CODE OF CONDUCT

Whilst the Tata Code of Conduct is applicable to all Whole-time Directors and employees of the Company, the Board has also adopted a Tata Code of Conduct for Non-Executive Directors and Independent Directors, both of which are available on the Company's website (weblink: http://www.tatamotors.com/about-us/policies.php). All the Board members and senior management of the Company as on March 31, 2015 have affirmed compliance with their respective Codes of Conduct. A Declaration to this effect, duly signed by the Executive Director is annexed hereto.

SUBSIDIARY COMPANIES

The Company does not have any material non-listed Indian subsidiary company and hence, it is not required to have an Independent Director of the Company on the Board of such subsidiary company. However the following Independent Directors of the Company, are also present in an independent capacity, on the Board of the below mentioned subsidiary companies:

The Company adopted a Policy for Determining Material Subsidiaries of the Company, pursuant to the provisions of Clause 49 (V) (D) of the Listing Agreement, states the following:

- meaning of 'Material' Subsidiary

- Requirement of Independent Director in certain Material Non Listed Indian Subsidiaries

- Restriction on disposal of Shares of a Material Subsidiary by the Company

- Restriction on transfer of Assets of a Material Subsidiary and

- Disclosure requirements, based on revised Clause 49 of the Listing Agreement and any other laws and regulations as may be applicable to the Company.

This policy is available on the website of the Company (weblink: http://www.tatamotors.com/about-us/policies.php).

The Audit Committee also has a meeting wherein the CEO and CFO of the subsidiary companies make a presentation on significant issues in audit, internal control, risk management, etc. Significant issues pertaining to subsidiary companies are also discussed at Audit Committee meetings of the Company. Apart from disclosures made in the Directors' Report, there were no strategic investments made by the Company's non-listed subsidiaries during the year under review.

The minutes of the subsidiary companies are placed before the Board of Directors of the Company and the attention of the Directors is drawn to significant transactions and arrangements entered into by the subsidiary companies. The performance of its subsidiaries is also reviewed by the Board periodically.

GENERAL BODY MEETINGS

All resolutions moved at the last AGM were passed by means of electronic and physical voting, by the requisite majority of members attending the meeting. None of the businesses proposed to be transacted at the ensuing AGM require the passing of a special resolution by way of postal ballot.

POSTAL BALLOT

Members' approval was sought vide the following Postal Ballot Notices under Section 110 of the Act, details of which are relayed below:

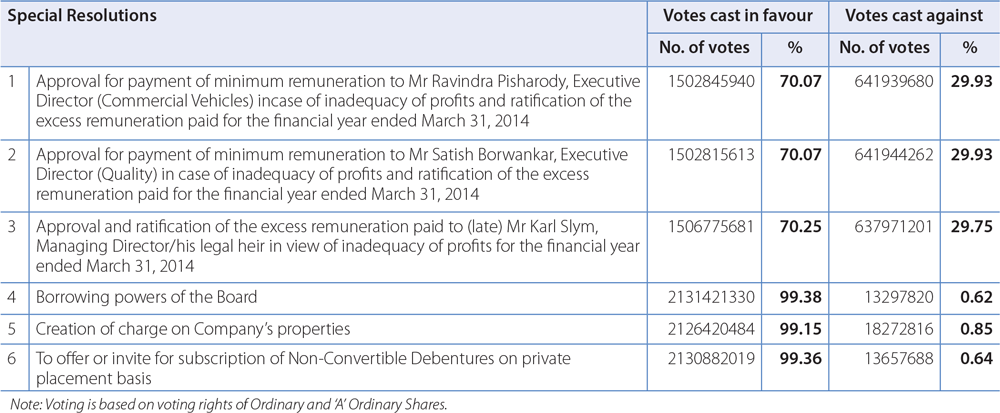

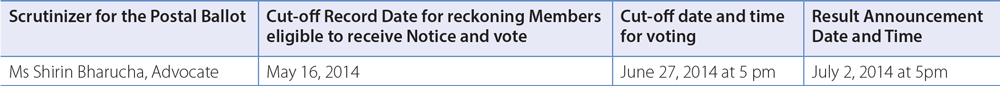

- Postal Ballot Notice dated May 22, 2014, pertaining to the following matters:-

Resolution Nos. 4, 5 and 6 mentioned in the aforesaid Notice were passed with requisite majority by the Shareholders and Resolution Nos. 1, 2 and 3 were not passed by the Shareholders by the requisite majority of minimum 75%.

