FINANCIAL PERFORMANCE ON A STANDALONE BASIS

The financial information discussed in this section is derived from the Company's Audited Standalone Financial Statements.

As explained in the business section, the domestic economic environment deteriorated further, in the current fiscal. As a result, the automotive industry shrunk significantly.

Revenues (net of excise duty) were Rs.34,288.11 crores in FY2013- 14, as compared to Rs.44,765.72 crores, representing a decrease of 23.4%. As explained above, the total number of vehicles sold during the year decreased by 30.2%. The domestic volumes decreased significantly by 32.1% to 519,755 vehicles from 765,557 vehicles in FY 2013-14 and export volumes decreased marginally by 2% to 49,922 vehicles from 50,938 vehicles in FY 2013-14. The sale of spare parts / aggregates has also decreased by 8.2% to Rs.3,006.31 crores from Rs.3,273.80 crores in FY 2012-13.

Significant volumes reduction, adverse product mix, more particularly in the commercial vehicles, and intense competition amongst all product segments, impacted the operating margin, recording a negative margin of 1.4% of sales (positive 4.8% for FY 2012-13). As a result the Loss before tax was Rs.1,025.80 crores, as compared to Profit before tax of Rs.174.93 crores in FY 2012-13. There was a tax credit of Rs.1,360.32 crores in FY 2013-14 due to significant loss from operations. The Profit after tax was Rs.334.52 crores as compared to Rs.301.81 crores in FY 2012-13.

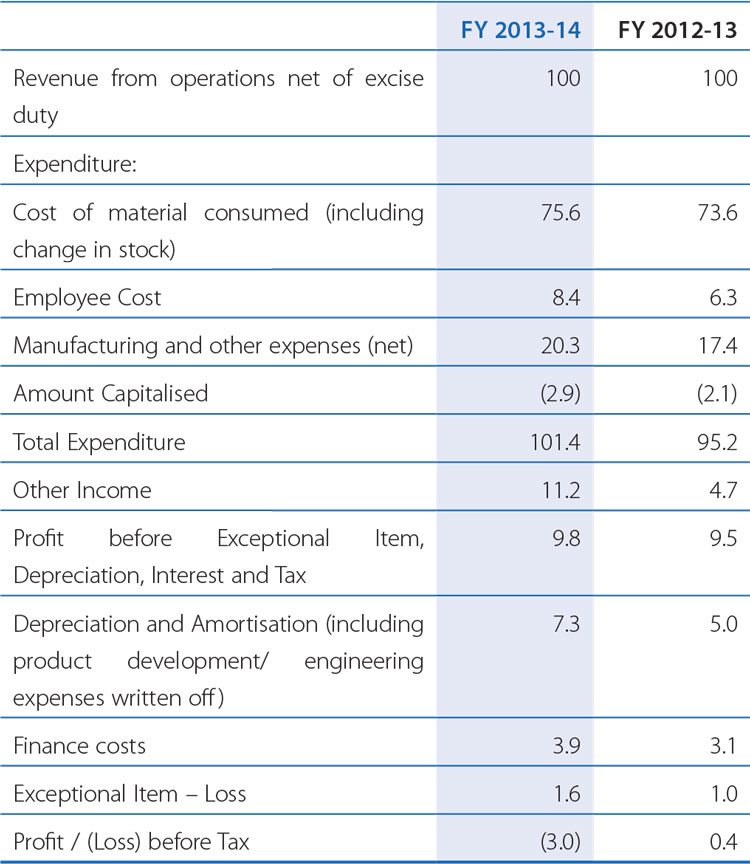

The analysis of performance is given below:-

Percentage to revenue from operations

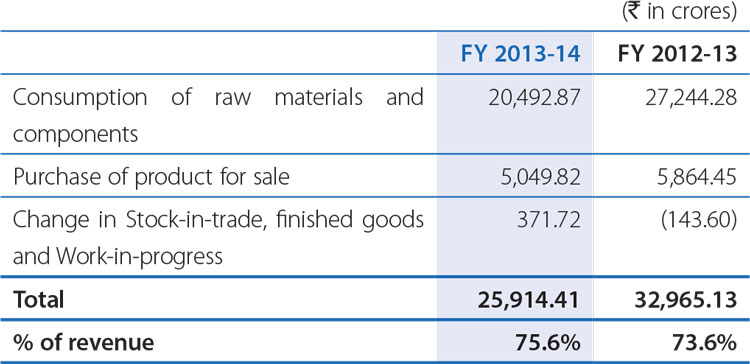

Cost of materials consumed (including change in stock):

The increase in terms of % to revenue was mainly due to adverse product mix and higher Variable Marketing Expenses (netted off in revenue)

Employee Cost: There was marginal increase to Rs.2,877.69 crores from Rs.2,837.00 crores in FY 2012-13 (1.4% over last year). The increase was mainly attributable to normal yearly increases, promotions, and wage agreements. The Company has taken steps to contain the manpower cost, by reduction in head count both permanent and temporary. However, due to lower volumes, the employee cost to revenue has increased from 6.3% to 8.4%.

