During Fiscal 2018, Tata Motors Limited issued rated, listed, unsecured NCDs of Rs.1,500 crores. The proceeds have been utilized for general corporate purpose.

In Fiscal 2018, TMF Holdings Ltd (TMFHL), and its subsidiaries, TMFL & TMFSL, issued NCDs and raised Rs.3,231 crores. Bank borrowings through secured and unsecured term loans continued to remain as the major source of funds for long-term borrowing, and during, Fiscal 2018 Rs.2,330 crores was raised. Overall during Fiscal 2018 for the TMFL group, the short-term debt (net) increased by Rs.50,079 million and long-term debt (net) increased by Rs.72 million.

During Fiscal 2016, TML Holdings Pte. Ltd., a subsidiary of the Company, has

- refinanced an existing unsecured multi-currency loan of US$600 million (US$250 million and SG$62.8 million maturing in November 2017 and US$210 million and SG$114 million maturing in November 2019) with a new unsecured loan of US$600 million (US$300 million maturing in October 2020 and US$300 million maturing in October 2022); and

- refinanced the existing SG$350 million 4.25% Senior notes due in May 2018 with a new syndicated loan of US$250 million maturing in March 2020.

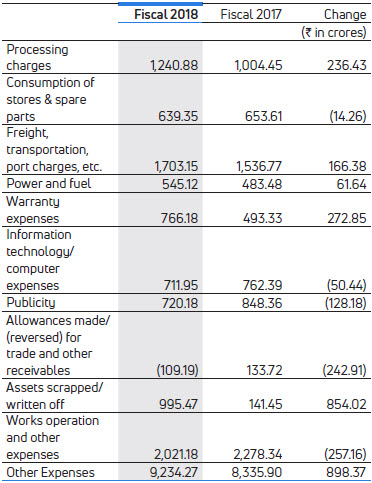

- Freight, transportation, port charges etc., as a percentage to total revenue, were 2.9% in Fiscal 2018, as compared to 3.1% in Fiscal 2017.

- Publicity expenses represented 1.2% of total revenues in Fiscal 2018 and 1.7% in Fiscal 2017. In addition to routine product and brand campaigns, the Company incurred expenses relating to new product introduction campaigns for the Nexon etc. Further, expenses were incurred for the Auto Expo and Geneva Motor Show.

- Warranty expenses represented 1.3% and 1%, of the Company’s revenues in Fiscal 2018 and 2017, respectively. The increase was due to volumes of M&HCV. Further, the Company has increased product warranty period for certain vehicles from four years to six years.

- Information technology/computer expenses represented 1.2% and 1.6% of the Company’s revenues in Fiscal 2018 and 2017, respectively.

- Assets written off of Rs.995.47 crores in Fiscal 2018 represents 1.7% of the Company’s revenues.

- There was reversal in allowances for trade and other receivables of Rs.109.19 crores in Fiscal 2018, due to favorable litigation orders.

- Works operation and other expenses have decreased to 3.4% of net revenue in Fiscal 2018 from 4.9% in Fiscal 2017. Decrease is due to charge off of certain projects discontinued. The Company has run certain ImpACT projects thereby reducing its fixed costs.

During Fiscal 2018, TML Holdings Pte Ltd, has refinanced an existing unsecured loan of US$ 600 million (US$ 300 million maturing in October 2020 and US$ 300 million maturing in October 2022) and a syndicated loan of US$ 250 million maturing in March 2020 with a new unsecured loan of GB£ 640 million (GB£ 190 million maturing in July 2020, GB£ 225 million in July 2022 and GB£ 225 million in July 2023).

The Tata Motors Group funds its short-term working capital requirements with cash generated from operations, overdraft facilities with banks, short-and medium-term borrowings from lending institutions, banks and commercial paper. The maturities of these short-and medium-term borrowings and debentures are generally matched to particular cash flow requirements. The working capital limits are Rs.14,000 crores from various banks in India as at March 31, 2018. The working capital limits are secured by hypothecation of certain existing current assets of the Company. The working capital limits are renewed annually.

Jaguar Land Rover Automotive plc currently has a GB£1.94 billion revolving credit facility with a syndicate of 31 banks, maturing in 2022. The revolving credit facility remained undrawn as at March 31, 2018.

Tata Motors Limited currently has Rs.500 crores revolving credit facility which remained undrawn as at March 31, 2018.

Short-term borrowings as ast March 31, 2018 and 2017 is Rs.16,794.85 crores and Rs.13,859.94 crores respectively.

