Emerging markets: In Brazil, rising interest rates and falling consumer confidence left total new vehicle registrations down 4.5% year-on-year. Despite this backdrop, JLR expanded its sales by 21.1% to over 11,000 vehicles. Meanwhile, in India and Russia the total vehicle markets also contracted (by 6.2% and 6.0% respectively), but JLR grew its sales by 8.6% and 14.7%. Only in South Africa did the economic situation overcome JLR sales momentum. The 25% depreciation in the Rand against Sterling forced JLR to raise prices to prevent losses being made on several models. JLR sales contracted by 9.9% on the previous year.

Asia Pacific: Total JLR sales increased by 27.7% year-on-year to 22,795. Of the three NSCs in the region, South Korea experienced the fastest expansion. On the back of a rebound in economic growth following the slowdown in 2012, JLR sales jumped 51.8%. In Japan, advanced purchases of vehicles to beat the increase in the consumption tax in April 2014 more than offset the deterioration in consumer sentiment. Total JLR sales increased by 33.2% against growth in the total passenger car market of 9.0% in FY 2013-14. Finally, in Australia, the unwinding of the mining boom and growing slack in the economy were compounded by dwindling consumer confidence and rising unemployment. Total new car sales growth was a meager 1.3% after over 8% the year before. JLR sales were buoyant though, and grew by 15.3%.

Jaguar Land Rover's Sales & Distribution: JLR markets products in over 170 countries, through a global network of 18 national sales companies (NSCs), 84 importers, 53 export partners and 2,518 franchise sales dealers, of which 784 are joint Jaguar and Land Rover dealers. JLR has established robust business processes and systems to ensure that its production plans meet anticipated retail sales demand and to enable the active management of its inventory of finished vehicles and dealer inventory throughout its network. JLR has robust arrangements in place with: Black Horse (part of the Lloyds Bank Group) in the UK, FGA Capital (a joint venture between Fiat Auto and Credit Agricole) in Europe and Chase Auto Finance in the USA for the provision of dealer and consumer Financial Services products. Jaguar Land Rover has similar arrangements with local Auto Financial Services providers in other key markets. JLR's financing partners offer its customers a full range of consumer financing options

Tata Daewoo Commercial Vehicles (TDCV): FY 2013-14 was a very encouraging as well as challenging year for the TDCV. On one hand Domestic volumes increased by 21.9% resulting in strong performance of the TDCV as compared to its competitors coupled with gradual recovery in the Korean economy. On the other hand Export volumes (including KD) decreased by 14.6% as compared to the previous year mainly due to adverse economic conditions in global markets. TDCV's total sales volume increased by 5% in FY 2013-14 compared to FY 2012-13.

Total market for Heavy Commercial Vehicles (HCV) in Korea was almost stagnant during FY 2013-14 as compared to the previous year; however the TDCV achieved growth rate of 25.7% with sales of 2,995 units of HCV in FY 2013-14 as compared to 2,383 units in the previous year. Medium Duty Trucks segment Industry witnessed 6% growth in FY2013-14 mainly driven by gradual recovery of Korean economy. In this segment also Company outperformed Industry by achieving 19% volume growth with sales of 3,589 units in FY 2013-14 as compared to 3,017 units in the previous year. TDCV was able to improve its market share in both, HCV as well as MCV segment.

TDCV exported 4,016 units in FY 2013-14, a reduction of 14.6% as compared to 4,700 units sold in the previous year. TDCV's sales decreased significantly in some of its traditional export markets like Russia, Laos, South Africa, Vietnam etc. Sales in previous year were high due to few specific tenders (eg. Kuwait, Iraq) which are not yearly requirement.

Tata Motors Finance Ltd (TMFL): Due to severely strained market conditions, total disbursements (including refinance) by TMFL declined by 22% at Rs.8,767.56 crores as compared to Rs.11,180.03 crores. TMFL financed a total of 157,886 vehicles reflecting decline of 38% over the 254,086 vehicles financed in the previous year. Disbursements for commercial vehicles were at Rs.7,504.35 crores (123,989 units) as compared to Rs.8,814.90 crores (183,514 units) of the previous year. Disbursements of passenger vehicles declined by 49% to Rs.1,213.46 crores (32,637 units) as compared to Rs.2,363.53 crores (70,563 units) in previous year.

