Notice

Board’s Report

Management Discussion & Analysis Corporate Governance Report

Business Responsibility Report

81

TO THE MEMBERS OF TATA MOTORS LIMITED

The Directors present their Seventy Second Annual Report along with the Audited Statement of Accounts for Fiscal 2017.

Pursuant to the notification issued by the Ministry of Corporate Affairs on February 16, 2015 and under the Companies (Indian Accounting

Standards) Rules, 2015 and other accounting principles generally accepted in India, the Company has adopted Indian Accounting Standards

on April 1, 2016, with the transition date as April 1, 2015. Fiscal 2016 Financial Statements have been prepared in accordance with the

recognised and measurement principles stated therein.

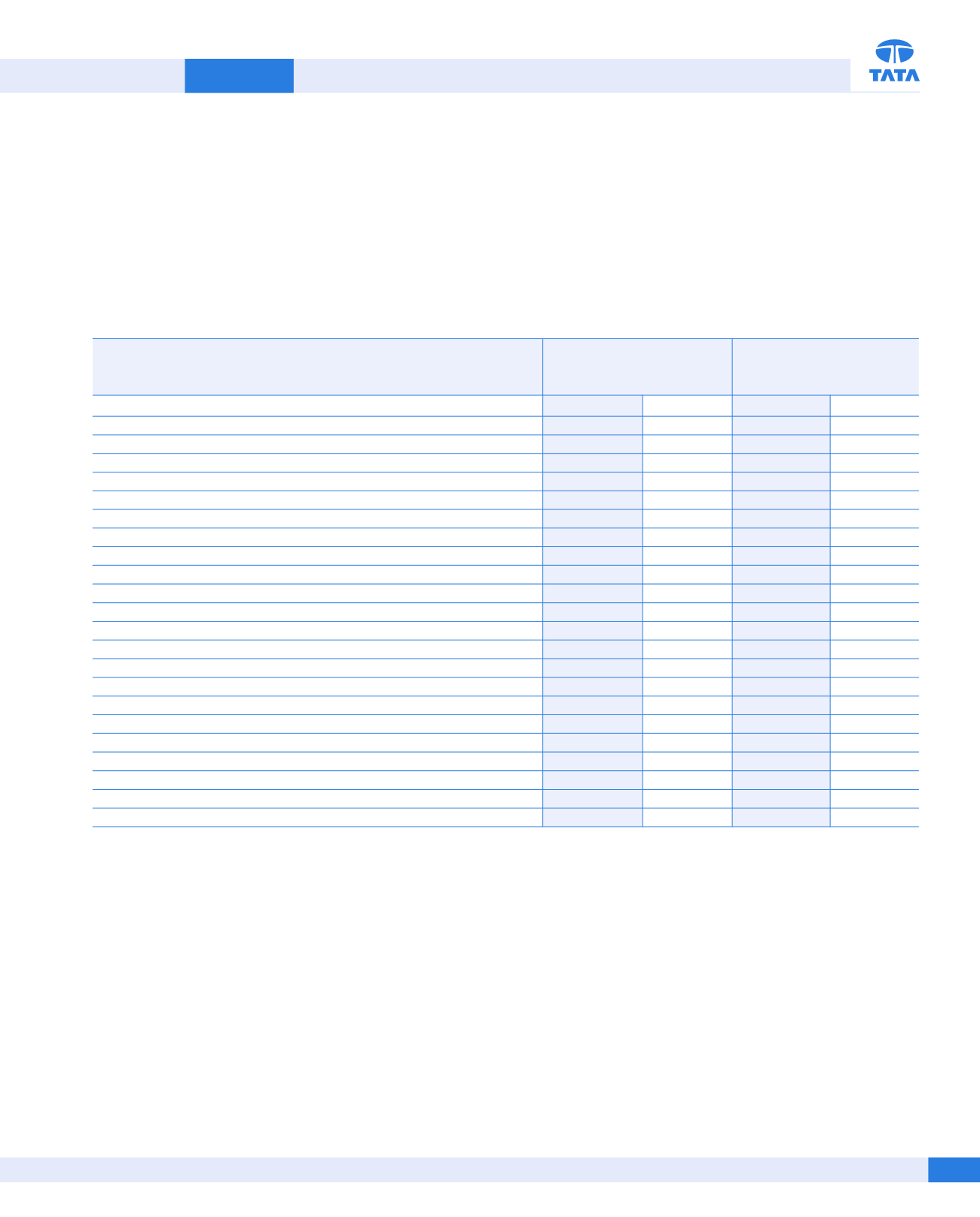

FINANCIAL PERFORMANCE SUMMARY

BOARD’S REPORT

(

`

in crores)

