Compliance Officer

Mr H K Sethna, Company Secretary, who is the Compliance Officer, can be contacted at: Tata Motors Limited, Bombay House, 24, Homi Mody Street, Mumbai - 400 001, India.

Tel: 91 22 6665 7824; Email:[email protected].

Complaints or queries relating to the shares and/or debentures can be forwarded to the Company’s Registrar and Transfer Agents – M/s TSR Darashaw Consultants Pvt. Limited at [email protected], whereas complaints or queries relating to the public fixed deposits can be forwarded to the Registrars to the Fixed Deposits Scheme – M/s TSR Darashaw Consultants Pvt. Limited at [email protected]. TSRDL is the focal point of contact for investor services in order to address various FD related matters mainly including repayment / revalidation, issue of duplicate FD receipts / warrants, TDS certificates, change in bank details/ address and PAN corrections. In view of increase in the correspondence, TSRDL have increased their investor interface strength (telephone and counter departments) and have taken other steps for rendering speedy and satisfactory services to the FD holders.

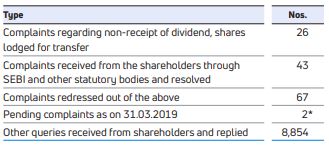

The status on the total number of investors' complaints during FY 2018-19 is as follows:

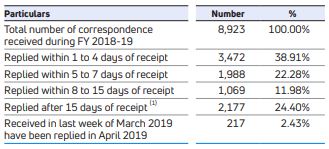

All letters received from the investors are replied to and the response time for attending to investors’ correspondence during FY 2018-19 is shown in the following table:

- These correspondence pertain to court cases involving retrieval of case files, co-ordination with the Company/Advocates, partial documents awaited from Investors, cases involving registration of legal documents, executed documents received for issue of duplicate certificates and transmission of shares without legal representation which involve checking documents, sending notices to Stock Exchange(s) and issue of duplicate certificates/transmission of shares after approval from the Company. However, all these cases have been attended to within 30 days.

There were no pending share transfers pertaining to the Financial Year ended March 31, 2019.

On recommendations of the Stakeholders’ Relationship Committee, the Company has taken various investor friendly initiatives like organising Shareholders’ visit to the Company’s Works at Pune, sending reminders to investors who have not claimed their dues, sending nomination forms, etc.

CORPORATE SOCIAL RESPONSIBILITY (CSR) COMMITTEE

The Committee is constituted by the Board in accordance with the Act to:

- Formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the Company as specified in Schedule VII of the Act;

- Recommend the amount of expenditure to be incurred on the activities referred to in clause (a); and

- Monitor the Corporate Social Responsibility Policy of the Company from time to time.

The CSR Policy is uploaded on the Company’s website at https:// investors.tatamotors.com/pdf/csr-policy.pdf as required under the provisions of Section 135 of the Act and Rule 9 of the Companies (Corporate Social Responsibility Policy) Rules, 2014.

Risk Management Committee (RMC)

The Committee is constituted and functions as per Regulation 21 of the SEBI Listing Regulations to frame, implement and monitor the risk management plan for the Company. The suitably revised terms of reference enumerated in the Committee Charter, after incorporating therein the regulatory changes mandated under the SEBI (Listing Obligations and Disclosure Requirements) (Amendment) Regulations, 2018, are as follows:

- Review the Company’s risk governance structure, risk assessment and risk management policies, practices and guidelines and procedures, including the risk management plan.

- Review and approve the Enterprise Risk Management ('ERM') framework.

- Review the Company’s risk appetite and strategy relating to key risks, including product risk and reputational risk, cyber security risk, commodity risk, risks associated with the financial assets and liabilities such as interest risk, credit risk, liquidity exchange rate funding risk and market risk, as well as the guidelines, policies and processes for monitoring and mitigating such risks.

- Oversee Company’s process and policies for determining risk tolerance and review management’s measurement and comparison of overall risk tolerance to established levels.

- Review and analyze risk exposure related to specific issues, concentrations and limit excesses and provide oversight of risk across organization.

- Review compliance with enterprise risk management policy, monitor breaches / trigger trips of risk tolerance limits and direct action.

- Nurture a healthy and independent risk management function in the Company.

- Carry out any other function as is referred by the Board from time.