Due to weak operating and economic environment in India, movement of commercial vehicles has slowed down in all segments and large and small fleet operators have large waiting period and reduced trips. Delay in receipt of payments by large fleet operators from companies is further delaying payments to attached vehicles of smaller operators. This has resulted in low income and increased levels of provisioning, due to loss of contracts by small fleet operators / First time users in M&HCV / LCV segment since last few months. The performance of HCV loans was the weakest due to slow economic growth, overcapacity and rising input costs.

Various monetary and fiscal measures were unable to stimulate growth across segments resulting sluggish growth and consequent lower demand of all commercial and passenger vehicles. However, with a highly motivated employee workforce, significantly greater customer orientation and an increased branch network / field infrastructure, TMFL is poised for significant, sustainable growth and is confident that it would deliver on its vision for the future.

With a view to de-risk the portfolio and explore additional sources of revenue, the used vehicle finance business was re-launched by seeding the business in select geographies during the year. Disbursements achieved under refinance were at Rs.49.74 crores (1,260 vehicles) during FY 2013-14 as against Rs.1.60 crores (9 vehicles) in the previous year.

TMFL increased its reach by opening a number of limited services branches (called Spoke branches) exclusively in Tier 2 & 3 towns. This has also helped in reducing the turn-around-times to improve customer satisfaction.

TMFL's new initiative of Channel Finance and fee based Insurance support business has also helped improve its profitability. TMFL is confident of significantly adding to its revenues and profitability through these new businesses in the coming period. TMFL has also tied up with the Company's used vehicle business for working together to improve realizationvalue from the sale of repossessed stocks by refurbishing them and selling them through the Company's dealers.

TMFL has further enhanced its "Office of the Customer initiative" as well as its spokes branch network & infrastructure and is confident that these investments will pay rich dividends through significantly increased interactions/relations with its customers and dealers.

Tata Technologies Ltd (TTL): TTL is a key strategic partner in several of the information technology initiatives for the Tata Motors Group. The broad scope of TTL activities are as follows:

- Engineering Automation Group [EAG]: EAG addresses the engineering and design needs of manufacturers through services for all stages of the product development and manufacturing process.

- Enterprise Solutions Group [ESG]: ESG addresses the Information Technology needs of manufacturers including business solutions, strategic consulting, ERP implementation, systems integration, IT networking and infrastructure solutions and program management.

- Product Lifecycle Management [PLM]: PLM addresses the product development technology solution requirements of manufacturers including end-to-end implementation of PLM technology, best practices and PLM consulting. PLM also includes the TTL's proprietary applications iGETIT® and iCHECKIT®.

During FY 2013-14, the capabilities in the industrial machinery domain, was significantly expanded through the acquisition of Cambric, now comprises an additional 325 engineering experts with extensive knowledge in systems, mechanical and electrical engineering, product design, electronics and embedded design and development. TTL innovative and frugal engineering approach helps organizations create products – at a faster pace with a lower cost – delivering more value to the end-user.

The consolidated revenue in FY 2013-14 was Rs.2,394.73 crores, an increase of 17.1% against Rs.2,045.42 crores in the previous year. The Services/Products business mix was a 77:23 split as compared to 76:24 mix for FY 2012-13. The Americas revenue was Rs.743.69 crores with Asia Pacific recording Rs.972.88 crores and Europe generating Rs.960.38 crores.

FINANCIAL PERFORMANCE ON A CONSOLIDATED BASIS

The financial information discussed in this section is derived from the Company's Audited Consolidated Financial Statements.

Tata Motors Group primarily operates in the automotive segment. The acquisition of JLR enabled the Company to enter the premium car market. The Company continues to focus on profitable growth opportunities in global automotive business, through new products and market expansion. The Company and JLR, continue to focus on integration, and synergy through sharing of resources, platforms, facilities for product development and manufacturing, sourcing strategy, mutual sharing of best practices.

