Range Rover Sport, Land Rover Discovery and Jaguar F-TYPE performed particularly well in Asia Pacific.

Other overseas markets

Emerging market growth has generally been hampered by political and economic factors as well as significant currency devaluation. Jaguar Land Rover's retail volumes in the Rest of the World market declined by 9.0% to 66,636 units in Fiscal 2015 compared to 73,193 units in Fiscal 2014, primarily as a consequence of economic sanctions and low energy prices impacting Russia and slowing economic growth reducing consumer spending in Brazil and South Africa. Slowing economic growth and ongoing recessionary pressures in Brazil have contributed to a decrease in automotive sales industry-wide of 11.0% in Fiscal 2015 compared to Fiscal 2014, and Jaguar Land Rover sales volumes in Brazil have followed suit, decreasing 16.6% in Fiscal 2015 compared to Fiscal 2014. Continuing economic sanctions and softer energy prices have had an adverse effect on passenger car sales industry-wide in Russia, which decreased 17.7% in Fiscal 2015 compared to Fiscal 2014. Jaguar Land Rover sales, however, have fallen comparatively slower, decreasing 9.6% in Fiscal 2015 compared to Fiscal 2014, as Range Rover Sport continued to perform well and F-TYPE volumes increased. South Africa's persistent slow growth continues to impact the automotive industry as passenger car sales fell by 1.7% in Fiscal 2015 compared to Fiscal 2014 and Jaguar Land Rover retail volumes dropped by 23.2% in Fiscal 2015 compared to Fiscal 2014.

Jaguar Land Rover's Sales & Distribution

Jaguar Land Rover markets products in 170 countries, through a global network of 19 national sales companies, 73 importers, 53 export partners and 2,674 franchise sales dealers, of which 915 are joint Jaguar and Land Rover dealers. Jaguar Land Rover has established processes and systems designed to ensure that its production plans meet anticipated retail sales demand and to enable the active management of its inventory of finished vehicles and dealer inventory throughout its network. Jaguar Land Rover has multi-year exclusive branded arrangements in place with: Black Horse (part of the Lloyds Bank Group) in the United Kingdom, FCA Bank (a joint venture between Fiat Chrysler Auto and Credit Agricole) in Europe and Chase Auto Finance in the United States for the provision of dealer and consumer financial services products. Jaguar Land Rover has a number of similar arrangements with local auto financial services providers in other key markets. Jaguar Land Rover's financing partners offer its customers a full range of consumer financing options.

Jaguar Land Rover — Competition

Jaguar Land Rover operates in a globally competitive environment and faces competition from established premium and other vehicle manufacturers that aspire to move into the premium performance car and premium SUV markets, some of which are much larger than the Company. Jaguar vehicles compete primarily against other European brands such as Audi, BMW and Mercedes Benz. Land Rover and Range Rover vehicles compete largely against SUVs manufactured by Audi, BMW, Infiniti, Lexus, Mercedes Benz, Porsche and Volkswagen. The Land Rover Defender competes with vehicles manufactured by Isuzu, Nissan and Toyota.

Jaguar Land Rover — Seasonality

Jaguar Land Rover sales volume is impacted by the semi-annual registration of vehicles in the United Kingdom where the vehicle registration number changes every six months, which in turn has an impact on the resale value of the vehicles. This leads to a concentration of sales during the periods when the change occurs. Seasonality in most other markets is driven by the introduction of new model year derivatives, for example, in the US market. Additionally in the US market, there is some seasonality around the purchase of vehicles in northern states where the purchase of Jaguar vehicles is concentrated in the spring and summer months, and the purchase of 4x4 vehicles is concentrated in the autumn/winter months. In China there is an increase in vehicle purchases during the fourth Fiscal quarter, which includes the Chinese New Year holiday. Furthermore, western European markets tend to be impacted by summer and winter holidays. The resulting sales profile influences operating results on a quarter-to-quarter basis.

Other Operations Overview

The Company's other operations business segment mainly includes information technology services, machine tools and factory automation services. The Company's revenue from other operations before inter-segment eliminations was Rs. 2,747.79 crores in Fiscal 2015, an increase of 9.1% from Rs. 2,518.99 crores in Fiscal 2014. Revenues from other operations represented 1.1% of total revenues, before inter-segment eliminations, in Fiscal 2014 and 2015.

Research and Development

Over the years, the Company has devoted significant resources towards its research and development activities. The Company's research and development activities focus on product development, environmental technologies and vehicle safety. The Company's Engineering Research Centre, or ERC, established in 1966, is one of the few in-house automotive research and development centres in India recognised by the Government. ERC is integrated with all of the Tata Motors Global Automotive Product Design and Development Centers in South Korea, Italy and the United Kingdom. In addition to this, the Company leverages key competencies through various engineering service suppliers and design teams of its suppliers.

