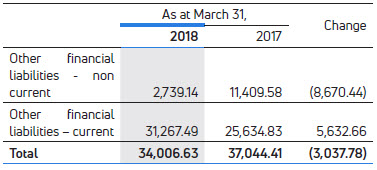

Other financial liabilities

These included Rs.8,657.86 crores of derivative financial instruments, mainly attributable to Jaguar Land Rover as at March 31, 2018 compared to Rs.25,517.52 crores as at March 31, 2017, reflecting favourable foreign exchange movement between USD and GBP. However, current maturities of long-term borrowings were Rs.10,956.12 crores as at March 31, 2018, as compared to Rs.4,114.86 crores as at March 31, 2017.

Trade payables were Rs.72,038.41 crores as at March 31, 2018, as compared to Rs.57,698.33 crores as at March 31, 2017.

Acceptances were Rs.4,901.42 crores as at March 31, 2018, as compared to Rs.4,834.24 crores as at March 31, 2017.

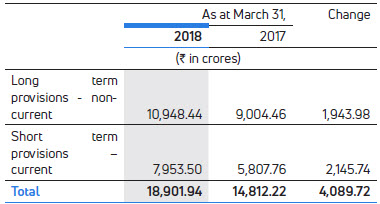

Provisions (current and non-current) were made towards warranty and employee benefit schemes. Short-term provisions are those, which are expected to be settled during next financial year. The details are as follows:

- Provision for warranty increased to Rs.15,935.10 crores as at March 31, 2018, as compared to Rs.12,031.33 crores as at March 31, 2017, an increase of Rs.3,903.77 crores.

- The provision for employee benefits obligations increased to Rs.844.64 crores as at March 31, 2018, as compared to Rs.801.90 crores as at March 31, 2017.

- Provision for legal and product liability increased to Rs.1,319.87 crores as at March 31, 2018, as compared to Rs.1,266.00 crores as at March 31, 2017.

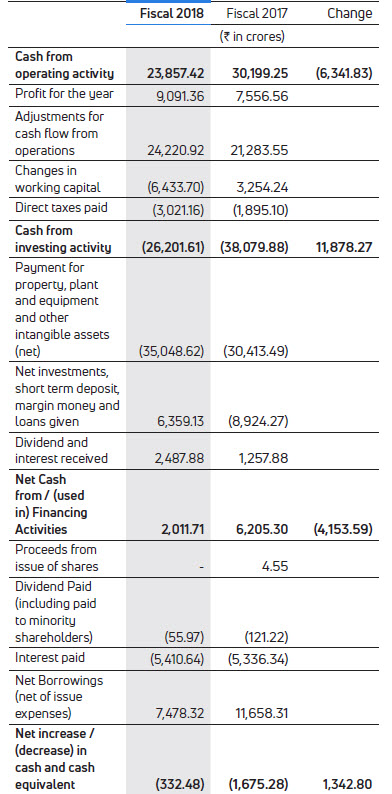

- Capital expenditure (net) was at Rs.35,048.62 crores in Fiscal 2018, compared to Rs.30,413.49 crores, related mainly to capacity/ expansion of facilities, quality and reliability projects and product development projects.

- Net investments, short-term deposits, margin money and loans given was an inflow of Rs.6,359.13 crores in Fiscal 2018 as compared to outflow of Rs.8,924.27 crores in Fiscal 2017, mainly at Jaguar Land Rover.

- In Fiscal 2018, Rs.4,559.81 crores were raised from longterm borrowings (net) as compared to Rs.9,172.39 crores (net) in Fiscal 2017 as described in further detail below

- Net increase in short-term borrowings of Rs.2,960.35 crores in Fiscal 2018 as compared to Rs.2,485.30 crores in Fiscal 2017, mainly at Tata and other brand vehicles (including vehicle financing).

