Standalone Balance Sheet

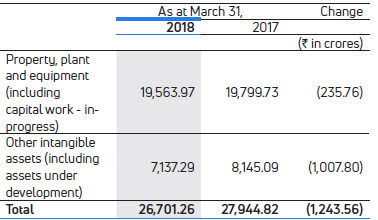

Property, plant and equipment and Other Intangible assets.

There is decrease (net of depreciation and amortization) in the intangible and tangible assets in Fiscal 2018. The decrease is mainly due to higher depreciation and amortization and certain write offs / provision for impairment during the year.

Investments in subsidiaries, joint ventures and associates were Rs.14,632.51 crores as at March 31, 2018, as compared to Rs.14,330.02 crores as at March 31, 2017. During Fiscal 2018, the Company made additional investments of Rs.300 crores in Tata Motors Finance Holdings Ltd.

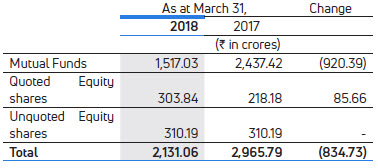

Investments (Current + Non-current) were Rs.2,131.06 crores as at March 31, 2018, as compared to Rs.2,965.79 crores as at March 31, 2017. The details are as follows:

There was decrease in mutual fund investments in Fiscal 2018. Increase in quoted equity shares were due to increase in market value as at March 31, 2018, and also due to investments in the Rights issue of Tata Steel Ltd.

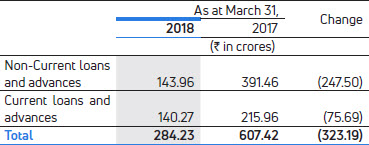

Loans and Advances (Current + Non-current)

Loans and advances include advance to suppliers, contractors etc. Advance and other receivables increased to Rs.68.03 crores as at March 31, 2018, as compared to Rs.82.59 crores as at March 31, 2017, offset by reduction in inter-corporate deposits by Rs.60 crores.

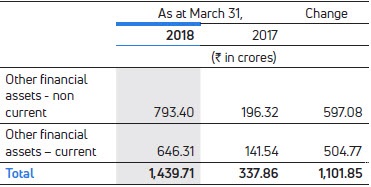

Other Financial Assets (Current + Non-current)

The above includes Rs.878.54 crores on account of accrual of Government grants receivable. Further, it also consists of Rs.242.34 crores of derivative financial instruments, as at March 31, 2018 compared to Rs.291.10 crores as at March 31, 2017, reflecting notional liability due to the valuation of derivative contracts.

Inventories as at March 31, 2018, were Rs.5,670.13 crores as compared to Rs.5,553.01 crores as at March 31, 2017, an increase of 2.1%. In terms of number of days of sales, finished goods represented 13 inventory days in Fiscal 2018 as compared to 23 days in Fiscal 2017.

Trade Receivables (net of allowance for doubtful debts) were Rs.3,479.81 crores as at March 31, 2018, representing an increase of 63.5% compared to Rs.2,128.00 crores as at March 31, 2017. The allowances for doubtful debts were Rs.543.50 crores as at March 31, 2018 compared to Rs.693.17 crores as at March 31, 2017. The increase in Trade receivable is due to year end billings both at Tata Motors Ltd and Fiat India Automobiles Private Ltd.

Cash and cash equivalents were Rs.546.82 crores, as at March 31, 2018, compared to Rs.228.94 crores as at March 31, 2017. The increase was mainly attributable to balances with banks and cheques on hand, offset by deposit with banks.

Other bank balances were Rs.248.60 crores, as at March 31, 2018, compared to Rs.97.67 crores as at March 31, 2017. These include earmarked balances with banks of Rs.248.53 crores as at March 31, 2018, compared to Rs.86.60 crores as at March 31, 2017.

Current tax assets (net) (current + non-current) were Rs.769.63 crores, as at March 31, 2018, compared to Rs.902.16 crores as at March 31, 2017.