Manufacturing and Other Expenses: These expenses relate to manufacturing, operations and incidental expenses other than raw materials and employee cost. This expenditure mainly included job work charges, advertisement & publicity and other selling and administrative costs. The expenses were Rs.6,987.53 crores during current fiscal, as compared to Rs.7,783.32 crores for FY 2012-13, representing 20.3% of revenue for FY 2013-14 (17.4% for FY 2012-13).

There been decrease in expenses in terms of absolute terms on account of lower volumes and cost reduction initiative taken by the Company. However, due to lower volumes, these costs were under absorbed.

Amount capitalised represents expenditure transferred to capital and other accounts allocated out of employee cost and other expenses incurred in connection with product development projects and other capital items. The expenditure transferred to capital and other accounts increased to Rs.1,009.11 crores from Rs.953.80 crores of FY 2012-13, and mainly related to ongoing product development for new products and variants.

Other Income was Rs.3,833.03 crores (Rs.2,088.20 crores for FY 2012- 13). For FY 2013-14, it includes dividends from subsidiary companies of Rs.1,573.98 crores (including dividend from JLR), as compared to Rs.1,583.58 crores for FY 2012-13. During the year, the Company has divested its investments in certain foreign subsidiaries to TML Holdings Pte Ltd, Singapore, a wholly owned subsidiary resulting in a profit of Rs.1,966.12 crores. Other income also includes interest income of Rs.178.02 crores as compared to Rs.383.64 crores for FY 2012-13. (The dividend from subsidiary companies and profit on divestment are eliminated in the consolidated income statement, being income from subsidiaries).

Profit before Exceptional Item, Depreciation, Interest and Tax (PBDIT) was Rs.3,350.62 crores in FY 2013-14, compared to Rs.4,222.27 crores in FY 2012-13. Lower volumes and adverse product mix, resulted in negative operating profit. This was offset by dividend from subsidiaries and profit from divestment of investments in certain foreign subsidiaries.

Depreciation and Amortization (including product development / engineering expenses written off) increased by Rs.255.66crores (11.4% increase over last year) to Rs.2,499.04crores from Rs.2,243.38 crores in FY 2012-13.

- Depreciation increased by Rs.36.25 crores, reflecting impact of additions to fixed assets towards plant and facilities for expansion and new products introduction.

- Amortization increased by Rs.216.43 crores related to product development projects capitalized for products launched in recent years.

Finance Costs decreased marginally to Rs.1,337.52 crores from Rs.1,387.76 crores in FY 2012-13.

Exceptional Items

- During FY 2013-14, the Company further provided Rs.202 crores for the cost associated with the closure of operations of subsidiary company, Hispano Carrocera SA.

- As per the accounting policy followed by the Company the exchange gain / loss on foreign currency long term monetary items, is amortised over the tenor of such monetary item. The net exchange loss including on revaluation of foreign currency borrowings, deposits and loans and amortisation, was Rs.273.06 crores for the year (last year Rs.263.12 crores).

- Employee separation cost – To address the challenges, business downturn, the Company had rolled out organization wide cost optimization programme, which included employee cost as important pillar, Accordingly, based on requests from employees for early retirement, the Company has given early retirement with a lump sum amount of Rs.47.28 crores to various employees.

- During FY 2013-14, the Company has provided Rs.17.52 crores as diminution in value of investment for a subsidiary Company, Tata Motors (Thailand) Ltd based on valuation received while divesting the investments to TML Holdings, Singapore.

Loss before Tax of Rs.1,025.80 crores represented a steep reduction of Rs.1,200.73 crores from Profit before tax of Rs.174.93 crores in FY 2012-13. The loss was mainly attributable to lower M&HCV and SCV volumes and severe contraction of passenger car volumes, increase in variable marketing expenses, resulting in lower operating margin, under absorption of fixed costs. The loss from operation was partially offset by dividend form subsidiary companies and profit on divestment of foreign subsidiaries.

