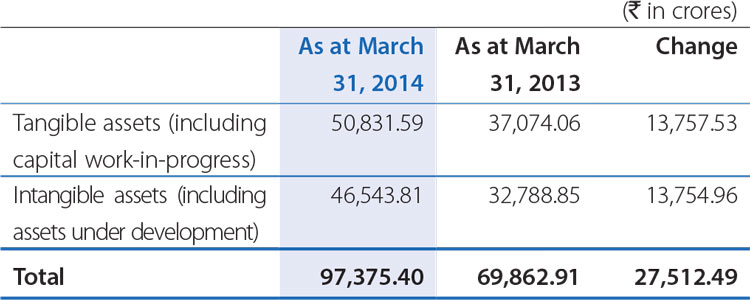

Fixed Assets:

The increase (net of depreciation) in the tangible assets mainly represented additions towards capacity / new product plans of the Company. The increase (net of amortization) in the intangible assets was Rs.13,754.96 crores, mainly attributable to new product developments projects at TML and JLR.

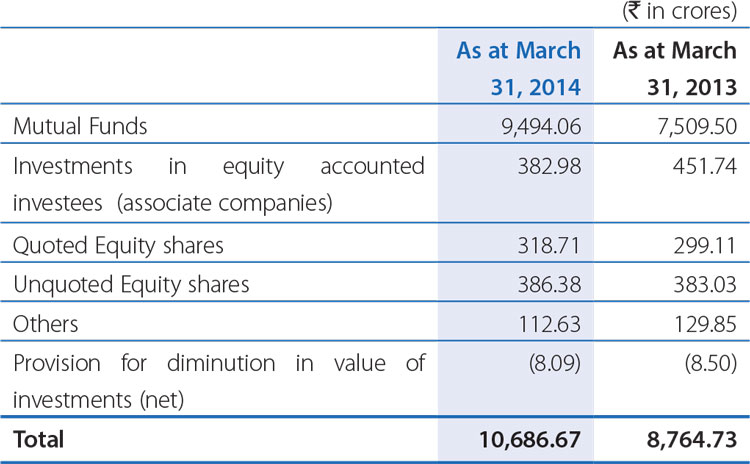

Investments (Current + Non-current) were Rs.10,686.67 crores as at March 31, 2014, as compared to Rs.8,764.73 crores as at March 31, 2013. The break-up is as follows:

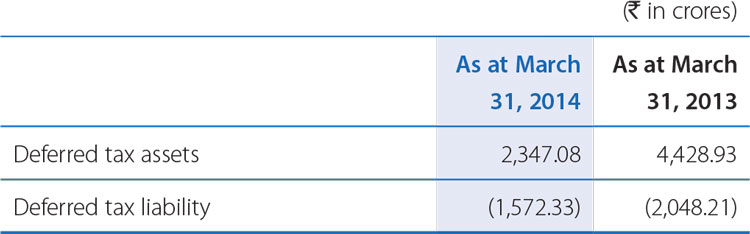

Deferred tax assets / liability:

Deferred tax assets, represents timing differences for which there will be future current tax benefits by way of unabsorbed tax losses and expenses allowable on payment basis in future years.

Deferred tax liabilities represent timing differences where current benefit in tax will be off-set by debit in the Statement of Profit and Loss.

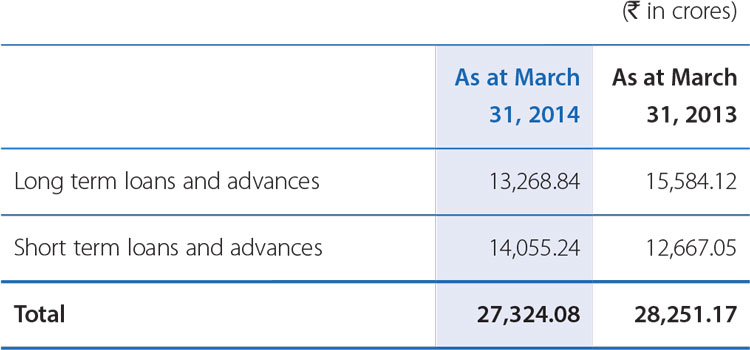

Loans and Advances

Loans and advances include

- Credit entitlement of Minimum Alternate Tax (MAT) of Rs.787.59 crores as at March 31, 2014 (Rs.1,516.40 crores as at March 31, 2013), relating to Tata Motors. The credit / refund will be against tax paid at normal rate, within time limit as per the Income Tax Act.

