TO THE MEMBERS OF TATA MOTORS LIMITED

The Directors present their Seventy Third Annual Report along with the Audited Statement of Accounts for Fiscal 2018.

DIVIDEND

In view of the losses for Fiscal 2018, no dividend is permitted to be paid to the Members as per the provisions of the Companies Act, 2013 (‘the Act’) and the Rules framed thereunder.

TRANSFER TO RESERVES

Due to losses in Fiscal 2018, resulting in debit balance in retained earnings, no amount has been transferred to the Debenture Redemption Reserve.

OPERATING RESULTS AND PROFITS

The year 2017 for India was marked by a number of key structural initiatives to build strength across macro-economic parameters for sustainable growth in the future. The growth in the first half of the year suffered, despite global tailwinds. However, the weakness seen at the beginning of 2017 seems to have bottomed out with the onset of 2018. Currently, the Indian economy seems to be on the path to recovery from the effects of demonetization, transition into BS-IV emission norms and the introduction of the Goods and Service Tax, with indicators of industrial production, stock market index, auto sales and exports having shown some uptick.

The year 2017 saw global economy accelerating although UK economy evidently slowed down, while the US economy continued to grow at a modest pace. The Chinese economy continued to grow strong, however, the Euro zone and Japan showed signs of acceleration like many of the major emerging economies such as Turkey and Russia. The US economy grew at 2.7% in 2017, supported by broad-based strength in domestic demand, especially investment. The Eurozone grew at a faster rate then in a decade, in 2017 by 2.4%, highest since 2007, reflecting the strong consumption, investment, and exports. The UK by contrast, was growing by 1.8% in 2017, down from 2016’s 1.9% rate and the weakest expansion since 2012, mainly reflecting the impact of higher inflation in the wake of the 2016 Brexit vote and weaker investment from companies due to uncertainty of future trade arrangements. China registering growth of 6.9% in 2017 and had remained solid this year. Activity continued to shift to consumption, while investment growth rates remain well below those in recent years. Industrial production has stabilized following significant cuts in overcapacity sectors implemented over the past 2 years.

During 2017, prices of base metal also strengthened, with the strong growth in infrastructure sector in major countries around the globe. Crude prices remained range bound in major part of 2017 although it started to give a signal of upward breakout towards fourth quarter of Fiscal 2018. Brent crude started sharp rally in the middle of 2017 around US$44/bbl and has rallied all the way to US$79/bbl. The tensions in the Middle East and West Asia would only add to the increase in oil prices. The US shale output was also expected to grow just by 1.1 million bpd and the year 2018 could be the year of oil deficit to the tune of 7.5 lacs bpd.

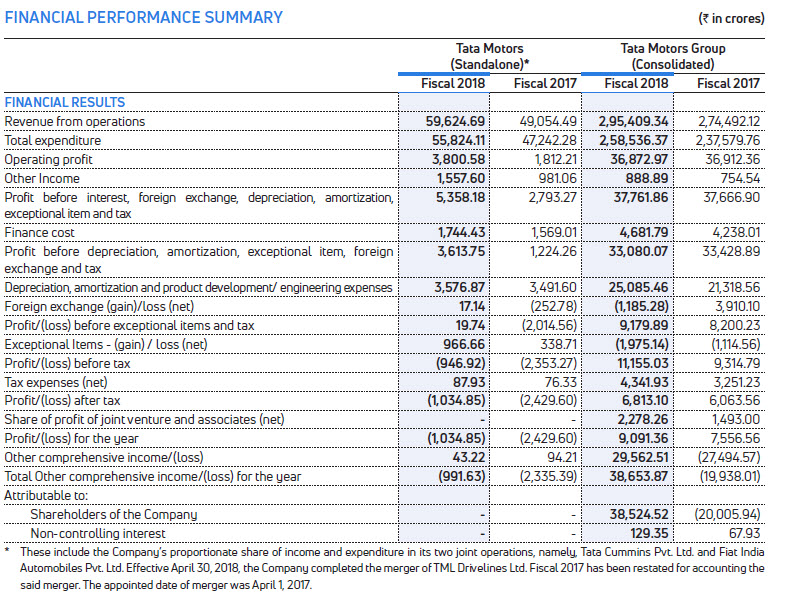

The Tata Motors Group registered a growth of 7.6% in income from operations to Rs. 2,95,409 crores in Fiscal 2018 as compared to Rs. 2,74,492 crores in Fiscal 2017. This was due to growth in the business in India, higher wholesale volumes in Jaguar and Land Rover offset by negative translation impact from Great Britain Pound (‘GB£’) to Indian Rupee (Rs.) of Rs. 3,192 crores. The consolidated EBITDA margins for Fiscal 2018 stood at 10.6%. EBIT was lower due to non-recurrence of Tianjin recoveries offset by favourable foreign currency revaluation and pension credit at Jaguar Land Rover. Consequently, Profit Before Tax and Profit After Tax [post share of profit of joint ventures and associates (net)] were Rs. 11,155 crores and Rs. 9,091 crores, respectively.