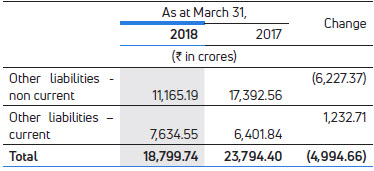

Other liabilities

These mainly includes liabilities towards employee benefits obligations of Rs.4,100.76 crores as at March 31, 2018, as compared to Rs.11,984.03 crores as at March 31, 2017, decrease mainly at Jaguar Land Rover. Deferred revenue were Rs.9,413.29 crores as at March 31, 2018, as compared to Rs.6,926.35 crores as at March 31, 2017. Statutory dues (VAT, Excise, Service Tax, Octroi etc.) were Rs.3,176.86 crores as at March 31, 2018, as compared to Rs.2,658.93 crores as at March 31, 2017.

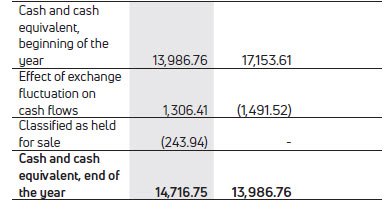

Consolidated Cash Flow

The following table sets forth selected items from consolidated cash flow statement:

Cash generated from operations before working capital changes was Rs.33,312.28 crores in Fiscal 2018, as compared to Rs.28,840.11 crores in the previous year, representing an increase in cash from generated from consolidated operations. After considering the impact of working capital changes including the net movement of vehicle financing portfolio, the net cash generated from operations was Rs.23,857.42 crores in Fiscal 2018, as compared to Rs.30,199.25 crores in the previous year. The increase in trade receivables, finance receivables, inventories and other assets amounting to Rs.17,440.36 crores mainly due to increase in sales was offset by increase in trade and other payables and provisions amounting to Rs.11,006.66 crores.

The net cash outflow from investing activity decreased to Rs.26,201.61 crores in Fiscal 2018 from Rs.38,079.88 crores in Fiscal 2017.

The net change in financing activity was an inflow of Rs.2,011.71 crores in Fiscal 2018 as compared to Rs.6,205.30 crores in Fiscal 2017.

Free cash flows of (a non-GAAP measure, measured at cash flow from operating activities, less payment for property, plant and equipment and intangible assets) were negative of Rs.7,322 crores due to lower growth and higher investments in Jaguar Land Rover.

As at March 31, 2018, the Company’s borrowings (including shortterm debt) were Rs.88,950.47 crores, compared to Rs.78,603.98 crores as at March 31, 2017.

Principal Sources of Funding Liquidity

The Company finances its capital expenditures and research and development investments through cash generated from operations, cash and cash equivalents, debt and equity funding. The Company also raises funds through sale of investments, including divestment in stakes of subsidiaries on a selective basis.

The Company’s cash and bank balances on a consolidated basis were Rs.34,613.91 crores as at March 31, 2018, as compared to Rs.36,077.88 crores as at March 31, 2017. These enable the Company to cater to business needs in the event of changes in market conditions.

The Company’s capital expenditures were Rs.42,672.28 crores and Rs.31,750.74 crores for Fiscal 2018 and 2017, respectively, and it currently plans to invest approximately Rs.461 billion in Fiscal 2019 in new products and technologies. The Company intends to continue to invest in new products and technologies to meet consumer and regulatory requirements. These investments are intended to enable the Company to pursue further growth opportunities and improve the Company’s competitive positioning. In December 2015, Jaguar Land Rover announced the initial investment of GB£1 billion to build a manufacturing facility in Slovakia with annual capacity of 150,000 units and production scheduled to begin in 2018 (construction of the plant commenced in September 2016) and in November 2016 confirmed that the all new Land Rover Discovery would be the first model manufactured at the plant. In November 2015, Jaguar Land Rover announced additional investment of GB£450 million to double capacity at the engine manufacturing facility in Wolverhampton and production of the 2.0l Ingenium petrol engine recently began. The manufacturing partnership with Magna Steyr, an operating unit of Magna International Inc, to build vehicles in Graz, Austria was announced in July 2015. Jaguar E Pace was the first vehicle to be produced as a part of Jaguar Land Rover’s contract manufacturing agreement with Magna Steyr, Austria in late 2017 and it will be joined by Jaguar I Pace from 2018. The Company expects to meet most of its investments out of operating cash flows and cash liquidity available. In order to meet the remaining funding requirements, the Company may be required to raise funds through additional loans and by accessing capital markets from time to time, as deemed necessary.