Some of the Company’s financing agreements and debt arrangements set limits on and/or require prior lender consent for, among other things, undertaking new projects, issuing new securities, changes in management, mergers, sales of undertakings and investment in subsidiaries. In addition, certain negative covenants may limit the Company’s ability to borrow additional funds or to incur additional liens, and/or provide for increased costs in case of breach. Certain of the Company’s financing arrangements also include financial covenants to maintain certain debt- to-equity ratios, debt-to-earnings ratios, liquidity ratios, capital expenditure ratios and debt coverage ratios.

The Company monitors compliance with its financial covenants on an ongoing basis. The Company also reviews its refinancing strategy and continues to plan for deployment of long-term funds to address any potential non-compliance.

As at March 31, 2018, GB£542 million of cash was held by Jaguar Land Rover subsidiaries outside of the UK. The cash in some of these jurisdictions is subject to certain restrictions on cash pooling, intercompany loan arrangements or interim dividends. However, annual dividends are generally permitted and JLR do not believe that these restrictions have, or are expected to have, any impact on Jaguar Land Rover’s ability to meet it’s cash obligations.

Certain debt issued by Jaguar Land Rover is subject to customary covenants and events of default, which include, among other things, restrictions or limitations on the amount of cash, which may be transferred outside the Jaguar Land Rover group of companies in the form of dividends, loans or investments to the Company and its subsidiaries. These are referred to as restricted payments in the relevant Jaguar Land Rover financing documentation. In general, the amount of cash which may be transferred as restricted payments from the Jaguar Land Rover group to the Company and its subsidiaries is limited to 50% of its cumulative consolidated net income (as defined in the relevant financing documentation) from January 2011. As at March 31, 2018, the estimated amount that is available for dividend payments, other distributions and restricted payments was approximately GB£ 4,941 million.

FINANCIAL PERFORMANCE ON A STANDALONE BASIS

The financial information discussed in this section is derived from the Company’s Audited Standalone Financial Statements. These include the Company’s proportionate share of income and expenditure in its two Joint Operations, namely Tata Cummins Pvt Ltd and Fiat India Automobiles Pvt Ltd.

Effective April 30, 2018, the Company completed the merger of TML Drivelines Ltd (appointed date April 01, 2017) pursuant to scheme of arrangement of merger. Comparative numbers have been restated for the accounting impact of the merger.

Fiscal 2018 has been a good year, followed a period of high demand in the automotive sector in India.

Revenue from operations of the Company for Fiscal 2018, stood at Rs.59,624.69 crores as compared to Rs.49,054.49 crores, increased by 21.5%. Total number of vehicles sold were 636,968 units in Fiscal 2018, as compared to 543,656 units in Fiscal 2017, a growth of 17.2%. Revenue from operations (net of excise duty) stood at Rs.58,456.55 crores as compared to Rs.44,430.95 crores, increase of 31.6%.

Cost of materials consumed (including change in stock)

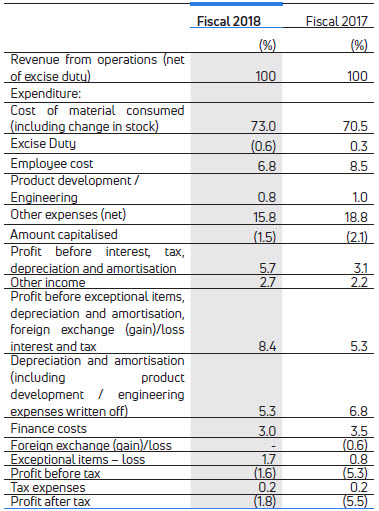

Cost of material consumed increased to 73.0% of total revenue from 70.5% in Fiscal 2017, representing an increase of 250 bps, mainly due to product mix.

Excise duty for the Fiscal 2018 represents the reversal of excise duty on closing inventories as at July 1, 2017. Consequent to the introduction of Goods and Service Tax (GST) with effect from July 1, 2017, Central Excise, Value Added Tax (VAT) etc. have been replaced by GST. Excise duty for Fiscal 2018 was Rs.793.28 crores in Fiscal 2018 as compared to Rs.4,738.15 crores in Fiscal 2017. Of this recovery from sales was Rs.1,168.14 crores for Fiscal 2018 as compared toRs.4,623.54 crores for Fiscal 2017. The same has been netted off against Revenue from operations to be comparable for discussion of performance.

Employee Costs were Rs.3,966.73 crores in Fiscal 2018 as compared to Rs.3,764.35 crores in Fiscal 2017, an increase by 5.4%, mainly due to higher volumes, annual increments, higher performance payment provisions for Fiscal 2018 and wage revisions at some plant locations.

Other Expenses includes all works operations, indirect manufacturing expenses, freight cost, fixed marketing costs and other administrative costs. These expenses have increased by 10.8%to Rs.9,234.27 crores in Fiscal 2018 from Rs.8,335.90 crores in Fiscal 2017. The breakdown is provided below:

The changes are mainly driven by volumes and the size of operations.