Transfer of unclaimed / unpaid amounts to the Investor Education and Protection Fund (IEPF):

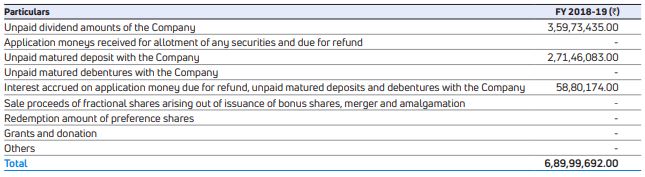

- Pursuant to Sections 124 and 125 of the Act and the Investor Education and Protection Fund (Accounting, Audit, Transfer and Refund) Rules, 2016 (“IEPF Rules”), all unclaimed/unpaid dividend, application money, debenture interest and interest on deposits as well as principal amount of debentures and deposits, sale proceeds of fractional shares, redemption amount of preference shares, etc. pertaining to the Company remaining unpaid or unclaimed for a period of 7 years from the date they became due for payment, are liable to be transferred to the Investor Education and Protection Fund (IEPF) Authority, established by the Central Government.

- Upto March 31, 2019, the Company has transferred Rs. 32,11,06,566.34 to IEPF, including the following amounts during the year.

Furthermore, the IEPF Rules mandate companies to transfer shares of shareholders whose dividends remain unpaid / unclaimed for a period of 7 consecutive years to the demat account of the IEPF Authority. The said requirement does not apply to shares in respect of which there is a specific order of the Court, Tribunal or Statutory Authority, restraining any transfer of shares.

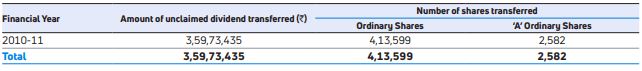

In light of the aforesaid provisions, the Company has during the year, transferred the unclaimed dividends, outstanding for 7 consecutive years of the Company. Further, shares of the Company, in respect of which dividend has not been claimed for 7 consecutive years or more, have also been transferred to the demat account of the IEPF Authority. The details of the unclaimed dividends and shares transferred to IEPF during the year 2018-19 are as follows:

The members who have a claim on the above dividends and shares may claim the same from the IEPF Authority by submitting an online application in the prescribed Form No.IEPF-5 available on the website www.iepf.gov.in and sending a physical copy of the same duly signed to the Company along with requisite documents enumerated in the Form No. IEPF-5. No claims shall lie against the Company in respect of the dividend/shares so transferred. The Members/Claimants can file only one consolidated claim in a financial year as per the IEPF Rules.

Considering the above, there are no shares lying in the suspense account of the Company under Regulation 39(4) of the SEBI Listing Regulations.

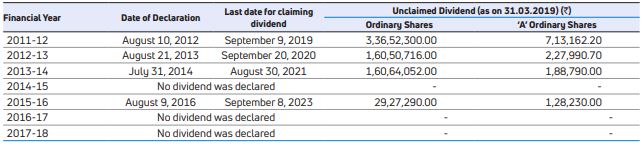

The Company strongly recommends shareholders to encash / claim their respective dividend within the period given below from the Company’s Registrar and Share Transfer Agents:

Whilst the Company’s Registrar & Transfer Agent has already written to the Members, Debenture holders and Depositors informing them about the due dates for transfer to IEPF for unclaimed dividends/interest payments, attention of the stakeholders is again drawn to this matter through the Annual Report. The data on unpaid / unclaimed dividend and other unclaimed monies is also available on the Company’s website at https://www.tatamotors.com/investor/iepf/. Investors who have not yet encashed their unclaimed/unpaid amounts are requested to correspond with the Company’s Registrar and Transfer Agents, at the earliest. Members may refer to the Refund Procedure for claiming the aforementioned amounts transferred to the IEPF Authority as detailed on http://www.iepf.gov.in/IEPF/refund.html.

