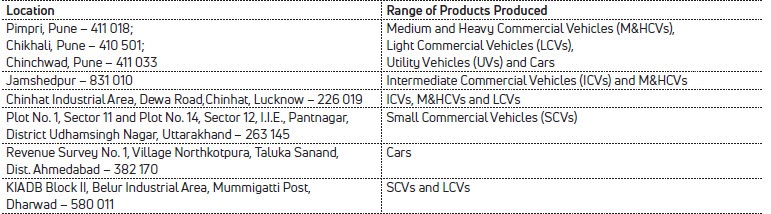

PLANT LOCATIONS

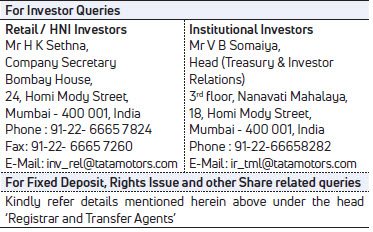

ADDRESS FOR CORRESPONDENCE

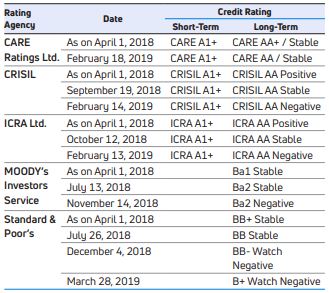

CREDIT RATINGS

Credit ratings obtained along with revisions thereto during FY 2018-19, for all debt instruments in India and abroad:

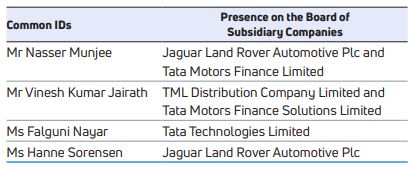

SUBSIDIARY COMPANIES

During FY 2018-19, the Company did not have any material unlisted Indian subsidiary company and hence, it was not required to have an ID of the Company on the Board of such subsidiary company.

However, the following IDs of the Company are on the Board of below mentioned subsidiary companies:

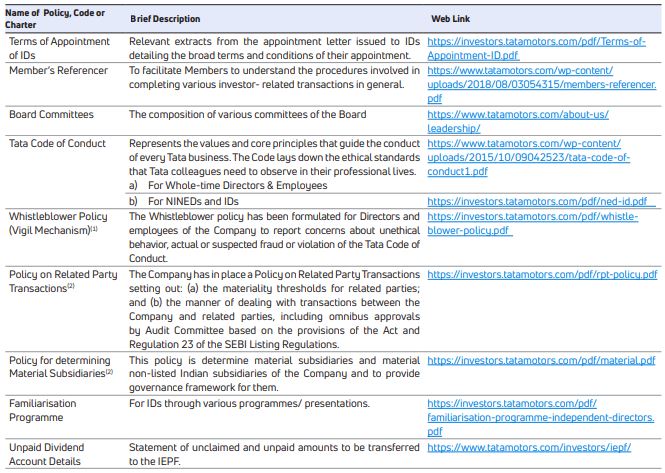

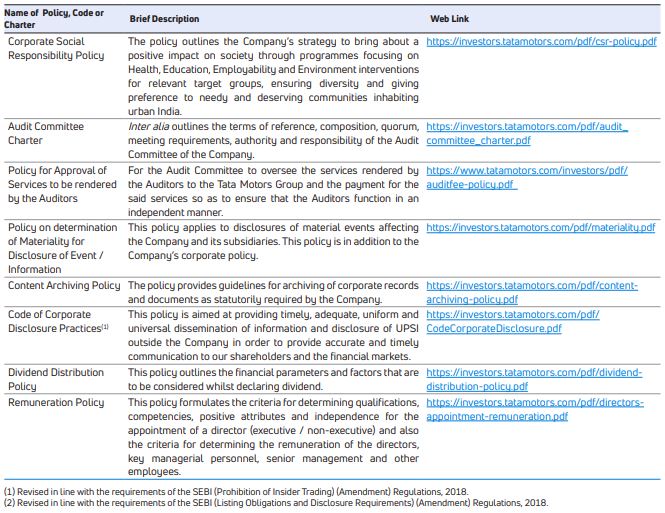

The Company adopted a Policy for Determining Material Subsidiaries of the Company, pursuant to Regulation 16(1)(c) of the SEBI Listing Regulations. This policy is available on the Company’s website at http://investors.tatamotors.com/pdf/material.pdf pursuant to Regulation 46(2) of the SEBI Listing Regulations.

