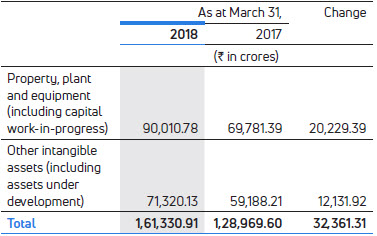

Property, plant and equipment and other intangible assets

There is increase (net of depreciation and amortization) in the intangible and tangible assets in Fiscal 2018, due to favourable currency translation impact from GB£ to INR of Rs.16,486 crores. Further, the increase is driven by Jaguar Land Rover Slovakia plant and tooling and facilities for new products like E-Pace, Velar, I-Pace, XF. At Tata Motors Ltd, the additions were mainly in tooling’s, and product development cost for new products.

Investments in equity accounted investees were Rs.5,385.24 crores as at March 31, 2018, as compared to Rs.4,606.01 crores as at March 31, 2017. The increase was mainly due to profits at the Company’s Joint Venture at China of GB£252 million (Rs.2,138.92 crores).

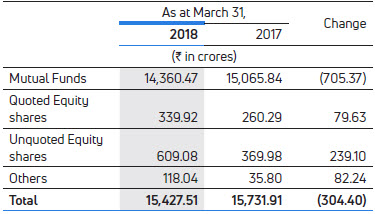

Financial Assets (Current + Non-current)

Investments (Current + Non-current) were Rs.15,427.51 crores as at March 31, 2018, as compared to Rs.15,731.91 crores as at March 31, 2017. The details are as follows:

The decrease in mutual fund investments was mainly at Tata Motors Limited.

Finance receivables (current + non-current) were Rs.23,881.18 crores as at March 31, 2018, as compared to Rs.17,563.25 crores as at March 31, 2017, an increase of 36%, primarily due to increased vehicle financing business. The Gross finance receivables were Rs.25,070.75 crores as at March 31, 2018, as compared to Rs.21,160.76 crores as at March 31, 2017.

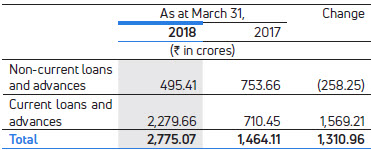

Loans & Advances

Loans and advances include advance and other recoveries from suppliers, contractors amounting to Rs.2,260.50 crores and Rs.684.35 crores in Fiscal 2018 and 2017 respectively.

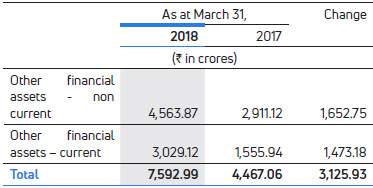

Other Financial Assets

These included Rs.5,323.03 crores of derivative financial instruments, mainly attributable to Jaguar Land Rover as at March 31, 2018 compared to Rs.4,285.52 crores as at March 31, 2017, reflecting notional asset due to the valuation of derivative contracts.

Deferred tax assets / liability: Deferred tax assets represent timing differences for which there will be future current tax benefits due to unabsorbed tax losses and expenses allowable on a payment basis in future years. Deferred tax liabilities represent timing differences where current benefit in tax will be offset by a debit in the statement of profit and loss.

A deferred tax liability (net) of Rs.1,038.47 crores was recorded in the income statement and Rs.4,394.71 crores in other comprehensive income, which mainly includes post-retirement benefits and cash flow hedges in Fiscal 2018. The major movement is due to deferred tax liability in respect of gains on derivatives and post-retirement benefits.

Inventories as at March 31, 2018, were Rs.42,137.63 crores as compared to Rs.35,085.31 crores as at March 31, 2017, an increase of 20%. Inventory at Tata and other brand vehicles (including vehicle financing) was Rs.7,318.87 crores as at March 31, 2018 as compared to Rs.6,923.42 crores as at March 31, 2017. Inventory at Jaguar Land Rover was Rs.34,805.01 crores as at March 31, 2018, an increase of 24%, as compared to Rs.28,079.40 crores as at March 31, 2017. In terms of number of days of sales, finished goods represented 42 inventory days in Fiscal 2018 as compared to 38 days in Fiscal 2017. The increase is mainly due to inventory held for new models (E-Pace, I-Pace and Velar) at Jaguar Land Rover.

