(

`

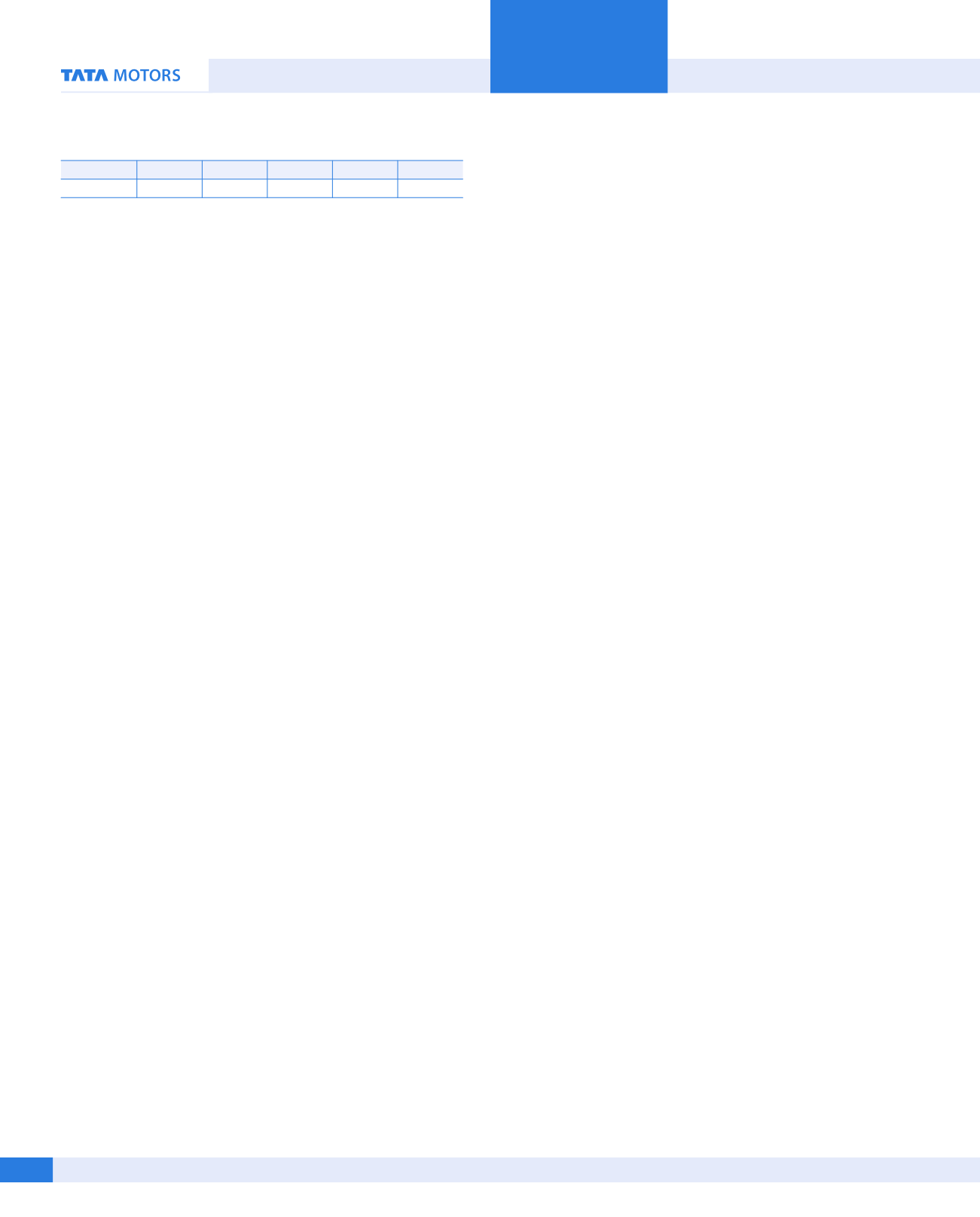

in Lakhs)

Percentile 10

th

25

th

Median 75

th

90

th

289

372

410

553

681

(Data Source: Aon Hewitt – COO Compensation Benchmarking Study, July 2017 with

Revenues in excess of

`

10,000 crores in FY 2016-17. The value represented above refers

to Cost to Company, which includes basic salary, all allowances, benefits valuations,

performance bonuses / commissions and Long term incentives.)

Note: A percentile is a measure used in statistics, indicating the value under which a

given percentage of observations in a group of observations fall. For example, the 25

th

percentile is the value (or score) under which 25% of the observations may be found.

