ANNEXURE TO THE INDEPENDENT AUDITORS' REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS OF TATA MOTORS LIMITED FOR THE YEAR ENDED MARCH 31, 2015

(Referred to in paragraph 1 under 'Report on Other Legal and Regulatory Requirements' section of our report of even date)

Our reporting on the Order includes an associate company incorporated in India, to which the Order is applicable, which has been audited by another auditor and our report in respect of this company is based solely on the report of the other auditor, to the extent considered applicable for reporting under the Order in the case of the consolidated financial statements.

In respect of a jointly controlled company and an associate company incorporated in India, which have been included in the consolidated financial statements based on unaudited financial statements of such companies provided to us by the Management, whilst in our opinion, and according to the information and explanations given to us, reporting under the Order is applicable in respect of these companies, since these companies are unaudited, the possible effects of the same on our reporting under the Order in the case of the consolidated financial statements has not been considered.

- In respect of the fixed assets of the Holding Company, subsidiary companies, associate companies and jointly controlled company incorporated in India:

- The respective companies have maintained proper records showing full particulars, including quantitative details and situation of fixed assets.

- The Holding Company, subsidiary companies, associate companies and jointly controlled company incorporated in India have a program of verification of fixed assets to cover all the items in a phased manner over a period of three years/reasonable intervals which, in our opinion and the opinion of the other auditor, is reasonable having regard to the size of the respective companies and the nature of their assets. Pursuant to the program, certain fixed assets were physically verified by the Management of the respective companies during the year. According to the information and explanations given to us and the other auditor, no material discrepancies were noticed on such verification.

- In respect of the inventories of the Holding Company, subsidiary companies, associate companies and jointly controlled company incorporated in India:

- As explained to us and the other auditor, the inventories were physically verified during the year by the Management of the respective companies at reasonable intervals. In case of inventory lying with the third parties, certificates confirming stocks have been obtained in respect of substantial portion of the stocks.

- In our opinion and the opinion of the other auditor and according to the information and explanations given to us and the other auditor, the procedures of physical verification of inventories followed by the Management of the respective companies were reasonable and adequate in relation to the size of the respective companies and the nature of their business.

- In our opinion and the opinion of the other auditor and according to the information and explanations given to us and the other auditor, the respective companies have maintained proper records of their inventories and no material discrepancies were noticed on physical verification.

- According to the information and explanations given to us, the Holding Company has granted loans to the extent included in the consolidated financial statements, secured or unsecured, to companies, firms or other parties covered in the Register maintained under Section 189 of the Companies Act, 2013. In respect of such loans:

- The receipts of principal amounts and interest have been regular/as per stipulations.

- There is no overdue amount in excess of Rs.1 lakh remaining outstanding as at the year-end. The subsidiary companies, associate companies and jointly controlled company incorporated in India have not granted any loans, secured or unsecured, to companies, firms or other parties covered in the Register maintained under Section 189 of the Companies Act, 2013 by the respective companies.

- In our opinion and the opinion of the other auditor and according to the information and explanations given to us and the other auditor, there is an adequate internal control system in subsidiary companies and associate company incorporated in India, commensurate with the size of the respective companies and the nature of their businesses for the purchase of inventory and fixed assets and for the sale of goods and services and during the course of our and the other auditor's audit no continuing failure to correct major weaknesses in such internal control system has been observed, except in one subsidiary company, controls over review and monitoring of advances from customers for sale of goods and services, recording of purchases and sales of pre-owned cars and the process of raising claims for various incentives in two of the subsidiary's units, which need to be strengthened.