- Receivables towards vehicle financing by Tata Motors Finance Ltd was almost same at Rs.18,294.32 crores as at March 31, 2014, as compared to Rs.18,226.78 crores as at March 31, 2013; and

- VAT, other taxes recoverable, statutory deposits and dues of Rs.4,274.57 crores as at March 31, 2014, as compared to Rs.5,015.31 crores as at March 31, 2013.

Inventories as of March 31, 2014, stood at Rs.27,270.89 crores as compared to Rs.21,036.82 crores as at March 31, 2013. Inventory at TML was Rs.3,862.53 crores as compared to Rs.4,455.03 crores as at March 31, 2013. Inventory at JLR was Rs.21,634.06 crores as compared to Rs.14,726.76 crores as at March 31, 2013. The increase at JLR is consistent with the volume growth. (In terms of number of days of sales, finished goods represented 30 inventory days in FY 2013-14 as compared to 29 days in FY 2012-13).

Trade Receivables (net of allowance for doubtful debts) were Rs.10,574.23 crores as at March 31, 2014, representing a decrease of Rs.385.37 crores. Trade Receivables have decreased in TML by Rs.601.34 crores. The allowances for doubtful debts were Rs.621.70 crores as at March 31, 2014 against Rs.321.71 crores as at March 31, 2013.

Cash and bank balances were Rs.29,711.79 crores, as at March 31, 2014 compared to Rs.21,114.82 crores as at March 31, 2013. The Company holds cash and bank balances in Indian Rupees, GB£, and Chinese Renminbi etc. The cash balances include bank deposits maturing within one year of Rs.21,628.97 crores; compared to Rs.12,763.93 crores as at March 31, 2013. It included Rs.3,354 crores as at March 31, 2014 (Rs.4,320 crores as at March 31, 2013) held by a subsidiary that operates in a country where exchange control restrictions potentially restrict the balances being available for general use by Tata Motors Limited and other subsidiaries.