Trade Receivables (net of allowance for doubtful debts) were Rs.19,893.30 crores as at March 31, 2018, representing an increase of 41.3% compared to Rs.14,075.55 crores as at March 31, 2017. Trade Receivables have increased at Tata and other brand vehicles (including vehicle financing) to Rs.5,492.78 crores as at March 31, 2018 as compared to Rs.3,471.93 crores as at March 31, 2017. The increase was mainly due to higher sales at year end. Trade receivables at Jaguar Land Rover was Rs.14,374.03 crores as at March 31, 2018, as compared to Rs.10,006.21 crores as at March 31, 2017, due to introduction of new models. The allowances for doubtful debts were Rs.1,261.67 crores as at March 31, 2018 compared to Rs.1,377.44 crores as at March 31, 2017.

Cash and cash equivalents were Rs.14,716.75 crores, as at March 31, 2018, compared to Rs.13,986.76 crores as at March 31, 2017. The Company holds cash and bank balances in Indian rupees, GB£, Chinese Renminbi, etc.

Other bank balances were Rs.19,897.15 crores, as at March 31, 2018, compared to Rs.22,091.12 crores as at March 31, 2017. These include bank deposits maturing within one year of Rs.19,361.58 crores as at March 31, 2018, compared to Rs.21,852.76 crores as at March 31, 2017.

Current tax assets (net) (current + non-current) were Rs.1,108.81 crores, as at March 31, 2018, compared to Rs.1,195.67 crores as at March 31, 2017.

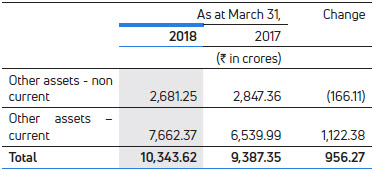

Other Assets

These mainly includes prepaid expenses, including rentals on operating lease of `2,584.66 crores as at March 31, 2018, as compared to Rs.2,063.55 crores as at March 31, 2017. Taxes recoverable, statutory deposits and dues from government were Rs.6,724.43 crores as at March 31, 2018, as compared to Rs.6,030.06 crores as at March 31, 2017.

Shareholders’ fund was Rs.95,427.91 crores and Rs.58,061.89 crores as at March 31, 2018 and 2017, respectively, an increase of 64.4%. Reserves increased by 65.1% from Rs.57,382.67 crores as at March 31, 2017 to Rs.94,748.69 crores as at March 31, 2018. Though, the profit for Fiscal 2018 was Rs.8,988.91 crores, increase in Reserves of Rs.37,366.02 crores was primarily attributable to following reasons:

- Credits for remeasurement of employee benefit plans was Rs.3,909.10 in Fiscal 2018.

- Translation gain of Rs.9,921.36 crores recognized in Translation Reserve on consolidation of subsidiaries further contributed to an increase in Reserves and Surplus.

- Further increase in Hedging Reserves by Rs.14,285.59 crores, primarily due to mark-to-market gains on forwards and options in Jaguar Land Rover, primarily due to the Strengthening in the US$-GB£ forward rates.

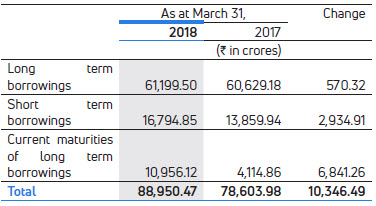

Borrowings

- Current maturities of long-term borrowings represent the amount of loan repayable within one year.

- During Fiscal 2018,

- the Company raised Rs.1,500 crores through unsecured nonconvertible debentures with a tenor ranging from 3 years to 5 years.

- Jaguar Land Rover Automotive plc, issued USD 500 million (Rs.3,156.93 crores) Senior Notes maturing in October 2027 at a coupon of 4.5%.

- TML Holdings Pte. Singapore, a wholly owned subsidiary of Tata Motors Ltd, had refinanced its existing syndicate loan of USD 850 million with a new syndicated loan facility of GBP 640 million.