6. Pecuniary relationship directly or indirectlywith the Company,

or relationship with themanagerial personnel, if any:

Besides the remuneration paid/payable to Mr Borwankar, there

is no other pecuniary relationship with the Company or with the

managerial personnel of the Company.

7. Recognition or Awards:

Some of the significant Awards and Recognitions received by the

Company during the year are given below:

Plants

:

Jamshedpur:

World Class Quality Level II.

Ranked 1

st

in the Industry category for environmental

initiatives by Jharkhand State Pollution Control Board.

CII-GreenCo ‘Gold Rating’ Best Practices Award 2016 for its

Innovative Project on water conservation.

Pune:

Excellent Energy Efficient Unit Award in the Automobile

Manufacturing category at the 17

th

National Awards for

Excellence in Energy Management organised by CII.

First runner - up in the Automotive Sector, Mega Large Business

category at the Frost & Sullivan - IndiaManufacturing Excellence

Awards 2016.

Lucknow:

The Srishti Good Green Governance Award 2016.

Social Return on Investment Award by KPMG.

Certification of GreenCo “Silver rating” during Green Co

Summit 2016 by CII.

Apprentices’ Training Excellence Award by Govt. of UP.

III. OTHER INFORMATION

1. Reasons of loss or inadequate profits:

For Fiscal 2017 the Consolidated Revenue from operations

and Profit After Tax was

`

2,74,492 crores and

`

6,064 crores

respectively as against

`

2,77,661 crores and

`

11,101

crores respectively in the previous year. The Standalone

Revenue from operations and Profit/Loss After Tax was

`

49,100 crores and (

`

2,480) crores respectively as against

`

47,384 crores and (

`

62) crores respectively for the previous

year. The loss as calculated under Section 198 of the Act

for FY 2016-17 was

`

2,564 crores (previous year: loss

of

`

464 crores).

The Indian economic in Fiscal 2017, on a macro – economic

level stayed fairly robust and stable. Automotive Industry in

India, grew in Fiscal 2017 by 8.3% over the previous year, as

against the growth of 6.0% in the Company’s vehicles sales

resulting in the Company’s market share decreasing to 12.8%

in the Indian automotive industry from 13.1% in the previous

year. The Company was more severely impacted in view of

certain sectors performing more adversely, which impacted

segments in which the Company had larger volumes and higher

market shares. The volatile domestic demand for commercial

vehicles throughout the year, was a result of Government and

regulatory announcements - e.g. Goods and Service Tax (GST),

Demonetization, emissions change from BS-III to BS-IV etc. Within

the domestic market, the Company sold 324,175 commercial

vehicles, a marginal fall of 0.8% from Fiscal 2016. The Company’s

passenger vehicles sales were higher by 23.5% at 157,020 vehicles,

registering a 5.2% market share. The Company sold 137,175 cars

(higher by 28.4%) and 19,845 utility vehicles and vans, (lower by

2.2%).

Whilst the Company has significantly improved its income

from operations of

`

49,100 crores in Fiscal 2017, which is 3.6%

higher from

`

47,384 crores in the previous year, muted demand

of M&HCV and LCV due to demonetization, weak replacement

demand, subdued freight demand from industrial segment, and

lower than expected pre-buying ahead of the implementation

of BS-IV. This resulted in lower EBITDA margins of 3.5% as against

7.1% in the previous year.

2. Steps taken or proposed to be taken for improvement:

The Company has taken various initiatives, to maintain its

leadership, improve market share and financial performance. It

has been aggressively pursuing and implementing its strategies

to improve volumes and reduce costs through improving

operational efficiencies, timely launch of new products,

refreshing products, building brand strengths, improving dealer

effectiveness and restructuring customer facing functions

thereby enhancing sales and service experience and improved

working capital management. The Company has also expanded

its new look, stylish, tech savvy, best-in-class flagship passenger

vehicle showrooms, for superior customer experience.

Short term strategy:

Based on the recommendation of the

NRC, the Board at its recently held meetings held on May 23,

2017 and May 31, 2017 critically reviewed the performance for

the financial year 2016-17 and have made major leadership and

organisational changes as also set the tone for a turnaround

plan with emphasis on the main business of the Company –

the domestic commercial vehicle business, by bringing focus

on sales and service, cost control, rigor in capital allocation with

careful calibration and rebuilding the credibility with customers,

dealers and investors.

Corporate Overview

Financial Statements

Statutory Reports

76

72nd Annual Report 2016-17