The Audit Committee also has a meeting wherein the CEO and CFO of subsidiary companies make a presentation on significant issues in audit, internal control, risk management, etc. Significant issues pertaining to subsidiary companies are also discussed at Audit Committee meetings of the Company.

The minutes of the subsidiary companies are placed before the Board of Directors of the Company and the attention of the Directors is drawn to significant transactions and arrangements entered into by the subsidiary companies. The performance of its subsidiaries is also reviewed by the Board periodically.

DISCLOSURES

- Details of transactions with related parties as specified in Indian Accounting Standards (IND AS 24) have been reported in the financial Statements. During the year under review, there was no transaction of a material nature with any of the related parties, which was in conflict with the interests of the Company. The Audit Committee takes into consideration the management representation and an independent audit consultant’s report, whilst scrutinizing and approving all related party transactions, from the perspective of fulfilling the criteria of meeting arms’ length pricing and being transacted in the ordinary course of business. During the period, all transactions with related parties entered into by the Company were in the ordinary course of business and on an arm’s length basis, were approved by the Audit Committee. The detailed Policy on Related Party Transactions is available on the website of the Company at https://investors.tatamotors.com/pdf/rptpolicy.pdf.

- The Company has complied with various rules and regulations prescribed by the Stock Exchanges, Securities and Exchange Board of India ('SEBI') or any other statutory authority relating to the capital markets during the last 3 years. No penalties or strictures have been imposed by them on the Company except as mentioned below:

- In accordance with the provisions of the Act and Regulation 22 of the SEBI Listing Regulations, the Company has in place a Vigil Mechanism and a Whistle-Blower Policy duly approved by the Audit Committee which provides a formal mechanism for all Directors and employees of the Company to approach the Management of the Company (Audit Committee in case where the concern involves the Senior Management) and make protective disclosures to the Management about unethical behaviour, actual or suspected fraud or violation of the Company’s Code of Conduct or Ethics policy. The disclosures reported are addressed in the manner and within the time frames prescribed in the Policy. The Company affirms that no director or employee of the Company has been denied access to the Audit Committee.

- Prevention of Insider Trading Code: As per SEBI (Prohibition of

Insider Trading) Regulations, 2015, the Company has adopted a

revised Code of Conduct for Prevention of Insider Trading & Code

of Corporate Disclosure Practices. All the Directors, employees

and third parties such as auditors, consultants etc. who could

have access to the UPSI of the Company are governed by

this code. The trading window is closed during the time of

declaration of results and occurrence of any material events as

per the Code. Mr P B Balaji, the CFO, is the Compliance Officer, is

responsible for setting forth procedures and implementation of

the Code for trading in the Company’s securities.

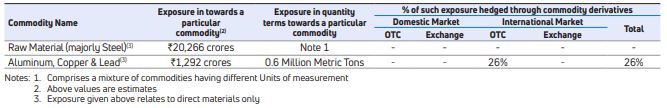

- Total exposure of the Company to commodities: Rs.21,558 crores

- Exposure of the Company to various Commodities :

- Commodity risks faced by the Company during the year and measures adopted to combat the same: Headwinds are noticed in Flat and Long Steel, one alternate source is developed and plans to import, if required, are being chalked out. Strong negotiations indicate recoupment of some portion of the increases in FY 2019-20.

- The Company has complied with all the mandatory requirements of Corporate Governance as specified in subparas (2) to (10) of Part C of Schedule V of the SEBI Listing Regulations and disclosures on compliance with corporate governance requirements specified in Regulations 17 to 27 have been included in the relevant sections of this report.

- The Company also fulfills all the non-mandatory requirements as specified in Part E of the Schedule II of the SEBI Listing Regulations.

- Commodity price risk or foreign exchange risk and hedging activities: During the FY 2018-19, the Company had managed the foreign exchange and commodity price risk and hedged to the extent considered necessary. The Company enters into forward contracts for hedging foreign exchange and commodity exposures against exports and imports. The details of foreign currency and commodity exposure are disclosed in Note No.42(c) (i)(a) and 42(c)(iv) to the Standalone Financial Statements.

