Tata Motors Limited (TML)

- In 2016, TML had stepped into its transformation journey, which was aimed at countering some of the biggest internal and external challenges that the Company was facing then. Very few product introductions, weak market activation compounded with increasing pressure on margins and a complex organisation structure were a few of them. TML’s challenges were accentuated by the developments in the external environment such as structural reforms in the economy and introduction of new emission standards.

- Our business sought a ‘Turnaround’ to overcome these challenges and to prepare for the future.

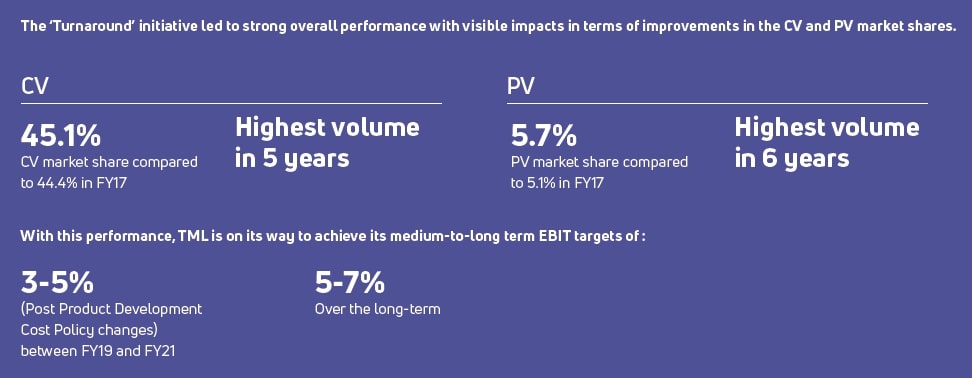

The ‘Turnaround’ story translated into success, with TML delivering profitable growth even in challenging conditions.

Progressing on a clear roadmap

The roadmap for ‘Turnaround’ has been contoured with our strategic interventions for both our CV and PV businesses.

For each of the execution areas, there were a series of interventions undertaken with measurable impacts.

Sales enhancement

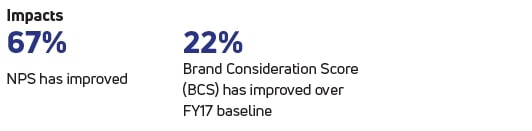

Customer centricity

- Initiatives to improve ‘first time right’ and zero-defect stations were launched to focus on reducing rejection, rework, warranty and inventory cost and vendor recoveries.

- Better planning and execution resulted in improvement of the Sales and Operations (S&OP) metrics such as forecast accuracy, adherence to production plan, finished goods cover days, reduction in unplanned shipments and others across both the PV and CV businesses.

- Word-of-mouth communication was strengthened by onboarding Tata ‘Advocates’ through a structured approach, including both offline and online engagement with advocates.

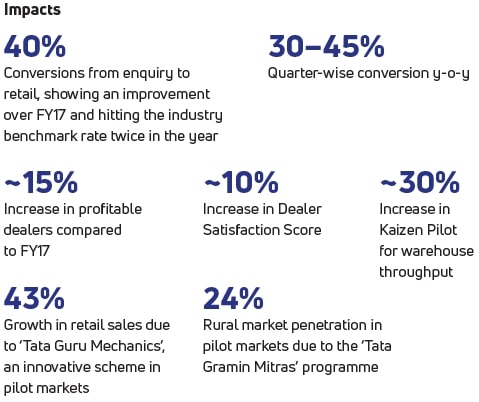

Intense top-line focus

- CV Relationship with Supply Chain Partners comprised initiatives focussed at gaining market share.

- 18 work streams/levers deployed that covered TML policy changes, as well as dealer operational efficiency improvements

- Mini-projects were rolled out in commercial, aftermarket and operations areas

Leveraging production and supply-chain efficiencies

Building a strategic supplier base

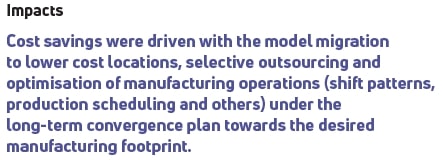

TML conducted deep-dive workshops to develop a plan for a robust and strategic supplier base, along with rigorous and exhaustive supplier assessments. This enabled cost savings with optimised manufacturing operations.

Cost reduction and bottom-line improvement

Align cost management

Running Mega Competitive Teardown and VAVE idea generation workshops to reduce costs for both CV and PV. Benchmark comparison to focus on high-potential areas, commercial negotiations, ‘should cost model’ and e-auctions. Restructuring of post-sales discount, realisation of value chain opportunities in supply chain and optimisation in Regional Sales Office (RSO) costs.

