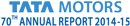

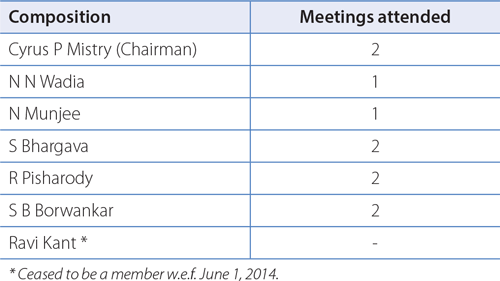

The Committee comprises of three Independent Directors and one Non-Executive Director. During the year under review, four meetings of the Committee were held on May 29, 2014, July 23, 2014, January 14, 2015 and March 30, 2015. The decisions are taken by the Committee, at meetings or by passing circular resolutions. The composition of the NRC and attendance at its meeting is as follows:

During the year, the NRC recommended the following policies and criteria pursuant to the provisions of the Act and the Listing Agreement, which were adopted and implemented by the Board:

- Remuneration Policy for Directors, Key Managerial Personnel and other employees;

- Governance Guidelines on Board Effectiveness;

- Process on evaluation of the Board of Directors, Committee thereof and individual directors;

- Policy on Board Diversity;

- Familiarisation Programme for Independent Directors, available on the website of the Company; and

- Definitive criteria for selection and appointment of Independent Directors.

Remuneration Policy

The Company adopted a Remuneration Policy for Directors, KMP and other employees, in accordance with the provisions of the Act and the Listing Agreement. For details on the Remuneration Policy, kindly refer to the Annexure to the Directors' Report.

Remuneration to Directors:

Non-Executive Directors

-

A sitting fee of Rs. 20,000/- for attendance at each meeting of the Board, Audit Committee, Executive Committee, NRC and for annual Independent Directors Meeting; Rs. 5,000/- for attendance at each meeting of Stakeholder Relationship Committee, Ethics & Compliance Committee and Rs. 10,000/- for attendance at each meeting of Safety, Health & Environment Committee, the Corporate Social Responsibility Committee, Risk Management Committee, Fund Raising Committee and other special need based committees, is paid to its Members (excluding Managing Director and Executive Directors) and also to Directors attending as Special Invitees. The sitting fees paid/payable to the Non Whole-time Directors is excluded whilst calculating the limits of remuneration in accordance with Section 197 of the Act. The Company also reimburses out-of-pocket expenses to Directors attending meetings held at a city other than the one in which the Directors reside. With effect from May 26, 2015, the sitting fees payable to Non-Executive Directors were revised upward by the Board on the recommendation of the NRC to Rs. 60,000/- for attendance at each meeting of the Board, Audit Committee, Executive Committee, NRC and Independent Directors; and Rs. 20,000/- for attendance at each meeting of Stakeholder Relationship Committee, Safety, Health & Environment Committee, Corporate Social Responsibility Committee, Risk Management Committee, Fund Raising Committee and other special need based comittees.

For details on sitting fees paid to Non-Executive Directors for FY 14-15, kindly refer to the Directors' Report.

The remuneration by way of Commission to the Non-Executive Directors is decided by the Board of Directors and distributed to them based on their participation and contribution at the Board and certain Committee meetings as well as time spent on matters other than at meetings. The Members had, at the Annual General Meeting held on August 21, 2013, approved the payment of remuneration by way of commission to the Non Whole-time Directors of the Company, of a sum not exceeding 1% per annum of the net profits of the Company, calculated in accordance with the provisions of the Companies Act, 1956, for a period of 5 years commencing April 1, 2013, respectively.

No Commission was paid to any Non-Executive Director for FY 2014-15 in view of inadequacy of profits.

Executive Directors

The remuneration paid to the Executive Directors is commensurate with industry standards and Board level positions held in similar sized companies, taking into consideration the individual responsibilities shouldered by them and is in consonance with the terms of appointment approved by the Members, at the time of their appointment.

The NRC, reviews and recommends to the Board the changes in the managerial remuneration of the Executive Directors on a yearly basis. This review is based on the Balance Score Card that includes the performance of the Company and the individual director on certain defined qualitative and quantitative parameters such as volumes, EBITDA, cashflows, cost reduction initiatives, safety, strategic initiatives and special projects as decided by the Board vis-a-vis targets set in the beginning of the year. This review also takes into consideration the benchmark study undertaken by reputed independent agencies on comparative industry remuneration and practices.

Incentive remuneration paid/payable is subject to the achievement of certain performance criteria and such other parameters as may be considered appropriate from time to time by the Board, not exceeding 200% of the basic salary. An indicative list of factors that may be considered for determining the extent of incentive remuneration, by the Board and as recommended by the NRC are, the Company's performance on certain defined qualitative and quantitative parameters as may be decided by the Board from time to time, industry benchmarks of remuneration and performance of the individual.

For details pertaining to Managerial Remuneration paid to the Executive Directors during FY 14-15 and the terms of their appointment, kindly refer to the Directors' Report.

The Company does not have an Employee Stock Option Scheme

Retirement Policy for Directors

The Company has adopted the Tata Group Governance Guidelines on Board Effectiveness, wherein the Managing and Executive Directors retire at the age of 65 years. The Executive Director, who have been retained on the Company's Board beyond the age of 65 years, as Non-Executive Directors for special reasons may continue as Directors at the discretion of the Board but in no case beyond the age of 70 years. The Company has also adopted a Policy for Managing and Executive Directors which has also been approved by the Members of the Company, offering special retirement benefits including pension, ex-gratia and medical. In addition to the above, the retiring Managing Director is entitled to residential accommodation or compensation in lieu of accommodation on retirement. The quantum and payment of the said benefits are subject to an eligibility criteria of the retiring director and is payable at the discretion of the Board in each individual case on the recommendation of the Nomination and Remuneration Committee.

Section 149 of the Act provides that an Independent Director shall hold office for a term of upto 5 consecutive years on the Board of a Company and would not be liable to retire by rotation pursuant to Section 152 of the Act. An Independent Director would be eligible to be re-appointed for another five years on passing of a Special Resolution by the Company. However no Independent Director shall hold office for more than two consecutive terms but would be eligible for appointment after the expiration of three years of ceasing to become an Independent Director. Provided that, during the said period of 3 years, he/she is not appointed in or be associated with the Company in any other capacity, either directly or indirectly. The retirement age for Independent Directors is 75 years as per the Governance Guidelines on Board Effectiveness. Accordingly, all Independent Directors have a tenure of 5 years each or upon attaining the retirement age of 75 years, whichever is earlier.

STAKEHOLDER RELATIONSHIP COMMITTEE

The Stakeholder Relationship Committee comprising of two Independent Directors is empowered:

- Review statutory compliance relating to all security holders.

- Consider and resolve the grievances of security holders of the company including complaints related to transfer of securities, non-receipt of annual report/declared dividends/notices/balance sheet.

- Oversee compliances in respect of dividend payments and transfer of unclaimed amounts to the Investor Education and Protection Fund.

- Oversee and review all matters related to the transfer of securities of the company.

- Approve issue of duplicate certificates of the company.

- Review movements in shareholding and ownership structures of the company.

- Ensure setting of proper controls and oversee performance of the Registrar and Share Transfer Agent.

- Recommend measures for overall improvement of the quality of investor services.

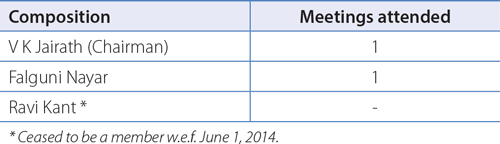

During the year under review, one Committee meeting was held on July 31, 2014, attended by both the members of the Committee, namely, Mr V K Jairath, who chaired the meeting and Ms Falguni Nayar. Mr Ravi Kant consequent to his retirement on June 1, 2014, ceased to be a member of the Committee.

Compliance Officer

Mr H K Sethna, Company Secretary, who is the Compliance Officer, can be contacted at: Tata Motors Limited, Bombay House, 24, Homi Mody Street, Mumbai - 400 001, India.

Tel: 91 22 6665 8282, 91 22 6665 7824; Fax: 91 22 6665 7260; Email: [email protected].

Complaints or queries relating to the shares and/or debentures can be forwarded to the Company's Registrar and Transfer Agents – M/s TSR Darashaw Limited at [email protected], whereas complaints or queries relating to the public fixed deposits can be forwarded to the Registrars to the Fixed Deposits Scheme – M/s TSR Darashaw Limited at [email protected].

Complaints or queries relating to the Rights Issue launched by the Company via Letter of Offer dated March 30, 2015 of Ordinary and 'A' Ordinary Shares, can be forwarded to Link Intime India Private Limited, the Registrar to the Issue, for addressing any pre-Issue/post-Issue related matter and all grievances relating to the Applications Supported by Blocked Amount (ASBA) process. Tel: (91 22) 6171 5400 / 9167779196/97/98/99; Fax: (91 22) 2596 0329; Website: www.linkintime.co.in; Email: [email protected]; Contact Person: Sachin Achar.

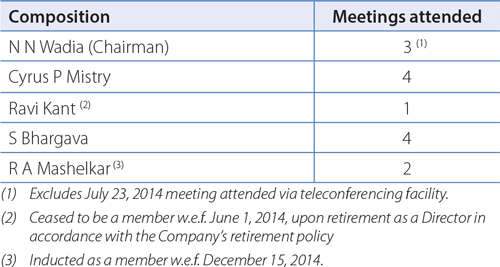

The status on the total number of investors' complaints during FY 2014-15 is as follows:

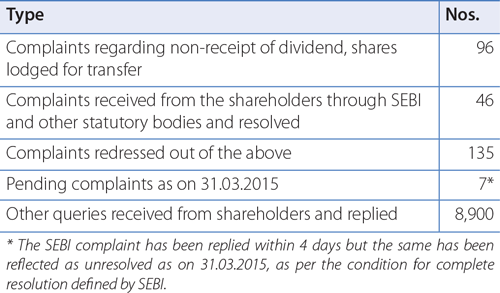

All letters received from the investors are replied to and the response time for attending to investors' correspondence during FY2014-15 is shown in the following table:

There were no pending share transfers pertaining to the Financial Year ended March 31, 2015. Out of the total number of complaints mentioned above, 46 complaints pertained to letters received through Statutory/Regulatory bodies and those related to Court/Consumer forum matters, fraudulent encashment and non-receipt of dividend amounts.

On recommendations of the Stakeholder Relationship Committee, the Company has taken various investor friendly initiatives like organising Shareholders' visit to Company Works at Pune, sending reminders to investors who have not claimed their dues, sending nomination forms etc.

OTHER COMMITTEES

The Executive Committee of the Board reviews capital and revenue budgets, long-term business strategies and plans, the organizational structure of the Company, real estate and investment transactions, allotment of shares and/or debentures, borrowing and other routine matters. The Committee also discusses the matters pertaining to legal cases, acquisitions and divestment, new business forays and donations. During the year under review, two Committee meetings were held on September 24, 2014 and December 15, 2014. The Executive Committee of Board comprises three Independent Directors, one Non-Executive Director and two Executive Directors. The composition of the Executive Committee of Board and attendance at meetings is given hereunder:

The Executive Committee of the Board had constituted a Donations Committee in 2003, however no meetings of the Donations Committee were held during the year under review.

The Ethics and Compliance Committee was constituted to formulate policies relating to the implementation of the Tata Code of Conduct for Prevention of Insider Trading (the Code), take on record the monthly reports on dealings in securities by the "Specified Persons" and decide penal action in respect of violations of the applicable regulations/the Code. During the year under review, one meeting of the Committee was held on July 31, 2014. The composition of the Ethics and Compliance Committee and attendance at meetings, is given hereunder:

Mr C Ramakrishnan, Chief Financial Officer, acts as the Compliance Officer under the said Code.

Consequent to the notification of the SEBI (Prohibition of Insider Trading) Regulations, 2015 dated January 15, 2015, the function of the Ethics and Compliance Committee was rendered redundant. Therefore the Committee was dissolved with effect from May 14, 2015 and accordingly the reporting, monitoring and governance aspect of the Insider Trading Regulations, is vested within the purview of the Audit Committee.

The Safety, Health & Environment (SHE) Committee was constituted with the objective of reviewing Safety, Health and Environment practices. The terms of reference of the Committee include the following:

- to take a holistic approach to safety, health and environmental matters in decision making;

- to provide direction to Tata Motors Group in carrying out its safety, health an d environment function;

- to frame broad guidelines/policies with regard to safety, health and environment;

- to oversee the implementation of these guidelines/policies; and

- to review the policies, processes and systems periodically and recommend measures for improvement from time to time.

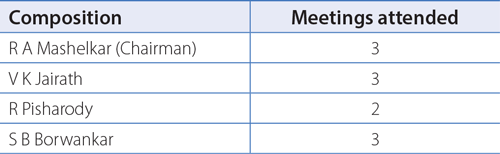

The Committee comprises of two Independent Directors and two Executive Directors. During the year under review, three meetings of the Committee were held on July 16, 2014, November 7, 2014 and March 25, 2015. The composition of the SHE Committee and attendance at the meetings is given hereunder:

Corporate Social Responsibility (CSR) Committee was constituted by the Board in accordance with the Act to:

- Formulate and recommend to the Board, a Corporate Social Responsibility Policy which shall indicate the activities to be undertaken by the Company as specified in Schedule VII;

- Recommend the amount of expenditure to be incurred on the activities referred to in clause (a); and

- Monitor the Corporate Social Responsibility Policy of the Company from time to time.

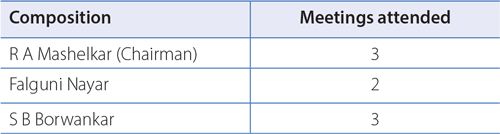

The CSR committee comprises of two Independent Directors and one Executive Director. During the year under review, three meetings of the Committee were held on July 16, 2014, November 7, 2014 and March 12, 2015. The composition of the CSR Committee and attendance at its meeting is given hereunder:

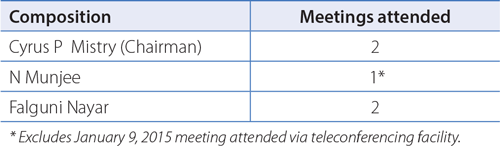

Fund Raising Committee of the Board was constituted for a specific need based purpose, comprising of two Independent Directors and one Non-Executive Director. During the year under review two meetings of the Committee were held on August 25, 2014 and January 9, 2015. The composition of the Committee and attendance at its meeting is given hereunder:

Risk Management Committee was constituted by the Board at its meeting held on October 8, 2014 pursuant to the provisions of the Listing Agreement, comprising of four Independent Directors namely, Mr Nasser Munjee, as Chairman, Dr Mashelkar, Mr V K Jairath and Ms Falguni Nayar as members. The terms of reference enumerated in the Committee Charter are as follows:

- Principles and objectives inter alia included assisting the Board in overseeing the Company's risk management process and controls, risk tolerance, capital liquidity and funding etc. and its periodic review to the Board.

- The Committee shall be appointed by the Board of Directors and may be staffed with Directors and/or executives from the Company. Company Secretary shall act as the Secretary to the Committee meetings.

- Quorum shall be any two members or one-third of the members, whichever is higher. The Committee shall meet at least once every quarter and Chief Internal Auditor shall be the permanent invitee to the Committee meetings.

- Committee shall act and have powers in accordance with the terms of reference specified in writing by the Board and shall be responsible for reviewing Company's risk governance structure, assessment, practice, guidelines etc.

- The Committee will report to the Board periodically on various matters and shall undergo an annual self-evaluation of its performance and report the results to the Board.

During the year under review one meeting of the Committee was held on January 15, 2015, attended by all members.

Apart from the above, the Board of Directors also constitutes Committee(s) of Directors and/or Executives with specific terms of reference, as it deems fit.