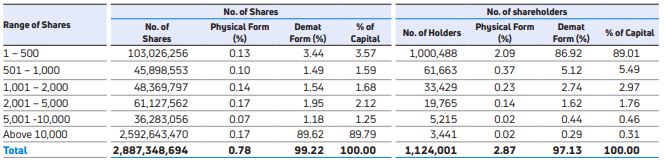

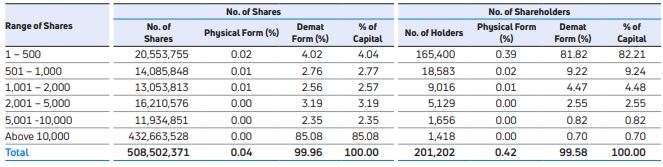

DISTRIBUTION OF SHAREHOLDING AS AT MARCH 31, 2019

Ordinary Shares

'A' Ordinary Shares

For details on the Shareholding Pattern and Top 10 Shareholders, kindly refer Form MGT-9 appended to the Board’s Report of this Annual Report

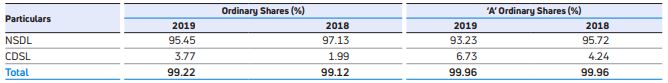

DEMATERIALISATION OF SHARES

The Company’s Ordinary and ‘A’ Ordinary Shares are tradable compulsorily in electronic form. The electronic holding of the shares as on March 31, 2019 through the National Securities Depository Limited (NSDL) and the Central Depository Services Limited ('CDSL') are as follows:

OUTSTANDING SECURITIES

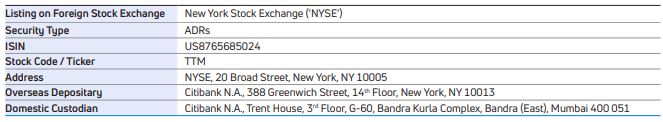

Outstanding Depositary Receipts/Warrants or Convertible instruments, conversion / maturity date and likely impact on equity as on March 31, 2019 are as follows:

- Depositary Receipts: The Company has 6,47,39,272 ADRs listed on the New York Stock Exchange as on March 31, 2019. Each

Depository Receipt represents 5 underlying Ordinary Shares of Rs.2/- each.

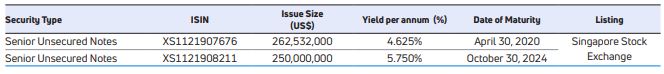

- Senior Unsecured Notes: In October 2014, the Company issued a dual tranche of Senior Unsecured Notes, details of which are given

hereunder:

- There are no outstanding warrants or any other convertible instruments issued by the Company.

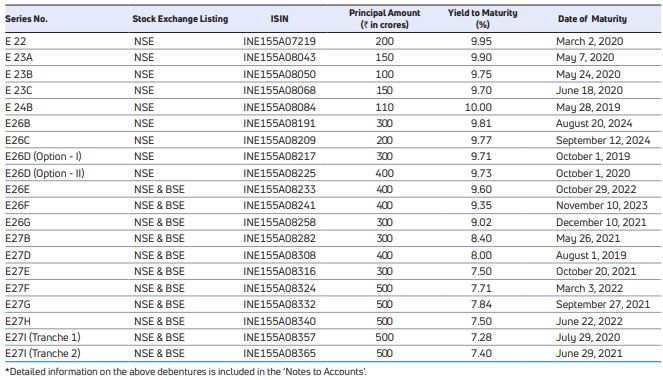

- The following Non-Convertible Debentures (NCD) are listed on NSE and BSE under Wholesale Debt Market Segment*:

Debenture Trustee: Vistra ITCL (India) Limited, situated at the IL&FS Financial Centre, 7th Floor, East Quadrant, Plot C- 22, G Block, Bandra Kurla Complex, Bandra (E), Mumbai 400051, are the debenture trustees for all the aforementioned NCD’s issued by the Company. They may be contacted at Tel.: +91 22 2659 3333, Fax : + 91 22 2653 3297, Email id: [email protected].