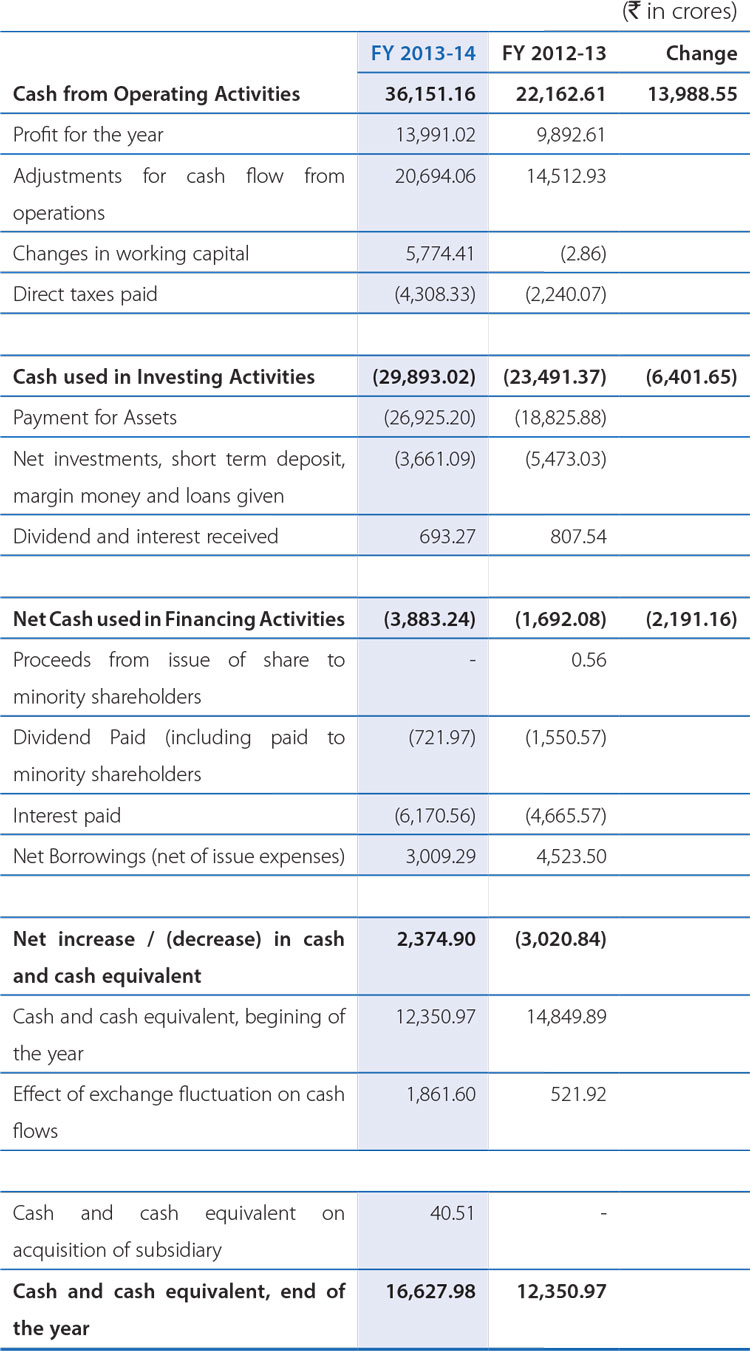

Consolidated Cash Flow

The following table sets forth selected items from consolidated cash flow statement:

Analysis:

- Cash generated from operations before working capital changes was Rs.34,685.08 crores as compared to Rs.24,405.53 crores in the previous year, representing an increase in cash generated through consolidated operations, consistent with the growth in revenue on a consolidated basis. After considering the impact of working capital changes and net movement of vehicle financing portfolio, the net cash generated from operations was Rs.40,459.59 crores as compared to Rs.24,402.66 crores in the previous year. The following factors contributed to net increase in working capital for the year:-

- Increase in trade and other assets amounting Rs.3,254.09 crores mainly due to increase in sales to importers at JLR.

- The above increases were offset by increase in trade and other payables by Rs.4,552.24 crores (due to revenue growth) and net increase in provisions of Rs.888.18 crores.

- Decrease in inventories amounting to Rs.2,852.55 crores (mainly in finished goods) due to higher volumes / activity at JLR.

- The net cash outflow from investing activity increased during the current year to Rs.29,893.02 crores from Rs.23,491.38 crores for the last year.

- Capital expenditure was at Rs.26,925.20 crores during the year as against Rs.18,825.88 crores for the last year, related mainly to capacity / expansion of facilities, quality and reliability projects and product development projects.

- The change in net investments mainly represents fixed/restricted deposits (net) Rs.4,389.07 crores against Rs.6,135.57 crores in the last year.

- The net change in financing activity was an outflow of Rs.3,883.24 crores as compared to Rs.1,692.09 crores for last year.

- During FY 2013-14, Rs.5,925.53 crores were raised from long term borrowings (net) as compared to Rs.5,525.25 crores. (Refer discussion below).

- Net decrease in short term borrowings of Rs.2,466.25 crores as compared to increase of Rs.1,846.66 crores.

As of March 31, 2014, Tata Motors Group borrowings (including short term debt) were Rs.60,642.28 crores compared with Rs.50,715.71 crores as of March 31, 2013.

The Company believes that it has sufficient resources available to meet planned capital requirements. However, the sources of funding could be adversely affected by an economic slowdown as was witnessed in FY 2008-09 or other macroeconomic factors in India and abroad such as Europe and markets where the Company is present such as China. A decrease in the demand for the Company products and services could lead to an inability to obtain funds from external sources on acceptable terms or in a timely manner. In order to refinance the Company acquisition related borrowings and for supporting long term fund needs, the Company continued to raise funds in FY 2012-13 and FY 2013-14, through issue of various debt securities described below.