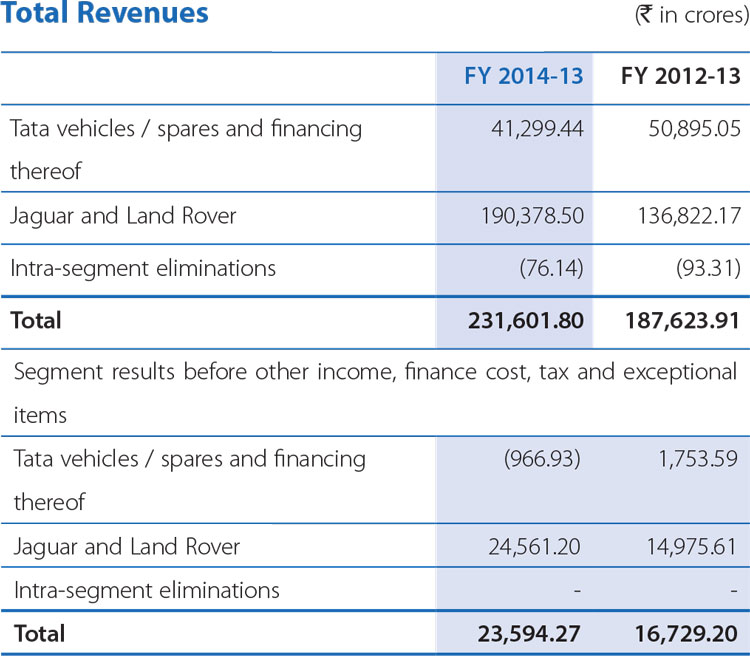

The business segments are (i) automotive operations and (ii) all other operations. The automotive operations include all activities relating to development, design, manufacture, assembly and sale of vehicles including financing thereof, as well as sale of related parts and accessories. The Company provides financing for vehicles sold by the dealers in India. The vehicle financing is intended to drive sale of vehicles by providing financing to the dealers' customers and as such, is an integral part of automotive business. Automotive operations segment accounted for 98.9% and 98.8% of total revenues in FY 2013-14 and FY 2012-13, respectively. For FY 2013-14, revenue from automotive operations before inter-segment eliminations was Rs.231,601.80 crores compared to Rs.187,623.91crores for FY 2012-13.

The automotive operations segment is further divided into Tata Motors and other brand vehicles (including spares and vehicle financing) and Jaguar Land Rover. (A reference may be made to review of performance of TML and Jaguar Land Rover business as discussed above). For FY 2013-14, Jaguar Land Rover contributed 82.2% (72.9% for FY 2012-13) of the total automotive revenue (before intra segment elimination) and the remaining 17.8% (27.1% for FY 2012-13) was contributed by Tata and other brand vehicles. Revenue and segment results for automotive operations are given below:

The other operations business segment includes information technology, machine tools and factory automation solutions, and investment business. For FY 2013-14, revenue from other operations before inter-segment eliminations was Rs.2,518.99 crores compared to Rs.2,265.92 crores for FY 2012-13. Segment results before other income, finance cost, tax and exceptional items (before intersegment eliminations) were Rs.282.66 crores as compared to Rs.375.68 crores for FY 2012-13.

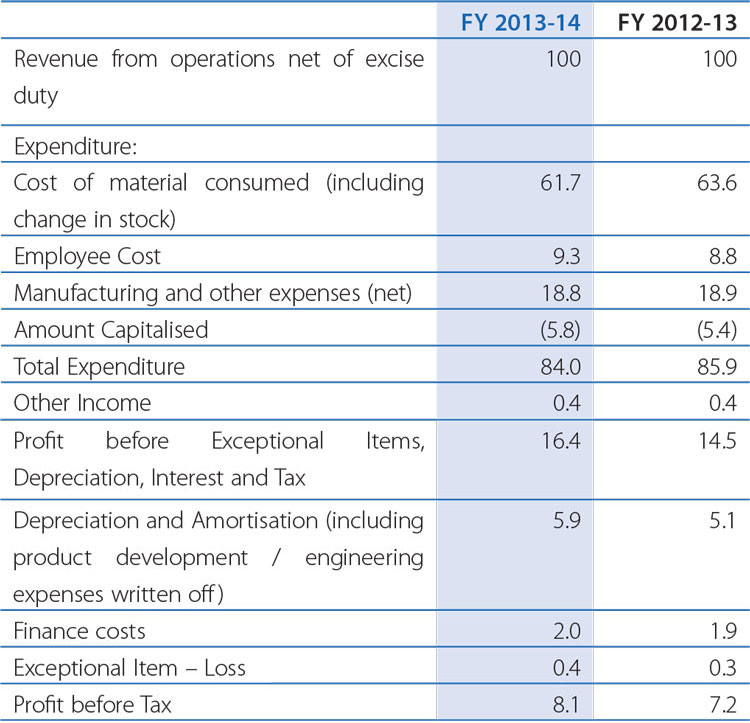

The revenue from operations net of excise duty on a consolidated basis has grown by 23.3% in FY 2013-14 to Rs.232,833.66 crores. The increase is mainly attributable to growth in automotive revenue mainly at Jaguar Land Rover business. The analysis of performance on consolidated basis is given below:-

Percentage to Revenue from operations