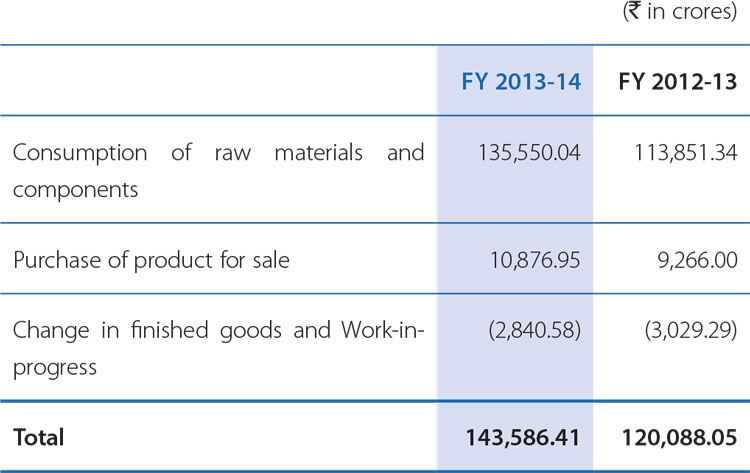

Cost of materials consumed (including change in stock)

Cost of material consumed decreased from 64.6% to 62.4% of total revenue (excluding income from vehicle financing). At TML RM cost was 75.6% of net revenue as compared to 73.6%, representing an increase of 200 basis points, mainly attributable to product mix (reduction in M&HCV sales). For JLR the RM cost was 60.9% of revenue (FY 2012-13 62.5%), representing a reduction of 160 basis points. The reduction is mainly attributable to product mix, cost reduction programmes and reduction in input price of major metals consumed. On a consolidated basis, JLR operations have significantly contributed to reduction in material cost in terms of % to revenue.

Employee Cost was Rs.21,556.42 crores in FY 2013-14 as compared to Rs.16,632.19 crores in FY 2012-13; an increase of Rs.4,924.23 crores. Of the increase Rs.1,823.07 crores (approximately) relates to translation impact of JLR from UK Pounds to Indian Rupee. At JLR the increase in employee cost is attributable to increases in the permanent and contractual head count to support the volume increases/new launches and product development projects. At TML the employee cost marginally increased to Rs.2,877.69 crores as compared to Rs.2,837.00 crores in FY 2012-13.

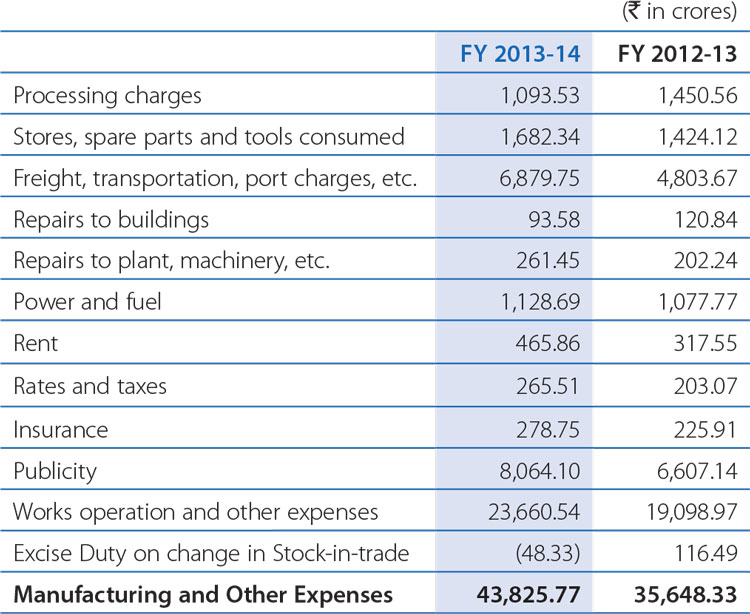

Manufacturing and Other Expenses include all works operation, indirect manufacturing expenses, freight cost, fixed marketing costs and other administrative costs. These expenses have increased to Rs.43,825.77 crores from Rs.35,648.33 crores in FY 2012-13. As explained above, each line item includes the element of translation impact of JLR (approximately Rs.3,704 crores).

The breakup is given below-

The increases are mainly driven by volumes, size of operations and also include inflation impact however this has remained same at 18.8% as compared to 18.9% in FY 2012-13, in terms of % to revenue.

- Processing charges were mainly incurred by TML, where mainly due to volume contraction, the expenditure was lower.

- Freight, transportation, port charges etc. have increased, mainly at JLR, in view of increase in volumes in the overseas markets.

- The publicity expenses increase, mainly related to new product launches (Range Rover Sport and the F-Type launch) and ongoing product / brand campaigns.

