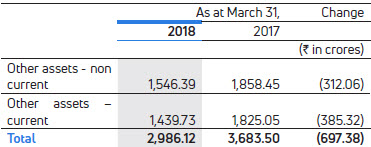

Other assets (Current + Non-current)

These mainly includes prepaid expenses, including rentals on operating lease of Rs.221.74 crores as at March 31, 2018, as compared to Rs.234.02 crores as at March 31, 2017. Taxes recoverable, statutory deposits and dues from government were Rs.1.978.74 crores as at March 31, 2018, as compared to Rs.2,444.36 crores as at March 31, 2017. Capital advances were Rs.285.54 crores as at March 31, 2018, as compared to Rs.561.01 crores as at March 31, 2017. Recoverable form insurance companies were Rs.212.96 crores as at March 31, 2018 as compared to Rs.170.84 crores as at March 31, 2017.

Shareholders’ fund was Rs.20,170.98 crores and Rs.21,162.61 crores as at March 31, 2018 and 2017, respectively, a decrease of 4.7%.

Reserves decreased by 4.8% from Rs.20,483.39 crores as at March 31, 2017 to Rs.19,491.76 crores as at March 31, 2018, mainly due to losses for Fiscal 2018.

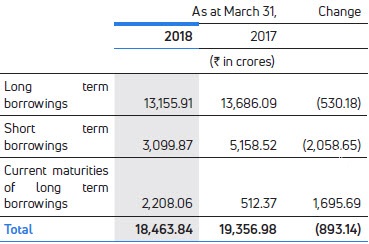

Borrowings

Current maturities of long-term borrowings represent the amount of loan repayable within one year.

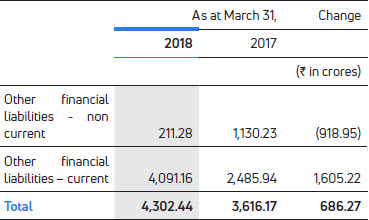

Other financial liabilities

These included Rs.977.26 crores of financial guarantee contracts as at March 31, 2018 compared to Rs.2,045.08 crores as at March 31, 2017. The reduction is due to payments of Rs.905 crores and reduction in provision by Rs.163 crores in Fiscal 2018. Current maturities of long-term borrowings were Rs.2,208.06 crores as at March 31, 2018 as compared to Rs.512.37 crores as at March 31, 2017. Further, interest accrued but not due on borrowings were Rs.500.06 crores as at March 31, 2018 as compared to Rs.449.73 crores as at March 31, 2017.

Trade payables were Rs.9,411.05 crores as at March 31, 2018, as compared to Rs.7,082.95 crores as at March 31, 2017, mainly due to creditors for goods supplied and services received, liabilities for variable marketing expenses, wage revisions etc.

Acceptanceswere Rs.4,814.58 crores as at March 31, 2018, as compared to Rs.4,379.29 crores as at March 31, 2017.

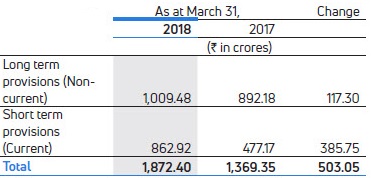

Provisions (current and non-current) were made towards warranty and employee benefit schemes. Short-term provisions are those, which are expected to be settled during next financial year. The details are as follows:

Provision for warranty increased to Rs.1,103.47 crores as at March 31, 2018, as compared to Rs.666.82 crores as at March 31, 2017, an increase of Rs.436.65 crores, mainly due to increase in volumes, higher warranty cost for BS IV models and also increase of warranty period for certain vehicle models.

The provision for employee benefits obligations were flat at Rs.655.05 crores as at March 31, 2018, as compared to Rs.652.14 crores as at March 31, 2017.