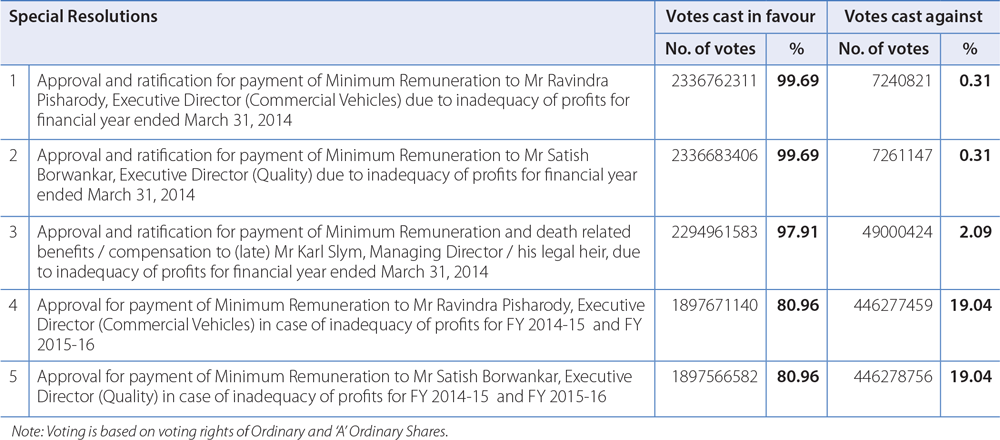

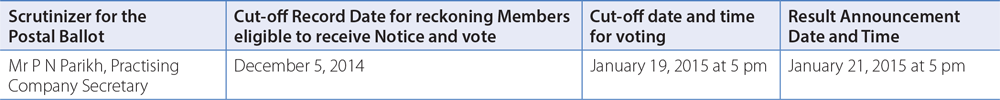

- Postal Ballot Notice dated December 9, 2014, pertaining to the following matters :-

All Resolutions mentioned in the aforesaid Notice were passed with requisite majority by the Shareholders.

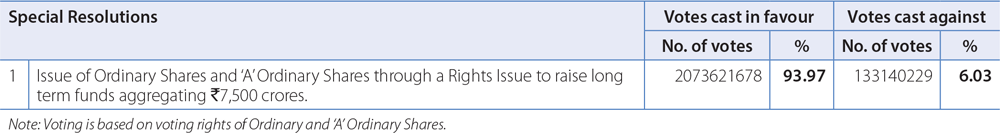

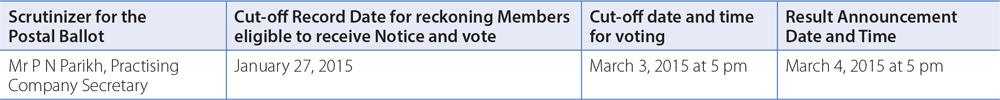

- Postal Ballot Notice dated January 27, 2015, pertaining to the following matter :-

The Resolution mentioned in the aforesaid Notice was passed by the Shareholders with requisite majority.

Procedure for Postal Ballot

In compliance with Clause 35B of the Listing Agreement and Sections 108, 110 and other applicable provisions of the Act, read with related Rules, the Company provides electronic voting facility to all its Members, to enable them to cast their votes electronically. The Company engages the services of NSDL for the purpose of providing e-facility to all its Members. The Members have the option to vote either by physical ballot or by e-voting.