- The works operation and other expenses have increased to 10.2% from 10.1% of net revenue. While a part of revenue relates to volumes, the major increases were in IT costs, warranty and engineering expenses at JLR, partly offset by exchange gain on trading activities at JLR.

Amount capitalised represents expenditure transferred to capital and other accounts allocated out of employee cost and other expenses, incurred in connection with product development projects and other capital items. The expenditure transferred to capital and other accounts has increased to Rs.13,537.85 crores from Rs.10,193.45 crores of FY 2012-13, mainly on account of various product development projects undertaken by the Company and JLR, for introduction of new products, development of engine and products variants.

Other Income was Rs.828.59 crores from Rs.815.59 crores in FY 2012-13 and mainly includes interest income of Rs.675.45 crores (FY 2012-13 Rs.694.06 crores) and profit on sale of investment of Rs.114.58 crores (FY 2012-13 Rs.80.09 crores). The increase is due to profit on sale of mutual funds, mainly at TML.

Profit before Interest, Depreciation, Exceptional Items and Tax has increased from Rs.27,433.16crores in FY 2012-13 to Rs.38,231.50 crores in FY 2013-14, and represented 16.4% of revenue.

Depreciation and Amortization (including product development / engineering expenses written off): During FY 2013-14, expenditure increased to Rs.13,643.37 crores from Rs.9,622.87 crores in FY 2012-13. The increase in depreciation of Rs.1,496.84 crores is on account of plant and equipment and tooling (mainly towards capacity and new products) installed in last year, the full effect of which is reflected in the current year. The amortization expenses have gone up from Rs.3,593.90 crores in FY 2012-13 to Rs.5,573.94 crores in FY 2013-14, attributable to new product introduced during the last year. The expenditure on product development / engineering cost written off has increased by Rs.543.62 crores. As explained above, there was an element of increase representing translation impact.

Finance Cost increased by 33.0% to Rs.4,733.78 crores from Rs.3,560.25 crores in FY 2012-13. The increase mainly represented borrowings for the short term and long term needs of the Group. The increase is partly attributable to prepayment of 2011 Senior notes by JLR.

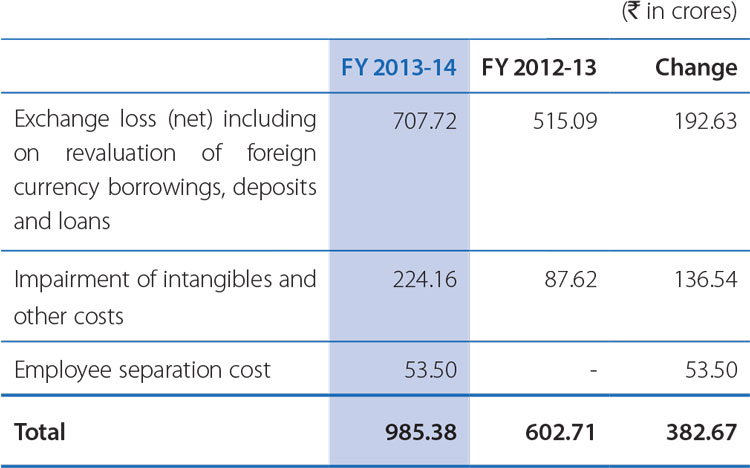

Exceptional Items

- Foreign exchange loss (net) represents impact on account of revaluation of foreign currency borrowings, deposits and loans, and amortisation of loss / gain, on such foreign currency monetary items which was deferred in previous years.

- Impairment of intangibles and other costs are in respect of subsidiary companies, triggered by continuous under performance, mainly attributed by challenging market conditions in which the subsidiaries operate.

- Employee separation cost -To address the challenges, business downturn, the Company had rolled out organization wide cost optimization programme, which included employee cost as an important pillar, Accordingly, based on requests from employees for early retirement, the Company has given early retirement with a lump sum amount of Rs.53.50 crores to various employees.

Consolidated Profit Before Tax (PBT) increased to Rs.18,868.97 crores in FY 2013-14, compared to Rs.13,647.33 crores in FY 2012-13, representing an increase of Rs.5,221.64 crores. Due to severe contraction in domestic volumes, TML's contribution to PBT was negative. JLR by virtue of its strong performance, contributed to PBT. The increase also includes translation impact.

Tax Expense represents a net charge of Rs.4,764.79 crores in FY 2013-14, as compared to net charge of Rs.3,776.66 crores in FY 2012- 13. The tax expense is not comparable with the profit before tax, since it is consolidated on a line-by-line addition for each subsidiary company and no tax effect is recorded in respect of consolidation adjustments. Effective tax rate in FY 2013-14 is 25.3% as compared to 27.7% in FY 2012-13.