Tata Motors Limited recorded revenue from operations (including joint operations) of Rs. 59,625 crores in Fiscal 2018, 21.6% higher from Rs. 49,054 crores in Fiscal 2017. Growth in demand of Medium and Heavy Commercial Vehicle (M&HCV) and Light Commercial Vehicle (LCV), new product offerings in passenger cars and Utility Vehicles (UV), resulted in increase in EBITDA margins to 5.8% in Fiscal 2018 as against 3.4% in Fiscal 2017. Loss Before and After Tax (including joint operations) for Fiscal 2018 were at Rs. 947 crores and Rs. 1,035 crores, respectively as compared to Loss Before and After Tax (including joint operations) of Rs. 2,353 crores and Rs. 2,430 crores, respectively for Fiscal 2017. There will be significant disruptions in the Auto Industry necessitating a review of the Company’s tangible and intangible assets to ensure “Fit for Future”. Accordingly, an exceptional provision for impairment of Rs. 963 crores has been taken in Fiscal 2018.

Jaguar Land Rover (‘JLR’) (as per IFRS) recorded a 5.9% higher revenue of GB£25.8 billion in Fiscal 2018 compared to GB£24.3 billion in Fiscal 2017 driven by higher sales volumes and favourable mix.

Consolidated EBITDA for Fiscal 2018 was GB£3.3 billion, marginally higher as compared to EBITDA of GB£3.0 billion for Fiscal 2017, as the higher revenue was offset by higher marketing expense, higher incentives and certain engineering charges. EBIT was GB£974 million in Fiscal 2018 compared to GB£1.5 billion in Fiscal 2017, due to higher depreciation and amortisation related to new product launches which was partially offset by higher profits from our China Joint Venture.

Profit Before Tax (‘PBT’) in Fiscal 2018 was GB£1.5 billion marginally lower than PBT GB£1.6 billion in Fiscal 2017, due to lower EBIT and the non-recurrence of Tianjin recoveries from Fiscal 2017 offset by more favourable foreign currency revaluation of debt and hedges as well as the GB£437 million pension credit realised in first quarter of Fiscal 2018.

GB£437 million pension realised in first quarter of Fiscal 2018 was partially offset by engineering charges (‘Fit for Future‘) in fourth quarter of Fiscal 2018.

TMF Holdings Limited (‘TMFHL’) (earlier known as Tata Motors Finance Limited) (consolidated) (as per Indian GAAP) the Company’s captive financing subsidiary, reported revenues of Rs. 2,876 crores (Fiscal 2017: Rs. 2,721 crores) and Profit After Tax of Rs. 217 crores in Fiscal 2018 as compared to Loss After Tax of Rs. 1,182 crores in Fiscal 2017.

Tata Daewoo Commercial Vehicle Company Limited (‘TDCV’) (as per Korean GAAP) South Korea registered revenues of KRW 868.26 billion, a drop of 15.8% in Fiscal 2018 over the Fiscal 2017 mainly due to lower domestic sales. The Profit After Tax was KRW 33.66 billion compared to KRW 50.25 billion of Fiscal 2017. Lower profitability was mainly due to the impact of lower domestic sales which was partially set-off by material cost reduction.

VEHICLE SALES AND MARKET SHARES

The Tata Motors Group sales for the year stood at 12,21,124 vehicles, up by 11.9% as compared to Fiscal 2017. Global sales of all Commercial Vehicles (CV) were 4,56,552 vehicles, while sales of Passenger Vehicles (PV) were at 7,64,572 vehicles.

TATA MOTORS

Tata Motors recorded sales of 584,564 vehicles, a growth of 21.9% over Fiscal 2017, higher than the Indian Auto Industry grew by 10%. The Company’s market share increased to 14.1% in Fiscal 2018 from 12.7% in Fiscal 2017. The Company’s exports on standalone basis were lower by 18.4% to 52,404 vehicles in Fiscal 2018 as compared to 64,221 vehicles in Fiscal 2017.