The Committee operates as per its Charter approved by the Board and within the broad guidelines laid down in it. The Company has a Risk Management Policy in accordance with the provisions of the Act and SEBI Listing Regulations. It establishes various levels of accountability and overview within the Company, while vesting identified managers with responsibility for each significant risk.

The Board takes responsibility for the overall process of risk management in the organisation. Through Enterprise Risk Management Programme, business units and corporate functions address opportunities and the attendant risks with an institutionalized approach aligned to the Company’s objectives. The business risk is managed through cross-functional involvement and communication across businesses. The results of the risk assessment are thoroughly discussed with the Senior Management before being presented to the RMC.

THE SAFETY, HEALTH & SUSTAINABILITY COMMITTEE

The Committee reviews Safety, Health and Sustainability practices. The terms of reference of the Committee include the following:

- To take a holistic approach to safety, health and sustainability matters in decision making;

- To provide direction to Tata Motors Group in carrying out its safety, health and sustainability function;

- To frame broad guidelines/policies with regard to safety, health and sustainability;

- To oversee the implementation of these guidelines/policies; and

- To review the safety, health and sustainability policies, processes and systems periodically and recommend measures for improvement from time to time.

CODE OF CONDUCT

Whilst the Tata Code of Conduct is applicable to all Wholetime Directors and employees of the Company, the Board has also adopted the Tata Code of Conduct for NINEDs and IDs as specified under Schedule IV of the Act and Regulation 26(3) of the SEBI Listing Regulations. The detailed Codes of Conduct are respectively available on the website of the Company at https:// www.tatamotors.com/wp-content/uploads/2015/10/09042523/ tata-code-of-conduct1.pdf and https://investors.tatamotors.com/ pdf/ned-id.pdf. Pursuant to Regulation 26(5) of the SEBI Listing Regulations, all members of senior management have confirmed that there are no material, financial and commercial transactions wherein they have a personal interest that may have a potential conflict with the interest of the Company at large. Pursuant to Regulation 26(3) of the SEBI Listing Regulations, all the Board members and senior management of the Company as on March 31, 2019 have affirmed compliance with their respective Codes of Conduct. A Declaration to this effect, duly signed by the CEO & MD is annexed to this Report. Furthermore, pursuant to the provisions of Regulations 8 and 9 under the SEBI (Prohibition of Insider Trading) Regulations, 2015 the Company has adopted and endeavors adherence to the Tata Code of Conduct for Prevention of Insider Trading and the Code of Corporate Disclosure Practices. Kindly refer to the Company’s website https://investors.tatamotors. com/pdf/CodeCorporateDisclosure.pdf for the detailed Code of Corporate Disclosure Policy of the Company.

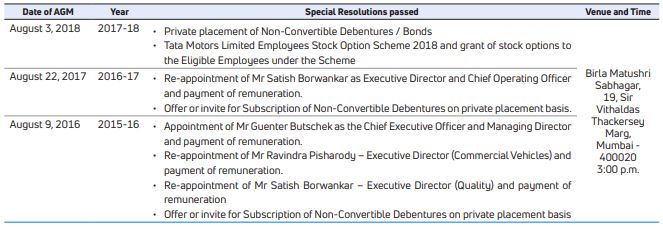

GENERAL BODY MEETINGS

Annual General Meeting (AGM)

There were no special resolutions proposed to be passed through Postal Ballot during the last year or at the forthcoming AGM.

The Minutes of the aforementioned General Meetings are available on the Company’s website. There were no resolutions passed by Postal Ballot by the Company during the year under review.

MODES OF COMMUNICATION

The Quarterly, Half Yearly and Annual Results are regularly submitted to the Stock Exchanges in accordance with the SEBI Listing Regulations and are generally published in the Indian Express, Financial Express and the Loksatta (Marathi). The Company has emailed to the Members who had provided email addresses, the half yearly results of the Company. The information regarding the performance of the Company is shared with the shareholders vide the Annual Report. The official news releases, including on the quarterly and annual results and presentations made to institutional investors and analysts are also posted on the Company’s website (www.tatamotors.com) in the 'Investors' section.

The Annual Report, Quarterly Results, Shareholding Pattern, Press Releases, Intimation of Board Meetings and other relevant information of the Company are posted through BSE Listing Centre and NSE Electronic Application Processing System (NEAPS) portals for investor information.