With the ongoing need for investments in products and technologies, the Company on a standalone basis (Including joint operations) was free cash flow (a non-GAAP measure, measured at cash flow from operating activities, less payment for property, plant and equipment and intangible assets) positive in Fiscal 2018, of `1,310.99 crores.

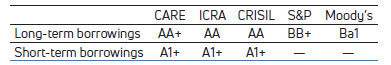

The following table provides information for the credit rating of Tata Motors Limited for short-term borrowing and long-term borrowing from the following rating agencies as at March 31, 2018:

Credit Analysis and Research Ltd Ratings, or CARE, Information and Credit Rating Agency of India Ltd, or ICRA, Credit Rating Information Services of India Limited, or CRISIL Ltd, Standard & Poor’s Ratings Group, or S&P, and Moody’s Investor Services, or Moody’s. A credit rating is not a recommendation to buy, sell or hold securities. A credit rating may be subject to withdrawal or revision at any time. Each rating should be evaluated separately of any other rating:

The Company believes that it has sufficient liquidity available to meet its planned capital requirements. However, the Company’s sources of funding could be materially and adversely affected by an economic slowdown, as was witnessed in Fiscal 2009, or other macroeconomic factors in India and abroad, such as in the United Kingdom, the United States, Europe, Russia and China, all of which are beyond the Company’s control. A decrease in the demand for the Company’s vehicles could affect its ability to obtain funds from external sources on acceptable terms or in a timely manner.

The Company’s cash is located at various subsidiaries within the Tata Motors Group. There may be legal, contractual or economic restrictions on the ability of subsidiaries to transfer funds to the Company in the form of cash dividends, loans, or advances. Brazil, Russia, South Africa and other jurisdictions have regulatory restrictions, disincentives or costs on pooling or transferring of cash. However, such restrictions have not had and are not estimated to have a significant impact on the Company’s ability to meet its cash obligations.

In order to refinance the Company’s borrowings and for supporting long-term fund needs, the Company continued to raise funds in Fiscal 2017 and 2018, through issue of various debt securities described below.

During Fiscal 2017, the Company raised Rs.2,700 crores through unsecured NCDs with a tenor ranging from 2 years to 5 years. The proceeds have been used for refinancing and supporting the funding requirements of the Company.

In January 2017, Jaguar Land Rover Automotive plc issued EUR 650 million senior notes due 2024 at a coupon of 2.200% per annum and GBP 300 million senior notes due 2021 at a coupon of 2.750% per annum. The proceeds were for general corporate purposes, including support for Jaguar Land Rover’s ongoing growth and capital spending requirements.

In March 2017 Jaguar Land Rover Automotive plc completed consent transactions to align the terms of its US$ 500 million 5.625% senior notes due 2023, its US$ 700 million 4.125% senior notes due 2018 and its GB£ 400 million 5.000% senior notes due 2022 to bonds it issued after January 2014.

During Fiscal 2017, Tata Motors Limited issued rated, listed, unsecured NCDs of Rs.2,700 crores. The proceeds have been utilized for general corporate purpose. Tata Motors Limited prepaid Rs.300 crores of its Unsecured 8.60% NCD due 2018 in February 2017.

During Fiscal 2017, Tata Motors Finance Limited through its subsidiary Sheba Properties Ltd., issued 22,500,000 privately placed, cumulative non-participating compulsory convertible preference shares of Rs.100 each convertible after seven years, which qualifies as tier 1 capital. In Fiscal 2017, Tata Motors Finance Limited, and its subsidiaries, Sheba Properties Ltd and Tata Motors Finance Solutions Ltd, issued NCDs and raised Rs.316 crores. Bank borrowings through secured and unsecured term loans continued to remain as the major source of funds for longterm borrowing, and during, Fiscal 2017 Rs.2,625 crores were raised.

In October 2017, Jaguar Land Rover Automotive plc issued US$500 million senior notes due 2027 at a coupon of 4.50% per annum. The proceeds were for general corporate purposes, including support for Jaguar Land Rover’s ongoing growth and capital spending requirements.