The Company dispatches the postal ballot notices and forms along with postage pre-paid business reply envelopes to its Members whose names appear in the Register of Members/the List of beneficiaries as on a cut-off date. The Postal Ballot Notice is sent to members in electronic form to the email addresses registered with their depository participants (in case of electronic shareholding)/the Company's Registrar and Transfer Agents (in case of physical shareholding). The Company also publishes a notice in the newspaper declaring the details of completion of dispatch and other requirements as mandated under the Act and the applicable Rules.

Voting rights are reckoned on the paid-up value of shares registered in names of Members as on the cut-off date. Members desiring to exercise their votes by physical postal ballot forms are requested to return the forms duly completed and signed, to the Scrutinizer on or before the end of the voting period. Members desiring to exercise their votes by electronic mode are requested to vote before close of business hours on the last day of e-voting.

The Scrutinizer submits his/her report to the Chairman, after the completion of scrutiny and the consolidated results of the voting by postal ballot are then announced by the Chairman/authorised officer. The results are also displayed on the website of the Company, www.tatamotors.com, besides being communicated to the Stock Exchanges, Depositories and the Registrar and Transfer Agent.

DISCLOSURES

- Details of relevant related party transactions entered into by the Company are included in the Directors' Report and in the Notes to Accounts. During the year, the Company has framed a Policy on Related Party Transactions setting out (a) the materiality thresholds for related parties and (b) the manner of dealing with transactions between the Company and related parties based on the provisions of the Act and Listing Agreement requirements. The policy is also available on the website of the Company (http://www.tatamotors.com/about-us/policies.php). During the year, there were no materially significant transactions with related parties, as per the Policy adopted by the Company, that have potential conflict with the interests of the Company at large. All transactions with related parties entered into by the Company were in the normal course of business on an arm's length basis and were approved by the Audit Committee.

- The Company has complied with various rules and regulations prescribed by the Stock Exchanges, Securities and Exchange Board of India or any other statutory authority relating to the capital markets during the last 3 years. No penalties or strictures have been imposed by them on the Company.

- The Audit Committee has established a Vigil Mechanism and adopted a revised Whistle-Blower Policy at its meeting held on May 29, 2014, which provides a formal mechanism for all Directors and employees of the Company to approach the Management of the Company (Audit Committee in case where the concern involves the Senior Management) and make protective disclosures to the Management about unethical behaviour, actual or suspected fraud or violation of the Company's Code of Conduct or ethics policy. A copy of the policy is also uploaded on the website of the Company (weblink: http://www.tatamotors.com/about-us/policies.php). The disclosures reported are addressed in the manner and within the time frames prescribed in the Policy. The Company affirms that no director or employee of the Company has been denied access to the Audit Committee.

- The Company has fulfilled the following non-mandatory requirements as prescribed in Annexure XIII to the Clause 49 of the Listing Agreements entered into with the Stock Exchanges:

- The Board: The Non-Executive Chairman maintains a separate office, for which the Company does not reimburse expenses.

- Shareholder Rights: Details are given under the heading "Means of Communications".

- Audit Qualifications: During the year under review, there was no audit qualification in the Auditors' Report on the Company's financial statements. The Company continues to adopt best practices to ensure a regime of unqualified financial statements.

- Separate posts of Chairman and CEO: The post of the Non-Executive Chairman of the Board is separate from that of the Managing Director/CEO. The position of Managing Director is vacant as on date of this annual report. However, as an interim measure, a Corporate Steering Committee (CSC), was constituted during the financial year 2013-14 to provide oversight of strategy and key aspects of the Company's operations. The CSC comprises Mr Cyrus Mistry, Chairman, Mr Ravindra Pisharody, Mr Satish Borwankar, Mr C Ramakrishnan, the Chief Financial Officer as well as Mr Gajendra Chandel, Chief Human Resource Officer, Mr Mayank Pareek, President (Passenger Vehicle Business Unit) and Dr Timothy Leverton, Head, Advanced and Product Engineering.

- Reporting of Internal Auditor: The Chief Internal Auditor reports to the Audit Committee of the Company, to ensure independence of the Internal Audit function.