Structural improvements

- TML’s modular Bill of Materials (BOM) capability was horizontally deployed across CV and other PV platforms.

- TML created and tested the BOM Architecture, its system and process readiness through POC on control set of Vehicle Configurations (VCs) and went on to implement it successfully on all VCs of the Alpha (X4) Platform.

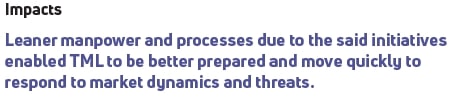

Organisational restructuring

- Rationalising and reducing 13 managerial layers within the organisational structure considerably to five layers improved direction and decision making through streamlining of processes, de-centralisation and delayering.

- Implementation of a BSC and alignment of KPIs with target outcomes and success factor helped in creating controls.

- Compensation Benchmarking Study, Rewards Strategy and Benefits Strategy have been revamped.

- Empowerment of management and employees to take decisions percolated to lower levels.

Keeping the momentum with Turnaround 2.0

It’s time to deliver again

Building on the success of the first ‘Turnaround’ story, which focussed on execution, Turnaround 2.0 aims to embed the turnaround thinking deep into the organisation. With TML’s concrete learnings from its CV turnaround story, the Company is laying the future roadmap for its PV business and is assured of its success in this space as well. The objective is to enable the PV business to fund itself for the future and also help in taking it much beyond the aspirations of being the No. 3 player in the domestic market by FY19 as stated in the current vision of the Company, along with continuing focus on the CV business.

The basic building blocks of Turnaround 2.0 are its objectives, ‘Winning Decisively’ in the CV business, ‘Winning Sustainably’ in the PV business and embedding turnaround into our way of life/culture.

Turnaround 2.0 objectives

Strengthening product planning to address white spaces

TML has introduced more than 50 products with more than 200+ variants, including Ultra 1518, SIGNA 3718, Ace Gold and Starbus Hybrid. Additionally, TML is adopting the BS IV technology to strengthen its product range.

Leading in technology and powertrain solutions

TML aims to use emission control technologies across the CV range that aid in superior performance, reliability, commercial affordability, environmental sustainability and future readiness of its vehicles. Use of the SCR technology will enable TML to meet the increasingly stringent emission norms.

Building modularity and architecture approach in product development

Creating an effect across the entire value chain, this will give TML the chance to reduce the number of suppliers and also connect with more capable suppliers by leveraging its installed capacity in return of a higher output.

Enhancing customer engagement, along with product and service offerings

While focussing on key customers, TML is concentrating on improved live deal visibility. A significant aspect is constant engagement with different stakeholders, including dealers and financiers, among others. With concerted efforts towards each of these strategic intervention areas, the production capacity is significantly ramping up and the Company is well prepared for FY19.

Sales enhancement

TML is focussing on bringing in different vehicle models – from small hatchbacks to SUVs – in order to cover different customer segments, while enhancing network coverage with an improved dealer network, reinforced channel engagement and channel capability and intensified marketing strategy.

Stepping up capacity utilisation

The Company is setting targets for all products and plant locations to meet the enhanced requirement of capacity utilisation.

Architecture approach for new launches

TML is prepared to launch two new platforms – Optimal Modular Efficient Global Advanced (OMEGA-ARC) and Agile Light Flexible Advanced (ALFA-ARC) – by 2019. The two innovative architectures were unveiled at the Auto Expo (India) 2018. The ALFA-ARC will bring about high commonality across architecture for both hatchbacks and sedans. The OMEGA-ARC is a proven architecture for Land Rover and is suited for products ranging from long SUVs to full-size sedans.

As a major ‘turnaround’ initiative, TML is trying to embed a culture of ownership and collaboration among employees. By introducing Employee Stock Ownership Plans (ESOPs) the Company is trying to align rewards with performance. This, in turn, will bring about a competitive, consistent and cash-accretive growth in the long term.

Structural cost reduction

The Company is bringing about many structural changes to optimise operations for faster decision making and overall execution of the annual production plans. There is also an enhanced focus on embedding new capabilities through analysis based on idea generation and data-driven negotiations, which will facilitate innovative ways of efficiency enhancement and cost reduction.

Affordable and efficient capex

The Company is working towards an affordable and efficient capex to ensure return on research investments and reduced time to market.

Improvement by Actions (ImpACT) Initiatives

To further step up the pace of Turnaround 2.0, almost more than 20 prioritised high-impact initiatives are planned. The ImpACT initiatives are shaped by bringing into consideration factors such as strategic objectives of the business division, future trends and opportunities, key business challenges and overall business excellence.

1,900 Crores savings through ‘ImpACT’ initiatives during FY18