BUSINESS OVERVIEW

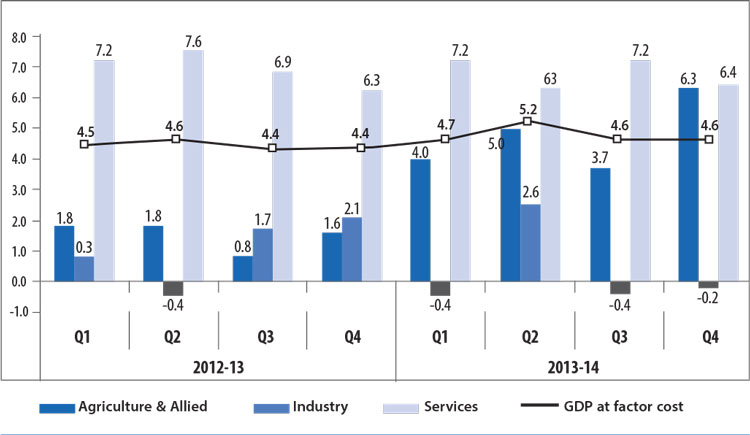

India's GDP growth continues to remain weak, at 4.7% in FY 2013-14 (advance estimates) after growing at 4.5% in FY 2012-13. Industrial activity continues to remain weak. Index of Industrial production (IIP) was negative at 0.1% during FY 2013-14. The stagnation in the industrial activity was broad-based. While mining output registered a negative of 1.1%, manufacturing output registered a negative of 0.7% during the same period. FY 2013-14 witnessed a decline in investments in new projects in line with slowdown in overall growth.

Growth rate in GDP

Source: Ministry of Statistics and Programme implementation

On the back of tight monetary policy, limited Fiscal spending, rising Inflation and slowing investments, over the previous year, FY 2013-14 saw many of the same challenges continuing into the year.

FY 2013-14 was marked by the challenge to the Government to contain the fiscal deficit, and the Government expenditure on infrastructure and other key sectors suffered. Current account deficit was brought in control.

As a result, the domestic auto industry saw decline after a long time. With the continued high interest rates and inflation, households were forced to spend more on essentials and discretionary spend reduced, leading to deferring of purchase decisions. The consistent stagnation of the industrial growth mainly in the areas of mining and quarrying, manufacturing and infrastructure adversely impacted the domestic auto industry.

On the global economy front, it was still a struggle, with the Euro zone in recession for much of 2013. However, in the developed world which had started as an uneven and patchy, recovery began to strengthen. The US economy, despite having to cope with feuding over its budget, seems to have sped up. It has been creating jobs and its housing market and stock indicator have moved up sharply. By the end of the year 2013, the UK had become, on some counts the fastest growing large developed economy. UK labour market conditions improved as employment increased. Rising consumer and business confidence helped to underpin stronger retail sales and investment spending, while the recovery in house prices helped shore up household wealth. This was led by higher consumption, in turn leading to fears of overheating in the housing market.

Germany had a solid year, reducing unemployment and boosting living standards. However, across the Mediterranean the pattern was more disappointing, with Italy, Spain, Portugal and Greece all enduring a year of rising unemployment. Europe and the euro are not out of trouble, but the acute phase of their difficulties may be past. However, there is still a long way to go: deflation risks remain, the sovereign and banking crisis is not fully resolved, and there is a considerable gulf in performance between the core and the periphery.

The structural shift from the developed world towards the emerging world continued but at a slightly slower pace than before. Industrial activity picked up pace throughout the year, supporting continued employment growth. With asset prices buoyant and confidence returning, the pillars of support for consumer spending fell back into place during 2013. In the emerging markets due to announcement by the US Federal Reserve in May, that it would soon begin reducing its monthly asset purchases (so-called "tapering"), caused currencies to depreciate, stock markets to fall and borrowing costs to rise. Countries with large current account and fiscal deficits were worst affected.

Growth in China was at 7.5% and Africa, encouragingly, grew by more than 5%.

Tata Motors Business:

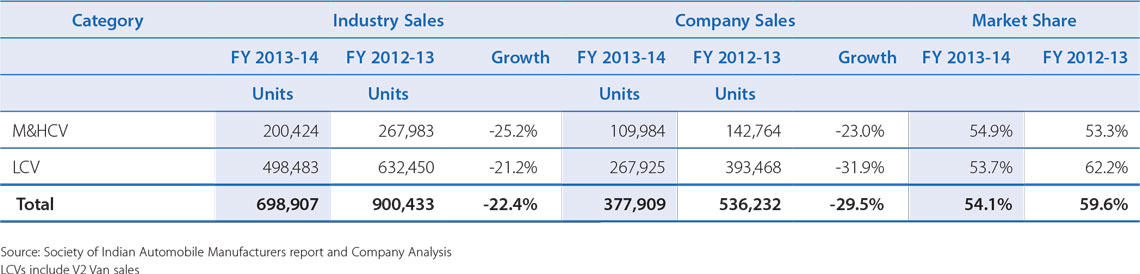

Consequent to the macro economic factors as explained above, the Indian automobile industry posted a decline of 9.3% in FY 2013-14, as compared to 1.1% growth in the last fiscal. The commercial vehicles declined by 22.4% (last year growth of 1.7%) and passenger vehicles declined by 4.7% (last year growth of 0.9%).