- Details of utilization of funds raised through preferential allotment or qualified institutions placement as specified under Regulation 32 (7A) – Not applicable.

- None of the Directors of the Company have been debarred or disqualified from being appointed or continuing as directors of companies by the Securities and Exchange Board of India or the Ministry of Corporate Affairs or any such statutory authority. A Certificate to this effect, duly signed by the Practicing Company Secretary is annexed to this Report.

- The Company and its Subsidiaries on a consolidated basis have paid Rs.70.43 crores to the Statutory Auditors and to all entities in their network firm. For details please refer to the Note No. 36 in the Consolidated Financial Statements.

- The Company has established an appropriate mechanism for dealing with complaints in relation to Sexual Harassment of Women at Workplace, in accordance with its Policy on Prevention of Sexual Harassment at Workplace (‘POSH’) which is available on the website of the Company. For disclosure regarding the number of complaints filed, disposed of and pending, please refer to the Board’s Report.

- The Company is in compliance with the disclosures required to be made under this report in accordance with Regulation 34(3) read together with Schedule V(c) to the SEBI Listing Regulations.

- Appropriate information has been placed on the Company’s website pursuant to clauses (b) to (i) of sub-regulation (2) of Regulation 46 of the SEBI Listing Regulations.

The SEBI vide Order dated March 6, 2018 had issued directions for the Company to conduct an internal inquiry within 3 months into the leakage of information relating to its financial results for the quarter ended December 2015 and to take appropriate actions against those responsible as well as to submit its report within 7 days thereafter. Accordingly, the Company engaged Ernst & Young LLP (E&Y) on March 15, 2018 to independently conduct a forensic investigation and prepare a report thereon in line with SEBI directives. The Company vide its letters dated June 7, 2018 and June 11, 2018 submitted to SEBI, the outcome of the E&Y forensic investigation report as well as the measures adopted / proposed to be adopted by the Company to further strengthen its processes relating to handling of Unpublished Price Sensitive Information ('UPSI') (especially related to financial statements) within the organisation, on the basis of suggestions/observations made by E&Y in its forensic investigation report.

During FY 2017-18 the Company had paid a penalty of Rs.5.60 lakhs each, levied by BSE and NSE, in respect of delayed filing of the listing application for 266 Ordinary Shares and 80 ‘A’ Ordinary Shares allotted, out of shares held in abeyance, on settlement of an inter-se dispute amongst the shareholders

The Company has revised the Whistle-Blower policy to insert “reporting of incidents of leak or suspected leak of UPSI" in terms of the Securities and Exchange Board of India (Prohibition of Insider Trading) Regulations, 2015, as amended from time to time and the revised policy was approved by the Board at its meeting held on March 26, 2019. Kindly refer to the Company’s website https://investors.tatamotors.com/pdf/whistle-blowerpolicy.pdf for the detailed Whistle-Blower Policy of Company.

The Risk Management Policy of the Company with respect to commodities including hedging: The Company being, a USD 44 billion organization, is a leading global automobile manufacturer of cars, utility vehicles, buses, trucks and defense vehicles. Material costs incurred result from direct and indirect consumption of a wide variety of commodities including Aluminium and its alloys, Copper, Zinc, Lead, Steel products, Plastics, Rubber, Platinum, Palladium and Rhodium.

The Original Equipment Manufacturer (‘OEM’) ultimately bears the price risk in the automobile manufacturing value chain due to escalation clauses with auto-component manufacturers. Hence, increase in commodity prices directly impacts the operating margins of the Company.

The objective of the commodity price risk management programs is to offset the price risk by locking in input prices, thereby maintaining stability in input prices and reducing pricing pressure. The Company currently hedges only base metals i.e. Aluminum, Copper and Lead for a period of 1 year on a rolling basis with hedge ratios up to 50%.

The Company uses various hedging instruments like premium paying and zero cost derivative transactions, including forwards, vanilla options, cost reduction structures, seagulls, etc.

The Commodities Risk Management Policy is placed before the Audit Committee and the Board of Directors annually for review.

On behalf of the Board of Directors

N CHANDRASEKARAN

Chairman

(DIN: 00121863)

Mumbai,

May 20, 2019