Tata Motors

(Standalone)*

Tata Motors Group

(Consolidated)

Fiscal 2017 Fiscal 2016 Fiscal 2017 Fiscal 2016

FINANCIAL RESULTS

Income from operations

49,100.41

47,383.61

2,74,492.12

2,77,660.59

Total expenditure

47,399.74

44,018.78

2,37,579.76

2,35,884.31

Operating profit

1,700.67

3,364.83

36,912.36

41,776.28

Other Income

978.84

1,402.31

754.54

885.35

Profit before interest, depreciation, amortization, exceptional item and tax

2,679.51

4,767.14

37,666.90

42,661.63

Finance costs

1,590.15

1,592.00

4,238.01

4,889.08

Cash profit

1,089.36

3,175.14

33,428.89

37,772.55

Depreciation, amortization and product development/ engineering expenses

3,423.87

2,747.49

21,318.56

20,179.55

Foreign exchange (gain)/loss (net)

(252.45)

222.91

3,910.10

1,616.88

Profit/(loss) for the year before exceptional items and tax

(2,082.06)

204.74

8,200.23

15,976.12

Exceptional Items - loss (net)

338.71

271.84

(1,114.56)

1,850.35

Profit/(loss) before tax

(2,420.77)

(67.10)

9,314.79

14,125.77

Tax expenses/(credit) (net)

59.22

(4.80)

3,251.23

3,025.05

Profit/(loss) after tax

(2,479.99)

(62.30)

6,063.56

11,100.72

Share of profit of joint ventures and associates (net)

-

-

1,493.00

577.47

Profit/(loss) for the year

(2,479.99)

(62.30)

7,556.56

11,678.19

Other comprehensive income/(loss)

95.48

85.47

(27,494.57)

3,157.46

Total Other comprehensive income/(loss) for the year

(2,384.51)

23.17

(19,938.01)

14,835.65

Attributable to:

(a) Shareholders of the Company

(20,005.94)

14,724.64

(b) Non-controlling interest

67.93

111.01

DIVIDEND

Considering the continued weak operating environment in the

standalone business and in viewof the losses for the year, no dividend

is permitted to be paid to the Members for Fiscal 2017, as per the

Companies Act, 2013 (“the Act”) and the Rules framed thereunder.

TRANSFER TO RESERVES

In Fiscal 2016, an additional amount has been transferred from

retained earnings to Debenture Redemption Reserve (DRR) on

outstanding Non-Convertible Debentures (NCDs) and Senior Notes

(including interest accrued where applicable) of

`

43.79 crores.

Due to losses in Fiscal 2017, resulting in debit balance in retained

earnings no amount has been transferred to DRR on the NCDs

allotted in Fiscal 2017.

OPERATING RESULTS AND PROFITS

Fiscal 2017 has been marked by couple of ‘Black Swan’ events (like

Brexit -UK decision to exit EU and Demonetization in India) having

a large impact on the future course of developments. This year was

marked by the way for the long awaited and transformational Goods

and Service Tax (GST).

Growth of World GDP has been 3.1% in Fiscal 2016. A recovery in

commodity prices has provided some relief to commodity exporters

and helped in reducing the deflationary pressures. The Orgainisation

of the Petroleum Exporting Countries (OPEC) ability to increase

price by cutting down production has been curtailed by rising

Shale gas output in US. Moreover, structural problems such as low

productivity growth and high-income inequality persisted and are

* These include the Company’s proportionate share of income and expenditure in its two Joint Operations, namely Tata Cummins Pvt Ltd and Fiat India Automobiles Pvt Ltd.