The Company has a passenger car electrical and electronics facility for the development of hardware-in-the-loop systems, labcars and infotainment systems to achieve system and component integration. The Company has an advance engineering workshop, with a lithium-ion battery module, for the development of electric vehicle and hybrid products. The Company has a crash test facility for passive safety development in order to meet regulatory and consumer group test requirements and evaluate occupant safety, which includes a full vehicle level crash test facility, a sled test facility for simulating the crash environment on subsystems, a pedestrian safety testing facility, a high strain rate machine and a pendulum impact test facility for goods carrier vehicles. This facility is also supported with computer-aided engineering infrastructure to simulate tests in a digital environment. The Company's safety development facilities also incorporate other equipment the Company believes will help improve the safety and design of its vehicles, such as an emission labs engine development facility, a testing facility for developing vehicles with lower noise and vibration levels, an engine emission and performance development facility and an eight poster test facility that helps to assess structural durability of M&HCVs. In addition, the Company is installing a new engine noise test facility and transmission control unit which the Company expects will aid powertrain development. Other key facilities include a full vehicle environmental testing facility, a material pair compatibility equipment corrosion test facility, heavy duty dynamometers and aggregate endurance test rigs.

The Company's product design and development centres aim to create a highly scalable digital product development and virtual testing and validation environment, targeting to a reduced of product development cycle-time, improved quality and ability to create multiple design options. Global design studios are key part of the Company's product conceptualisation strategy. The Company has aligned its end-to-end digital product development objectives and infrastructure with its business goals and has made significant investments to enhance its capabilities, especially in the areas of product development through computer-aided design, computer aided manufacturing, computer-aided engineering, knowledge-based engineering, product lifecycle management and manufacturing planning. In specific engineering review processes, such as digital mock up, and virtual build and validation, the Company has been able to provide capabilities for reduced time and increased quality in product designs. The design IP is managed through a product lifecycle management system, enabling backbone processes, the Company has institutionalised 'issue tracking' work flow based systems in various domains to manage them effectively.

The Company has initiated a technology platform for small electric vehicles with a GVW of 1 tonne with the National Automotive Board, SIAM and other original equipment manufacturers. In addition, the Company's research and development activities also focus on developing vehicles that consume alternative fuels, including CNG, liquefied petroleum gas, bio-diesel, compressed air and electricity. The Company is continuing to develop greentechnology vehicles and is presently developing an electric vehicle on the small commercial vehicle platform. The Company is pursuing alternative fuel options such as ethanol blending. Furthermore, the Company is working on development of vehicles fueled by hydrogen.

The Company is also pursuing various initiatives, such as the introduction of premium lightweight architecture, to enable its business to comply with the existing and evolving emissions legislations in the developed world, which it believes will be a key enabler of both reduction in CO2 emissions and further efficiencies in manufacturing and engineering.

The Company has implemented initiatives in vehicle electronics, such as engine management systems, in-vehicle network architecture and multiplexed wiring. The Company is in the process of implementing electronic stability programs, automated and automatic transmission systems, telematics for communication and tracking, anti-lock braking systems and intelligent transportation systems. The Company has implemented new driver information technologies and high performance infotainment systems with IT-enabled services. Likewise, various new technologies and systems including hybrid technologies that would improve the safety, performance and emissions of the Company's product range are being implemented in its passenger cars and commercial vehicles.

The Company is developing an enterprise-level vehicle diagnostics system with global connectivity in order to achieve faster diagnostics of complex electronics in vehicles in order to provide prompt service to customers. The Company is also developing prognostic data collection and analysis for failure prediction to the end customer. Furthermore, the Company's initiative in telematics has expanded into a fleet management, driver information and navigation systems, and vehicle tracking system using global navigation satellite systems. The Company intends to incorporate Wi-Fi and Bluetooth interfaces in its vehicles to facilitate secure and controlled connectivity to third-party IT enabled devices.

In 2006, the Company established a wholly-owned subsidiary, TMETC, to augment the abilities of its Engineering Research Centre, or ERC, with an objective to obtain access to leading-edge technologies to support product development activities. In October 2010, the Company also acquired a design house in Italy, Trilix.

Jaguar Land Rover's research and development operations are built around state of the art engineering facilities with an extensive test track, testing centres, design hubs and a recently inaugurated virtual innovation centre. The ERC in India and Jaguar Land Rover's engineering and development operations in the United Kingdom have identified areas to leverage their respective facilities and resources to enhance the product development process and achieve economies of scale.

Jaguar Land Rover's vehicle design teams are committed to a programme of new product design. Jaguar Land Rover's two design and development centres are equipped with computer-aided design, manufacturing and engineering tools configured to support an ambitious product development cycle plan. In recent years, Jaguar Land Rover has refreshed the entire Jaguar range under a unified concept and design language and has continued to enhance the design of Land Rover's range of all-terrain vehicles. Jaguar Land Rover's R&D operations look for synergies through sharing premium technologies, powertrain designs and vehicle architecture. The majority of Jaguar Land Rover's products are designed and engineered in the United Kingdom. Jaguar Land Rover endeavours to implement the best technologies into its product range to meet the requirements of a globally competitive market and to comply with regulatory requirements. Jaguar Land Rover currently offers hybrid technology on some of its models such as the Range Rover and Range Rover Sport and conducts research and development related to the further application of alternative fuels and technologies to further improve the environmental performance of its vehicles including the reduction of CO2 emissions.

The Company aims to utilise the best of technologies for its product range to meet the requirements of a globally competitive market.