Consolidated Profit for the year increased to Rs.13,991.02 crores from Rs.9,892.61 crores in FY 2012-13, after considering the profit from associate companies and share of minority. The increase in profit as compared to last year is attributable to higher volume in JLR.

Consolidated Balance Sheet

Shareholders' fund was Rs.65,603.45 crores and Rs.37,637.30 crores as at March 31, 2014 and 2013, respectively.

Reserves increased from Rs.36,999.23 crores as at March 31, 2013 to Rs.64,959.67 crores as of March 31, 2014. The increase represents strong performance on a consolidated basis as explained above

- An amount of Rs.5,399.55 crores (as at March 31, 2013 Rs.1,578.07 crores), balance in hedging reserves account, representing marked to market impact on the derivative financial instruments.

- Balance in Profit & Loss Account and General Reserve has gone up by Rs.13,303.73 crores, representing results from operations for the year, net of distribution of dividend and transfer to other reserves.

- These were offset by debit in the pension reserve of JLR, which increased by Rs.1,343.67 crores (net), due to changes of actuarial assumptions (discount rate and inflation rate).

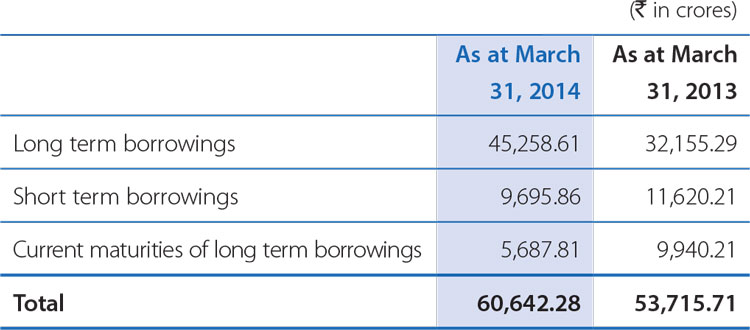

Borrowings:

- Current maturities of Long term borrowings represents amount of loan repayable within one year.

- Long term borrowings including the current portion increased by Rs.8,850.92 crores to Rs.50,946.42 crores.

- During FY 2013-14, TML Holdings Pte Singapore issued SG$ 350 million 4.25% Senior Notes, due 2018 and raised equivalent US$ 600 million (US$ 460 million and SG$ 176.8 million) syndicated loan facility with equivalent US$ 300 million (US$ 250 million and SG$ 62.8 million) maturing in November 2017 and equivalent US$ 300 million (US$ 210 million and SG$ 114 million) in November 2019.

- In FY 2013-14, the Company issued rated, listed, unsecured non-convertible debentures of Rs.1,100 crores with maturities of 2-4 years as a step to raise long term resources and optimize the loan maturity profile.

- The reduction of Rs.1,924.35 crores in the Short term borrowings were primarily due to reduction of loans from banks.

Other Long term liabilities were Rs.2,596.86 crores as at March 31, 2014, as compared to Rs.3,284.06 crores as at March 31, 2013. These included Rs.548.36 crores of derivative financial instruments, mainly JLR as at March 31, 2014 (Rs.1,733.50 crores as at March 31, 2013), reflecting decreased notional liability consequent to valuation of derivative contracts.

Trade payables were Rs.57,315.73 crores as at March 31, 2014, as compared to Rs.44,912.35 crores as at March 31, 2013. The increase is attributable to increase in volumes, mainly at JLR.

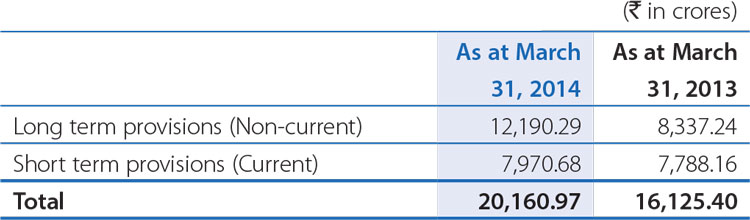

Provisions (current and non-current) were towards warranty, employee benefit schemes and proposed dividend. Short term provisions are those which are expected to be settled during next financial year. The details are as follows:

- Provision for warranty and product liability increased by Rs.2,763.12 crores mainly on account of volumes at JLR.

- The provision for employee benefits schemes increased by Rs.1,303.28 crores on account of change in actuarial factors at JLR.

Other current liabilities were Rs.17,373.86 crores as at March 31, 2014 as compared to Rs.22,224.94 crores as at March 31, 2013. This mainly includes liability towards vehicles sold under repurchase arrangements, liability for capital expenditure, statutory dues, and current liability of long term debt and advance / progress payment from customers. The decrease was mainly due to decrease in current maturities of long term debt (explained above), increase in liability for capital expenditure and derivative financial instruments.