In FY 2012-13, the Company issued rated, listed, unsecured non-convertible debentures of Rs.2,100 crores with maturities of 2-7 years as a step to raise long term resources and optimize the loan maturity profile.

In January 2013, JLR issued US$ 500 million Senior Notes due 2023, at a coupon of 5.625% per annum. The proceeds will be used for general corporate purposes, including, to support ongoing growth and capital spending plans. The notes are callable at a premium for the present value of future interest rates, if called before a specified date and thereafter are callable at fixed premiums.

During FY 2012-13, TMFL raised Rs.90.40 crores by issue of Subordinated Unsecured, Non-convertible debentures towards Tier 2 Capital and Rs.100 crores was raised by issue of Subordinated Unsecured Non-convertible Perpetual debentures towards Tier I Capital to meet its growth strategy and improve its capital adequacy ratio.

During FY 2013-14, the Company issued rated, listed, unsecured, non-convertible debentures of Rs.1,100 crores.

During FY 2013-14, JLR issued US$ 700 million 4.125% Senior Notes, due 2018 and GBP 400 million 5.0% Senior Notes, due 2022. The net proceeds from these issues have been utilised to refinance existing debt of GBP 750 million equivalent Senior Notes issued in May 2011.

During FY 2013-14, TML Holdings Pte Singapore issued SGD 350 million 4.25% Senior Notes, due 2018. The net proceeds from these issues have been utilised for redemption of preference shares issued to the Company and for general corporate purposes. TML Holdings Pte Singapore further raised equivalent US$ 600 million (US$ 460 million and SG$ 176.8 million) syndicated loan facility with equivalent US$ 300 million (US $ 250 million and SG$ 62.8 million) maturing in November 2017 and equivalent US$ 300 million (US$ 210 million and SG$ 114 million) in November 2019. The net proceeds from these have been utilised for acquiring certain offshore manufacturing subsidiaries/joint ventures from the Company at fair value and for general corporate purposes.

The Tata Motors Group fund its short-term working capital requirements with cash generated from operations, overdraft facilities with banks, short and medium term borrowings from lending institutions, banks and commercial paper. The maturities of these short and medium term borrowings and debentures are generally matched to particular cash flow requirements. The working capital limits are Rs.14,000 crores from banks in India as at March 31, 2014. The working capital limits are secured by hypothecation of certain existing current assets of the Company. The working capital limits are renewed annually.

JLR established 3-5 year committed Revolving Credit Facility from a syndicate of more than 20 banks. The outstanding balance under the facility which is completely undrawn, is GB£1,290 million as of March 31, 2014.

The Tata Motors Group cash and bank balances were Rs.29,711.79 crores as at March 31, 2014, as compared to Rs.21,114.82 crores as at March 31, 2013. These enable the Group to cater to business needs in the event of changes in market conditions.

Some of the Company's financing agreements and debt arrangements set limits on and / or require prior lender consents for, among other things, undertaking new projects, issuing new securities, changes in management, mergers, sale of undertakings and investment in subsidiaries. In addition, certain financial covenants may limit the Company's ability to borrow additional funds or to incur additional liens. Certain of the Company financing arrangements also include various covenants to maintain certain debt-to-equity ratios, debt-to-earnings ratios, liquidity ratios, capital expenditure ratios and debt coverage ratios all of which, except one, have been met by the Company. The breach of the single covenant has also been waived by the lenders and has not resulted in any 'Default' or penalties.

The cash and liquidity is located at various locations in its subsidiaries along with balances in India. Jaguar Land Rover's subsidiary in China is subject to foreign exchange controls and thereby has some restrictions on transferring cash to other companies of the group outside of China.

There may also be legal or economic restrictions on the ability of subsidiaries to transfer funds to the Company in the form of cash dividends, loans, or advances, however such restrictions have not had and are not estimated to have significant impact on the ability of the Company to meet its cash obligations.