Further in respect of the holding company, 3 subsidiary companies, 1 jointly controlled company and 1 associate company incorporated in India, in our opinion and the opinion of the other auditor and according to the information and explanations given to us and the other auditor, having regard to the explanations that some/most of the items purchased are of special nature and suitable alternative sources are not readily available for obtaining comparable quotations, there is an adequate internal control system in the Holding Company, subsidiary companies, associate company and jointly controlled company incorporated in India commensurate with the size of the respective companies and the nature of their business with regard to purchases of inventory and fixed assets and the sale of goods and services. During the course of our and the other auditor's audit, no major weakness in such internal control system has been observed. - According to the information and explanations given to us, the Holding Company, subsidiary companies, associate companies and jointly controlled Company incorporated in India have not accepted any deposit during the year. There were no unclaimed deposits, except with the Holding Company which has complied with the provisions of Sections 73 to 76 or any other relevant provisions of the Companies Act, 2013.

- According to the information and explanations given to us and the other auditor, in our opinion and the opinion of the other auditor, the Holding Company, subsidiary companies, associate companies and jointly controlled company incorporated in India have, prima facie, made and maintained the prescribed cost records pursuant to the Companies (Cost Records and Audit) Rules, 2014, as amended, prescribed by the Central Government under subsection (1) of Section 148 of the Companies Act, 2013. Neither we nor the other auditor have, however, made a detailed examination of the cost records with a view to determine whether they are accurate or complete.

- According to the information and explanations given to us and the other auditor, in respect of statutory dues of the Holding Company, subsidiary companies, associate companies and jointly controlled Company incorporated in India:

- The respective companies have generally been regular in depositing undisputed statutory dues, including Provident Fund, Employees' State Insurance, Income-tax, Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty, Value Added Tax, Cess and other material statutory dues applicable to the respective companies with the appropriate authorities.

- Dues of Employees' State Insurance aggregating Rs. 6,323 and Service tax aggregating Rs. 93.60 lacs were due by two subsidiary companies, incorporated in India for a period of more than six months from the date they became due, there were no other undisputed amounts payable by the respective companies in respect of Service Tax, Employees' State Insurance, Provident Fund, Sales Tax ,Wealth Tax, , Customs Duty, Excise Duty, Value Added Tax, Cess and other material statutory dues in arrears as at March 31, 2015 for a period of more than six months from the date they became payable.

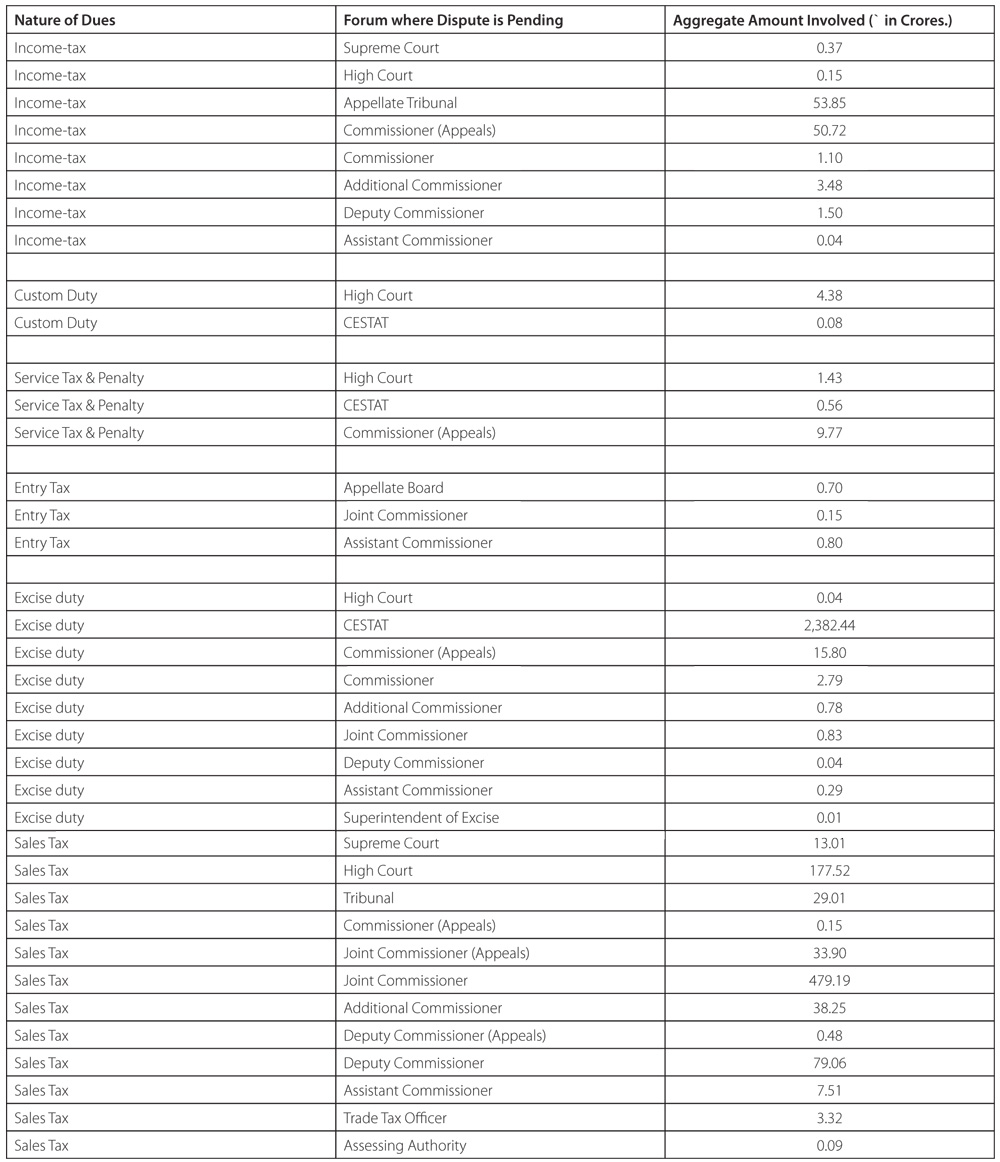

- Details of dues of Income-tax, Sales Tax, Wealth Tax, Service Tax, Customs Duty, Excise Duty, Value Added Tax and Cess which have not been deposited as on March 31, 2015 on account of disputes by the aforesaid companies are given below:

- The aforesaid companies have been generally regular in transferring amounts to the Investor Education and Protection Fund in accordance with the relevant provisions of the Companies Act, 1956 (1 of 1956) and Rules made thereunder within time.

- The Group, its associates and jointly controlled company, does not have consolidated accumulated losses at the end of the financial year and, have not incurred cash losses on a consolidated basis during the financial year covered by our audit and in the immediately preceding financial year.

- In our opinion and the opinion of the other auditor and according to the information and explanations given to us and the other auditor, the Holding Company, subsidiary companies, associate companies and jointly controlled company incorporated in India have not defaulted in the repayment of dues to financial institutions, banks and debenture holders.

- According to the information and explanations given to us, the Holding Company, subsidiary companies, associate companies and jointly controlled company incorporated in India have not given guarantees for loans taken by others from banks and financial institutions, except in case of one subsidiary company where guarantees given by the company, for loans taken by others from banks and financial institutions are not, prima facie, prejudicial to the interests of the Group.

- In our opinion and the opinion of the other auditor and according to the information and explanations given to us and the other auditor, the term loans have been applied by the Holding Company, subsidiary companies, associate companies and jointly controlled company incorporated in India during the year for the purposes for which they were obtained, other than temporary deployment pending application.

- To the best of our knowledge and according to the information and explanations given to us and the other auditor, no fraud by the Holding Company, its subsidiary companies, associate companies and jointly controlled company incorporated in India and no material fraud on the Holding Company, its subsidiary companies, associate companies and jointly controlled company incorporated in India has been noticed or reported during the year.

For DELOITTE HASKINS & SELLS LLP

Chartered Accountants

(Firm's Registration No. 117366W/W-100018)

| B. P. SHROFF | |

| Partner | |

| MUMBAI, May 26, 2015 | (Membership No. 34382) |