Tax expenses -There was tax credit of Rs.1,360.32 crores as compared to Rs.126.88 for FY 2012-13. The tax expenses was after considering the tax benefit on R&D expenditure, provision of disallowances and tax treatment of foreign exchange differences.

Profit After Tax (PAT) increased to Rs.334.52 crores from Rs.301.81 crores in FY 2012-13. Consequently, basic Earnings Per Share (EPS) increased to Rs.1.03 as compared to Rs.0.93 for the previous year for Ordinary Shares and to Rs.1.13 as compared to Rs.1.03 for 'A' Ordinary Shares for the previous year.

Standalone Balance Sheet

Shareholders' funds were Rs.19,176.65 crores and Rs.19,134.84 crores as at March 31, 2014 and 2013, respectively.

Reserves increased to Rs.18,532.87crores as at March 31, 2014 from Rs.18,496.77 crores as at March 31, 2013, reflecting an increase of Rs.36.10 crores

- The PAT for the current year of Rs.334.52 crores added to the Profit & Loss account and Rs.354.52 crores (net) were added to the Securities Premium account mainly by way of premium on shares issued on conversion of Foreign Currency Convertible Notes (FCCN).

- The above was offset by proposed dividend (including tax thereon) of Rs.741.96 crores.

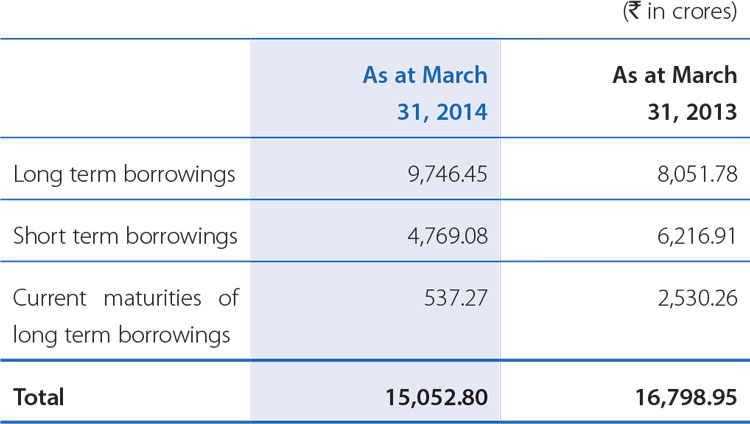

Borrowings:

During FY 2013-14, the Company repaid 2% Non-Convertible Debenture (2014) of Rs.2,458.05 crores (including premium) and fixed deposits from public and shareholders of Rs.362.19 crores. Foreign Currency Convertible Notes (FCCN) was fully converted to Ordinary shares. This was partly offset by Non-Convertible debentures taken during year of Rs.1,100 crores. Reduction in short term borrowings comprises of reduction in commercial paper by Rs.1,193.12 crores, Loans and advances from subsidiaries and associates by Rs.319.60 crores, net decrease in loan, cash credit, overdraft accounts by Rs.436.08 crores, Foreign Currency Non Repatriable Borrowings (FCNR(B)) by Rs.689.42 crores. These were offset by increase in the loan from banks by Rs.1,600 crores and Buyer's line of credit by Rs.187.63 crores The debt/equity ratio after considering cash / investment in mutual fund was 0.77 as compared to 0.85 as at March 31, 2013.

Due to significant reduction in volumes, the Company had to deploy short term funds to support critical long term finance needs, The Company is in the process of taking appropriate steps to increase the long term funds.

Trade payables were Rs.9,672.36 crores as at March 31, 2014 as compared to Rs.8,455.02 crores as at March 31, 2013. There has been increase in acceptances due to increase in the term.

Provisions (current and non-current) as at March 31, 2014 and 2013 were Rs.2,708.11crores and Rs.2,200.77 crores, respectively. The provisions are mainly towards warranty, employee retirement benefits, delinquency and proposed dividends. The increase is mainly in the provision for delinquency by Rs.680.37 crores.

Fixed Assets: The tangible assets (net of depreciation and including capital work in progress) increased marginally from Rs.13,795.55 crores as at March 31, 2013 to Rs.13,850.35 crores. The intangible assets (net of amortisation, including the projects under development), increased from Rs.6,412.99 crores as at March 31,2013 to Rs.7,745.29 crores. The intangible assets under development were Rs.4,638.22 crores as at March 31, 2014, which relate to new products planned in the future.