The industry performance in the domestic market during FY 2013-14 and the Company's market share are given below:-

INDUSTRY STRUCTURE AND DEVELOPMENTS

Commercial Vehicles:

The demand for Commercial vehicles remained depressed throughout the year. For FY 2013-14 the Commercial vehicle industry volumes at 698,907 reflect a decline of 22.4% over FY 2012-13. The Medium and Heavy Commercial Vehicles (M&HCV) segment recorded a further negative of 25.2% on the back of 23.3% decline in the last fiscal. The ban on mining, fleet underutilization, fall in resale value and low economic activities contributed to the fall. However, over the last few months, the decline has slowed down and volumes have stabilized through efforts taken by the Government to revive the sector by 4% reduction in excise duty, partial lifting of mining bans and increase in freight rates, indicating that the economy may be nearing the end of the down-cycle. While the M&HCV segment had declined in the last fiscal, the contraction of the Light Commercial Vehicles (LCV) segment by 21.2% is more significant because it was the growth driver in the past, growing by 17.9% in the last fiscal. The fall in this segment has been led by the drop in the Small Commercial Vehicle (SCV) volumes where fund availability is the most critical element. The high default rates in loans coupled with early delinquencies prompted the financiers to tighten lending norms, reduce the Loan-to-value (LTV) ratio and go into a collection mode impacting the SCV segment quite sharply.

The Company registered a decline of 29.5% to 377,909 units, primarily due to fall in LCV volumes coupled with the falling demand in M&HCV. The domestic industry performance during FY 2013-14 and the Company's market share are given below:-

The Company's commercial vehicle sales in the domestic and international markets at 420,992 units were 27.5% lower than the previous year.

Even under these difficult conditions, the Company has been able to gain market share in the critical M&HCV segment. The Company has been focusing intensely on market and customer activities to stimulate the buying sentiments. Activities included the Prima Truck Racing Championship event in March, 2014 the first of its kindinitiative in the Indian trucking history. The Prima LX series of trucks – a combination of economy & technology - were launched in FY2013- 14 which included – 2523T, 3123T, 4028S (Single reduction and Hub reduction) and 4928S (Single reduction and Hub reduction), 4923.S LX, Prima 4938 Tractor, 3138K Tipper, LPT 3723 - India's first 5 axle truck and LPK 3118, and Prima LX series of Tippers – 2523K, 3123K, 2528K & 3128K. One of the successful marketing initiatives was the Power of Five campaign for M&HCV trucks which was conducted across various locations across the country to counter competition. The campaign focuses on five advantages of the Company's vehicles – 1) Better KMPL, 2) Best Vehicle Uptime 3) Highest Resale Value, 4) Best in class four year warranty, 5) Lowest maintenance cost and five powerful offerings – i) Triple benefit insurance, ii) Increased Oil change interval, iii) 4 Year AMC, iv) Tata Alert, v) Fleetman. The bus segment also witnessed growthin market share for the Company, due to intensive sales efforts coupled with launch of buses with mechanical FIP, introduction of Starbus Ultra in Stage carriage, marketing initiatives such as 'Humare Bus Ki Baat Hain' and 'Dream it to win it' program. The warranty for M&HCV buses and trucks were increased to three years and four years respectively symbolizing improvement in quality. The Tata Alert service, to return a vehicle back on road within 48 hours, has been expanded across all national highways.

The Company registered a decline in the market share of LCV segment due to the sharp fall in volumes of the high share SCV segment. The newly launched Ultra trucks have started to receive good response from the market. There have been various other initiatives such as the Freedom campaign and Triumph through trials campaign of back-to-back and standalone fuel trials to establish the superior fuel efficiency of vehicles. The Company tied up with various PCGs (Public sector, Co-operative & Gramin banks) and has brought out several lucrative financing schemes to ease the financing situation. The Companyalso launched a major initiative called, 'Saathi', a Parts retailers' customer referral program for entire SCV range, to leverage their customer base. Some of launches this year were the Ace, Magic DICOR and facelifts.

Passenger Vehicles:

The Passenger Vehicle Industry contracted for the first time in the last five years, in FY 2013-14 with decline of 4.7%. The last such instance was during the economic slowdown of FY 2008-09 when it remained close to flat at negative 0.5%. The decline in sales volumes is seen across segments, but sedans bore the biggest brunt. Hatchbacks and UV's continue to be the volume segments. The high growth in UV segment last year, with the onset of Soft Roaders could not be repeated this year. The premium and luxury vehicles segment however has seen a growth even in an otherwise declining year.

The domestic performance in passenger vehicle segment is given below: